|

市場調查報告書

商品編碼

1716619

互動式白板市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Interactive Whiteboard Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

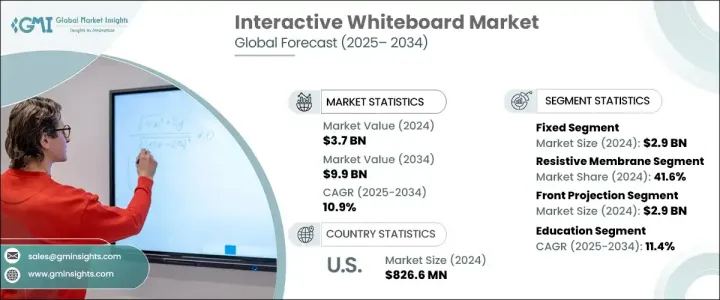

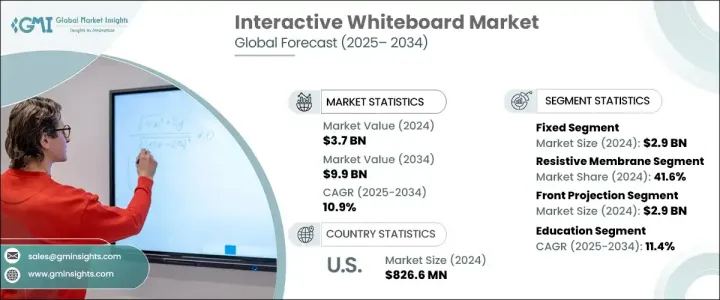

2024 年全球互動式白板市場規模達到 37 億美元,預計 2025 年至 2034 年的複合年成長率將達到 10.9%。這項成長動力源自於對增強參與度和互動性的高階簡報工具日益成長的需求。隨著企業、教育機構和公司企業轉向數位學習和會議解決方案,互動式白板正成為不可或缺的工具。這些高科技板可以實現即時內容操作,使演示更加動態,視覺上更加引人注目。整合影片、動畫和互動式圖表等多媒體元素的能力顯著提高了觀眾的保留率和參與度。

隨著全球各產業數位轉型加速,互動式白板在各領域已廣泛應用。在教育環境中,學校和大學正在迅速整合這些工具以增強學生的學習體驗。數位教室正在隨著互動式白板而不斷發展,透過觸控顯示器、協作工具和線上資源提供沉浸式教學方法。同樣,企業部門正在利用互動式白板來簡化會議、腦力激盪會議和培訓計劃。對醫療保健和政府部門的需求也在不斷成長,其中互動式簡報和即時資料視覺化對於有效溝通至關重要。對互動式和引人入勝的內容傳遞的日益成長的需求推動著市場向前發展,使得互動式白板成為現代學習和商業環境中的必備工具。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 37億美元 |

| 預測值 | 99億美元 |

| 複合年成長率 | 10.9% |

這個市場的一個關鍵驅動力是互動式白板能夠將傳統的演示轉變為高度吸引人的協作體驗。這些先進的工具使用戶能夠操縱螢幕上的內容,從而鼓勵觀眾更好地參與。演示者可以整合各種多媒體元素,從而創造出一個互動且引人入勝的環境,增強訊息的保留和理解。這種功能使得互動式白板在教育和企業環境中特別有價值,因為清晰度、參與度和即時協作至關重要。

市場依外型分為固定式互動式白板和可攜式互動式白板。固定部分在該產業佔據主導地位,2024 年市場規模將達到 29 億美元。固定互動式白板通常安裝在牆壁或支架上,是教室、會議室和培訓中心的永久解決方案。這些板子具有觸控感應、數位內容顯示、與各種裝置的無縫連接等功能,是互動學習和商業簡報不可或缺的工具。它們能夠提高生產力和溝通能力,推動世界各地的機構和企業採用它們。

按技術分類,電阻膜系統在 2024 年佔據了 41.6% 的顯著市場。這些系統對觸控輸入具有出色的反應能力,允許使用者使用手指、觸控筆或其他物體與電路板進行互動。它們價格實惠且用途廣泛,成為各種應用的首選,包括教育、企業培訓和零售展示解決方案。隨著對數位基礎設施的投資不斷增加以及對互動式學習工具的日益青睞,預計未來幾年對電阻膜白板的需求將會上升。

2024 年,美國互動式白板市場規模將達到 8.266 億美元,這得益於教育和企業環境中學習管理系統 (LMS) 的日益整合。隨著 LMS 的採用率不斷提高,互動式白板正成為必不可少的組成部分,可實現無縫的課程規劃、即時內容傳遞和有效的評估策略。增強數位學習體驗和企業培訓計畫的能力正在加速它們在各個行業的部署。人們對混合學習解決方案和智慧教室的日益關注進一步推動了美國市場的擴張,使互動式白板成為不斷發展的教育和商業領域的關鍵參與者。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商格局

- 利潤率分析

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 越來越注重透過互動功能增強演示效果

- 白板觸覺和靈敏度的不斷提升的技術

- 與數位平台的融合日益加深

- 轉向互動式和以學生為中心的學習方法轉變

- 產業陷阱與挑戰

- 初始成本高

- 互動式白板與現有IT基礎設施的整合挑戰

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依技術,2021-2034 年

- 主要趨勢

- 紅外線的

- 電阻膜

- 電磁筆

- 電容式

- 其他

第6章:市場估計與預測:依外形尺寸,2021-2034

- 主要趨勢

- 固定的

- 便攜的

第7章:市場估計與預測:依預測技術,2021-2034 年

- 主要趨勢

- 正投

- 背投

第8章:市場估計與預測:依螢幕尺寸,2021-2034

- 主要趨勢

- 最大 69 英寸

- 70 – 90英寸

- 90吋以上

第9章:市場估計與預測:依最終用途,2021-2034

- 主要趨勢

- 教育

- 公司的

- 商業的

- 其他

第10章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 11 章:公司簡介

- BenQ

- Clevertouch

- Epson

- Genee World

- Hitachi

- Hitevision

- IQBoard

- Julong Educational Technology

- LG Electronics

- Mimio (Boxlight)

- Newline Interactive

- Panasonic

- PolyVision

- Promethean

- Ricoh

- Samsung

- Sharp

- Smart Technologies

- TouchIT Technologies

- ViewSonic

The Global Interactive Whiteboard Market reached USD 3.7 billion in 2024 and is projected to grow at a CAGR of 10.9% from 2025 to 2034. This growth is fueled by the increasing demand for advanced presentation tools that enhance engagement and interactivity. As businesses, educational institutions, and corporate enterprises shift toward digitalized learning and meeting solutions, interactive whiteboards are becoming essential tools. These high-tech boards allow real-time content manipulation, making presentations more dynamic and visually compelling. The ability to integrate multimedia elements, including videos, animations, and interactive charts, significantly improves audience retention and participation.

With the global digital transformation accelerating across industries, interactive whiteboards are seeing widespread adoption in various sectors. In educational settings, schools and universities are rapidly integrating these tools to enhance student learning experiences. Digital classrooms are evolving with interactive whiteboards, offering an immersive approach to teaching through touch-sensitive displays, collaborative tools, and online resources. Similarly, the corporate sector is leveraging interactive whiteboards to streamline meetings, brainstorming sessions, and training programs. The demand is also rising in healthcare and government sectors, where interactive presentations and real-time data visualization are critical for effective communication. The increasing need for interactive and engaging content delivery is pushing the market forward, making interactive whiteboards a must-have tool in modern learning and business environments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.7 Billion |

| Forecast Value | $9.9 Billion |

| CAGR | 10.9% |

A key driver of this market is the ability of interactive whiteboards to transform conventional presentations into highly engaging and collaborative experiences. These advanced tools enable users to manipulate on-screen content, encouraging better audience participation. Presenters can integrate various multimedia elements, resulting in an interactive and engaging environment that enhances information retention and understanding. This capability has made interactive whiteboards particularly valuable in educational and corporate settings, where clarity, engagement, and real-time collaboration are essential.

The market is segmented by form factor into fixed and portable interactive whiteboards. The fixed segment dominated the industry, accounting for USD 2.9 billion in 2024. Fixed interactive whiteboards, typically mounted on walls or stands, serve as a permanent solution in classrooms, conference rooms, and training centers. These boards come equipped with features such as touch sensitivity, digital content display, and seamless connectivity with various devices, making them indispensable tools for interactive learning and business presentations. Their ability to enhance productivity and communication is driving their adoption in institutions and enterprises worldwide.

By technology, resistive membrane systems held a significant market share of 41.6% in 2024. These systems offer exceptional responsiveness to touch inputs, allowing users to interact with the board using fingers, styluses, or other objects. Their affordability and versatility make them a preferred choice for various applications, including education, corporate training, and retail display solutions. With growing investments in digital infrastructure and the increasing preference for interactive learning tools, the demand for resistive membrane-based whiteboards is expected to rise in the coming years.

The U.S. Interactive Whiteboard Market reached USD 826.6 million in 2024, driven by the growing integration of learning management systems (LMS) in both educational and corporate settings. As LMS adoption increases, interactive whiteboards are becoming an essential component, enabling seamless lesson planning, real-time content delivery, and effective assessment strategies. The ability to enhance digital learning experiences and corporate training programs is accelerating their deployment across various industries. The rising focus on blended learning solutions and smart classrooms is further propelling market expansion in the U.S., making interactive whiteboards a key player in the evolving education and business landscapes.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Growing focus on enhancing the presentation with interactive features

- 3.6.1.2 Rising technology in touch and sensitivity of whiteboards

- 3.6.1.3 Rising integration with digital platforms

- 3.6.1.4 The shift toward interactive and student-centered learning methods

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High initial cost

- 3.6.2.2 Integration challenges in interactive whiteboards with existing IT infrastructure

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Technology, 2021-2034 (USD Million)

- 5.1 Key trends

- 5.2 Infrared

- 5.3 Resistive membrane

- 5.4 Electromagnetic pen

- 5.5 Capacitive

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Form Factor, 2021-2034 (USD Million)

- 6.1 Key trends

- 6.2 Fixed

- 6.3 Portable

Chapter 7 Market Estimates & Forecast, By Projection Technique, 2021-2034 (USD Million)

- 7.1 Key trends

- 7.2 Front projection

- 7.3 Rear projection

Chapter 8 Market Estimates & Forecast, By Screen Size, 2021-2034 (USD Million)

- 8.1 Key trends

- 8.2 Up to 69 inches

- 8.3 70 – 90 inches

- 8.4 Above 90 inches

Chapter 9 Market Estimates & Forecast, By End Use, 2021-2034 (USD Million)

- 9.1 Key trends

- 9.2 Education

- 9.3 Corporate

- 9.4 Commercial

- 9.5 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Million)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 BenQ

- 11.2 Clevertouch

- 11.3 Epson

- 11.4 Genee World

- 11.5 Hitachi

- 11.6 Hitevision

- 11.7 IQBoard

- 11.8 Julong Educational Technology

- 11.9 LG Electronics

- 11.10 Mimio (Boxlight)

- 11.11 Newline Interactive

- 11.12 Panasonic

- 11.13 PolyVision

- 11.14 Promethean

- 11.15 Ricoh

- 11.16 Samsung

- 11.17 Sharp

- 11.18 Smart Technologies

- 11.19 TouchIT Technologies

- 11.20 ViewSonic