|

市場調查報告書

商品編碼

1716592

視訊對講設備市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Video Intercom Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

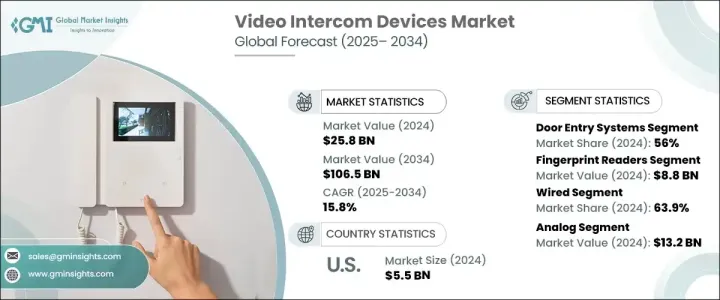

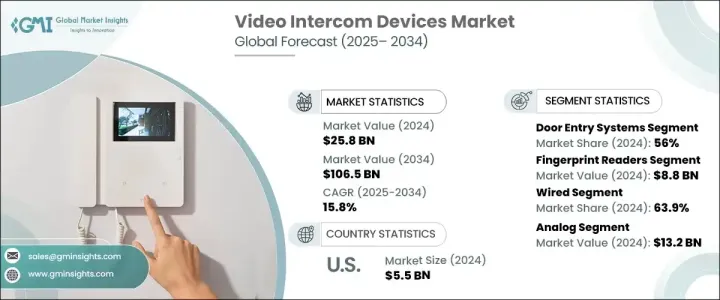

2024 年全球視訊對講設備市場價值為 258 億美元,預計 2025 年至 2034 年的複合年成長率為 15.8%。市場快速成長的動力來自於對先進家庭安全系統日益成長的需求以及無線通訊技術的不斷創新。消費者對安全的關注度不斷提高,對智慧家庭安全解決方案的需求也越來越高。可支配收入的增加和家庭安全研發投資的增加進一步推動了全球對這些系統的應用。人工智慧與智慧家庭技術的結合,使得系統更有效率、安全、使用者友好,增強了可視對講設備的吸引力。隨著基於雲端和無線的安全系統日益普及,消費者正在從傳統解決方案轉向採用透過行動裝置提供即時通知和遠端控制的系統。隨著城市人口遷移的加速以及雙收入家庭對遠端監控系統的追求,對智慧安全解決方案的需求持續上升。

市場根據設備類型分為手持設備、門禁系統和視訊嬰兒監視器。受住宅和商業建築對高級安全功能需求不斷成長的推動,門禁系統領域在 2024 年佔據了全球視訊對講設備市場的 56%。物聯網和基於人工智慧的存取控制系統的整合透過實現用戶身份驗證、遠端管理和持續監控增強了安全性。人們越來越關注智慧安全解決方案以應對日益嚴重的安全威脅,這推動了門禁系統的採用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 258億美元 |

| 預測值 | 1065億美元 |

| 複合年成長率 | 15.8% |

根據存取控制,市場分為指紋讀取器、密碼存取、感應卡和無線存取。 2024 年指紋辨識器市場價值為 88 億美元,反映出人們對生物辨識安全系統的偏好日益增加。隨著住宅、商業和工業環境中的安全問題日益嚴重,業主們紛紛選擇基於生物辨識的控制系統,因為它們可靠、易用,並且能夠防止未經授權的存取。指紋辨識器提供非接觸式、快速且安全的身份驗證,降低憑證被盜或濫用的風險。人工智慧與指紋識別、基於雲端的存取和行動身份驗證的整合進一步增強了這些系統的安全性和便利性。

根據系統類型,市場分為有線和無線。 2024 年,有線市場佔據了 63.9% 的市場佔有率,因為高安全性環境青睞有線解決方案,因為它們可靠且具有抵禦網路威脅的能力。政府設施、軍事基地和關鍵基礎設施站點需要最高程度的安全,與無線方案相比,有線系統可以更好地防止資料外洩和系統中斷。

技術部分分為模擬系統和基於 IP 的系統。由於類比技術在低頻寬環境的可靠性,其市場規模到 2024 年將達到 132 億美元。與依賴網際網路連接的基於 IP 的系統不同,模擬系統獨立運行,因此非常適合寬頻普及率有限的老建築和農村地區。

根據最終用途,市場分為汽車、商業、政府、住宅和其他。受智慧辦公室和共享辦公空間對自動門禁控制需求不斷成長的推動,商業領域將在 2024 年以 93 億美元的規模引領市場。基於物聯網的辦公環境的日益普及推動了對非接觸式進入、訪客記錄以及透過視訊對講系統提高安全性的需求。 2024 年,美國市場規模達 55 億美元,對整合物聯網、人工智慧和基於雲端的監控系統以提高住宅安全性的複雜家庭安全解決方案的需求不斷成長。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商格局

- 利潤率分析

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 家庭安全系統需求不斷成長

- 無線通訊技術的進步

- 智慧家庭普及率不斷上升

- 都市化和住宅小區不斷擴大

- 與物聯網和自動化整合

- 產業陷阱與挑戰

- 初始安裝和維護成本高

- 隱私和資料安全問題

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依設備類型,2021-2034

- 主要趨勢

- 門禁系統

- 手持裝置

- 視訊嬰兒監視器

第6章:市場估計與預測:按存取控制,2021-2034

- 主要趨勢

- 指紋辨識器

- 密碼訪問

- 感應卡

- 無線存取

第7章:市場估計與預測:按系統,2021-2034

- 主要趨勢

- 有線

- 無線的

第8章:市場估計與預測:依技術,2021-2034 年

- 主要趨勢

- 模擬

- 基於IP

第9章:市場估計與預測:依最終用途,2021-2034

- 主要趨勢

- 汽車

- 商業的

- 政府

- 住宅

- 其他

第10章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 11 章:公司簡介

- ABB Ltd

- Aiphone

- Axis Communications AB

- ButterflyMX Inc.

- Comelit Group

- Commend International GmbH

- Dahua Technologies Co. Ltd

- Doorbird

- Fermax

- Godrej & Boyce Mfg. Co. Ltd.

- Hangzhou Hikvision Digital Technology Co. Ltd

- Honeywell

- KOCOM Co., Ltd.

- Legrand

- Mivanta

- MOX Group Limited

- Panasonic Holdings Corporation

- Ring

- Siedle & Sohne OHG

- Xiamen Leelen Technology Co., Ltd

- Zicom

- ZKTeco

The Global Video Intercom Devices Market was valued at USD 25.8 billion in 2024 and is anticipated to grow at a CAGR of 15.8% from 2025 to 2034. The rapid growth of the market is driven by the increasing demand for advanced home security systems and rising innovations in wireless communication technology. Consumers are more concerned about safety, leading to a higher demand for smart home security solutions. Rising disposable income and growing investments in research and development for home security have further fueled the adoption of these systems globally. The integration of AI with smart home technologies has enabled more efficient, secure, and user-friendly systems, enhancing the appeal of video intercom devices. With the increasing popularity of cloud-based and wireless security systems, consumers are shifting away from conventional solutions to adopt systems that offer real-time notifications and remote control through mobile devices. As urban migration accelerates and dual-income families seek remote surveillance systems, demand for intelligent security solutions continues to rise.

The market is segmented by device type into handheld devices, door entry systems, and video baby monitors. The door entry systems segment captured 56% of the global video intercom devices market in 2024, driven by the increasing need for advanced security features in residential and commercial buildings. Integration of IoT and AI-based access control systems has enhanced security by enabling user identity verification, remote management, and continuous surveillance. The growing focus on smart security solutions to address rising security threats is boosting the adoption of door entry systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $25.8 Billion |

| Forecast Value | $106.5 Billion |

| CAGR | 15.8% |

By access control, the market is divided into fingerprint readers, password access, proximity cards, and wireless access. The fingerprint readers segment was valued at USD 8.8 billion in 2024, reflecting the increasing preference for biometric security systems. As security concerns grow in residential, commercial, and industrial settings, property owners are opting for biometric-based control systems due to their reliability, ease of use, and ability to prevent unauthorized access. Fingerprint readers offer contactless, fast, and secure authentication, reducing the risk of credential theft or misuse. The integration of AI with fingerprint recognition, cloud-based access, and mobile authentication further enhances the security and convenience of these systems.

The market is bifurcated by system type into wired and wireless. The wired segment held 63.9% of the market share in 2024, as high-security environments favor wired solutions due to their reliability and resilience against cyber threats. Government facilities, military bases, and critical infrastructure sites require maximum security, and wired systems offer better protection against data breaches and system disruptions compared to wireless alternatives.

The technology segment is divided into analog and IP-based systems. The analog segment accounted for USD 13.2 billion in 2024 due to its reliability in low-bandwidth environments. Unlike IP-based systems that rely on internet connectivity, analog systems operate independently, making them ideal for older buildings and rural areas where broadband penetration is limited.

By end use, the market is segmented into automotive, commercial, government, residential, and others. The commercial segment led the market with USD 9.3 billion in 2024, driven by the rising demand for automated access control in smart offices and co-working spaces. Increased adoption of IoT-based office environments has fueled the need for contactless entry, visitor logging, and improved security through video intercom systems. In 2024, the US market accounted for USD 5.5 billion, with growing demand for sophisticated home security solutions that integrate IoT, AI, and cloud-based monitoring systems to improve residential security.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing demand for home security systems

- 3.6.1.2 Advancements in wireless communication technology

- 3.6.1.3 Rising adoption in smart homes

- 3.6.1.4 Growing urbanization and residential complexes

- 3.6.1.5 Integration with IoT and automation

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High initial installation and maintenance costs

- 3.6.2.2 Privacy and data security concerns

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Device Type, 2021-2034 (USD Billion & Units)

- 5.1 Key trends

- 5.2 Door entry systems

- 5.3 Handheld devices

- 5.4 Video baby monitors

Chapter 6 Market Estimates & Forecast, By Access control, 2021-2034 (USD Billion)

- 6.1 Key trends

- 6.2 Fingerprint readers

- 6.3 Password access

- 6.4 Proximity cards

- 6.5 Wireless access

Chapter 7 Market Estimates & Forecast, By System, 2021-2034 (USD Billion & Units)

- 7.1 Key trends

- 7.2 Wired

- 7.3 Wireless

Chapter 8 Market Estimates & Forecast, By Technology, 2021-2034 (USD Billion)

- 8.1 Key trends

- 8.2 Analog

- 8.3 IP-based

Chapter 9 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion & Units)

- 9.1 Key trends

- 9.2 Automotive

- 9.3 Commercial

- 9.4 Government

- 9.5 Residential

- 9.6 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion & Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 ABB Ltd

- 11.2 Aiphone

- 11.3 Axis Communications AB

- 11.4 ButterflyMX Inc.

- 11.5 Comelit Group

- 11.6 Commend International GmbH

- 11.7 Dahua Technologies Co. Ltd

- 11.8 Doorbird

- 11.9 Fermax

- 11.10 Godrej & Boyce Mfg. Co. Ltd.

- 11.11 Hangzhou Hikvision Digital Technology Co. Ltd

- 11.12 Honeywell

- 11.13 KOCOM Co., Ltd.

- 11.14 Legrand

- 11.15 Mivanta

- 11.16 MOX Group Limited

- 11.17 Panasonic Holdings Corporation

- 11.18 Ring

- 11.19 Siedle & Sohne OHG

- 11.20 Xiamen Leelen Technology Co., Ltd

- 11.21 Zicom

- 11.22 ZKTeco