|

市場調查報告書

商品編碼

1716620

生物醫學加熱和解凍設備市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Biomedical Warming and Thawing Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

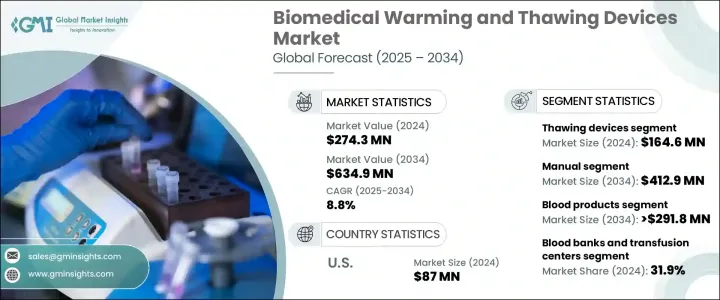

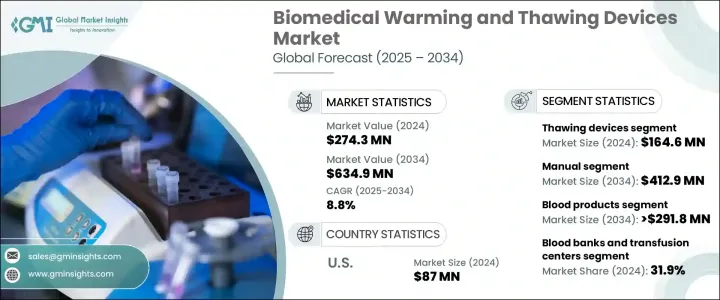

2024 年全球生物醫學加熱和解凍設備市場規模達到 2.743 億美元,預計 2025 年至 2034 年期間的複合年成長率為 8.8%。隨著血庫數量的增加、幹細胞研究的增多以及依賴冷凍保存樣本處理的 IVF 程序的使用日益增多,市場正在不斷擴大。慢性病的流行、再生醫學的進步以及冷凍保存在醫療保健領域的更廣泛應用正在促進市場的成長。冷凍保存技術在細胞治療、基因治療和個人化醫療中的應用推動了對加熱和解凍設備的需求。這些設備對於血庫和生物庫至關重要,可維持血液製品、幹細胞和胚胎等冷凍保存樣本的質量,這些樣本對於研究和治療至關重要。癌症和心血管疾病等慢性病的發病率上升進一步增加了醫院和輸血中心對這些設備的需求。

對幹細胞研究和再生醫學的投資也促進了市場成長。私人和政府實體正在資助開發先進的解凍設備,以改善樣本的保存和利用。此外,不孕症病例的增加導致對體外受精程序的需求不斷成長,其中加熱和解凍設備在處理卵母細胞、胚胎和精液樣本方面發揮著至關重要的作用。在這些過程中嚴格控制樣品處理至關重要,這推動了對這些設備的持續需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 2.743億美元 |

| 預測值 | 6.349億美元 |

| 複合年成長率 | 8.8% |

解凍設備在市場上佔有特別重要的地位,2024 年的營收為 1.646 億美元。這些設備可確保冷凍保存樣本的活力,並廣泛用於血庫,用於解凍輸血和外科手術所需的血漿和血小板。具有溫度控制功能的先進解凍系統可有效且安全地解凍幹細胞和胚胎等敏感樣本。隨著再生醫學和幹細胞療法的發展,解凍設備的需求預計將保持強勁。它們在生物庫和 IVF 診所中的應用日益廣泛,也鞏固了該領域的領先地位。

手動部分更具成本效益且適合小規模操作,預計複合年成長率為 8.6%,到 2034 年將達到 4.129 億美元以上。手動設備在自動化程度較低的發展中地區廣泛使用。這些設備操作簡單,所需基礎設施極少,非常適合小型實驗室和診所。它們也適合用於處理在解凍或加熱過程中需要密切關注的樣本,例如精液和組織樣本。

按樣本類型分類,血液製品佔據市場主導地位,預計該細分市場的複合年成長率為 8.7%,到 2034 年將達到 2.918 億美元以上。血漿、血小板和紅血球等血液製品需要在輸血和外科手術過程中精確處理。這些設備確保了緊急和常規醫療程序中使用的血液製品的安全性和有效性。外科手術和癌症治療的增加進一步推動了醫院和生物庫對這些設備的需求。

血庫和輸血中心佔據主導地位,2024 年的收入佔有率為 31.9%。這些設施處理緊急和外科輸血所需的大量血漿和血小板解凍。自動快速解凍系統的採用正在提高這些環境中的營運效率。

在美國,生物醫學加熱和解凍設備市場在 2024 年的價值為 8,700 萬美元,預計到 2034 年將以 8.4% 的複合年成長率成長。由於慢性病盛行率不斷上升和外科手術量巨大,美國市場在北美佔有相當大的佔有率。美國的醫院和醫療機構正在整合現代解凍系統,以滿足緊急情況和外科手術環境中對血液製品日益成長的需求。對再生醫學和體外受精應用研究和開發的重視進一步促進了這些設備的採用。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 全球血庫和輸血中心數量不斷增加

- 生物技術領域樣品分析和研究的不斷發展

- 導致輸血的道路交通事故和創傷病例不斷增加

- 產業陷阱與挑戰

- 解凍生物醫學產品和樣本的嚴格規定

- 與大批量相關的問題

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 定價分析

- 差距分析

- 波特的分析

- PESTEL分析

- 價值鏈分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按產品,2021 - 2034 年

- 主要趨勢

- 解凍裝置

- 加溫裝置

第6章:市場估計與預測:按模式,2021 - 2034 年

- 主要趨勢

- 手動的

- 自動的

第7章:市場估計與預測:依樣本類型,2021 - 2034 年

- 主要趨勢

- 血液製品

- 卵子/胚胎

- 精液

- 其他樣本類型

第8章:市場估計與預測:依最終用途 2021 - 2034

- 主要趨勢

- 血庫和輸血中心

- 醫院

- 研究實驗室

- 製藥公司

- 其他最終用途

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Arctiko

- Barkey

- BioCision

- BioLife Solutions

- BOEKEL

- Cytiva

- eppendorf

- Haier Biomedical

- Helmer SCIENTIFIC

- IVF tech

- LABCOLD

- PHCbi

- SARTORIUS

- Thermo Fisher

The Global Biomedical Warming And Thawing Devices Market reached USD 274.3 million in 2024 and is projected to grow at a CAGR of 8.8% between 2025 and 2034. The market is expanding due to the rising number of blood banks, increasing stem cell research, and the growing use of IVF procedures that rely on cryopreserved sample handling. The prevalence of chronic diseases, advancements in regenerative medicine, and the broader application of cryopreservation in healthcare are contributing to market growth. The use of cryopreservation techniques in cell therapy, gene therapy, and personalized medicine has fueled the demand for warming and thawing devices. These devices are essential in blood banks and biobanks to maintain the quality of cryopreserved samples such as blood products, stem cells, and embryos, which are critical for research and treatment. The rising incidence of chronic conditions such as cancer and cardiovascular diseases has further increased demand for these devices in hospitals and transfusion centers.

Investments in stem cell research and regenerative medicine are also contributing to market growth. Private and government entities are funding the development of advanced thawing devices to improve sample preservation and utilization. Additionally, the increasing cases of infertility have led to a growing demand for IVF procedures, where warming and thawing devices play a crucial role in handling oocytes, embryos, and semen samples. Maintaining strict control over sample handling during these processes is essential, which drives the continued demand for these devices.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $274.3 Million |

| Forecast Value | $634.9 Million |

| CAGR | 8.8% |

Thawing devices, in particular, have a significant role in the market, generating USD 164.6 million in revenue in 2024. These devices ensure the viability of cryopreserved samples and are extensively used in blood banks for thawing plasma and platelets required for transfusions and surgical procedures. Advanced thawing systems with temperature control features provide effective and safe thawing of sensitive samples such as stem cells and embryos. With the growth of regenerative medicine and stem cell therapies, the demand for thawing devices is expected to remain strong. Their increasing use in biobanks and IVF clinics also supports the leading position of this segment.

The manual segment, which is more cost-effective and suitable for small-scale operations, is expected to grow at a CAGR of 8.6%, reaching over USD 412.9 million by 2034. Manual devices are widely used in developing regions where automation is less accessible. These devices, which are easy to operate and require minimal infrastructure, are ideal for small laboratories and clinics. They are also preferred for handling samples that need close attention during thawing or warming, such as semen and tissue samples.

Blood products dominate the market by sample type, with this segment expected to grow at a CAGR of 8.7%, reaching over USD 291.8 million by 2034. Blood products such as plasma, platelets, and red blood cells require precise handling during transfusion and surgical procedures. These devices ensure the safety and efficacy of blood products used in emergency and routine medical procedures. Increasing surgical procedures and cancer treatments further drive the need for these devices in hospitals and biobanks.

Blood banks and transfusion centers held a dominant market position with a 31.9% revenue share in 2024. These facilities handle large volumes of plasma and platelet thawing necessary for emergency and surgical transfusions. The adoption of automated and rapid thawing systems is improving operational efficiency in these settings.

In the U.S., the biomedical warming and thawing devices market was valued at USD 87 million in 2024 and is projected to grow at a CAGR of 8.4% through 2034. The U.S. market holds a significant share in North America due to the increasing prevalence of chronic diseases and a high volume of surgical procedures. Hospitals and healthcare institutions in the U.S. are integrating modern thawing systems to manage the growing demand for blood products in emergencies and surgical settings. The emphasis on applied research and development in regenerative medicine and IVF has further bolstered the adoption of these devices.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing number of blood banks and blood infusion centers worldwide

- 3.2.1.2 Increased development of sample analysis and studies in the biotechnology sector

- 3.2.1.3 Rising number of road accidents and trauma cases leading to blood transfusions

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Strict regulations for thawed biomedical products and samples

- 3.2.2.2 Issues related to large batch sizes

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Pricing analysis

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Value chain analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Thawing devices

- 5.3 Warming devices

Chapter 6 Market Estimates and Forecast, By Mode, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Manual

- 6.3 Automatic

Chapter 7 Market Estimates and Forecast, By Sample Type, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Blood products

- 7.3 Ovum/embryo

- 7.4 Semen

- 7.5 Other sample types

Chapter 8 Market Estimates and Forecast, By End Use 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Blood banks and transfusion centers

- 8.3 Hospitals

- 8.4 Research laboratories

- 8.5 Pharmaceutical companies

- 8.6 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Arctiko

- 10.2 Barkey

- 10.3 BioCision

- 10.4 BioLife Solutions

- 10.5 BOEKEL

- 10.6 Cytiva

- 10.7 eppendorf

- 10.8 Haier Biomedical

- 10.9 Helmer SCIENTIFIC

- 10.10 IVF tech

- 10.11 LABCOLD

- 10.12 PHCbi

- 10.13 SARTORIUS

- 10.14 Thermo Fisher