|

市場調查報告書

商品編碼

1716585

智慧拳擊機市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Smart Boxing Machine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

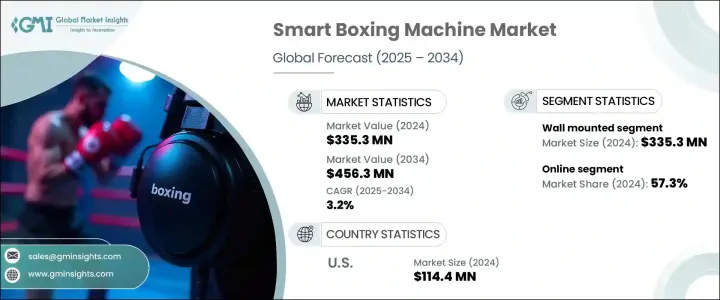

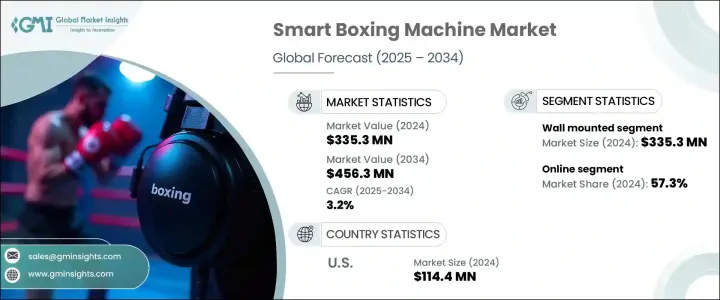

2024 年全球智慧拳擊機市場價值為 3.353 億美元,預計 2025 年至 2034 年的複合年成長率為 3.2%。如今的消費者更喜歡提供沉浸式體驗和先進技術的數位產品。人們對創新健身器材的日益成長的興趣推動了對整合人工智慧 (AI)、感測器和即時資料分析的智慧拳擊機的需求。這些技術改進提供了個人化的訓練課程,使用者可以監控出拳速度、準確性和力量等關鍵性能指標。隨著越來越多的健身愛好者尋求有效且互動的鍛鍊解決方案,對智慧拳擊機的需求持續上升,為製造商開發滿足這些不斷變化的偏好的產品創造了機會。

智慧拳擊機市場按類型分為壁掛式和落地式。壁掛式智慧拳擊機在 2024 年創造了 3.353 億美元的收入,預計到 2034 年將成長到 4.563 億美元。其節省空間的設計使其成為家庭健身房和小型健身空間的首選。消費者希望能夠最佳化自己的生活空間,同時也能使用高品質的訓練設備。這些機器採用了人工智慧、感測器和連接等先進技術,可提供有關技術、划水指標和訓練進度的即時回饋。使用者可以透過調整衝擊強度、速度和間歇訓練等參數來客製化他們的鍛鍊體驗,從而增強機器的多功能性。對虛擬訓練程序和模擬戰鬥課程等互動功能的需求不斷成長,進一步推動了這些模型的採用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 3.353億美元 |

| 預測值 | 4.563億美元 |

| 複合年成長率 | 3.2% |

市場也根據配銷通路細分為線上和線下銷售。 2024 年,線上市場佔據市場主導地位,創造了 1.923 億美元的收入,佔據了約 57.3% 的市場佔有率。線上銷售管道消除了地理限制,讓消費者可以輕鬆獲得先進的健身器材,從而使製造商能夠接觸到更廣泛的受眾。許多品牌更願意透過其網站或電子商務平台直接向消費者銷售產品,繞過中間商以降低成本並提供有競爭力的價格。這種直接面對消費者的方式有助於製造商在增強購買體驗的同時保持對客戶關係的控制。由於人們越來越依賴數位購物,並且它為全球健身愛好者提供了便利,網路銷售繼續佔據市場主導地位。

美國智慧拳擊機市場在 2024 年的價值約為 1.144 億美元,預計在 2025 年至 2034 年期間的複合年成長率為 2.9%。由於便利性、隱私問題以及 COVID-19 大流行的影響等因素加速了家庭健身的趨勢,美國引領北美市場。美國消費者以其對技術進步的熱情而聞名,他們是最早採用智慧健身設備的消費者之一。智慧拳擊機通常整合人工智慧、感測器和 Wi-Fi 和藍牙等連接功能,為使用者提供互動式訓練體驗、即時回饋和提高鍛鍊效率。隨著對緊湊型多功能健身器材的需求不斷成長,美國市場預計將保持其在智慧拳擊機行業的領導地位。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 衝擊力

- 成長動力

- 先進技術的融合

- 越來越重視健身和健康

- 電子商務平台的擴展

- 產業陷阱與挑戰

- 初期投資高

- 技術挑戰和用戶適應性

- 成長動力

- 消費者購買行為分析

- 人口趨勢

- 影響購買決策的因素

- 消費者產品採用

- 首選配銷通路

- 首選價格範圍

- 技術概述

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按類型,2021 年至 2034 年

- 主要趨勢

- 壁掛式

- 落地式

第6章:市場估計與預測:依電源分類,2021 年至 2034 年

- 主要趨勢

- 電的

- 電池供電

第7章:市場估計與預測:依價格區間,2021 年至 2034 年

- 主要趨勢

- 低的

- 中等的

- 高的

第 8 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 住宅

- 商業的

- 健身中心和健身房

- 運動訓練設施

- 零售和酒店

- 其他(商場及娛樂中心、企業健康計畫等)

第9章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 線上

- 電子商務平台

- 公司網站

- 離線

- 體育用品店

- 大型超市

- 其他(健身器材零售店等)

第10章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第 11 章:公司簡介

- Corner Boxing

- Everlast Worldwide Inc.

- FightCamp

- Hykso

- Liteboxer

- Nexersys

- PIQ

- Ringside

- SkyTechSport Inc.

- StrikeTec

- UBX

The Global Smart Boxing Machine Market was valued at USD 335.3 million in 2024 and is projected to grow at a CAGR of 3.2% from 2025 to 2034. Consumers today prefer digital products that offer immersive experiences and advanced technology. This growing inclination toward innovative fitness equipment has driven the demand for smart boxing machines that integrate artificial intelligence (AI), sensors, and real-time data analytics. These technological enhancements provide personalized training sessions where users can monitor key performance metrics such as punch speed, accuracy, and power. As more fitness enthusiasts seek effective and interactive workout solutions, the demand for smart boxing machines continues to rise, creating opportunities for manufacturers to develop products that cater to these evolving preferences.

The smart boxing machine market is segmented by type into wall-mounted and floor-standing models. Wall-mounted smart boxing machines generated USD 335.3 million in revenue in 2024 and are expected to grow to USD 456.3 million by 2034. Their space-efficient design makes them a preferred choice for home gyms and smaller fitness spaces. Consumers appreciate the ability to optimize their living spaces while maintaining access to high-quality training equipment. These machines incorporate advanced technologies such as AI, sensors, and connectivity to offer real-time feedback on technique, stroke metrics, and training progress. Users can customize their workout experience by adjusting parameters like impact intensity, speed, and interval training, enhancing the machine's versatility. The rising demand for interactive features, such as virtual training routines and simulated combat sessions, further drives the adoption of these models.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $335.3 Million |

| Forecast Value | $456.3 Million |

| CAGR | 3.2% |

The market is also segmented by distribution channel into online and offline sales. The online segment led the market in 2024, generating USD 192.3 million in revenue and capturing around 57.3% of the market share. Online sales channels allow manufacturers to reach a broader audience by eliminating geographical limitations and providing consumers with easy access to advanced exercise equipment. Many brands prefer selling their products directly to consumers through their websites or e-commerce platforms, bypassing intermediaries to reduce costs and offer competitive pricing. This direct-to-consumer approach helps manufacturers maintain control over customer relationships while enhancing the buying experience. Online sales continue to dominate the market due to the growing reliance on digital shopping and the convenience it offers to fitness enthusiasts worldwide.

The U.S. smart boxing machine market, valued at approximately USD 114.4 million in 2024, is expected to grow at a CAGR of 2.9% from 2025 to 2034. The U.S. leads the North American market due to factors such as convenience, privacy concerns, and the impact of the COVID-19 pandemic, which accelerated the trend toward home fitness. U.S. consumers, recognized for their enthusiasm toward technological advancements, are among the first to adopt smart fitness devices. Smart boxing machines often integrate AI, sensors, and connectivity features such as Wi-Fi and Bluetooth, providing users with interactive training experiences, real-time feedback, and increased workout efficiency. As demand for compact and versatile fitness equipment grows, the U.S. market is expected to maintain its leadership position in the smart boxing machine industry.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast parameters

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Integration of advanced technologies

- 3.2.1.2 Growing emphasis on fitness and wellness

- 3.2.1.3 Expansion of e-commerce platforms

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment

- 3.2.2.2 Technical challenges and user adaptability

- 3.2.1 Growth drivers

- 3.3 Consumer buying behavior analysis

- 3.3.1 Demographic trends

- 3.3.2 Factors affecting buying decisions

- 3.3.3 Consumer product adoption

- 3.3.4 Preferred distribution channel

- 3.3.5 Preferred price range

- 3.4 Technological overview

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021 – 2034 (USD Million) (Thousand Units)

- 5.1 Key Trends

- 5.2 Wall mounted

- 5.3 Floor standing

Chapter 6 Market Estimates & Forecast, By Power Source, 2021 – 2034 (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Electric

- 6.3 Battery operated

Chapter 7 Market Estimates & Forecast, By Price Range, 2021 – 2034, (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 Low

- 7.3 Medium

- 7.4 High

Chapter 8 Market Estimates & Forecast, By Application, 2021 – 2034, (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 Residential

- 8.3 Commercial

- 8.3.1 Fitness centers and gyms

- 8.3.2 Sports training facilities

- 8.3.3 Retail and hospitality

- 8.3.4 Others (Arcades and Entertainment Centers, Corporate Wellness Programs,etc.)

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 – 2034, (USD Million) (Thousand Units)

- 9.1 Key trends

- 9.2 Online

- 9.2.1 E-commerce platforms

- 9.2.2 Company websites

- 9.3 Offline

- 9.3.1 Sporting goods stores

- 9.3.2 Hypermarkets

- 9.3.3 Others (Fitness Equipment Retail Stores, etc.)

Chapter 10 Market Estimates & Forecast, By Region, 2021 – 2034, (USD Million) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 U.K.

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 11.1 Corner Boxing

- 11.2 Everlast Worldwide Inc.

- 11.3 FightCamp

- 11.4 Hykso

- 11.5 Liteboxer

- 11.6 Nexersys

- 11.7 PIQ

- 11.8 Ringside

- 11.9 SkyTechSport Inc.

- 11.10 StrikeTec

- 11.11 UBX