|

市場調查報告書

商品編碼

1716588

資料中心機器人市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Data Center Robotics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

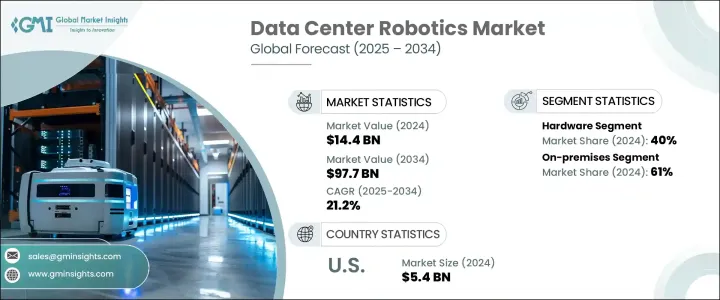

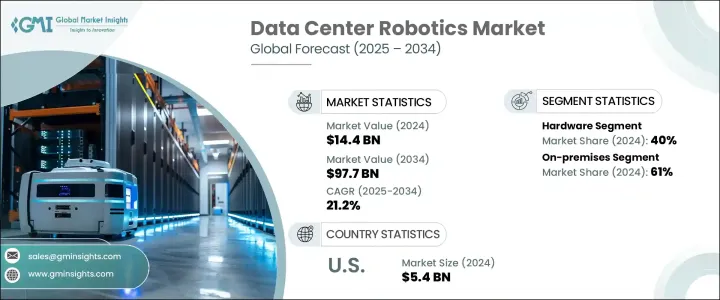

全球資料中心機器人市場在 2024 年的估值為 144 億美元,預計在 2025 年至 2034 年期間的複合年成長率將達到 21.2%,這得益於資料中心自動化需求的不斷成長。提高生產力、減少人力勞動和增強營運效率的需求推動了對機器人的需求。透過自動執行伺服器維護、電纜管理和環境監控等基本任務,機器人可以最大限度地減少人為錯誤並減少停機時間,從而以最少的監督實現更順暢、更有效率的運作。

隨著資料中心數量和規模的不斷成長,特別是超大規模和邊緣設施的興起,機器人的角色變得越來越重要。這些自動化系統對於管理需要處理的大量任務至關重要,包括設備處理、伺服器監督和冷卻最佳化。這些流程的自動化有助於最大限度地減少停機時間和空閒時間,從而在資料需求不斷成長的情況下提高生產力。對更有效率、更具可擴展性的機器人解決方案的需求不斷成長,反映了對資料中心日益成長的依賴以及維護其複雜基礎設施的需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 144億美元 |

| 預測值 | 977億美元 |

| 複合年成長率 | 21.2% |

市場分為硬體、軟體和服務,其中硬體目前佔據市場主導地位,到 2024 年將佔據約 40% 的佔有率。預計該領域將繼續強勁成長,複合年成長率將超過 19.5%。自主移動機器人 (AMR) 和機械手臂等自動化技術正逐步取代體力勞動,以實現更快、更準確的維護和設備處理。

資料中心機器人也根據部署模型進行分類,市場分為內部部署模型和基於雲端的模型。到 2024 年,本地部署市場將佔據大部分佔有率,達到 61%。預計到 2034 年,該領域的複合年成長率將超過 20.5%。內部部署具有顯著優勢,包括對機器人系統的更大控制,這有助於提高效能並減少對外部網路的依賴,最大限度地減少延遲並實現對伺服器監控和自動化等任務的更快回應。

在機器人類型領域,服務機器人因其在自動化操作和提高系統可靠性方面的關鍵作用而佔據主導地位。這些機器人擴大用於監控加熱、冷卻和安全巡邏等任務,從而提高了資料中心的整體效能。服務機器人還提供遠端管理,使IT人員可以遠端監督操作,從而進一步提高營運效率。

在北美,美國佔據主導地位,佔有該地區 93% 的市場佔有率。美國繼續透過其技術中心推動成長,各大公司投資機器人技術來維護伺服器基礎設施並最佳化能源消耗。隨著對高效能運算、人工智慧和雲端操作的需求不斷成長,資料中心機器人正成為確保可靠、高效營運的關鍵部分。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 零件供應商

- 製造商

- 系統整合商

- 技術提供者

- 最終用途

- 利潤率分析

- 技術與創新格局

- 專利分析

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 自動化需求不斷成長

- 不斷擴大資料中心規模

- 雲端運算和人工智慧工作負載的成長

- 對增強安全性的需求日益成長

- 產業陷阱與挑戰

- 初期投資成本高

- 與現有基礎設施的複雜整合

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按組件,2021 - 2034 年

- 主要趨勢

- 硬體

- 感應器

- 執行器

- 馬達

- 視覺系統

- 人工智慧處理器

- 其他

- 軟體

- 服務

第6章:市場估計與預測:按機器人,2021 - 2034 年

- 主要趨勢

- 協作機器人

- 工業機器人

- 服務機器人

- 其他

第7章:市場估計與預測:依部署模型,2021 - 2034 年

- 主要趨勢

- 本地

- 基於雲端

第8章:市場估計與預測:依企業規模,2021 - 2034 年

- 主要趨勢

- 中小企業

- 大型企業

第9章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 金融服務業

- 主機託管

- 能源

- 政府

- 衛生保健

- 製造業

- IT與電信

- 其他

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第 11 章:公司簡介

- 365 Data Centers

- ABB

- Amazon Web Services

- Boston Dynamics

- China Telecom

- Cisco Systems

- ConnectWise

- Digital Realty

- Equinix

- Fanuc

- Hewlett Packard Enterprise Development

- Huawei Technologies

- IBM

- Microsoft Corporation

- NTT Communications

- Rockwell Automation

- Siemens

- SoftBank Robotics

- Verizon

The Global Data Center Robotics Market, with a valuation of USD 14.4 billion in 2024, is expected to grow at a CAGR of 21.2% from 2025 to 2034, driven by the increasing need for automation in data centers. The demand for robotics is being fueled by the necessity for improved productivity, reduced human labor, and enhanced operational efficiency. By automating essential tasks such as server maintenance, cable management, and environmental monitoring, robotics are minimizing human errors and reducing downtime, enabling smoother, more efficient operations with minimal supervision.

As data centers continue to grow in number and scale, particularly with the rise of hyperscale and edge facilities, the role of robotics becomes increasingly vital. These automated systems are essential for managing the vast array of tasks that need to be handled, including equipment handling, server supervision, and cooling optimization. The automation of these processes helps to minimize downtime and idle time, improving productivity in the face of rising data demands. This expanding need for more efficient and scalable robotic solutions reflects the growing reliance on data centers and the need to maintain their complex infrastructure.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $14.4 Billion |

| Forecast Value | $97.7 Billion |

| CAGR | 21.2% |

The market is segmented into hardware, software, and services, with hardware currently leading the market, accounting for approximately 40% of the share in 2024. This segment is expected to continue its strong growth, expanding at a CAGR of over 19.5%. Automation technologies such as autonomous mobile robots (AMRs) and robotic arms are gradually replacing manual labor, enabling faster, more accurate maintenance and equipment handling.

Data center robotics are also categorized based on deployment model, with the market divided between on-premises and cloud-based models. In 2024, the on-premises segment holds the majority share, representing 61% of the market. This segment is expected to grow at a CAGR of more than 20.5% through 2034. On-premises deployment offers significant advantages, including greater control over robotic systems, which helps improve performance and reduces reliance on external networks, minimizing latency and enabling quicker responses for tasks like server monitoring and automation.

Within the robot type segment, service robots are poised to dominate, thanks to their pivotal role in automating operations and improving system reliability. These robots are increasingly utilized for monitoring tasks such as heating, cooling, and security patrols, enhancing the overall performance of data centers. Service robots also provide remote management, allowing IT staff to oversee operations from a distance, which further boosts operational efficiency.

In North America, the U.S. leads the market with a substantial 93% market share in the region. The U.S. continues to drive growth through its tech hubs, with major corporations investing in robotics to maintain server infrastructure and optimize energy consumption. As demand for high-performance computing, AI, and cloud operations grows, data center robotics are becoming a critical part of ensuring reliable, efficient operations.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Component suppliers

- 3.2.2 Manufacturers

- 3.2.3 System integrators

- 3.2.4 Technology providers

- 3.2.5 End use

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Rising demand for automation

- 3.8.1.2 Increasing data center expansion

- 3.8.1.3 Growth in cloud computing and AI workloads

- 3.8.1.4 Growing need for enhanced security

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 High initial investment costs

- 3.8.2.2 Complex integration with existing infrastructure

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 Sensor

- 5.2.2 Actuator

- 5.2.3 Motors

- 5.2.4 Vision systems

- 5.2.5 AI processors

- 5.2.6 Others

- 5.3 Software

- 5.4 Services

Chapter 6 Market Estimates & Forecast, By Robot, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Collaborative robots

- 6.3 Industrial robots

- 6.4 Service robots

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By Deployment Model, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 On-premises

- 7.3 Cloud-based

Chapter 8 Market Estimates & Forecast, By Enterprise Size, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 SME

- 8.3 Large enterprises

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 BFSI

- 9.3 Colocation

- 9.4 Energy

- 9.5 Government

- 9.6 Healthcare

- 9.7 Manufacturing

- 9.8 IT & telecom

- 9.9 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 365 Data Centers

- 11.2 ABB

- 11.3 Amazon Web Services

- 11.4 Boston Dynamics

- 11.5 China Telecom

- 11.6 Cisco Systems

- 11.7 ConnectWise

- 11.8 Digital Realty

- 11.9 Equinix

- 11.10 Fanuc

- 11.11 Google

- 11.12 Hewlett Packard Enterprise Development

- 11.13 Huawei Technologies

- 11.14 IBM

- 11.15 Microsoft Corporation

- 11.16 NTT Communications

- 11.17 Rockwell Automation

- 11.18 Siemens

- 11.19 SoftBank Robotics

- 11.20 Verizon