|

市場調查報告書

商品編碼

1716524

木材切割機市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Timber Cutting Machine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

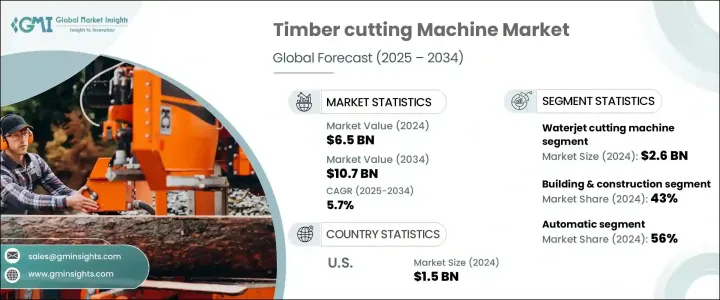

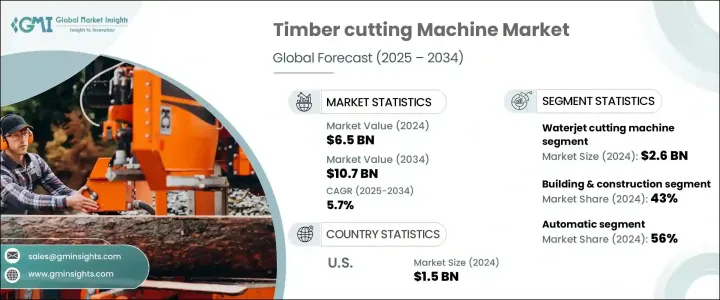

2024 年全球木材切割機市場價值為 65 億美元,預計 2025 年至 2034 年期間的複合年成長率為 5.7%。對木材和木材產品的需求不斷成長,以及對木材加工和森林管理的投資增加,正在推動市場擴張。木材在木工行業中發揮著至關重要的作用,廣泛用於製造橫梁、地板、鑲板和家具。隨著城鎮化和基礎設施項目的不斷發展,對木材產品的需求不斷增加,推動了高效能木材切割機的銷售。不斷擴大的家具市場(尤其是發展中國家的家具市場)推動了對大批量生產木材切割技術的需求。此外,木材出口的增加需要能夠加工大量木材以供出口市場的機器。對膠合板、單板和建築木材等加工木材的需求也在成長,這推動了先進切割技術的採用。

2024 年,水刀切割機領域將以 26 億美元的營收引領市場。同時,預計到 2034 年,雷射切割機領域將以 6.1% 的複合年成長率顯著成長。雷射切割技術具有卓越的精度和質量,使其成為現代木工的寶貴工具。該技術可以實現乾淨的切割,最大程度地減少材料損失,非常適合複雜的圖案和小細節。先進的雷射技術可以處理不同類型和厚度的木材,增加了木工應用的多功能性。除了切割之外,新開發的雷射系統還可以雕刻和標記木材,從而能夠創造出複雜的設計、紋理和標誌。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 65億美元 |

| 預測值 | 107億美元 |

| 複合年成長率 | 5.7% |

到 2024 年,建築和施工領域將佔木材切割機市場的約 43%。發展中經濟體的快速城市化和工業化正在推動結構應用和室內裝飾對木材的需求。亞太等地區建築活動的增加對這一領域的成長做出了重大貢獻。木製家具產業也正在經歷向木材切割自動化和精準化的轉變。製造商正在採用先進的機械來滿足客製化和永續木製家具日益成長的需求,提高生產力並最大限度地減少材料浪費。隨著技術創新繼續塑造產業並滿足消費者對高品質和環保家具的需求,預計這一趨勢將持續下去。

由於人們對高精度先進系統的偏好日益成長,自動化領域將在 2024 年佔據木材切割機市場約 56% 的佔有率。自動切割機透過最大限度地減少材料浪費和切割成本來提高效率。這些系統收集有關材料類型、數量和尺寸的重要資料,從而允許專門的軟體最佳化材料使用並提高生產力。自動化機器專為在單層切割過程中提供卓越的性能而設計,可用於傳送帶和靜態設定。

2024年,美國在北美木材切割機市場佔據主導地位,佔有該地區約80%的佔有率,創造15億美元的收入。美國市場的擴張受到技術進步、木材和木材產品需求增加以及木材出口增加的推動。美國在工業原木生產、木漿、木屑顆粒和鋸木領域仍保持全球領先地位,進一步鞏固了在市場上的地位。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素。

- 利潤率分析。

- 中斷

- 未來展望

- 製成品

- 經銷商

- 供應商格局

- 技術格局

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 木材和木材產品需求不斷成長

- 木材加工和出口增加

- 產業陷阱與挑戰

- 初期投資高

- 維護成本高

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按機器技術,2021-2034 年

- 主要趨勢

- 雷射切割機

- 銑削切割機

- 水刀切割機

- 鋸切機

第6章:市場估計與預測:依營運機制,2021-2034 年

- 主要趨勢

- 自動的

- 半自動

- 手動的

第7章:市場估計與預測:按機器安裝量,2021-2034 年

- 主要趨勢

- 水平的

- 垂直的

第8章:市場估計與預測:按最終用途產業,2021-2034 年

- 主要趨勢

- 家具製造

- 建築與施工

- 林業和伐木業

- 其他(紙漿和紙張、包裝等)

第9章:市場估計與預測:按配銷通路,2021-2034

- 主要趨勢

- 直銷

- 間接銷售

第10章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第 11 章:公司簡介

- Bezner-Oswald

- Gelgoog Company

- Homag

- Kikukawa Enterprise

- Mebor

- Michael Weinig

- Nihar Industries

- Salvador

- Salvamac

- SCM

- Socomec

- TL Pathak

- Umaboy

- Walter Werkzeuge

- Weho Machinery

The Global Timber Cutting Machine Market was valued at USD 6.5 billion in 2024 and is projected to expand at a CAGR of 5.7% from 2025 to 2034. The growing demand for wood and timber products, along with increased investment in timber processing and forest management, is driving market expansion. Timber plays a crucial role in the woodwork industry, being widely used for making beams, flooring, paneling, and furniture. As urbanization and infrastructure projects continue to grow, the need for timber products is increasing, driving the sales of efficient timber cutting machines. The expanding furniture market, especially in developing nations, is contributing to the demand for wood cutting technologies for high-volume production. Additionally, rising timber exports require machines capable of processing large volumes of wood for export markets. Demand is also rising for processed wood materials, including plywood, veneer, and construction timber, which is boosting the adoption of advanced cutting technologies.

In 2024, the waterjet cutting machine segment led the market with revenues of USD 2.6 billion. Meanwhile, the laser cutting machine segment is predicted to witness notable growth at a CAGR of 6.1% through 2034. Laser cutting technology offers exceptional precision and quality, making it a valuable tool in modern woodworking. This technology provides clean cuts with minimal material loss, making it ideal for intricate patterns and small details. Advanced laser technology can handle different types and thicknesses of wood, adding versatility to woodworking applications. Apart from cutting, newly developed laser systems can also engrave and mark wood, enabling the creation of intricate designs, textures, and logos.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.5 Billion |

| Forecast Value | $10.7 Billion |

| CAGR | 5.7% |

The building and construction segment accounted for approximately 43% of the timber cutting machine market in 2024. Rapid urbanization and industrialization in developing economies are driving the demand for wood in structural applications and interior decor. Rising construction activity in regions such as Asia-Pacific is contributing significantly to the growth of this segment. The wood furniture industry is also experiencing a shift toward automation and precision in timber cutting. Manufacturers are adopting advanced machinery to meet the growing need for customized and sustainable wooden furniture, enhancing productivity and minimizing material waste. This trend is expected to persist as technological innovations continue to shape the industry and address consumer demands for high-quality and environmentally friendly furniture.

The automatic segment captured around 56% of the timber cutting machine market in 2024 due to the growing preference for advanced systems that offer high precision. Automated cutting machines improve efficiency by minimizing material waste and cutting costs. These systems collect essential data on material type, quantity, and dimensions, allowing specialized software to optimize material usage and enhance productivity. Automated machines are designed for superior performance in single-ply cutting processes and can be used in both conveyor and static setups.

In 2024, the United States dominated the North American timber cutting machine market, holding around 80% of the region's share and generating USD 1.5 billion in revenue. The expansion of the U.S. market is fueled by technological advancements, increased demand for wood and timber-based products, and rising wood exports. The U.S. remains a global leader in industrial roundwood production, wood pulp, wood pellets, and sawn wood, further reinforcing its position in the market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations.

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain.

- 3.1.2 Profit margin analysis.

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufactures

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Technological landscape

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rising demand for wood and timber products

- 3.6.1.2 Increase in timber processing and export

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High initial investment

- 3.6.2.2 High maintenance cost

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Machine Technology, 2021-2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Laser cutting machine

- 5.3 Milling cutting machine

- 5.4 Waterjet cutting machine

- 5.5 Saw cutting machine

Chapter 6 Market Estimates & Forecast, By Operating Mechanism, 2021-2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Automatic

- 6.3 Semi-automatic

- 6.4 Manual

Chapter 7 Market Estimates & Forecast, By Machine Installation, 2021-2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Horizontal

- 7.3 Vertical

Chapter 8 Market Estimates & Forecast, By End Use Industry, 2021-2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Furniture manufacturing

- 8.3 Building & construction

- 8.4 Forestry and logging

- 8.5 Others (pulp & paper, packaging, etc.)

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct sales

- 9.3 Indirect sales

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Bezner-Oswald

- 11.2 Gelgoog Company

- 11.3 Homag

- 11.4 Kikukawa Enterprise

- 11.5 Mebor

- 11.6 Michael Weinig

- 11.7 Nihar Industries

- 11.8 Salvador

- 11.9 Salvamac

- 11.10 SCM

- 11.11 Socomec

- 11.12 T.L Pathak

- 11.13 Umaboy

- 11.14 Walter Werkzeuge

- 11.15 Weho Machinery