|

市場調查報告書

商品編碼

1716572

家用鍋爐市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Residential Boiler Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

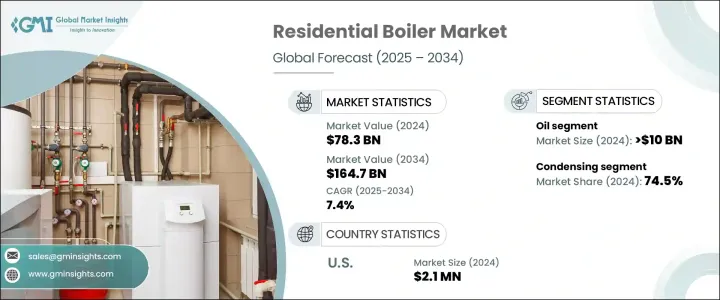

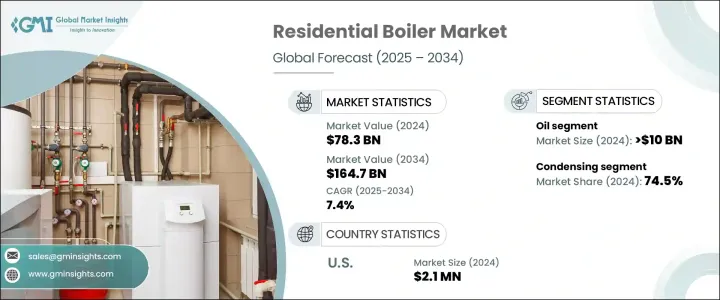

2024 年全球家用鍋爐市場規模達 783 億美元,預計 2025 年至 2034 年期間的複合年成長率為 7.4%。對節能供暖解決方案的需求不斷成長,加上嚴格的環境法規,正在推動市場擴張。世界各國政府正在實施更嚴格的碳排放標準,使得家用鍋爐技術比以往任何時候都更重要。隨著消費者轉向先進的高性能加熱系統,在監管壓力和生活方式偏好變化的共同推動下,現代鍋爐的採用率正在上升。

市場正在經歷變革性轉變,屋主優先考慮永續性、成本節約和長期能源效率。隨著可支配收入的增加和對生態生活的重視,消費者正在積極尋求既可靠又能減少環境影響的供暖解決方案。此外,智慧家庭技術的進步在市場動態中發揮關鍵作用。家用鍋爐與基於物聯網的溫度控制和遠端監控系統的整合進一步提升了消費者的興趣。鍋爐技術的創新,例如增強的熱交換效率和低氮氧化物排放設計,正在為永續性和性能設定新的基準。人們對智慧互聯供暖解決方案的日益青睞正在重塑行業趨勢,並將現代家用鍋爐定位為節能家庭的必需品。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 783億美元 |

| 預測值 | 1647億美元 |

| 複合年成長率 | 7.4% |

天然氣家用鍋爐的需求正在上升,預計到 2034 年將以 7% 的複合年成長率成長。充足的天然氣供應,加上政府鼓勵更清潔的暖氣解決方案的政策,正在加速市場滲透。隨著環境問題持續推動政策制定,消費者正在選擇符合永續發展目標的低排放替代品。減少碳足跡的推動和向綠色能源的轉變進一步支持了天然氣驅動的家用鍋爐的採用。

市場分為冷凝技術和非冷凝技術,其中冷凝鍋爐佔據主導地位。 2024年冷凝式家用鍋爐佔74.5%的市佔率。這些高效能系統因其能夠最大限度地降低能耗並提供卓越的加熱性能而越來越受歡迎。它們對環境的影響較小,且節省成本,因此成為尋求長期供暖解決方案的屋主的首選。隨著環保意識的增強,預計到 2034 年冷凝鍋爐的需求將持續成長,從而鞏固其在市場上的主導地位。

受極端天氣條件、智慧家庭自動化日益普及以及空間供暖需求不斷成長的推動,預計到 2034 年北美家用鍋爐市場將以 8.5% 的複合年成長率擴張。隨著寒冷季節的持續和老舊的暖氣基礎設施升級,對現代節能供暖系統的需求日益成長。此外,智慧家庭暖氣解決方案的技術進步正在增強消費者的興趣,遠端控制和可程式鍋爐系統越來越受歡迎。隨著消費者尋求可靠、高性能的暖氣解決方案,北美家用鍋爐市場將在未來十年實現顯著成長。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 戰略展望

- 創新與永續發展格局

第5章:市場規模及預測:依燃料,2021 年至 2034 年

- 主要趨勢

- 天然氣

- 油

- 電的

- 其他

第6章:市場規模及預測:依技術分類,2021 年至 2034 年

- 主要趨勢

- 冷凝

- 天然氣

- 油

- 電的

- 其他

- 無凝結

- 天然氣

- 油

- 電的

- 其他

第7章:市場規模及預測:依地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 丹麥

- 芬蘭

- 挪威

- 瑞典

- 英國

- 俄羅斯

- 羅馬尼亞

- 波蘭

- 奧地利

- 比利時

- 法國

- 德國

- 荷蘭

- 瑞士

- 希臘

- 義大利

- 葡萄牙

- 西班牙

- 亞太地區

- 中國

- 日本

- 韓國

- 澳洲

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 卡達

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

第8章:公司簡介

- AO Smith

- Allied Technologies

- BDR Thermea Group

- Bradford White Corporation

- Carrier

- Ferroli

- Laars Boilers

- Lennox International

- Lochinvar

- Navien

- NTI Boilers

- PB Heat

- Smith Boilers

- Thermona

- US Boiler Company

- Viessmann

- Weil-McLain

- Wolf

The Global Residential Boiler Market reached USD 78.3 billion in 2024 and is projected to grow at a CAGR of 7.4% between 2025 and 2034. The increasing demand for energy-efficient heating solutions, coupled with stringent environmental regulations, is fueling market expansion. Governments worldwide are enforcing stricter carbon emission standards, making residential boiler technologies more crucial than ever. As consumers shift toward advanced, high-performance heating systems, the adoption of modern boilers is rising, driven by a combination of regulatory pressure and changing lifestyle preferences.

The market is witnessing a transformative shift, with homeowners prioritizing sustainability, cost savings, and long-term energy efficiency. With rising disposable incomes and an emphasis on eco-conscious living, consumers are actively seeking heating solutions that offer both reliability and reduced environmental impact. Additionally, advancements in smart home technologies are playing a pivotal role in market dynamics. The integration of residential boilers with IoT-based temperature controls and remote monitoring systems is further elevating consumer interest. Innovations in boiler technology, such as enhanced heat exchange efficiency and low-NOx emission designs, are setting new benchmarks for sustainability and performance. This growing preference for intelligent, connected heating solutions is reshaping industry trends and positioning modern residential boilers as a staple in energy-conscious households.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $78.3 Billion |

| Forecast Value | $164.7 Billion |

| CAGR | 7.4% |

The demand for natural gas residential boilers is on the rise, projected to grow at a CAGR of 7% by 2034. Abundant natural gas availability, along with government policies encouraging cleaner heating solutions, is accelerating market penetration. As environmental concerns continue to drive policymaking, consumers are opting for low-emission alternatives that align with sustainability goals. The push for reduced carbon footprints and the transition toward greener energy sources are further supporting the adoption of natural gas-powered residential boilers.

The market is categorized into condensing and non-condensing technologies, with condensing boilers leading the segment. In 2024, condensing residential boilers accounted for 74.5% of the market share. These high-efficiency systems are gaining traction due to their ability to minimize energy consumption while delivering superior heating performance. Their lower environmental impact and cost-saving benefits make them a preferred choice among homeowners looking for long-term heating solutions. As eco-consciousness rises, the demand for condensing boilers is expected to witness sustained growth through 2034, reinforcing their dominance in the market.

North America Residential Boiler Market is expected to expand at a CAGR of 8.5% by 2034, driven by extreme weather conditions, the rising adoption of smart home automation, and increasing space heating requirements. The need for modern, energy-efficient heating systems is growing as colder seasons persist and older heating infrastructures undergo upgrades. Additionally, technological advancements in smart home heating solutions are amplifying consumer interest, with remote-controlled and programmable boiler systems gaining popularity. As consumers seek reliable, high-performance heating solutions, the North American residential boiler market is poised for significant growth over the next decade.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Fuel, 2021 – 2034 (‘000 Units & USD Million)

- 5.1 Key trends

- 5.2 Natural gas

- 5.3 Oil

- 5.4 Electric

- 5.5 Others

Chapter 6 Market Size and Forecast, By Technology, 2021 – 2034 (‘000 Units & USD Million)

- 6.1 Key trends

- 6.2 Condensing

- 6.2.1 Natural gas

- 6.2.2 Oil

- 6.2.3 Electric

- 6.2.4 Others

- 6.3 Non-condensing

- 6.3.1 Natural gas

- 6.3.2 Oil

- 6.3.3 Electric

- 6.3.4 Others

Chapter 7 Market Size and Forecast, By Region, 2021 – 2034 (‘000 Units & USD Million)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Denmark

- 7.3.2 Finland

- 7.3.3 Norway

- 7.3.4 Sweden

- 7.3.5 UK

- 7.3.6 Russia

- 7.3.7 Romania

- 7.3.8 Poland

- 7.3.9 Austria

- 7.3.10 Belgium

- 7.3.11 France

- 7.3.12 Germany

- 7.3.13 Netherlands

- 7.3.14 Switzerland

- 7.3.15 Greece

- 7.3.16 Italy

- 7.3.17 Portugal

- 7.3.18 Spain

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 South Korea

- 7.4.4 Australia

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 Qatar

- 7.5.4 South Africa

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

- 7.6.3 Mexico

Chapter 8 Company Profiles

- 8.1 A.O. Smith

- 8.2 Allied Technologies

- 8.3 BDR Thermea Group

- 8.4 Bradford White Corporation

- 8.5 Carrier

- 8.6 Ferroli

- 8.7 Laars Boilers

- 8.8 Lennox International

- 8.9 Lochinvar

- 8.10 Navien

- 8.11 NTI Boilers

- 8.12 PB Heat

- 8.13 Smith Boilers

- 8.14 Thermona

- 8.15 U.S. Boiler Company

- 8.16 Viessmann

- 8.17 Weil-McLain

- 8.18 Wolf