|

市場調查報告書

商品編碼

1716531

功率元件分析儀市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Power Device Analyzer Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

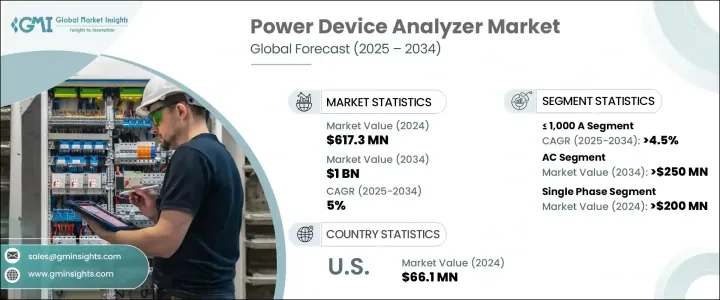

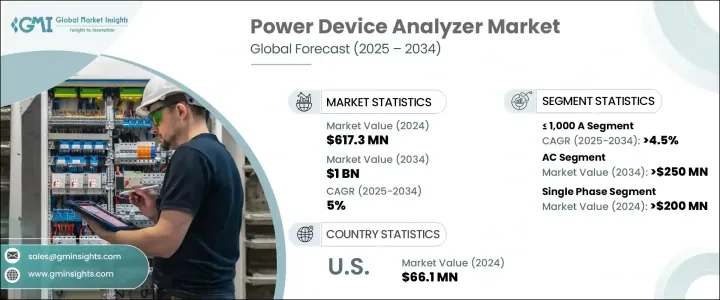

2024 年全球電力設備分析儀市場規模達到 6.173 億美元,預計 2025 年至 2034 年的複合年成長率為 5%。隨著各行各業尋求最佳化能源使用和減少浪費,對用於分析電力系統的先進工具的需求正在迅速成長。這種激增在能源效率和永續性變得至關重要的各個工業領域尤其明顯。將太陽能和風能等再生能源融入電力系統也推動了對這些設備的需求。此外,政府對再生能源基礎設施的政策和投資在推動電力測量系統的採用方面發揮著至關重要的作用。

人們越來越重視維持電網穩定性、管理波動的電力輸入以及提高系統效率,所有這些都進一步支持了電力設備分析儀市場的擴張。這些工具對於確保電力設備最佳運作並符合監管標準至關重要。各行各業擴大採用自動化和電氣化流程,這對精密電力測量系統的需求更大,以確保可靠的系統性能並減少效率低下。此外,旨在提高電網穩定性和能源效率的更嚴格的政府規定正在推動電力分析儀市場的發展。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 6.173億美元 |

| 預測值 | 10億美元 |

| 複合年成長率 | 5% |

汽車、醫療保健和電信業正在推動對這些分析儀的需求,因為在這些行業中保持電能品質和可靠性至關重要。此外,隨著向再生能源的轉變不斷進行,電力設備分析儀在監測和提高這些系統中使用的能源設備的效率方面發揮著至關重要的作用。

市場目前分為額定電流 <= 1,000 A 的設備和額定電流 > 1,000 A 的設備和。到 2034 年,額定電流 <= 1,000 A 的設備的複合年成長率預計超過 4.5%。這種成長歸因於對能源效率的日益關注,這刺激了對精確功率測試的需求,以確保符合能源規格。此外,電動車普及率的提高以及電力電子產品在各種工業應用中的日益普及也推動了這個市場的發展。

該行業也按相進行細分,包括單相和三相電力設備分析儀。 2024 年單相市場價值將超過 2 億美元,其需求主要受到汽車、再生能源和消費性電子等產業所推動。

在美國,功率元件分析儀市場在 2022 年的價值為 6,070 萬美元,到 2024 年將成長到 6,610 萬美元。到 2034 年,預計該市場價值將超過 1 億美元,因為向風能、太陽能和儲能系統等清潔能源解決方案的轉變加劇了對精確功率測量工具的需求,以確保最佳的電網穩定性和效率。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 戰略展望

- 創新與永續發展格局

第5章:市場規模及預測:依當前,2021 – 2034 年

- 主要趨勢

- ≤ 1,000 A

- > 1,000 安

第6章:市場規模及預測:依產品,2021 年至 2034 年

- 主要趨勢

- 交流和直流

- 交流電

- 直流

第7章:市場規模及預測:依階段,2021 年至 2034 年

- 主要趨勢

- 單相

- 三相

第 8 章:市場規模與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 汽車

- 消費性電子產品

- 能源

- 電信

- 衛生保健

- 其他

第9章:市場規模及預測:依地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 法國

- 俄羅斯

- 英國

- 義大利

- 西班牙

- 荷蘭

- 奧地利

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 澳洲

- 紐西蘭

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 卡達

- 埃及

- 南非

- 奈及利亞

- 拉丁美洲

- 巴西

- 阿根廷

第10章:公司簡介

- ADVANTEST CORPORATION

- Arbiter Systems

- B&K Precision Corporation

- Carlo Gavazzi

- Chroma ATE

- Circutor

- Delta Electronics

- Dewesoft

- DEWETRON

- Fluke Corporation

- HIOKI EE CORPORATION

- IWATSU ELECTRIC

- Keysight Technologies

- Magtrol

- NATIONAL INSTRUMENTS

- Rohde & Schwarz

- TEKTRONIX

- Texas Instruments

- Vitrek

- Yokogawa Test & Measurement Corporation

The Global Power Device Analyzer Market reached USD 617.3 million in 2024 and is estimated to depict a CAGR of 5% from 2025 to 2034. As industries seek to optimize energy use and reduce wastage, the demand for advanced tools to analyze power systems is rising rapidly. This surge is particularly noticeable across various industrial sectors where energy efficiency and sustainability are becoming critical. The integration of renewable energy sources, such as solar and wind, into power systems is also driving the need for these devices. Alongside, government policies and investments in renewable energy infrastructure are playing a crucial role in pushing the adoption of power measurement systems.

There is a growing emphasis on maintaining grid stability, managing fluctuating power inputs, and enhancing system efficiency, all of which further support the expansion of the power device analyzer market. These tools are crucial in ensuring power devices are functioning optimally and meeting regulatory standards. Industries are increasingly adopting automation and electrification processes, which is creating a greater demand for precision power measurement systems to ensure reliable system performance and mitigate inefficiencies. Additionally, stricter government mandates aimed at improving grid stability and energy efficiency are boosting the market for power analyzers.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $617.3 Million |

| Forecast Value | $1 Billion |

| CAGR | 5% |

The automotive, healthcare, and telecommunications sectors are driving the demand for these analyzers, as maintaining power quality and reliability is critical in these industries. Moreover, as the transition to renewable energy sources continues, power device analyzers play an essential role in monitoring and improving the efficiency of energy devices used in these systems.

The market is currently segmented into devices rated <= 1,000 A and those rated > 1,000 A. The <= 1,000 A devices are expected to experience a CAGR of over 4.5% through 2034. This growth is attributed to the increasing focus on energy efficiency, which is spurring demand for accurate power testing to ensure compliance with energy norms. Moreover, the rise in electric vehicle adoption and the increasing use of power electronics in various industrial applications are also fueling this market.

The industry is also segmented by phase, with single-phase and three-phase power device analyzers. The single-phase market was valued at over USD 200 million in 2024, with its demand primarily driven by industries like automotive, renewable energy, and consumer electronics.

In the U.S., the market for power device analyzers was valued at USD 60.7 million in 2022, increasing to USD 66.1 million in 2024. By 2034, it is expected to exceed USD 100 million, as the shift to clean energy solutions like wind, solar, and energy storage systems intensifies the need for precise power measurement tools to ensure optimal grid stability and efficiency.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Current, 2021 – 2034 (Units & USD Million)

- 5.1 Key trends

- 5.2 ≤ 1,000 A

- 5.3 > 1,000 A

Chapter 6 Market Size and Forecast, By Product, 2021 – 2034 (Units & USD Million)

- 6.1 Key trends

- 6.2 Both AC & DC

- 6.3 AC

- 6.4 DC

Chapter 7 Market Size and Forecast, By Phase, 2021 – 2034 (Units & USD Million)

- 7.1 Key trends

- 7.2 Single phase

- 7.3 Three phase

Chapter 8 Market Size and Forecast, By Application, 2021 – 2034 (Units & USD Million)

- 8.1 Key trends

- 8.2 Automotive

- 8.3 Consumer electronics

- 8.4 Energy

- 8.5 Telecom

- 8.6 Healthcare

- 8.7 Others

Chapter 9 Market Size and Forecast, By Region, 2021 – 2034 (Units & USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.2.3 Mexico

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 France

- 9.3.3 Russia

- 9.3.4 UK

- 9.3.5 Italy

- 9.3.6 Spain

- 9.3.7 Netherlands

- 9.3.8 Austria

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 South Korea

- 9.4.4 India

- 9.4.5 Australia

- 9.4.6 New Zealand

- 9.5 Middle East & Africa

- 9.5.1 Saudi Arabia

- 9.5.2 UAE

- 9.5.3 Qatar

- 9.5.4 Egypt

- 9.5.5 South Africa

- 9.5.6 Nigeria

- 9.6 Latin America

- 9.6.1 Brazil

- 9.6.2 Argentina

Chapter 10 Company Profiles

- 10.1 ADVANTEST CORPORATION

- 10.2 Arbiter Systems

- 10.3 B&K Precision Corporation

- 10.4 Carlo Gavazzi

- 10.5 Chroma ATE

- 10.6 Circutor

- 10.7 Delta Electronics

- 10.8 Dewesoft

- 10.9 DEWETRON

- 10.10 Fluke Corporation

- 10.11 HIOKI E.E. CORPORATION

- 10.12 IWATSU ELECTRIC

- 10.13 Keysight Technologies

- 10.14 Magtrol

- 10.15 NATIONAL INSTRUMENTS

- 10.16 Rohde & Schwarz

- 10.17 TEKTRONIX

- 10.18 Texas Instruments

- 10.19 Vitrek

- 10.20 Yokogawa Test & Measurement Corporation