|

市場調查報告書

商品編碼

1716549

氣炸鍋市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Air Fryer Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

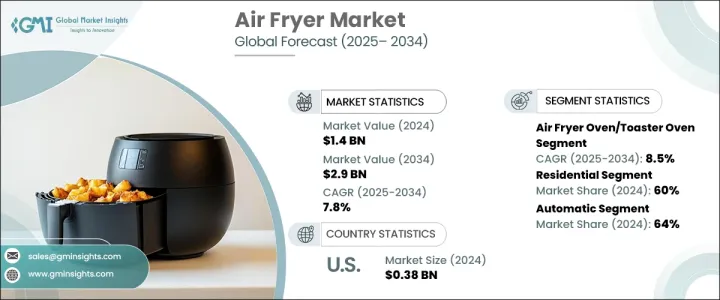

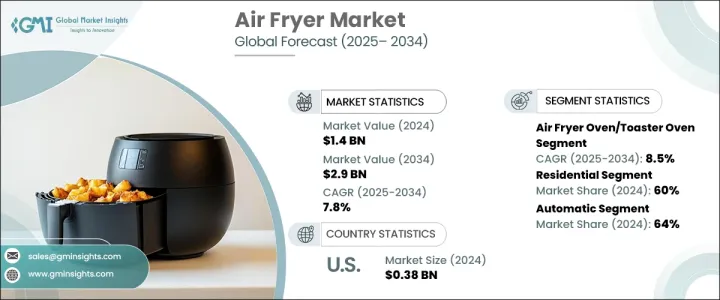

2024 年全球氣炸鍋市場規模達 14 億美元,預計 2025 年至 2034 年期間的複合年成長率為 7.8%。由於人們越來越關注健康和保健,以及對節省時間的便捷烹飪解決方案的需求不斷成長,該市場正在經歷顯著成長。隨著消費者的健康意識不斷增強,他們越來越傾向於使用較少油的烹飪方法,氣炸鍋也因此成為更健康膳食準備的首選。與傳統油炸方法相比,這些設備可以讓人們享受到酥脆可口的食物,而且脂肪和熱量明顯減少,這對於那些尋求保持更健康飲食的人來說是一個有吸引力的選擇。

氣炸鍋的日益普及也受到智慧廚房電器的持續採用趨勢的推動。消費者越來越尋求能夠簡化烹飪程序並提供多種選擇的多功能設備。氣炸鍋以其煎炸、烘焙、烘烤和加熱的功能而聞名,在希望快速準備健康餐點的忙碌家庭中廣受歡迎。此外,易於清理以及能夠在較短的時間內烹飪各種菜餚的便利性正在推動其廣泛普及。技術進步進一步推動了市場成長,製造商推出了配備 Wi-Fi 連接的智慧氣炸鍋,使用戶能夠透過智慧型手機應用程式或透過 Alexa 和 Google Assistant 等平台的語音命令來控制他們的設備。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 14億美元 |

| 預測值 | 29億美元 |

| 複合年成長率 | 7.8% |

市場按產品類型細分為氣炸鍋烤箱/烤麵包機和氣炸鍋籃。氣炸鍋/烤麵包機領域在 2024 年佔據市場主導地位,產值達 9 億美元。這些型號具有多種功能,包括油炸、烘焙、烘焙、烤麵包,甚至脫水等功能,因此在尋求多功能廚房電器的消費者中越來越受歡迎。氣炸鍋不僅滿足了注重健康的人們的需求,也吸引了那些希望在烹飪過程中有更大靈活性的人。

就最終用戶而言,市場分為住宅和商業兩部分,到 2024 年,住宅用途將佔據 60% 的市場佔有率。人們對便利和健康烹飪方式的日益追求推動了氣炸鍋在家庭中的快速普及。隨著智慧家庭技術的不斷發展,消費者越來越被可遠端操作的智慧氣炸鍋所吸引。這些設備使用戶能夠用最少的油來準備飯菜,提供更健康的選擇,同時又不影響口味。氣炸鍋與智慧家居生態系統的輕鬆整合進一步增強了其對精通科技的消費者的吸引力。

美國氣炸鍋市場佔有 80% 的佔有率,2024 年的產值達 3.8 億美元。這個市場主導地位得益於氣炸鍋的技術進步、智慧家居設備的日益普及以及人們對健康和保健的日益重視。隨著美國消費者尋求更健康的烹飪替代品,氣炸鍋(一種用最少的油享用油炸食品的方式)的需求持續激增。製造商正在利用這一趨勢,融入創新功能並增強氣炸鍋的整體功能,確保其在市場上的持續吸引力。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製成品

- 經銷商

- 供應商格局

- 技術格局

- 重要新聞和舉措

- 消費者購買行為分析

- 人口趨勢

- 影響購買決策的因素

- 產品偏好

- 首選價格範圍

- 首選配銷通路

- 監管格局

- 衝擊力

- 成長動力

- 更加重視健康

- 健康以及對便利性和節省時間的需求

- 產業陷阱與挑戰

- 烹飪容量有限

- 消費者對傳統烹飪方法的偏好

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依產品類型,2021-2034

- 主要趨勢

- 氣炸鍋/烤麵包機

- 氣炸鍋炸籃

第6章:市場估計與預測:依設備類型,2021-2034

- 主要趨勢

- 手動的

- 自動的

第7章:市場估計與預測:按瓦數,2021-2034

- 主要趨勢

- 低於1200瓦

- 1200-1500瓦

- 1500瓦以上

第8章:市場估計與預測:依最終用途,2021-2034

- 主要趨勢

- 住宅

- 商業的

第9章:市場估計與預測:按分銷管道,2021-2034

- 主要趨勢

- 線上

- 離線

第10章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第 11 章:公司簡介

- Black+Decker

- Breville

- Chefman

- Cosori

- Cuisinart

- Dash

- Farberware

- Gourmia

- GoWISE USA

- Groupe SEB

- Hamilton Beach

- Instant Pot

- Kalorik

- Ninja

- Philips

The Global Air Fryer Market generated USD 1.4 billion in 2024 and is projected to grow at a CAGR of 7.8% between 2025 and 2034. The market is experiencing significant growth due to the increasing focus on health and wellness and the rising demand for convenient cooking solutions that save time. As consumers become more health-conscious, they are gravitating toward cooking methods that use less oil, positioning air fryers as a preferred choice for healthier meal preparation. These appliances allow people to enjoy crispy and flavorful foods with significantly less fat and fewer calories compared to traditional frying methods, making them an attractive option for those seeking to maintain a healthier diet.

The growing popularity of air fryers is also fueled by the ongoing trend of adopting smart kitchen appliances. Consumers are increasingly seeking multifunctional devices that simplify their cooking routines while offering a wide range of options. Air fryers, known for their ability to fry, bake, roast, and reheat, have gained immense popularity among busy households looking to prepare quick and healthy meals. Additionally, the convenience of easy cleanup and the ability to cook a variety of dishes in a shorter time span is driving widespread adoption. Technological advancements have further boosted market growth, with manufacturers introducing smart air fryers equipped with Wi-Fi connectivity, enabling users to control their appliances via smartphone apps or voice commands through platforms like Alexa and Google Assistant.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.4 Billion |

| Forecast Value | $2.9 Billion |

| CAGR | 7.8% |

The market is segmented by product type into air fryer ovens/toaster ovens and air fryer baskets. The air fryer oven/toaster oven segment dominated the market in 2024, generating USD 0.9 billion. The multifunctionality of these models, which offer frying, baking, roasting, toasting, and even dehydrating capabilities, has made them increasingly popular among consumers looking for versatile kitchen appliances. Air fryer ovens not only cater to the needs of health-conscious individuals but also appeal to those who desire greater flexibility in their cooking routines.

In terms of end users, the market is split between residential and commercial segments, with residential use accounting for 60% of the market share in 2024. The rising inclination toward convenient and healthier cooking options has driven the rapid adoption of air fryers in households. As smart home technologies continue to evolve, consumers are increasingly drawn to smart air fryers that can be operated remotely. These devices allow users to prepare meals with minimal oil, offering a healthier alternative without compromising on taste. The ease of integrating air fryers with smart home ecosystems has further enhanced their appeal among tech-savvy consumers.

The U.S. air fryer market held an 80% share and generated USD 0.38 billion in 2024. This market dominance is driven by technological advancements in air fryers, the increasing popularity of smart home devices, and the growing emphasis on health and wellness. As American consumers seek healthier cooking alternatives, the demand for air fryers, which provide a way to enjoy fried food with minimal oil, continues to surge. Manufacturers are capitalizing on this trend by incorporating innovative features and enhancing the overall functionality of air fryers, ensuring their sustained appeal in the market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufactures

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Technological landscape

- 3.4 Key news & initiatives

- 3.5 Consumer buying behavior analysis

- 3.5.1 Demographic trends

- 3.5.2 Factors affecting buying decisions

- 3.5.3 Product preference

- 3.5.4 Preferred price range

- 3.5.5 Preferred distribution channel

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Increasing focus on health

- 3.7.1.2 Wellness and need for convenience and time saving benefits

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 Limited cooking capacity

- 3.7.2.2 Consumer preference for traditional cooking methods

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Air fryer oven/toaster oven

- 5.3 Air fryer basket

Chapter 6 Market Estimates & Forecast, By Device Type, 2021-2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Manual

- 6.3 Automatic

Chapter 7 Market Estimates & Forecast, By Wattage, 2021-2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Below 1200 watt

- 7.3 1200-1500 watt

- 7.4 Above 1500 watt

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Residential

- 8.3 Commercial

Chapter 9 Market Estimates & Forecast, By Distributional Channel, 2021-2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Online

- 9.3 Offline

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Black+Decker

- 11.2 Breville

- 11.3 Chefman

- 11.4 Cosori

- 11.5 Cuisinart

- 11.6 Dash

- 11.7 Farberware

- 11.8 Gourmia

- 11.9 GoWISE USA

- 11.10 Groupe SEB

- 11.11 Hamilton Beach

- 11.12 Instant Pot

- 11.13 Kalorik

- 11.14 Ninja

- 11.15 Philips