|

市場調查報告書

商品編碼

1716605

夯實機市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Tamping Rammer Machine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

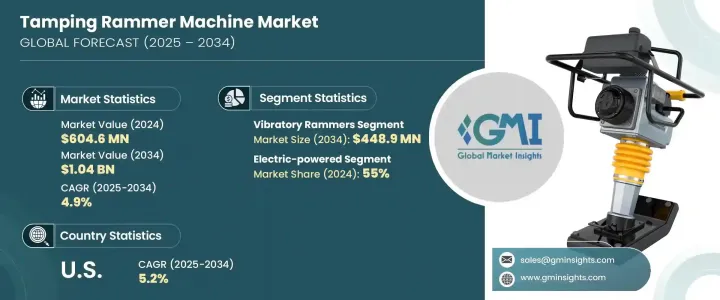

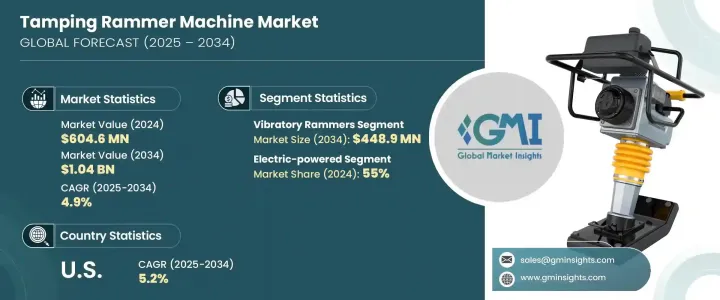

2024 年全球夯實夯機市值為 6.046 億美元,預計 2025 年至 2034 年的複合年成長率為 4.9%。建築活動和基礎設施發展的增加極大地促進了對夯實夯機的需求。隨著都市化及人口成長,住宅、商業綜合體、道路等各類基礎建設的建設需求不斷擴大。夯實機對於壓實礫石、土壤和瀝青至關重要,可確保這些結構的穩定性和耐用性。建築業的成長,特別是新興經濟體的建築業的成長,是這些機器需求不斷成長的主要驅動力。當承包商努力在專案中實現高效壓即時,夯實機為確保適當的土壤密度提供了理想的解決方案,這對於結構完整性至關重要。

夯實機因其效率而受到青睞,它可以幫助承包商最大限度地降低勞動力成本和專案時間表。它們能夠快速有效地壓實狹窄或難以到達的空間內的材料,這是一大優點。雖然振動平板壓實機、手扶壓路機和溝槽壓路機等替代技術也用於土壤壓實,但夯實機在市場上仍佔有重要地位。儘管有這樣的替代方案,夯實機仍然具有非凡的價值,特別是對於大型機器無法操作的狹窄空間內的任務。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 6.046億美元 |

| 預測值 | 10.4億美元 |

| 複合年成長率 | 4.9% |

就產品類型而言,市場分為衝擊夯、震動夯、手扶夯和遙控夯。振動夯實機預計將佔據主導地位,2024 年市場價值為 2.496 億美元,到 2034 年將成長到 4.489 億美元。這些機器在黏性土壤和混合土壤中非常有效,可以用最小的力氣快速壓實,非常適合中型到重型任務。與手動壓實方法相比,振動夯實機還節省時間和能源,因此在公用設施安裝等小型專案中很受歡迎。

市場按動力源細分,電動夯實機佔據市場主導地位,到 2024 年將佔 55% 的佔有率。這些機器由於零排放和低噪音,特別適合室內應用。電池供電的夯實機便於攜帶,且不會產生汽油供電電機型的排放,適合室內和室外使用。在電力供應有限的戶外環境中,汽油動力夯實機仍然很有用。

建築業是最大的終端用途領域,2024 年將佔超過 30.86% 的市場佔有率,預計到 2034 年將以 5.3% 的速度成長。這些機器對於道路工程、路面鋪設和溝槽回填等各種任務至關重要,尤其是在狹窄或密閉的空間。在大量基礎設施投資的推動下,美國市場預計在預測期內以 5.2% 的複合年成長率成長。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 定價分析

- 技術與創新格局

- 重要新聞和舉措

- 監管格局

- 製造商

- 經銷商

- 衝擊力

- 成長動力

- 增加建築活動

- 基礎建設發展

- 攜帶式設備需求不斷成長

- 技術進步

- 產業陷阱與挑戰

- 來自替代技術的競爭

- 環境問題

- 成長動力

- 成長潛力分析

- 技術概述

- 貿易分析(HS 編碼 – 84306100)

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依產品類型,2021-2034

- 主要趨勢

- 振動夯實機

- 衝擊夯

- 手扶式衝擊夯

- 遙控夯錘

第6章:市場估計與預測:按電源,2021-2034

- 主要趨勢

- 汽油動力

- 電動

- 電池供電

第7章:市場估計與預測:依類別,2021-2034

- 主要趨勢

- 自動的

- 手動的

- 半自動

第8章:市場估計與預測:依最終用途,2021-2034

- 主要趨勢

- 建造

- 基礎設施

- 礦業

- 庭園綠化

- 農業

- 其他

第9章:市場估計與預測:按配銷通路,2021-2034

- 主要趨勢

- 直銷

- 間接銷售

第10章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 11 章:公司簡介

- Ammann Group

- Atlas Copco

- Belle Group

- Bomag GmbH

- Caterpillar Inc.

- Chicago Pneumatic

- Doosan Corporation

- Husqvarna Group

- JCB

- MBW Inc.

- Mikasa Sangyo Co., Ltd.

- Multiquip Inc.

- Toro Company

- Wacker Neuson

- Weber MT

The Global Tamping Rammer Machine Market was valued at USD 604.6 million in 2024 and is expected to grow at a CAGR of 4.9% from 2025 to 2034. The rise in construction activities and infrastructure development is significantly contributing to the demand for tamping rammers. With urbanization and population growth, the need for constructing various types of infrastructure, including residential buildings, commercial complexes, and roads, continues to expand. Tamping rammers are critical in compacting gravel, soil, and asphalt, ensuring the stability and durability of these structures. The growth of the construction industry, particularly in emerging economies, is a key driver behind the increasing demand for these machines. As contractors strive for efficient compaction in their projects, tamping rammers provide an ideal solution for ensuring proper soil density, which is essential for structural integrity.

Tamping rammers are favored due to their efficiency, helping contractors minimize labor costs and project timelines. Their ability to quickly and effectively compact materials in tight or difficult-to-reach spaces is a major advantage. While alternative technologies such as vibratory plate compactors, walk-behind rollers, and trench rollers are also used for soil compaction, tamping rammers maintain their significance in the market. Despite the presence of such alternatives, tamping rammers offer exceptional value, particularly for tasks in confined spaces where larger machines cannot operate.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $604.6 Million |

| Forecast Value | $1.04 Billion |

| CAGR | 4.9% |

In terms of product type, the market is divided into percussion rammers, vibratory rammers, walk-behind rammers, and remote-controlled rammers. Vibratory rammers are expected to dominate, with a market value of USD 249.6 million in 2024, growing to USD 448.9 million by 2034. These machines are highly effective in cohesive and mixed soils, providing rapid compaction with minimal effort, which is ideal for medium-to-heavy tasks. Vibratory rammers also save time and energy compared to manual compaction methods, making them popular for small projects such as utility installations.

The market is segmented by power source, with electric-powered rammers leading the market with a 55% share in 2024. These machines are particularly suitable for indoor applications due to their zero emissions and low noise. Battery-powered rammers offer portability without the emissions of gasoline-powered models, making them versatile for both indoor and outdoor use. Gasoline-powered rammers remain useful in outdoor environments where electricity access is limited.

The construction sector is the largest end-use segment, accounting for over 30.86% of the market share in 2024, and it is expected to grow at a rate of 5.3% by 2034. These machines are essential for various tasks in roadwork, pavement laying, and trench backfilling, particularly in narrow or confined spaces. The market in the U.S. is projected to grow at a CAGR of 5.2% during the forecast period, driven by significant infrastructure investments.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.4.2.1 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.3 Pricing analysis

- 3.4 Technology & innovation landscape

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Manufacturers

- 3.8 Distributors

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Increasing construction activities

- 3.9.1.2 Infrastructure development

- 3.9.1.3 Growing demand for portable equipment

- 3.9.1.4 Technological advancements

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Competition from alternative technologies

- 3.9.2.2 Environmental concerns

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Technological overview

- 3.12 Trade analysis (HS Code – 84306100)

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 Vibratory rammers

- 5.3 Percussion rammers

- 5.4 Walk-behind rammers

- 5.5 Remote-controlled rammers

Chapter 6 Market Estimates & Forecast, By Power Source, 2021-2034 (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Gasoline-powered

- 6.3 Electric-powered

- 6.4 Battery-powered

Chapter 7 Market Estimates & Forecast, By Category, 2021-2034 (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 Automatic

- 7.3 Manual

- 7.4 Semi-automatic

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034 (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 Construction

- 8.3 Infrastructure

- 8.4 Mining

- 8.5 Landscaping and gardening

- 8.6 Agriculture

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Million) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct sales

- 9.3 Indirect sales

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Million) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Ammann Group

- 11.2 Atlas Copco

- 11.3 Belle Group

- 11.4 Bomag GmbH

- 11.5 Caterpillar Inc.

- 11.6 Chicago Pneumatic

- 11.7 Doosan Corporation

- 11.8 Husqvarna Group

- 11.9 JCB

- 11.10 MBW Inc.

- 11.11 Mikasa Sangyo Co., Ltd.

- 11.12 Multiquip Inc.

- 11.13 Toro Company

- 11.14 Wacker Neuson

- 11.15 Weber MT