|

市場調查報告書

商品編碼

1716571

汽車碰撞評估軟體市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Auto Collision Estimating Software Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

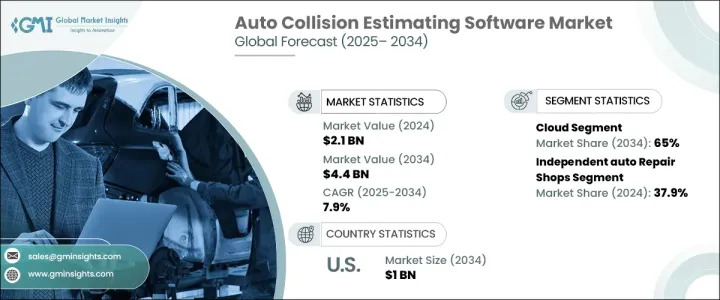

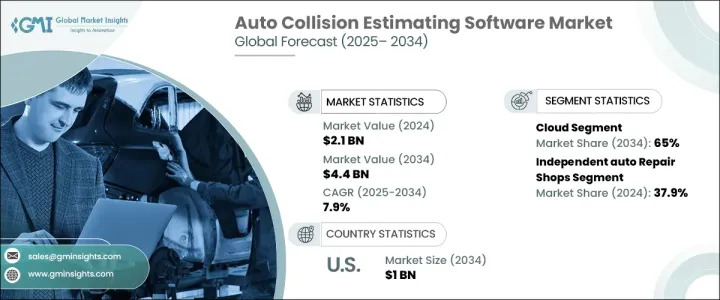

2024 年全球汽車碰撞估算軟體市場規模達到 21 億美元,預計 2025 年至 2034 年期間的複合年成長率為 7.9%。由於道路上車輛數量的增加,導致事故和碰撞案件發生的頻率更高,市場發展勢頭強勁。隨著城市化加快和汽車擁有量的增加,汽車修理廠面臨越來越大的壓力,需要提供更快、更準確的維修評估。為了滿足這項需求,修理廠正在採用先進的碰撞評估軟體解決方案,不僅可以自動化評估流程,還可以提高營運效率。這些工具對於改善工作流程管理、減少人力錯誤和加快保險索賠處理至關重要。隨著汽車產業不斷推出新車型和先進安全技術,碰撞修復的複雜性也隨之增加。汽車碰撞估算軟體透過提供即時洞察和簡化的估算生成,幫助維修專業人員跟上這些不斷變化的需求。此外,隨著消費者對快速服務和透明度的期望不斷提高,維修店正在利用這些解決方案提供準確的估價,確保更高的客戶滿意度和信任度。由於保險公司也強調準確性和更快的索賠結算,採用估算軟體已成為維持現代汽車維修生態系統競爭力的關鍵。

汽車碰撞評估軟體市場根據部署模型分為內部部署系統和基於雲端的系統。其中,預計到 2034 年,基於雲端的軟體將佔據 65% 的市場。人們對基於雲端的解決方案日益成長的偏好源於其靈活性、可擴展性和成本效益。與需要在硬體和許可證方面進行大量前期投資的傳統系統不同,基於雲端的平台以訂閱的方式營運,因此更實惠,特別是對於中小型維修企業而言。這些平台可以透過任何支援網際網路的設備遠端訪問,使維修店員工能夠在必要時從多個地點甚至在家中管理任務。這種可訪問性不僅簡化了內部工作流程,還有助於更快地回應客戶,最終帶來更好的服務體驗。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 21億美元 |

| 預測值 | 44億美元 |

| 複合年成長率 | 7.9% |

根據最終用戶,市場分為經銷商、獨立汽車修理廠、車隊管理公司和保險提供者。獨立維修店在 2024 年佔據了 37.9% 的市場佔有率,因為他們嚴重依賴估算軟體為客戶提供快速且準確的評估。該軟體透過透明可靠的成本估算提高小型商店的營運效率並增強客戶信任,從而幫助小型商店與大型經銷商競爭。透過減少週轉時間和提高服務質量,這些獨立企業更有能力建立客戶忠誠度並確保重複業務。

在快速數位轉型和自動化進步的推動下,美國汽車碰撞估算軟體市場預計到 2034 年將創造 10 億美元的收入。該國的高汽車擁有率和頻繁的保險索賠加速了對創新軟體解決方案的需求。憑藉強大的維修店和保險公司網路,加上人工智慧損害評估和自動索賠處理的採用,美國仍然是塑造全球汽車碰撞評估軟體市場未來的關鍵參與者。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 維修設施

- 軟體供應商

- 系統整合商

- 最終用途

- 利潤率分析

- 技術與創新格局

- 專利分析

- 重要新聞和舉措

- 監管格局

- 案例研究

- 衝擊力

- 成長動力

- 道路上車輛數量不斷增加

- 現代車輛日益複雜

- 先進技術的融合

- 保險業趨勢的變化

- 產業陷阱與挑戰

- 初始成本高

- 資料安全和隱私問題

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按組件,2021 - 2034 年

- 主要趨勢

- 軟體

- 服務

第6章:市場估計與預測:依部署模型,2021 - 2034 年

- 主要趨勢

- 本地

- 雲

第7章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 獨立汽車修理店

- 經銷商

- 車隊管理公司

- 保險公司

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第9章:公司簡介

- ABF System Software

- Alldata

- Audatex Solutions

- AutoLeap

- Auto Repair Invoice

- AutoTraker

- CCC Intelligent Solutions

- Constellation RO Writer

- Enlyte Group

- Estify

- Exzeo

- Genio

- Mitchell Repair Information Company

- RepairShopr

- Scott Systems

- Shop Ware

- Smart Estimator

- Torque360

- Utility Mobile

- Web-Est

The Global Auto Collision Estimating Software Market reached USD 2.1 billion in 2024 and is expected to witness a CAGR of 7.9% between 2025 and 2034. The market is gaining significant momentum due to the increasing number of vehicles on the road, which has led to a higher frequency of accidents and collision cases. As urbanization grows and vehicle ownership rises, auto-body shops face mounting pressure to deliver faster and more accurate repair assessments. To keep up with this demand, repair shops are adopting advanced collision estimating software solutions that not only automate the assessment process but also enhance operational efficiency. These tools are now essential for improving workflow management, reducing manual errors, and speeding up insurance claims processing. As the automotive industry evolves with new vehicle models and advanced safety technologies, the complexity of collision repair has grown. Auto collision estimating software helps repair professionals keep pace with these evolving demands by offering real-time insights and streamlined estimate generation. Additionally, as consumer expectations for quick service and transparency increase, repair shops are leveraging these solutions to provide accurate estimates, ensuring higher customer satisfaction and trust. With insurance companies also emphasizing precision and faster claims settlements, the adoption of estimating software has become integral to maintaining competitiveness in the modern auto repair ecosystem.

The auto collision estimating software market is segmented based on deployment models into on-premises and cloud-based systems. Among these, cloud-based software is expected to dominate with a 65% market share by 2034. The growing preference for cloud-based solutions stems from their flexibility, scalability, and cost-effectiveness. Unlike traditional systems that require a heavy upfront investment in hardware and licenses, cloud-based platforms operate on a subscription basis, making them more affordable, especially for small and medium repair businesses. These platforms can be accessed remotely from any internet-enabled device, enabling repair shop employees to manage tasks from multiple locations or even from home when necessary. This accessibility not only streamlines internal workflows but also helps in offering quicker responses to customers, ultimately driving better service experiences.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.1 Billion |

| Forecast Value | $4.4 Billion |

| CAGR | 7.9% |

Based on end users, the market is categorized into dealerships, independent auto repair shops, fleet management companies, and insurance providers. Independent repair shops held a leading 37.9% market share in 2024, as they heavily rely on estimating software to deliver quick and accurate assessments to their customers. This software helps smaller shops compete with larger dealerships by improving their operational efficiency and enhancing customer trust through transparent and reliable cost estimates. By reducing turnaround time and improving service quality, these independent businesses are better positioned to build customer loyalty and secure repeat business.

U.S. auto collision estimating software market is projected to generate USD 1 billion by 2034, fueled by rapid digital transformation and advancements in automation. The country's high rate of vehicle ownership and frequent insurance claims have accelerated demand for innovative software solutions. With a robust network of repair shops and insurance companies, coupled with the adoption of AI-powered damage assessment and automated claims processing, the U.S. remains a pivotal player in shaping the future of the global auto collision estimating software market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Repair facilities

- 3.2.2 Software provider

- 3.2.3 System integrators

- 3.2.4 End use

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Case studies

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Rising number of vehicles on the road

- 3.9.1.2 Growing complexity of modern vehicles

- 3.9.1.3 Integration of advanced technologies

- 3.9.1.4 Shifting insurance industry trends

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 High initial costs

- 3.9.2.2 Data security and privacy concerns

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Software

- 5.3 Services

Chapter 6 Market Estimates & Forecast, By Deployment Model, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 On-premises

- 6.3 Cloud

Chapter 7 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Independent auto repair shops

- 7.3 Dealerships

- 7.4 Fleet management companies

- 7.5 Insurance companies

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.3.7 Nordics

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Southeast Asia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 UAE

- 8.6.2 South Africa

- 8.6.3 Saudi Arabia

Chapter 9 Company Profiles

- 9.1 ABF System Software

- 9.2 Alldata

- 9.3 Audatex Solutions

- 9.4 AutoLeap

- 9.5 Auto Repair Invoice

- 9.6 AutoTraker

- 9.7 CCC Intelligent Solutions

- 9.8 Constellation R.O. Writer

- 9.9 Enlyte Group

- 9.10 Estify

- 9.11 Exzeo

- 9.12 Genio

- 9.13 Mitchell Repair Information Company

- 9.14 RepairShopr

- 9.15 Scott Systems

- 9.16 Shop Ware

- 9.17 Smart Estimator

- 9.18 Torque360

- 9.19 Utility Mobile

- 9.20 Web-Est