|

市場調查報告書

商品編碼

1716609

心律管理設備市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Cardiac Rhythm Management Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

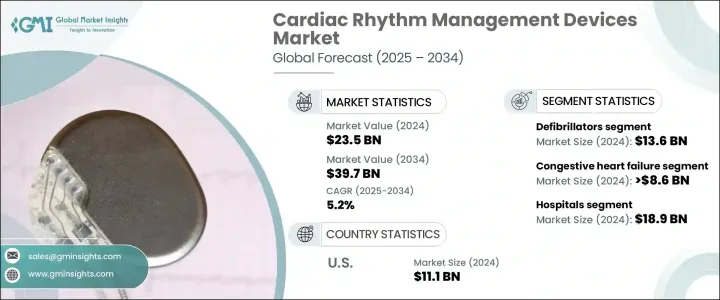

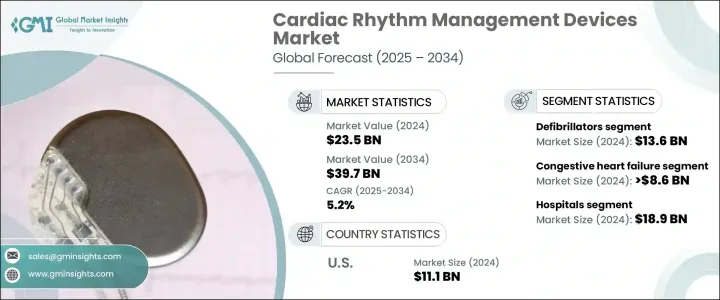

2024 年全球心律管理設備市場規模達到 235 億美元,預估 2025 年至 2034 年期間的複合年成長率為 5.2%。全球心血管疾病發病率的上升推動了該市場的成長,包括心臟衰竭、心律不整和其他心律相關疾病。主要經濟體老齡人口的穩定成長也推動了市場擴張,因為老年人更容易出現心臟併發症。久坐的生活方式、不良的飲食習慣以及高血壓、糖尿病和肥胖症病例的增加等因素進一步加劇了對先進心臟護理解決方案的需求。

心血管疾病仍然是全球死亡的主要原因,對能夠改善患者預後和提高生活品質的創新和有效的心律管理設備的需求日益成長。此外,遠端監控和下一代植入式設備等醫療技術的不斷進步正在改變醫療保健提供者管理和治療心律不整的方式。醫療保健支出的激增,加上人們對早期診斷和預防性心臟病護理的認知的提高,預計將為市場參與者帶來新的機會。人工智慧 (AI) 和機器學習 (ML) 與心臟節律管理系統的整合也有望透過實現預測分析和個人化治療方案來推動未來的市場趨勢。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 235億美元 |

| 預測值 | 397億美元 |

| 複合年成長率 | 5.2% |

該市場涵蓋廣泛的產品領域,包括心律調節器、去顫器和心臟再同步治療 (CRT) 設備。其中,除顫器佔據最大的市場佔有率,對整體收入貢獻巨大。除顫器,尤其是植入式心律轉復除顫器 (ICD),對於患有危及生命的心律不整高風險的患者至關重要。這些設備旨在持續監測心律,並在檢測到異常心律時發出電擊,從而防止心臟猝死。由於心血管疾病持續成為全球發病率和死亡率的主要原因,預計對除顫器的需求將穩定上升。

在應用方面,心律管理設備市場分為充血性心臟衰竭、心律不整、心搏過緩和心搏過速。其中,充血性心臟衰竭在2024年的收入為86億美元。 ICD和CRT系統等設備在心臟衰竭管理中發揮至關重要的作用,可以改善心律協調、提高心輸出量,緩解疲勞和呼吸困難等症狀,從而提高患者的生活品質。

2024 年,美國心律管理設備市場規模達到 111 億美元,佔全球主導地位。該國先進的醫療保健基礎設施,加上優惠的報銷框架和廣泛的最先進治療選擇,繼續推動市場成長。強大的臨床研究、持續的產品創新以及對研發的大量投資使得 CRM 設備在美國迅速普及,鞏固了其在該領域的全球領先地位。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 心臟衰竭和其他心臟疾病的盛行率不斷上升

- 心律監測技術進步與創新設備的引入

- 提高大眾意識

- 久坐的生活方式日益盛行

- 有利的報銷方案

- 老年人口基數不斷增加,肥胖盛行率不斷上升

- 產業陷阱與挑戰

- 設備成本高

- 產品召回

- 嚴格的法規核准

- 成長動力

- 成長潛力分析

- 監管格局

- 報銷場景

- 技術格局

- 未來市場趨勢

- 2024年定價分析

- 管道產品

- 指示景觀

- 2021年至2034年單位數量

- 心律調節器

- 除顫器

- CRT 裝置

- 波特的分析

- 差距分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 公司市佔率分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按產品,2021 年至 2034 年

- 主要趨勢

- 心律調節器

- 植入式心律調節器

- 體外心律調節器

- 除顫器

- 植入式心臟復律去顫器(ICD)

- 經靜脈植入式心臟復律去顫器

- 皮下植入式心臟復律去顫器

- 單腔ICD

- 雙腔ICD

- 體外去顫器

- 手動體外心臟去顫器

- 自動體外心臟去顫器

- 半自動體外心臟去顫器

- 全自動體外心臟去顫器

- 穿戴式心臟復律去顫器

- 植入式心臟復律去顫器(ICD)

- 心臟再同步治療裝置

- 心臟再同步治療裝置-D

- 心臟再同步治療裝置-P

第6章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 充血性心臟衰竭

- 心律不整

- 心搏過緩

- 心跳過速

- 其他應用

第7章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 醫院

- 心臟護理中心

- 門診手術中心

- 其他最終用途

第8章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- Abbott

- ABIOMED

- Amiitalia

- Asahi Kasei

- BIOTRONIK

- Boston Scientific

- BPL Medical Technologies

- CU Medical

- Defibtech

- LivaNova

- Medico

- Medtronic

- MicroPort

- Nihon Kohden

- Osypka Medical

- Pacetronix

- Philips

- Schiller

- Stryker

- Vitatron

The Global Cardiac Rhythm Management Devices Market reached USD 23.5 billion in 2024 and is projected to expand at a CAGR of 5.2% between 2025 and 2034. The growth of this market is fueled by the rising incidence of cardiovascular diseases worldwide, including heart failure, arrhythmias, and other rhythm-related disorders. The steady increase in aging populations across major economies is also driving market expansion, as older individuals are more prone to cardiac complications. Factors such as sedentary lifestyles, poor dietary habits, and rising cases of hypertension, diabetes, and obesity are further intensifying the need for advanced cardiac care solutions.

With cardiovascular diseases remaining the leading cause of mortality worldwide, there is a growing demand for innovative and effective cardiac rhythm management devices that can improve patient outcomes and enhance quality of life. Additionally, constant advancements in medical technology, including remote monitoring and next-generation implantable devices, are transforming the way healthcare providers manage and treat cardiac rhythm disorders. The surge in healthcare expenditure, coupled with greater awareness about early diagnosis and preventive cardiac care, is expected to open up new opportunities for market players. The integration of artificial intelligence (AI) and machine learning (ML) into cardiac rhythm management systems is also anticipated to drive future market trends by enabling predictive analytics and personalized treatment options.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $23.5 Billion |

| Forecast Value | $39.7 Billion |

| CAGR | 5.2% |

The market comprises a wide range of product segments, including pacemakers, defibrillators, and cardiac resynchronization therapy (CRT) devices. Among these, defibrillators hold the largest market share, contributing significantly to the overall revenue. Defibrillators, especially implantable cardioverter defibrillators (ICDs), are vital for patients at high risk of life-threatening arrhythmias. These devices are designed to monitor heart rhythms continuously and deliver electric shocks when abnormal rhythms are detected, thereby preventing sudden cardiac death. The demand for defibrillators is expected to rise steadily as cardiovascular conditions continue to be a leading cause of morbidity and mortality globally.

In terms of application, the cardiac rhythm management devices market is segmented into congestive heart failure, arrhythmias, bradycardia, and tachycardia. Among these, congestive heart failure accounted for USD 8.6 billion in 2024. Devices like ICDs and CRT systems play a crucial role in managing heart failure by improving heart rhythm coordination, enhancing cardiac output, and alleviating symptoms such as fatigue and breathlessness, thereby improving patient quality of life.

The United States Cardiac Rhythm Management Devices Market generated USD 11.1 billion in 2024, dominating the global landscape. The country's advanced healthcare infrastructure, coupled with favorable reimbursement frameworks and broad access to state-of-the-art treatment options, continues to propel market growth. Strong clinical research, ongoing product innovations, and significant investments in R&D are enabling the rapid adoption of CRM devices in the U.S., solidifying its position as a global leader in this space.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing prevalence of heart failure and other cardiac disorders

- 3.2.1.2 Technological advancements and introduction of innovative devices for cardiac rhythm monitoring

- 3.2.1.3 Increasing public awareness

- 3.2.1.4 Rising sedentary lifestyle

- 3.2.1.5 Favorable reimbursement scenario

- 3.2.1.6 Growing geriatric population base coupled with rising prevalence of obesity

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of devices

- 3.2.2.2 Product recalls

- 3.2.2.3 Stringent regulatory approvals

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Reimbursement scenario

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Pricing analysis, 2024

- 3.9 Pipeline products

- 3.10 Indication landscape

- 3.11 Number of units, 2021 - 2034

- 3.11.1 Pacemaker

- 3.11.2 Defibrillators

- 3.11.3 CRT devices

- 3.12 Porter's analysis

- 3.13 GAP analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Company market share analysis

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Pacemakers

- 5.2.1 Implantable pacemakers

- 5.2.2 External pacemakers

- 5.3 Defibrillators

- 5.3.1 Implantable cardioverter defibrillator (ICDs)

- 5.3.1.1 Transvenous implantable cardioverter defibrillator

- 5.3.1.2 Subcutaneous implantable cardioverter defibrillator

- 5.3.1.2.1 Single-chamber ICDs

- 5.3.1.2.2 Dual-chamber ICDs

- 5.3.2 External defibrillator

- 5.3.2.1 Manual external defibrillator

- 5.3.2.2 Automated external defibrillator

- 5.3.2.2.1 Semi-automated external defibrillator

- 5.3.2.2.2 Fully automated external defibrillator

- 5.3.2.3 Wearable cardioverter defibrillator

- 5.3.1 Implantable cardioverter defibrillator (ICDs)

- 5.4 Cardiac resynchronization therapy devices

- 5.4.1 Cardiac resynchronization therapy devices- D

- 5.4.2 Cardiac resynchronization therapy devices- P

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Congestive heart failure

- 6.3 Arrhythmias

- 6.4 Bradycardia

- 6.5 Tachycardia

- 6.6 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Cardiac care centers

- 7.4 Ambulatory surgical centers

- 7.5 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Abbott

- 9.2 ABIOMED

- 9.3 Amiitalia

- 9.4 Asahi Kasei

- 9.5 BIOTRONIK

- 9.6 Boston Scientific

- 9.7 BPL Medical Technologies

- 9.8 CU Medical

- 9.9 Defibtech

- 9.10 LivaNova

- 9.11 Medico

- 9.12 Medtronic

- 9.13 MicroPort

- 9.14 Nihon Kohden

- 9.15 Osypka Medical

- 9.16 Pacetronix

- 9.17 Philips

- 9.18 Schiller

- 9.19 Stryker

- 9.20 Vitatron