|

市場調查報告書

商品編碼

1716560

智慧嬰兒監視器市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Smart Baby Monitor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

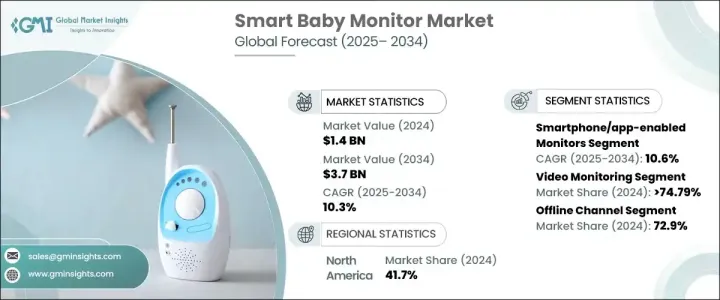

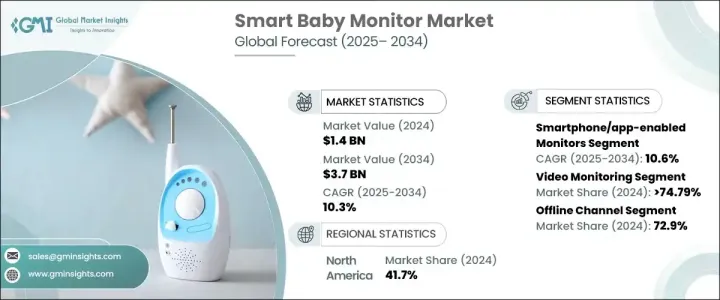

2024 年全球智慧嬰兒監視器市場價值為 14 億美元,預計 2025 年至 2034 年的複合年成長率為 10.3%。人們對嬰幼兒安全和保護的日益關注正在推動市場成長。父母,尤其是那些嬰兒無法進行口語溝通的父母,常常會擔心孩子的健康。具有睡眠追蹤和呼吸運動監測功能的智慧嬰兒監視器有助於緩解這些擔憂。儘管醫學知識和預防技術取得了進步,嬰兒猝死症候群(SIDS)仍然是許多父母的一大擔憂,這更加凸顯了對先進監測解決方案的需求。人均收入的增加、零售業的不斷成長、生活方式的改變以及兒童保育意識的增強也促進了市場擴張。嬰兒監視器的需求不斷增加,特別是在照顧者或保姆較少的已開發地區,進一步加速了市場的成長。

然而,連網設備的採用也引發了對資料安全和隱私的擔憂。未經授權存取兒童的影片仍然是一個嚴重的風險。為了減輕這些擔憂,製造商正專注於實施先進的加密技術和高水準的安全協議來保護敏感資料。安全漏洞可能允許駭客惡意存取視訊來源,從而導致隱私洩露和雲端儲存資料的潛在濫用。這些因素可能會阻止一些父母採用智慧嬰兒監視器,特別是當公司沒有提供有關其資料安全政策的透明度時。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 14億美元 |

| 預測值 | 37億美元 |

| 複合年成長率 | 10.3% |

市場按類型分為獨立監視器、智慧型手機/應用程式監視器和穿戴式監視器。智慧型手機/應用程式支援領域在 2024 年創造了 5 億美元的收入,預計在預測期內的複合年成長率約為 10.6%。這些監視器利用智慧型手機和平板電腦,透過易於使用的應用程式實現即時視訊串流和遠端管理。它們為父母提供了更大的靈活性,而且通常比傳統的獨立視訊監視器更實惠。

根據技術,市場分為音訊監控和視訊監控。 2024 年,視訊監控領域佔據了整個市場的 74.79% 以上,預計到 2034 年將以 10.3% 的複合年成長率成長。由人工智慧和機器學習提供支援的尖叫檢測、睡眠追蹤和人臉辨識等高級功能正在增強這些設備的功能。 Wi-Fi、藍牙等無線通訊技術確保資訊傳輸順暢、即時,並支援降噪、高畫質視訊等功能,提升智慧嬰兒監視器的整體效率。

市場也根據配銷通路細分為線上通路和線下通路。 2024 年,線下市場佔據 72.9% 的市場佔有率,嬰兒監視器產品在專賣店、超市、藥局和百貨公司中廣泛銷售。這些零售店對整體銷售貢獻巨大,因為它們為客戶提供專業指導並幫助他們選擇最適合其需求的產品。儘管線下通路佔據主導地位,但網路普及率的提高以及網路產品種類的日益豐富預計將在未來幾年推動線上通路的成長。

2024 年,北美佔據智慧嬰兒監視器市場主導地位,佔據全球約 41.7% 的市場佔有率,創造約 5 億美元的收入。智慧型手機的使用日益增多、網路存取日益普及以及對兒童安全的日益關注,推動了該地區高階嬰兒監控技術的採用。即時音訊和視訊監控、運動偵測和溫度追蹤等先進功能可幫助父母確保嬰兒的安全和健康,從而推動智慧嬰兒監視器的日益普及。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 定價分析

- 技術與創新格局

- 重要新聞和舉措

- 監管格局

- 製造商

- 經銷商

- 零售商

- 衝擊力

- 成長動力

- 遠端監控需求不斷成長

- 技術進步

- 日益重視兒童安全

- 產業陷阱與挑戰

- 隱私和安全問題

- 成本和可負擔性

- 成長動力

- 成長潛力分析

- 消費者購買行為

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:智慧嬰兒監視器市場估計與預測:依類型,2021-2034

- 主要趨勢

- 獨立顯示器

- 支援智慧型手機/應用程式的監視器

- 穿戴式監視器

第6章:智慧嬰兒監視器市場估計與預測:依技術分類,2021-2034 年

- 主要趨勢

- 音訊監控

- 視訊監控

第7章:智慧型嬰兒監視器市場估計與預測:依連結性,2021-2034 年

- 主要趨勢

- 無線的

- 有線

第8章:智慧嬰兒監視器市場估計與預測:按配銷通路,2021-2034 年

- 主要趨勢

- 線上

- 離線

第9章:智慧嬰兒監視器市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

第10章:公司簡介

- Angel Care Monitor Incorporation

- Arlo Technologies, Inc.

- Baby Brezza

- Dorel Industries, Inc.

- Haier Group

- I Baby Labs

- Infant Optics

- Lorex Technology Inc

- Masimo's

- Maxi-Cosi Inc.

- Net Gear Incorporation

- Owlet Baby Care

- Panasonic Corporation

- Philips

- Safety 1st

- Samsung Electronics Corporation

The Global Smart Baby Monitor Market was valued at USD 1.4 billion in 2024 and is projected to grow at a CAGR of 10.3% from 2025 to 2034. Increasing concerns over the safety and protection of infants and toddlers are driving market growth. Parents, especially those with infants who cannot verbally communicate, often experience anxiety about their child's well-being. Smart baby monitors with sleep tracking and breathing motion monitoring features help ease these concerns. Despite advancements in medical knowledge and prevention techniques, sudden infant death syndrome (SIDS) remains a significant worry for many parents, reinforcing the need for advanced monitoring solutions. Rising per capita income, growing retail availability, evolving lifestyles, and greater awareness of childcare are also contributing to market expansion. The increasing demand for baby monitors, particularly in developed regions where caretakers or maids are less common, further accelerates market growth.

However, the adoption of connected devices also raises concerns regarding data security and privacy. Unauthorized access to a child's video feed remains a critical risk. To mitigate these concerns, manufacturers are focusing on implementing advanced encryption technologies and high-level security protocols to protect sensitive data. Security vulnerabilities may allow hackers to access video feeds with malicious intent, leading to privacy breaches and potential misuse of data stored on the cloud. These factors could deter some parents from adopting smart baby monitors, particularly when companies do not provide transparency regarding their data security policies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.4 Billion |

| Forecast Value | $3.7 Billion |

| CAGR | 10.3% |

The market is segmented by type into standalone monitors, smartphone/app-enabled monitors, and wearable monitors. The smartphone/app-enabled segment generated USD 500 million in revenue in 2024 and is expected to grow at a CAGR of around 10.6% during the forecast period. These monitors utilize smartphones and tablets, allowing live video streaming and remote management through easy-to-use applications. They provide greater flexibility to parents and are often more affordable than traditional standalone video monitors.

By technology, the market is segmented into audio monitoring and video monitoring. The video monitoring segment accounted for over 74.79% of the total market in 2024 and is projected to grow at a CAGR of 10.3% through 2034. Advanced features like scream detection, sleep tracking, and face recognition, powered by AI and machine learning, are enhancing the functionality of these devices. Wireless communication technologies such as Wi-Fi and Bluetooth ensure smooth, real-time information transfer and enable features like noise cancellation and high-definition video, improving the overall efficiency of smart baby monitors.

The market is also segmented by distribution channel into online and offline channels. The offline segment accounted for 72.9% of the market in 2024, with baby monitor products being widely available in specialty stores, supermarkets, pharmacies, and department stores. These retail outlets contribute significantly to overall sales as they offer expert guidance to customers and help them choose the best products for their needs. Despite the dominance of offline channels, increasing internet penetration and the growing availability of a wide range of products online are expected to drive the growth of the online segment in the coming years.

North America dominated the smart baby monitor market in 2024, capturing around 41.7% of the global market share and generating approximately USD 500 million in revenue. The increasing use of smartphones, growing internet access, and rising concern for child safety are driving the adoption of high-end baby monitoring technologies in the region. Advanced features such as real-time audio and video monitoring, motion detection, and temperature tracking are helping parents ensure the safety and well-being of their infants, contributing to the growing popularity of smart baby monitors.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.3 Pricing analysis

- 3.4 Technology & innovation landscape

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Manufacturers

- 3.8 Distributors

- 3.9 Retailers

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Rising demand for remote monitoring

- 3.10.1.2 Advancement in technology

- 3.10.1.3 Growing emphasis on child safety

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 Privacy and security concerns

- 3.10.2.2 Cost and affordability

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Consumer buying behavior

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Company market share analysis

- 4.2 Competitive positioning matrix

- 4.3 Strategic outlook matrix

Chapter 5 Smart Baby Monitor Market Estimates & Forecast, By Type, 2021-2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Standalone monitors

- 5.3 Smartphone/app-enabled monitors

- 5.4 Wearable monitors

Chapter 6 Smart Baby Monitor Market Estimates & Forecast, By Technology, 2021-2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Audio monitoring

- 6.3 Video monitoring

Chapter 7 Smart Baby Monitor Market Estimates & Forecast, By Connectivity, 2021-2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Wireless

- 7.3 Wired

Chapter 8 Smart Baby Monitor Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Online

- 8.3 Offline

Chapter 9 Smart Baby Monitor Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 Saudi Arabia

- 9.6.2 UAE

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Angel Care Monitor Incorporation

- 10.2 Arlo Technologies, Inc.

- 10.3 Baby Brezza

- 10.4 Dorel Industries, Inc.

- 10.5 Haier Group

- 10.6 I Baby Labs

- 10.7 Infant Optics

- 10.8 Lorex Technology Inc

- 10.9 Masimo’s

- 10.10 Maxi-Cosi Inc.

- 10.11 Net Gear Incorporation

- 10.12 Owlet Baby Care

- 10.13 Panasonic Corporation

- 10.14 Philips

- 10.15 Safety 1st

- 10.16 Samsung Electronics Corporation