|

市場調查報告書

商品編碼

1716538

新鮮無花果市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Fresh Figs Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

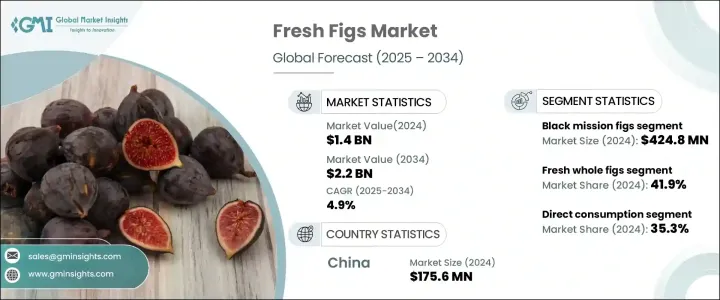

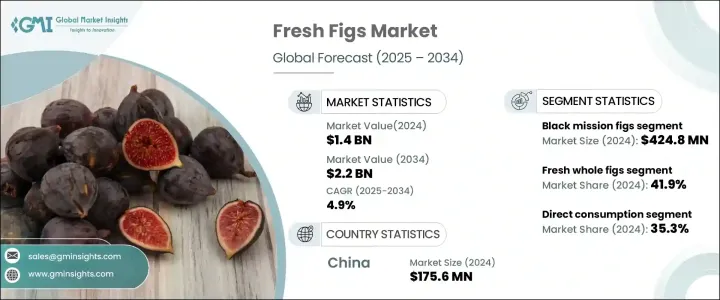

2024 年全球新鮮無花果市場價值為 14 億美元,預計 2025 年至 2034 年期間將以 4.9% 的複合年成長率穩步成長。需求的成長歸因於新鮮無花果提供的眾多健康益處,包括其豐富的纖維含量,有助於消化並有助於控制體重。每 100 克新鮮無花果含有每日建議纖維攝取量的 14%,以及支持整體健康的必需維生素。研究表明,經常食用新鮮無花果可以降低血壓和膽固醇水平,增加了其作為健康飲食選擇的吸引力。提供有機、從農場到家庭農產品的線上雜貨平台的日益普及也促進了新鮮無花果市場的發展,擴大了消費者獲取這些營養豐富的水果的管道。此外,它們在各種烹飪應用中的多功能性(從糕點到美味佳餚)進一步增加了需求。新鮮無花果因其有助於控制糖尿病和心臟病的能力而受到特別重視,使其成為注重增強免疫健康的消費者的熱門選擇。

根據產品類型,新鮮無花果市場分為黑色使命無花果、棕色火雞無花果、卡多塔無花果、卡利米爾納無花果、亞得里亞海無花果等。黑無花果市場表現突出,2024 年產值達 4.248 億美元,複合年成長率高達 5.9%。這些無花果以其甜美的口感和較長的保存期限而聞名,成為國內和出口市場的首選。此外,它們在主要無花果種植區的廣泛種植保證了穩定的供應,滿足了人們對天然甜味劑和更健康食品選擇日益成長的需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 14億美元 |

| 預測值 | 22億美元 |

| 複合年成長率 | 4.9% |

市場也按形式分類,新鮮無花果部分在 2024 年將佔據 41.9% 的顯著佔有率。越來越多的消費者選擇新鮮無花果作為精製糖的更健康替代品。無花果可用於各種菜餚,從沙拉、甜點到美食,因此很受歡迎。與乾無花果相比,新鮮無花果具有加工程度最低的額外優勢,因此對於注重健康的消費者來說,新鮮無花果是一種更具吸引力的選擇。

就最終用途而言,直接消費在 2024 年佔據了最大的市場佔有率,為 35.3%。新鮮無花果以其天然形式廣受喜愛,無論去皮與否,並被加入到各種食品中,如果醬、蛋糕和醬汁。它們的營養成分豐富,富含纖維、抗氧化劑和鉀、鎂等礦物質,促使人們越來越意識到它們的健康益處。隨著植物性飲食和超級食品趨勢的興起,對新鮮無花果的需求預計將持續上升。

在中國,新鮮無花果市場在 2024 年的產值達到 1.756 億美元,預計到 2034 年將達到 3.333 億美元,複合年成長率為 4.8%。儘管有氣候和交通方面的挑戰,消費者對新鮮無花果的興趣日益濃厚,推動著市場成長。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商格局

- 利潤率分析

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 提高消費者對健康益處的認知

- 網路雜貨和有機食品市場的擴張

- 功能性和藥用食品的需求不斷成長

- 產業陷阱與挑戰

- 保存期限短和易腐爛問題

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依產品類型,2021 年至 2034 年

- 主要趨勢

- 黑色使命無花果

- 棕色火雞無花果

- 角田無花果

- 卡利米爾納無花果

- 亞得里亞海無花果

- 其他

第6章:市場估計與預測:依形式,2021 年至 2034 年

- 主要趨勢

- 新鮮無花果

- 無花果乾

- 無花果醬/無花果泥

- 無花果醬/果凍

- 無花果糖漿

第7章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 直接消費

- 烘焙和糖果

- 乳製品

- 零食和穀物

- 飲料

- 冰沙

- 果汁

- 烹飪應用

- 其他

第8章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 超市和大賣場

- 專賣店

- 線上零售商

- 餐飲服務提供者

- 其他

第9章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第10章:公司簡介

- Alara Agri Business

- Athos Agricola

- California Figs

- Earl's Organic Produce

- FruitLips Jiaherb

- Hadley Fruit Orchards

- Mafpack

- Meurens Natural

- Roland Foods

- Valley Fig Growers

The Global Fresh Figs Market was valued at USD 1.4 billion in 2024 and is projected to grow at a steady CAGR of 4.9% from 2025 to 2034. The rise in demand is attributed to the numerous health benefits fresh figs offer, including their rich fiber content, which aids digestion and helps with weight management. Each 100-gram serving of fresh figs contains 14% of the recommended daily fiber intake, along with essential vitamins that support overall wellness. Studies have shown that regular consumption of fresh figs can lower blood pressure and cholesterol levels, adding to their appeal as a healthy dietary option. The market for fresh figs is also bolstered by the growing popularity of online grocery platforms that offer organic, farm-to-home produce, expanding consumer access to these nutrient-rich fruits. Additionally, their versatility in various culinary applications-from pastries to savory dishes-further increases demand. Fresh figs are particularly valued for their ability to help manage diabetes and heart conditions, making them a sought-after option for consumers focused on boosting their immune health.

By product type, the fresh figs market is segmented into black mission figs, brown turkey figs, Kadota figs, Calimyrna figs, Adriatic figs, and others. The black mission figs segment has been a standout performer, generating USD 424.8 million in 2024, with a robust CAGR of 5.9%. These figs are known for their sweet taste and superior shelf life, making them a preferred choice in both domestic and export markets. Furthermore, their widespread cultivation in key fig-growing regions supports a consistent supply, aligning with the increasing demand for natural sweeteners and healthier food options.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.4 Billion |

| Forecast Value | $2.2 Billion |

| CAGR | 4.9% |

The market is also divided by form, with the fresh whole figs segment accounting for a significant share of 41.9% in 2024. Consumers are increasingly turning to fresh whole figs as a healthier alternative to refined sugar. These figs are consumed in a variety of dishes, from salads and desserts to gourmet meals, driving their popularity. Fresh figs offer the added benefit of being minimally processed compared to dried figs, making them a more attractive option for health-conscious consumers.

Regarding end-use, direct consumption held the largest market share at 35.3% in 2024. Fresh figs are widely enjoyed in their natural form, whether peeled or unpeeled, and incorporated into various food products such as jams, cakes, and sauces. Their nutrient profile, rich in fiber, antioxidants, and minerals like potassium and magnesium, has contributed to the growing awareness of their health benefits. With the rise of plant-based diets and the superfood trend, the demand for fresh figs is expected to continue to rise.

In China, the fresh figs market generated USD 175.6 million in 2024 and is projected to reach USD 333.3 million by 2034, growing at a CAGR of 4.8%. Despite challenges related to climate and transportation, the increasing consumer interest in fresh figs is driving market growth.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing consumer awareness of health benefits

- 3.6.1.2 Expansion of online grocery and organic food markets

- 3.6.1.3 Rising demand in functional and medicinal foods

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Short shelf life and perishability issues

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 – 2034 (USD Billion) (Tons)

- 5.1 Key trends

- 5.2 Black mission figs

- 5.3 Brown turkey figs

- 5.4 Kadota figs

- 5.5 Calimyrna figs

- 5.6 Adriatic figs

- 5.7 Others

Chapter 6 Market Estimates and Forecast, By Form, 2021 – 2034 (USD Billion) (Tons)

- 6.1 Key trends

- 6.2 Fresh whole figs

- 6.3 Dried figs

- 6.4 Fig paste/puree

- 6.5 Fig jam/jelly

- 6.6 Fig syrup

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 (USD Billion) (Tons)

- 7.1 Key trends

- 7.2 Direct consumption

- 7.3 Bakery and confectionery

- 7.4 Dairy products

- 7.5 Snacks and cereals

- 7.6 Beverages

- 7.6.1 Smoothies

- 7.6.2 Juices

- 7.7 Culinary applications

- 7.8 Others

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 (USD Billion) (Tons)

- 8.1 Key trends

- 8.2 Supermarkets and hypermarkets

- 8.3 Specialty stores

- 8.4 Online retailers

- 8.5 Foodservice providers

- 8.6 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Billion) (Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Alara Agri Business

- 10.2 Athos Agricola

- 10.3 California Figs

- 10.4 Earl's Organic Produce

- 10.5 FruitLips Jiaherb

- 10.6 Hadley Fruit Orchards

- 10.7 Mafpack

- 10.8 Meurens Natural

- 10.9 Roland Foods

- 10.10 Valley Fig Growers