|

市場調查報告書

商品編碼

1716555

永磁市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Permanent Magnet Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

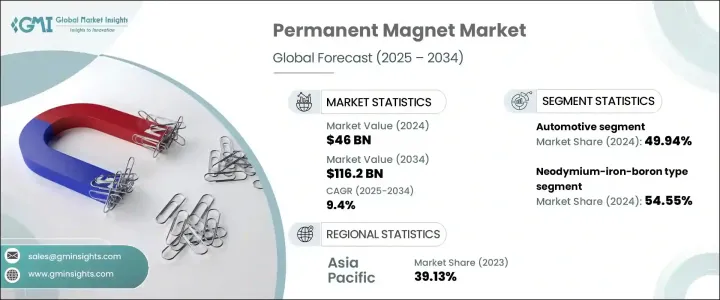

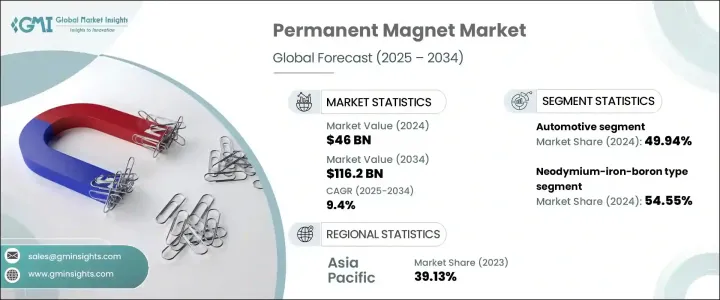

2024 年全球永磁市場規模達 460 億美元,預計 2025 年至 2034 年期間複合年成長率將達 9.4%,這主要得益於電動車 (EV) 普及率的提高以及各行各業對節能技術的需求不斷成長。永久磁鐵是現代工程中不可或缺的一部分,在從電動馬達和風力渦輪機到醫療設備和消費性電子產品等各種產品中發揮著至關重要的作用。隨著各行各業繼續優先考慮永續和節能的解決方案,對無需持續能量輸入即可提供卓越強度和可靠性的高性能磁鐵的需求變得更加突出。

它們無需外部電源即可維持持續磁場,這使得它們成為各種機械和電子應用的首選,尤其是在效率和節省空間的設計至關重要的場合。交通運輸和工業自動化向電氣化的加速轉變,以及機器人、航太和醫療設備領域的持續創新,進一步提升了對先進永久磁鐵的需求。智慧科技和物聯網設備在日常生活中的快速整合也促進了這些磁鐵更廣泛的應用前景。此外,政府推動風能和太陽能等再生能源的措施也間接增強了對能源生產和儲存設備所需的高性能磁鐵的需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 460億美元 |

| 預測值 | 1162億美元 |

| 複合年成長率 | 9.4% |

永久磁性市場依產品類型分為鐵氧體、釹鐵硼(NdFeB)、釤鈷和鋁鎳鈷。其中,釹鐵硼 (NdFeB) 磁鐵在 2024 年佔據市場主導地位,佔有 54.55% 的佔有率,這主要歸功於其卓越的磁性能。這些磁鐵因其高磁能、穩定的性能和高飽和感應而受到青睞,這使得它們成為電動機、發電機、音訊系統和各種馬達驅動電子設備的必備材料。材料科學和磁鐵技術的不斷進步使得釹鐵硼磁體在各行各業得到更廣泛的應用,超越了傳統的使用場景,並在航太和先進機器人等領域開闢了新的機遇,而輕巧而強大的磁鐵在這些領域至關重要。

從應用角度來看,汽車領域在 2024 年佔據了永磁市場 49.94% 的佔有率,預計到 2034 年將以 9.5% 的複合年成長率成長。隨著汽車產業急劇轉向電動車,高效能馬達、先進動力系統和精密感測器的整合正在加速。釹鐵硼磁鐵由於體積小、性能優越,已成為電動車(EV)馬達、再生煞車系統和其他核心汽車電子設備的關鍵部件,進一步推動了市場擴張。

從區域來看,2023 年亞太永磁市場佔 39.13% 的主導佔有率,中國憑藉其強大的稀土生產能力佔據領先地位。中國控制全球大部分稀土供應,包括對釹鐵硼和釤鈷磁鐵至關重要的材料,確保了具有競爭力的價格和供應鏈的穩定性。此外,在不斷擴大的電動車市場、再生能源項目和消費性電子產品生產的支持下,印度、日本和韓國等國家的工業化進程不斷加快和需求強勁,繼續加強亞太地區在全球永磁產業中的地位。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商格局

- 利潤率分析

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 電動車需求不斷成長

- 全球向永續能源生產轉變

- 製造技術的進步

- 產業陷阱與挑戰

- 價格高且原料有限

- 稀土金屬造成的危害

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按產品,2021 年至 2034 年

- 主要趨勢

- 鐵氧體

- 釹鐵硼

- 鈸

- 鋁鎳鈷

第6章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 汽車

- 電子產品

- 能源生產

- 其他

第7章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第8章:公司簡介

- Hitachi Metals, Ltd.

- Jiangmen Magsource New Material Co. Ltd.

- Adams Magnetic Products Co.

- Arnold Magnetic Technologies

- Anhui Earth-Panda Advance Magnetic Material Co. Ltd.

- Ningbo Yunsheng Co. Ltd.

- Daido Steel Co. Ltd.

- Molycorp Magnequench

- Thomas & Skinner Inc.

- Vacuumschmelze GmbH & Co. KG

- Electron Energy Corporation

- Hangzhou Permanent Magnet Group

- Goudsmit Magnetics Group

- TDK Corporation

The Global Permanent Magnet Market generated USD 46 billion in 2024 and is projected to expand at a 9.4% CAGR from 2025 to 2034, fueled largely by the increasing penetration of electric vehicles (EVs) and the rising demand for energy-efficient technologies across industries. Permanent magnets are indispensable in modern engineering, playing a vital role in a wide array of products ranging from electric motors and wind turbines to medical devices and consumer electronics. As industries continue to prioritize sustainable and energy-efficient solutions, the need for high-performance magnets that deliver superior strength and reliability without continuous energy input is becoming even more prominent.

Their ability to maintain a persistent magnetic field without external power makes them a preferred choice for various mechanical and electronic applications, especially where efficiency and space-saving designs are critical. The accelerating shift toward electrification in transportation and industrial automation, along with ongoing innovations in robotics, aerospace, and healthcare equipment, further elevates the demand for advanced permanent magnets. The rapid integration of smart technologies and IoT-enabled devices in daily life has also contributed to the broader application landscape of these magnets. Moreover, government initiatives promoting renewable energy sources such as wind and solar power are indirectly bolstering the need for high-performance magnets essential for energy generation and storage equipment.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $46 Billion |

| Forecast Value | $116.2 Billion |

| CAGR | 9.4% |

The permanent magnet market is categorized by product type into ferrite, neodymium-iron-boron (NdFeB), samarium-cobalt, and aluminum-nickel-cobalt. Among these, neodymium-iron-boron (NdFeB) magnets dominated the market with a commanding 54.55% share in 2024, primarily due to their exceptional magnetic properties. These magnets are favored for their high magnetic energy, stable performance, and high saturation induction, which make them essential for use in electric motors, generators, audio systems, and various motor-driven electronics. The ongoing advancements in material science and magnet technology have led to broader adoption of NdFeB magnets across industries, surpassing traditional use cases and opening new opportunities in sectors like aerospace and advanced robotics, where lightweight yet powerful magnets are crucial.

From an application standpoint, the automotive segment accounted for a substantial 49.94% share of the permanent magnet market in 2024 and is anticipated to grow at a 9.5% CAGR through 2034. As the automotive industry pivots sharply toward electric mobility, the integration of high-efficiency motors, advanced powertrain systems, and precision sensors is accelerating. Neodymium-iron-boron magnets, given their compact size and superior performance, have become critical components in electric vehicle (EV) motors, regenerative braking systems, and other core automotive electronics, further driving market expansion.

Regionally, the Asia Pacific Permanent Magnet Market held a dominant 39.13% share in 2023, with China spearheading this leadership position due to its extensive rare earth production capabilities. China's control over a large portion of the global rare earth supply, including materials crucial for neodymium-iron-boron and samarium-cobalt magnets, ensures competitive pricing and supply chain stability. Additionally, growing industrialization and robust demand from countries like India, Japan, and South Korea continue to strengthen Asia Pacific's standing in the global permanent magnet industry, supported by expanding EV markets, renewable energy projects, and consumer electronics production.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rising demand of electric vehicle

- 3.6.1.2 Global shift towards sustainable energy generation

- 3.6.1.3 Advancements in manufacturing technologies

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High price and limited availability of raw materials

- 3.6.2.2 Hazards caused by rare earth metals

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Ferrite

- 5.3 Neo (NdFeB)

- 5.4 SmCO

- 5.5 Alnico

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Automotive

- 6.3 Electronics

- 6.4 Energy generation

- 6.5 Others

Chapter 7 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Russia

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.6 Middle East and Africa

- 7.6.1 Saudi Arabia

- 7.6.2 South Africa

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Hitachi Metals, Ltd.

- 8.2 Jiangmen Magsource New Material Co. Ltd.

- 8.3 Adams Magnetic Products Co.

- 8.4 Arnold Magnetic Technologies

- 8.5 Anhui Earth-Panda Advance Magnetic Material Co. Ltd.

- 8.6 Ningbo Yunsheng Co. Ltd.

- 8.7 Daido Steel Co. Ltd.

- 8.8 Molycorp Magnequench

- 8.9 Thomas & Skinner Inc.

- 8.10 Vacuumschmelze GmbH & Co. KG

- 8.11 Electron Energy Corporation

- 8.12 Hangzhou Permanent Magnet Group

- 8.13 Goudsmit Magnetics Group

- 8.14 TDK Corporation