|

市場調查報告書

商品編碼

1716570

公用事業規模空氣絕緣變壓器市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Utility Scale Air Insulated Transformer Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

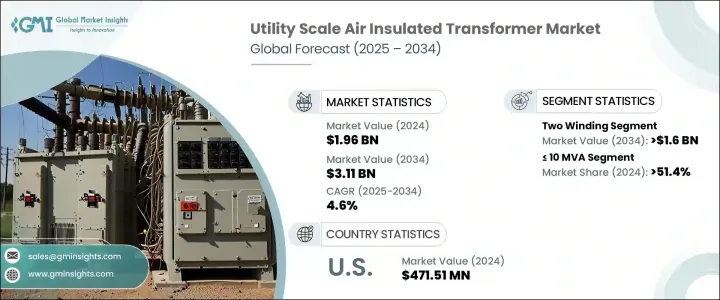

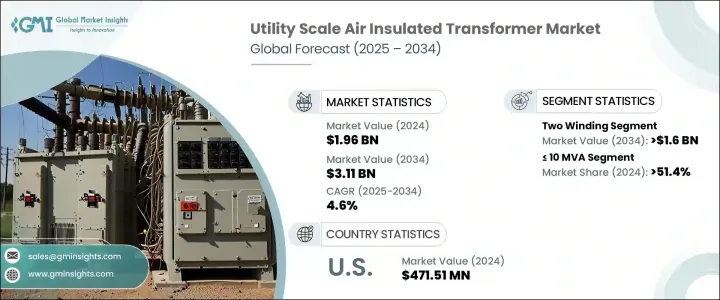

2024 年全球公用事業規模空氣絕緣變壓器市值為 19.6 億美元,預計 2025 年至 2034 年期間將以 4.6% 的強勁複合年成長率成長。這一成長是由全球電力需求的不斷成長所驅動,受到快速城市化、工業成長和經濟擴張(尤其是新興市場)的刺激。日益成長的能源需求促使各國對輸配電網路進行現代化改造,進一步加速了空氣絕緣開關設備 (AIS) 變壓器的大規模採用。隨著經濟的持續擴張和對可靠電力傳輸的需求激增,公用事業規模的 AIS 變壓器對於確保高效和不間斷的電力供應變得至關重要。特別是那些致力於擴大和加強電力基礎設施以滿足日益成長的能源需求的地區正在推動這些變壓器技術的採用。

隨著對 AIS 變壓器的需求不斷成長,雙繞組變壓器領域預計將佔據市場主導地位,到 2034 年預計收入將達到 16 億美元。這些變壓器對於輸電系統至關重要,特別是當需要在長距離升壓或降壓時。 AIS 變壓器設計的技術進步,包括鐵芯和繞組技術、冷卻機制和絕緣材料的增強,提高了效率、性能和壽命。這些升級使它們在現代高需求電網中更加可靠。此外,隨著對更複雜的電源管理的需求不斷成長以及向永續能源解決方案的轉變,這一領域也在不斷發展。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 19.6億美元 |

| 預測值 | 31.1億美元 |

| 複合年成長率 | 4.6% |

市場分為不同的等級,包括<= 10 MVA、> 10 MVA 至<= 100 MVA、> 100 MVA 至 <= 600 MVA 和 > 600 MVA。其中,預計 <= 10 MVA 部分將佔據最大的市場佔有率,到 2024 年將達到 51.4% 的市場佔有率。該部分將穩步成長,因為使用煤炭、天然氣、水力和核能的大型發電廠嚴重依賴這些變壓器進行高效的電力處理和長距離傳輸。

在美國,公用事業規模空氣絕緣變壓器市場在 2024 年創造了 4.7151 億美元的產值。清潔電力計劃和綠色新政等聯邦和州政策已使該國將脫碳工作列為優先事項。推動再生能源的應用需要對國家電力傳輸基礎設施進行重大升級,包括變電站和輸電網路。為了有效處理與再生能源相關的更高功率負荷,對 AIS 變壓器的需求也隨之增加。隨著美國不斷擴大其再生能源產能,對耐用、高效、可靠的電力基礎設施的需求只會越來越強烈。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 戰略展望

- 創新與永續發展格局

第5章:市場規模及預測:按繞組類型,2021 - 2034

- 主要趨勢

- 兩繞組

- 自耦變壓器

第6章:市場規模與預測:依評級,2021-2034 年,

- 主要趨勢

- ≤10兆伏安

- > 10 MVA 至 ≤ 100 MVA

- > 100 MVA 至 ≤ 600 MVA

- > 600 兆伏安

第7章:市場規模及預測:依地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 法國

- 俄羅斯

- 英國

- 義大利

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 澳洲

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第8章:公司簡介

- ABB

- ARTECHE

- Celme

- CG Power & Industrial Solutions

- DAIHEN Corporation

- Eaton

- Elsewedy Electric

- General Electric

- Hyosung Heavy Industries

- IMEFY GROUP

- Kirloskar Electric Company

- Mitsubishi Electric Corporation

- Ormazabal

- Pfiffner Group

- Schneider Electric

- Siemens Energy

- Toshiba International Corporation

- Trench Group

The Global Utility Scale Air Insulated Transformer Market was valued at USD 1.96 billion in 2024 and is expected to grow at a robust CAGR of 4.6% from 2025 to 2034. This growth is driven by the rising demand for electricity across the globe, spurred by rapid urbanization, industrial growth, and the expansion of economies, especially in emerging markets. The increasing need for energy is prompting nations to modernize their power transmission and distribution networks, further accelerating the adoption of Air Insulated Switchgear (AIS) transformers on a large scale. As economies continue to expand and the demand for reliable electricity transmission surges, utility-scale AIS transformers are becoming crucial to ensure efficient and uninterrupted power supply. In particular, regions focusing on expanding and enhancing their electrical infrastructure to meet growing energy needs are driving the adoption of these transformer technologies.

With the demand for AIS transformers growing, the two-winding transformer segment is expected to dominate the market, with an estimated revenue generation of USD 1.6 billion by 2034. These transformers are essential for transmission systems, particularly when it is required to either step up or step down voltage over long distances. The technological advancements in AIS transformer design, including enhancements in core and winding technology, cooling mechanisms, and insulation materials, have led to improved efficiency, performance, and longevity. These upgrades make them even more reliable in modern, high-demand power grids. Furthermore, this segment continues to evolve with the growing need for more sophisticated power management and the shift toward sustainable energy solutions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.96 Billion |

| Forecast Value | $3.11 Billion |

| CAGR | 4.6% |

The market is segmented into different ratings, including <= 10 MVA, > 10 MVA to <= 100 MVA, > 100 MVA to <= 600 MVA, and > 600 MVA. Among these, the <= 10 MVA segment is predicted to hold the largest market share, with 51.4% of the market in 2024. This segment is set to grow steadily, as large-scale power plants that use coal, natural gas, hydro, and nuclear energy rely heavily on these transformers for efficient power handling and transmission over long distances.

In the U.S., the Utility Scale Air Insulated Transformer Market generated USD 471.51 million in 2024. Federal and state policies such as the Clean Power Plan and the Green New Deal have positioned the country to prioritize decarbonization efforts. The push toward renewable energy adoption requires significant upgrades to the nation's power transmission infrastructure, including substations and transmission networks. To efficiently handle the higher power loads associated with renewable energy sources, the demand for AIS transformers has escalated. As the U.S. continues to expand its renewable energy capacity, the need for durable, efficient, and reliable power infrastructure will only intensify.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL Analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Winding, 2021 - 2034, (USD Million, '000 Units)

- 5.1 Key trends

- 5.2 Two winding

- 5.3 Auto transformer

Chapter 6 Market Size and Forecast, By Rating, 2021 - 2034, (USD Million, '000 Units)

- 6.1 Key trends

- 6.2 ≤ 10 MVA

- 6.3 > 10 MVA to ≤ 100 MVA

- 6.4 > 100 MVA to ≤ 600 MVA

- 6.5 > 600 MVA

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034, (USD Million, '000 Units)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 France

- 7.3.3 Russia

- 7.3.4 UK

- 7.3.5 Italy

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 South Korea

- 7.4.4 India

- 7.4.5 Australia

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 South Africa

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 ABB

- 8.2 ARTECHE

- 8.3 Celme

- 8.4 CG Power & Industrial Solutions

- 8.5 DAIHEN Corporation

- 8.6 Eaton

- 8.7 Elsewedy Electric

- 8.8 General Electric

- 8.9 Hyosung Heavy Industries

- 8.10 IMEFY GROUP

- 8.11 Kirloskar Electric Company

- 8.12 Mitsubishi Electric Corporation

- 8.13 Ormazabal

- 8.14 Pfiffner Group

- 8.15 Schneider Electric

- 8.16 Siemens Energy

- 8.17 Toshiba International Corporation

- 8.18 Trench Group