|

市場調查報告書

商品編碼

1716617

商用熱水器市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Commercial Water Heater Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

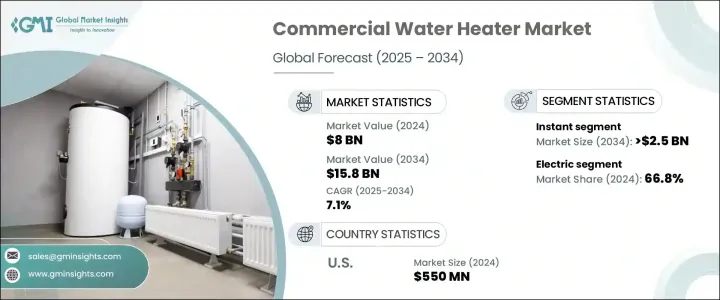

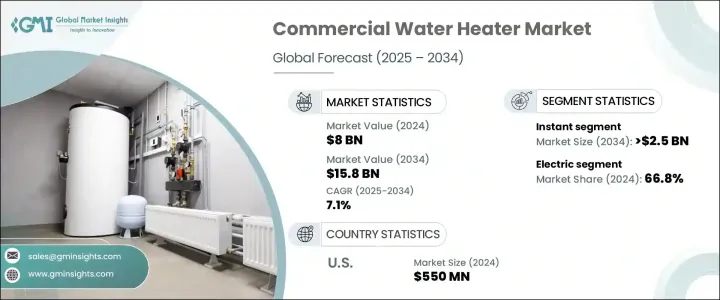

2024 年全球商用熱水器市場規模達 80 億美元,預計 2025 年至 2034 年期間的複合年成長率為 7.1%。隨著酒店、醫療保健、教育和商業領域的企業對節能、永續和技術先進的熱水解決方案的需求日益增加,該行業正在獲得發展動力。人們越來越重視減少碳足跡,加上城市化和基礎設施建設的持續推進,進一步推動了對滿足現代要求的高效熱水系統的需求。消費者對先進熱水器的能源消耗、成本節約和環境效益的認知不斷提高,這極大地影響市場趨勢。

此外,世界各國政府正在推出有利的監管框架和激勵措施,支持採用高效和再生能源整合熱水系統。隨著對智慧技術整合的關注度不斷提高,配備物聯網、遠端監控和自動化功能的商用熱水器也獲得了相當大的關注,幫助最終用戶最佳化能源使用和營運效率。對智慧和環保系統日益成長的需求為製造商開闢了新的途徑,使其能夠創新並提供滿足商業機構不斷變化的需求的解決方案。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 80億美元 |

| 預測值 | 158億美元 |

| 複合年成長率 | 7.1% |

市場根據加熱器類型、能源和設計進行細分,以滿足廣泛的商業應用。其中,即熱式熱水器市場預計將實現顯著成長,預計到 2034 年將創造 25 億美元的市場價值。即熱式熱水器以其緊湊的設計和快速加熱能力而聞名,其設計旨在安裝在靠近使用點的地方,從而減少了對大量管道的需求並最大限度地減少了熱量損失。它們節省空間的特性使其成為空間有限的商業建築(如飯店、辦公室和餐廳)的理想解決方案。隨著商業設施優先考慮能源效率並尋求降低營運成本,即熱式熱水器的需求持續上升,使其成為市場上成長最快的類別之一。

商用熱水器產業也依能源來源分類,主要分為電熱水器和瓦斯熱水器。 2024 年,電熱水器佔據市場主導地位,佔有 66.8% 的佔有率,這得益於其可靠性、耐用性以及與太陽能等新興再生能源的兼容性。這些裝置採用堅固的組件設計,可處理重型商業用途,同時確保長期性能。隨著永續發展目標推動各組織尋求更清潔的能源替代品,向電力和混合動力解決方案的轉變正在加速。製造商正專注於創新符合日益嚴格的能源法規的高效模型,以幫助商業實體滿足嚴格的環境和能源法規。

到 2024 年,北美商用熱水器市場規模將達到 5.5 億美元,佔市場佔有率的 13%,這得益於嚴格的能源效率規定和政府的優惠激勵措施,鼓勵安裝環保熱水系統。隨著越來越多的商業房地產追求LEED(能源與環境設計先鋒)認證,節能熱水器已成為實現綠色建築標準和降低長期能源成本的關鍵組成部分。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 價格趨勢分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 戰略儀表板

- 創新與技術格局

第5章:市場規模及預測:依產品,2021 年至 2034 年

- 主要趨勢

- 立即的

- 貯存

第6章:市場規模及預測:依能源類型,2021 年至 2034 年

- 主要趨勢

- 電的

- 氣體

第7章:市場規模及預測:依產能,2021 年至 2034 年

- 主要趨勢

- <30公升

- 30-100公升

- 100-250升

- 250-400升

- >400公升

第 8 章:市場規模與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 學院/大學

- 辦公室

- 政府/軍隊

- 其他

第9章:市場規模及預測:按通路,2021 年至 2034 年

- 主要趨勢

- 線上

- 經銷商

- 零售

第 10 章:市場規模與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 法國

- 德國

- 義大利

- 西班牙

- 荷蘭

- 葡萄牙

- 羅馬尼亞

- 瑞士

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 埃及

- 拉丁美洲

- 巴西

- 阿根廷

第 11 章:公司簡介

- American Standard Water Heaters

- AO Smith

- AQUAMAX Australia

- Bosch Thermotechnology

- Bradford White Corporation

- BDR Thermea Group

- GE Appliances

- Heatre Sadia

- HTP

- ORBITAL HORIZON

- Powrmatic

- Racold

- Rinnai Corporation

- Rheem Manufacturing Company

- STIEBEL ELTRON GmbH & Co. KG

- State Industries

- Saudi Ceramic Company

- Toshiba Corporation

- Westinghouse Electric Corporation

The Global Commercial Water Heater Market reached USD 8 billion in 2024 and is estimated to grow at a CAGR of 7.1% between 2025 and 2034. The industry is gaining momentum as businesses across hospitality, healthcare, education, and commercial sectors increasingly demand energy-efficient, sustainable, and technologically advanced water heating solutions. The rising emphasis on reducing carbon footprints, coupled with growing urbanization and infrastructural developments, is further fueling the need for efficient water heating systems that meet modern-day requirements. Heightened consumer awareness of energy consumption, cost savings, and environmental benefits associated with advanced water heaters is significantly shaping market trends.

Moreover, governments worldwide are introducing favorable regulatory frameworks and incentives that support the adoption of high-efficiency and renewable energy-integrated water heating systems. As the focus on smart technology integration grows, commercial water heaters equipped with IoT, remote monitoring, and automation features are also gaining considerable traction, helping end-users optimize energy use and operational efficiency. This increasing demand for intelligent and eco-friendly systems is opening new avenues for manufacturers to innovate and deliver solutions tailored to the evolving needs of commercial establishments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8 Billion |

| Forecast Value | $15.8 Billion |

| CAGR | 7.1% |

The market is segmented based on heater type, energy source, and design, catering to a broad range of commercial applications. Among these, the instant water heater segment is poised for remarkable growth and is projected to generate USD 2.5 billion by 2034. Instant water heaters, known for their compact design and rapid heating capability, are engineered to be installed close to points of use, reducing the need for extensive piping and minimizing heat loss. Their space-saving nature makes them an ideal solution for commercial buildings with limited space, such as hotels, offices, and restaurants. As commercial facilities prioritize energy efficiency and seek to lower operational costs, the demand for instant water heaters continues to rise, making them one of the fastest-growing categories in the market.

The commercial water heater industry is also classified by energy source, primarily into electric and gas heaters. Electric water heaters dominated the market with a 66.8% share in 2024, driven by their reliability, durability, and compatibility with emerging renewable energy sources like solar power. These units are designed with robust components to handle heavy-duty commercial usage while ensuring long-term performance. As sustainability goals push organizations to seek cleaner energy alternatives, the transition towards electric and hybrid solutions is accelerating. Manufacturers are focusing on innovating high-efficiency models that comply with tightening energy regulations, helping commercial entities meet stringent environmental and energy codes.

North America commercial water heater market accounted for USD 550 million and a 13% share in 2024, supported by strict energy efficiency mandates and attractive government incentives that encourage the installation of eco-friendly water heating systems. With more commercial properties aiming for LEED (Leadership in Energy and Environmental Design) certification, energy-efficient water heaters have become a critical component for achieving green building standards and reducing long-term energy costs.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Price trend analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Product, 2021 – 2034 (USD Million & ‘000 Units)

- 5.1 Key trends

- 5.2 Instant

- 5.3 Storage

Chapter 6 Market Size and Forecast, By Energy Source, 2021 – 2034 (USD Million & ‘000 Units)

- 6.1 Key trends

- 6.2 Electric

- 6.3 Gas

Chapter 7 Market Size and Forecast, By Capacity, 2021 – 2034 (USD Million & ‘000 Units)

- 7.1 Key trends

- 7.2 <30 liters

- 7.3 30-100 liters

- 7.4 100-250 liters

- 7.5 250-400 liters

- 7.6 >400 liters

Chapter 8 Market Size and Forecast, By Application, 2021 – 2034 (USD Million & ‘000 Units)

- 8.1 Key trends

- 8.2 College/University

- 8.3 Offices

- 8.4 Government/Military

- 8.5 Others

Chapter 9 Market Size and Forecast, By Channel, 2021 – 2034 (USD Million & ‘000 Units)

- 9.1 Key trends

- 9.2 Online

- 9.3 Dealer

- 9.4 Retail

Chapter 10 Market Size and Forecast, By Region, 2021 – 2034 (USD Million & ‘000 Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 France

- 10.3.3 Germany

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Netherlands

- 10.3.7 Portugal

- 10.3.8 Romania

- 10.3.9 Switzerland

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Middle East & Africa

- 10.5.1 Saudi Arabia

- 10.5.2 UAE

- 10.5.3 South Africa

- 10.5.4 Egypt

- 10.6 Latin America

- 10.6.1 Brazil

- 10.6.2 Argentina

Chapter 11 Company Profiles

- 11.1 American Standard Water Heaters

- 11.2 A.O Smith

- 11.3 AQUAMAX Australia

- 11.4 Bosch Thermotechnology

- 11.5 Bradford White Corporation

- 11.6 BDR Thermea Group

- 11.7 GE Appliances

- 11.8 Heatre Sadia

- 11.9 HTP

- 11.10 ORBITAL HORIZON

- 11.11 Powrmatic

- 11.12 Racold

- 11.13 Rinnai Corporation

- 11.14 Rheem Manufacturing Company

- 11.15 STIEBEL ELTRON GmbH & Co. KG

- 11.16 State Industries

- 11.17 Saudi Ceramic Company

- 11.18 Toshiba Corporation

- 11.19 Westinghouse Electric Corporation