|

市場調查報告書

商品編碼

1716659

先進空中交通市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Advanced Air Mobility Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

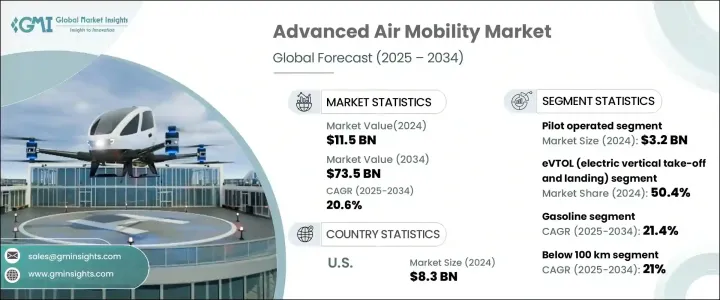

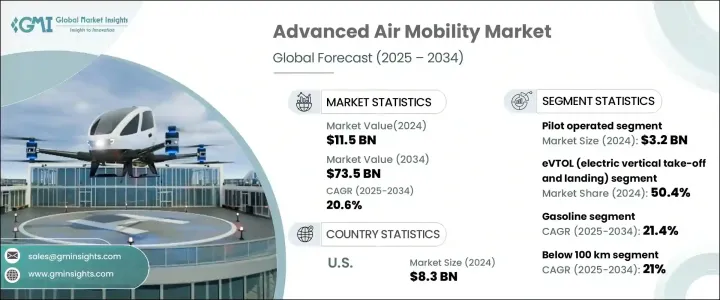

2024 年全球先進空中交通市場規模達 115 億美元,預計 2025 年至 2034 年期間的複合年成長率為 20.6%。隨著世界各國加強減少碳排放和應對氣候變遷的力度,交通運輸業正經歷向更清潔解決方案的轉型。先進的空中交通正在改變遊戲規則,提供永續的航空運輸選擇,減少交通堵塞,提高運輸效率,並最大限度地減少對環境的影響。電力推進系統、自動駕駛技術和創新車輛設計的日益融合正在加速 AAM 解決方案的採用。

全球各國政府和監管機構正在透過優惠政策和投資支持這些進步,從而實現 AAM 技術的快速認證和商業化。此外,城市規劃者和交通管理部門對將 AAM 系統納入智慧城市框架的興趣日益濃厚,這推動了市場的成長。隨著城市化進程的加快以及對更快、更有效率的出行解決方案的需求不斷成長,AAM 有望透過提供無縫的點對點交通徹底改變區域和城市交通。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 115億美元 |

| 預測值 | 735億美元 |

| 複合年成長率 | 20.6% |

到 2024 年,無人駕駛先進空中交通領域價值將達到 32 億美元,該領域將人類專業知識與技術創新相結合,提供安全可靠的城市空中交通,正在經歷強勁成長。有人駕駛的 AAM 飛行器利用經驗豐富的飛行員的技能,提供了額外的安全性,即使在複雜或人口稠密的環境中也能確保平穩運行。此外,現有航空基礎設施的整合和有利監管框架的實施正在加快認證進程,為這些技術的更快部署和更廣泛接受鋪平了道路。隨著業界向自動駕駛解決方案邁進,自動駕駛 AAM 車輛正在成為建立公眾信任和改善營運流程的橋樑。

AAM 市場按飛行器類型分類,包括電動垂直起降 (eVTOL) 飛機、短距起降 (STOL) 飛機和傳統固定翼飛機。 2024 年,eVTOL 領域將佔據 50.4% 的市場佔有率,這得益於電動和混合動力推進系統的日益普及。 eVTOL 飛機因其能夠滿足乘客運輸要求,同時遵守嚴格的安全和操作標準而越來越受到關注。 eVTOL 技術的發展有望在塑造先進空中交通的未來方面發揮關鍵作用,因為這些交通工具有可能提供可擴展、經濟高效且環境永續的交通解決方案。

美國先進空中交通市場價值 2024 年將達到 83 億美元,憑藉強大的技術創新生態系統和知名航太公司,美國將成為全球領導者。透過在研發方面投入大量資金以及建立完善的測試和部署新技術的基礎設施,美國正在推動 AAM 解決方案的進步和採用。美國積極的監管環境,加上公共和私營部門利益相關者之間的持續合作,正在加速先進空中機動技術的商業化,並使美國成為全球空中機動領域的領導者。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 都市化與交通堵塞

- 消費者偏好的改變

- 投資和政府支持

- 策略夥伴關係和合作

- 擴展用例和應用

- 產業陷阱與挑戰

- 監管和安全挑戰

- 大眾接受度和認知

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按營運模式,2021 年至 2034 年

- 主要趨勢

- 先導式

- 自主/遙控

第6章:市場估計與預測:按車型,2021 年至 2034 年

- 主要趨勢

- eVTOL(電動垂直起降)飛機

- STOL(短距起降)飛機

- 常規固定翼飛機

第7章:市場估計與預測:依推進類型,2021 年至 2034 年

- 主要趨勢

- 汽油

- 渦輪引擎(Turbo)

- 往復式(活塞)引擎

- 電力推進

- 混合動力推進

第8章:市場估計與預測:按範圍,2021 年至 2034 年

- 主要趨勢

- 100公里以下

- 100公里 – 250公里

- 250公里 – 500公里

- 超過500公里

第9章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 貨物運輸

- 客運

- 測繪與測量

- 特殊使命

- 監視和監控

- 其他

第 10 章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 商業的

- 政府和軍隊

第 11 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第12章:公司簡介

- Airbus SAS

- Aurora Flight Sciences

- Bell Textron Inc.

- Embraer SA

- Garmin Aviation

- GE Aviation

- GKN Aerospace

- Guangzhou EHang Intelligent Technology Co. Ltd.

- Honywell

- Joby Aviation

- Lilium GmbH

- Opener, Inc.

- Safran

- Siemens

- Thales Group

- The Boeing Company

The Global Advanced Air Mobility Market generated USD 11.5 billion in 2024 and is projected to grow at a CAGR of 20.6% between 2025 and 2034. As the world intensifies its efforts to reduce carbon emissions and combat climate change, the transportation sector is undergoing a transformative shift toward cleaner solutions. Advanced air mobility is emerging as a game-changer, offering sustainable air transport options that reduce traffic congestion, enhance transportation efficiency, and minimize environmental impacts. The increasing integration of electric propulsion systems, autonomous technologies, and innovative vehicle designs is accelerating the adoption of AAM solutions.

Governments and regulatory authorities across the globe are supporting these advancements through favorable policies and investments, enabling rapid certification and commercialization of AAM technologies. Furthermore, the growing interest from urban planners and transportation authorities in incorporating AAM systems into smart city frameworks is driving market growth. With the rise of urbanization and increasing demand for faster and more efficient travel solutions, AAM is expected to revolutionize regional and urban mobility by offering seamless, point-to-point transportation.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $11.5 Billion |

| Forecast Value | $73.5 Billion |

| CAGR | 20.6% |

The piloted advanced air mobility segment, valued at USD 3.2 billion in 2024, is witnessing robust growth as it blends human expertise with technological innovations to deliver safe and reliable urban air transportation. Piloted AAM vehicles offer an added layer of safety by leveraging the skills of experienced pilots, ensuring smooth operations even in complex or densely populated environments. Additionally, the integration of existing aviation infrastructure and the implementation of favorable regulatory frameworks are expediting the certification process, paving the way for faster deployment and wider acceptance of these technologies. As the industry moves toward autonomous solutions, piloted AAM vehicles are serving as a bridge to build public trust and refine operational processes.

The AAM market is categorized by vehicle types, including electric vertical take-off and landing (eVTOL) aircraft, short take-off and landing (STOL) aircraft, and conventional fixed-wing aircraft. In 2024, the eVTOL segment accounted for 50.4% of the market share, driven by the growing adoption of electric and hybrid propulsion systems. eVTOL aircraft are gaining traction due to their ability to meet passenger transportation requirements while adhering to stringent safety and operational standards. The development of eVTOL technology is expected to play a pivotal role in shaping the future of advanced air mobility, as these vehicles offer the potential for scalable, cost-effective, and environmentally sustainable transportation solutions.

The U.S. advanced air mobility market, valued at USD 8.3 billion in 2024, is positioned as a global leader fueled by a strong technological innovation ecosystem and the presence of prominent aerospace companies. With significant investments in research and development and a well-established infrastructure for testing and deploying new technologies, the U.S. is driving the advancement and adoption of AAM solutions. The country's proactive regulatory environment, combined with continuous collaboration between public and private sector stakeholders, is accelerating the commercialization of advanced air mobility technologies and positioning the U.S. as a frontrunner in the global AAM landscape.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Urbanization and traffic congestion

- 3.2.1.2 Changing consumer preferences

- 3.2.1.3 Investment and government support

- 3.2.1.4 Strategic partnerships and collaborations

- 3.2.1.5 Expansion of use cases and applications

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Regulatory and safety challenges

- 3.2.2.2 Public acceptance and perception

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Mode of Operation, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Pilot operated

- 5.3 Autonomous/Remotely operated

Chapter 6 Market Estimates and Forecast, By Vehicle Type, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 eVTOL (Electric Vertical Takeoff and Landing) aircraft

- 6.3 STOL (Short Takeoff and Landing) aircraft

- 6.4 Conventional fixed-wing aircraft

Chapter 7 Market Estimates and Forecast, By Propulsion Type, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Gasoline

- 7.2.1 Turbine engines (Turbo)

- 7.2.2 Reciprocating (Piston) engines

- 7.3 Electric propulsion

- 7.4 Hybrid propulsion

Chapter 8 Market Estimates and Forecast, By Range, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Below 100 km

- 8.3 100 km – 250 km

- 8.4 250 km – 500 km

- 8.5 More than 500 km

Chapter 9 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Cargo transport

- 9.3 Passenger transport

- 9.4 Mapping & surveying

- 9.5 Special mission

- 9.6 Surveillance & monitoring

- 9.7 Others

Chapter 10 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 10.1 Key trends

- 10.2 Commercial

- 10.3 Government & military

Chapter 11 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 Saudi Arabia

- 11.6.2 South Africa

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Airbus S.A.S.

- 12.2 Aurora Flight Sciences

- 12.3 Bell Textron Inc.

- 12.4 Embraer S.A.

- 12.5 Garmin Aviation

- 12.6 GE Aviation

- 12.7 GKN Aerospace

- 12.8 Guangzhou EHang Intelligent Technology Co. Ltd.

- 12.9 Honywell

- 12.10 Joby Aviation

- 12.11 Lilium GmbH

- 12.12 Opener, Inc.

- 12.13 Safran

- 12.14 Siemens

- 12.15 Thales Group

- 12.16 The Boeing Company