|

市場調查報告書

商品編碼

1716550

碳奈米管市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Carbon Nanotubes Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

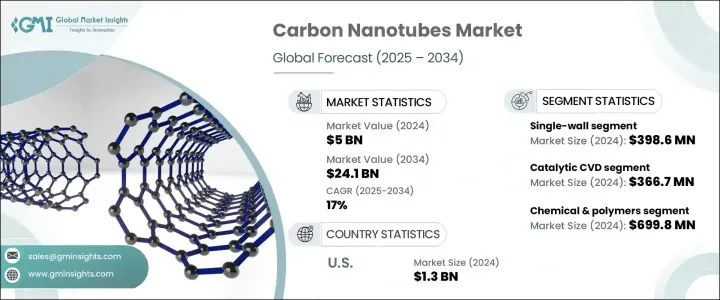

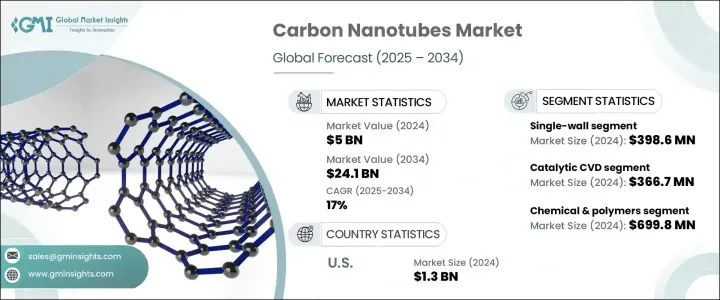

2024 年全球奈米碳管市場價值為 50 億美元,預計 2025 年至 2034 年期間的複合年成長率將達到 17%。該市場的快速成長得益於持續的技術進步、多個行業不斷成長的需求以及全球向永續發展的轉變。碳奈米管因其卓越的性能而受到廣泛關注,包括高抗張強度、出色的電導性和熱導性以及優異的柔韌性。這些特性使得 CNT 在下一代電子產品、儲能系統、結構加固和先進醫療設備等尖端應用中不可或缺。隨著各行各業越來越重視輕量、高性能和節能材料,CNT 的採用率持續激增。

市場參與者正在積極投資研發,以增強 CNT 生產流程並擴大應用可能性。對永續和環保材料的推動進一步加速了基於 CNT 的解決方案的創新。隨著航太、汽車、再生能源和醫療保健等產業將碳奈米管融入其產品中,需求趨勢仍然上升。世界各國政府和私人企業也正在資助探索碳奈米管在綠色能源技術的應用,包括儲氫和碳捕獲系統。這些因素共同使 CNT 成為未來工業進步的關鍵材料,推動未來十年的市場擴張。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 50億美元 |

| 預測值 | 241億美元 |

| 複合年成長率 | 17% |

碳奈米管市場分為單壁碳奈米管(SWCNT)和多壁碳奈米管(MWCNT),其中 SWCNT 佔據主導地位。 2024 年,SWCNT 創造了 3.986 億美元的收入。這些奈米管的特點是其單層圓柱形石墨烯結構,直徑為 1 至 2 奈米,具有獨特的電氣和熱學性能,使其成為高性能應用的理想選擇。隨著對先進電子產品的需求不斷成長,CNT 在軟性電子產品、智慧紡織品和穿戴式技術的發展中發揮關鍵作用。其卓越的導電性和機械強度為突破性創新鋪平了道路,進一步推動了市場成長。

CNT 的應用領域涵蓋了許多行業,包括汽車、航太和國防、醫療、化學品和聚合物、能源和電子。其中,化學品和聚合物領域引領市場,2024 年估值為 6.698 億美元,預計複合年成長率為 16.7%。 CNT 與聚合物複合材料的結合顯著提高了其機械強度、電導性和熱穩定性。這些高性能聚合物材料在需要輕質、耐用性和節能解決方案的產業中得到越來越廣泛的應用。隨著全球向永續發展的轉變,CNT 增強聚合物作為傳統材料的替代品正獲得越來越大的關注。

美國仍是碳奈米管市場的主要參與者,2024 年的市場規模將達到 13 億美元。美國在 CNT 創新和商業化方面處於領先地位,特別是在輕質材料、儲能和先進電子相關的應用方面。電動車、5G基礎設施和高性能電池的日益普及推動了對碳奈米管的需求,進一步增強了市場前景。此外,對綠色技術的持續投資和國內製造能力的擴大預計將在未來幾年維持該國的市場領導地位。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商格局

- 利潤率分析

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 建築業的復興

- 透過再生能源發電

- 快速發展的汽車產業

- 產業陷阱與挑戰

- 生產高純度CNT會增加產品成本

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按產品,2021 年至 2034 年

- 主要趨勢

- 單壁奈米碳管

- 多壁碳奈米管

第6章:市場估計與預測:按技術,2021 年至 2034 年

- 主要趨勢

- 浮動催化劑

- 石墨的雷射燒蝕

- 化學氣相沉積

- 催化化學氣相沉積

- 高壓一氧化碳

- 電弧放電

- 其他

第7章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 汽車

- 航太和國防

- 醫療的

- 化學品和聚合物

- 能源

- 電氣和電子產品

- 其他

第8章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第9章:公司簡介

- Arkema

- Cabot Corporation

- Carbon Solutions

- Chasm Advanced Materials

- Continental Carbon Company

- Klean Industries

- Kumho Petrochemical

- LG Chem

- Nanocyl

- Nanoshel

- Raymor Industries

- Showa Denko

- Thomas Swan

The Global Carbon Nanotubes Market was valued at USD 5 billion in 2024 and is set to expand at a CAGR of 17% from 2025 to 2034. The rapid growth of this market is fueled by ongoing technological advancements, rising demand across multiple industries, and a worldwide shift toward sustainability. Carbon nanotubes are gaining significant traction due to their remarkable properties, including high tensile strength, exceptional electrical and thermal conductivity, and superior flexibility. These attributes make CNTs indispensable in cutting-edge applications such as next-generation electronics, energy storage systems, structural reinforcement, and advanced medical devices. As industries increasingly prioritize lightweight, high-performance, and energy-efficient materials, CNT adoption continues to surge.

Market players are actively investing in research and development to enhance CNT production processes and expand application possibilities. The push for sustainable and environmentally friendly materials has further accelerated innovations in CNT-based solutions. With industries such as aerospace, automotive, renewable energy, and healthcare integrating CNTs into their products, the demand trajectory remains upward. Governments and private enterprises worldwide are also funding initiatives to explore CNTs in green energy technologies, including hydrogen storage and carbon capture systems. These factors collectively position CNTs as a key material in future industrial advancements, driving market expansion over the next decade.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5 Billion |

| Forecast Value | $24.1 Billion |

| CAGR | 17% |

The carbon nanotubes market is classified into single-wall carbon nanotubes (SWCNTs) and multi-wall carbon nanotubes (MWCNTs), with SWCNTs maintaining a dominant market position. In 2024, SWCNTs generated USD 398.6 million in revenue. These nanotubes, characterized by their single-layered cylindrical graphene structure with diameters ranging from 1 to 2 nanometers, exhibit unique electrical and thermal properties that make them ideal for high-performance applications. As demand for advanced electronics accelerates, CNTs are playing a pivotal role in the development of flexible electronics, smart textiles, and wearable technology. Their superior conductivity and mechanical strength are paving the way for groundbreaking innovations, further propelling market growth.

The application landscape for CNTs spans a diverse range of industries, including automotive, aerospace and defense, medical, chemicals and polymers, energy, and electronics. Among these, the chemicals and polymers segment led the market with a valuation of USD 669.8 million in 2024, with a projected CAGR of 16.7%. The integration of CNTs into polymer composites significantly enhances their mechanical strength, electrical conductivity, and thermal stability. These high-performance polymer-based materials are witnessing increased adoption in industries requiring lightweight, durable, and energy-efficient solutions. With the global shift toward sustainability, CNT-reinforced polymers are gaining momentum as an alternative to traditional materials.

The United States remains a key player in the carbon nanotubes market, generating USD 1.3 billion in 2024. The country leads the way in CNT innovation and commercialization, particularly in applications related to lightweight materials, energy storage, and advanced electronics. The growing penetration of electric vehicles, 5G infrastructure, and high-performance batteries has fueled demand for CNTs, further strengthening market prospects. Additionally, continued investments in green technologies and the expansion of domestic manufacturing capabilities are expected to sustain the country's market leadership in the coming years.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Base estimates and calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news and initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Revival in the construction industry

- 3.6.1.2 Energy generation via renewable sources

- 3.6.1.3 Rapidly growing automotive industry

- 3.6.2 Industry pitfalls and challenges

- 3.6.2.1 Production of high-purity CNT elevates product cost

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Single-wall carbon nanotubes

- 5.3 Multi-wall carbon nanotubes

Chapter 6 Market Estimates and Forecast, By Technology, 2021 – 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Floating catalyst

- 6.3 Laser ablation of graphite

- 6.4 Chemical vapor deposition

- 6.5 Catalytic CVD

- 6.6 High pressure carbon monoxide

- 6.7 Arc discharge

- 6.8 Others

Chapter 7 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Automotive

- 7.3 Aerospace and defense

- 7.4 Medical

- 7.5 Chemical & polymers

- 7.6 Energy

- 7.7 Electricals & electronics

- 7.8 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Arkema

- 9.2 Cabot Corporation

- 9.3 Carbon Solutions

- 9.4 Chasm Advanced Materials

- 9.5 Continental Carbon Company

- 9.6 Klean Industries

- 9.7 Kumho Petrochemical

- 9.8 LG Chem

- 9.9 Nanocyl

- 9.10 Nanoshel

- 9.11 Raymor Industries

- 9.12 Showa Denko

- 9.13 Thomas Swan