|

市場調查報告書

商品編碼

1716540

行動配件市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Mobile Accessories Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

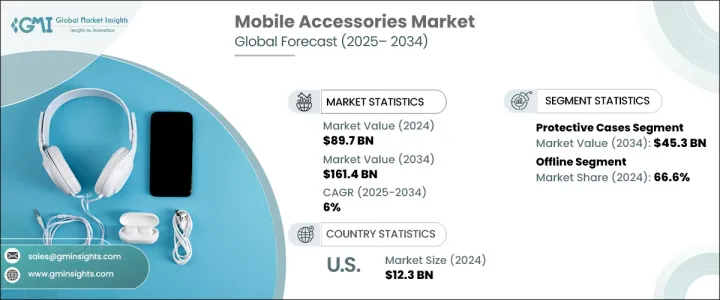

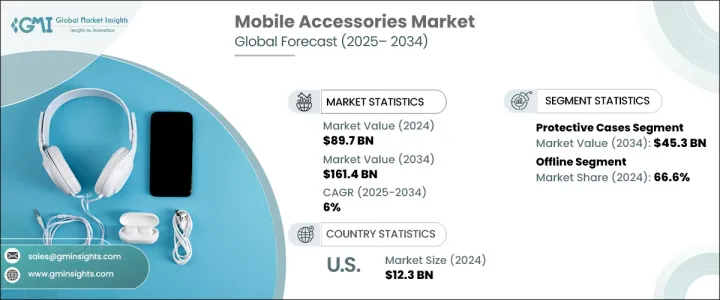

2024 年全球手機配件市場規模達到 897 億美元,預計 2025 年至 2034 年間將以 6% 的複合年成長率穩定成長。隨著智慧型手機成為日常生活中不可或缺的一部分,全球對手機配件的需求正在大幅成長。行動技術的不斷發展,加上智慧型手機個人化趨勢的興起,為行動配件製造商創造了巨大的機會。從時尚的保護殼到高性能的音訊設備,消費者越來越尋求不僅能增強功能而且能體現其風格的配件。具有先進功能的高階智慧型手機的日益普及,推動了對相容、高品質配件的需求。

此外,快速充電解決方案、無線和藍牙設備以及智慧穿戴裝置等技術進步正在重塑市場,迫使企業不斷創新。隨著越來越多的用戶採用支援 5G 的智慧型手機和物聯網設備,對下一代配件的需求預計將急劇上升。行動配件中人工智慧和語音控制功能的整合也越來越受歡迎,以滿足尋求無縫智慧體驗的技術型消費者的需求。此外,永續性正成為一個關注點,消費者表現出對環保配件的偏好,促使製造商探索可回收和可生物分解的材料進行產品開發。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 897億美元 |

| 預測值 | 1614億美元 |

| 複合年成長率 | 6% |

無線充電板、藍牙耳機和先進的手機遊戲配件等尖端創新的興起繼續推動市場成長。公司提供嵌入現代功能的各種產品,以促進更高的個人化和功能性。這種向更客製化和技術驅動的配件的轉變不僅提高了消費者滿意度,而且還增加了使用頻率,從而刺激了持續的需求。

市場按產品類型細分為耳機和耳麥、充電器和電纜、行動電源、保護套和其他配件。其中,保護套佔據了相當大的佔有率,2024 年的市場規模為 269 億美元,預計到 2034 年將達到 453 億美元。隨著智慧型手機價格越來越高、功能越來越豐富,保護套的需求也越來越強勁,可以防止設備意外跌落、刮擦和損壞。該細分市場的設計涵蓋了從堅固的裝甲外殼到時尚簡約的外殼等各種類型,並持續受到消費者的強烈關注。由於用戶追求身臨其境的音訊體驗,除保護套外,耳機和耳麥也構成了市場的主要組成部分。降噪、人體工學設計和增強音質等功能推動了音樂愛好者、遊戲玩家和專業人士對這些產品的需求。

手機配件的分銷分為線上和線下管道,其中線下銷售佔2024年66.6%的市場佔有率。線下管道允許客戶在購買前進行實物評估和測試產品,並透過店內協助提供支持,從而增強信任度和滿意度。

光是美國行動配件市場在 2024 年的價值就將達到 123 億美元,這得益於大量渴望採用最新技術的用戶群。北美消費者強大的購買力促進了對高階、功能豐富的手機配件的日益偏好,鼓勵品牌推出滿足不斷變化的消費者期望的卓越創新。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商格局

- 利潤率分析

- 成分分析

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 智慧型手機普及率上升

- 技術進步

- 頻繁推出新款智慧型手機

- 產業陷阱與挑戰

- 仿冒配件

- 競爭激烈的市場

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依產品類型,2021-2034

- 主要趨勢

- 耳機

- 充電器和數據線

- 行動電源

- 保護套

- 其他

第6章:市場估計與預測:按配銷通路,2021-2034 年

- 主要趨勢

- 線上

- 離線

第7章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第8章:公司簡介

- Anker Power Core

- Apple Inc.

- Aukey

- Belkin International Inc.

- Bose Corporation

- Groove Made Walnut

- Harman International Industries

- Incipio LLC

- Logitech International SA

- Plantronics, Inc.

- Samsung Electronics Co., Ltd.

- SanDisk

- Sony Corporation

- Xiaomi Corporation

The Global Mobile Accessories Market reached USD 89.7 billion in 2024 and is projected to expand at a steady CAGR of 6% between 2025 and 2034. With smartphones becoming an indispensable part of daily life, the demand for mobile accessories is witnessing a significant surge worldwide. The constant evolution of mobile technology, coupled with the rising trend of smartphone personalization, is creating substantial opportunities for mobile accessory manufacturers. From stylish protective cases to high-performance audio devices, consumers are increasingly seeking accessories that not only enhance functionality but also reflect their style. The growing adoption of premium smartphones with advanced features is fueling the need for compatible, high-quality accessories.

Besides, technological advancements like fast-charging solutions, wireless and Bluetooth-enabled devices, and smart wearables are reshaping the market, compelling companies to innovate continually. As more users embrace 5G-enabled smartphones and IoT-connected devices, the demand for next-generation accessories is expected to rise sharply. The integration of AI and voice-controlled functionalities in mobile accessories is also gaining traction, catering to tech-savvy consumers looking for seamless, smart experiences. Furthermore, sustainability is emerging as a key focus, with consumers showing a preference for eco-friendly accessories, prompting manufacturers to explore recyclable and biodegradable materials for product development.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $89.7 Billion |

| Forecast Value | $161.4 Billion |

| CAGR | 6% |

The rise of cutting-edge innovations such as wireless charging pads, Bluetooth headsets, and advanced mobile gaming accessories continues to propel market growth. Companies are offering a broad range of products embedded with modern features that promote greater personalization and functionality. This shift toward more customized and technology-driven accessories not only increases consumer satisfaction but also boosts the frequency of usage, fueling ongoing demand.

The market is segmented by product type into earphones and headphones, chargers and cables, power banks, protective cases, and other accessories. Among these, protective cases held a significant share, generating USD 26.9 billion in 2024, and are projected to generate USD 45.3 billion by 2034. As smartphones become more expensive and feature-rich, the demand for protective cases that safeguard devices from accidental drops, scratches, and damage remains robust. With designs ranging from rugged armor cases to sleek, minimalist covers, this segment continues to see strong consumer interest. Alongside protective cases, earphones and headphones form a major part of the market, as users seek immersive audio experiences. Features like noise-canceling, ergonomic designs, and enhanced sound quality drive the demand for these products among music enthusiasts, gamers, and professionals alike.

Distribution of mobile accessories is divided between online and offline channels, with offline sales accounting for 66.6% of the market share in 2024. Offline channels allow customers to physically assess and test products before purchase, supported by in-store assistance, enhancing trust and satisfaction.

The U.S. Mobile Accessories Market alone was valued at USD 12.3 billion in 2024, fueled by a large user base eager to adopt the latest technologies. The strong purchasing power of North American consumers fosters a growing preference for premium, feature-rich mobile accessories, encouraging brands to deliver superior innovations that meet evolving consumer expectations.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Ingredient analysis

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Rising smartphone adaptation

- 3.7.1.2 Technological advancements

- 3.7.1.3 Frequent launches of new smartphones

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 Counterfeits accessories

- 3.7.2.2 Highly competitive market

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By product Type, 2021-2034 (USD Billion)

- 5.1 Key trends

- 5.2 Earphones & headphones

- 5.3 Chargers & cables

- 5.4 Power bank

- 5.5 Protective cases

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion)

- 6.1 Key trends

- 6.2 Online

- 6.3 Offline

Chapter 7 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 Germany

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Spain

- 7.3.6 Russia

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 Australia

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.6 MEA

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Anker Power Core

- 8.2 Apple Inc.

- 8.3 Aukey

- 8.4 Belkin International Inc.

- 8.5 Bose Corporation

- 8.6 Google

- 8.7 Groove Made Walnut

- 8.8 Harman International Industries

- 8.9 Incipio LLC

- 8.10 Logitech International S.A.

- 8.11 Plantronics, Inc.

- 8.12 Samsung Electronics Co., Ltd.

- 8.13 SanDisk

- 8.14 Sony Corporation

- 8.15 Xiaomi Corporation