|

市場調查報告書

商品編碼

1716521

石油焦市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Petcoke Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

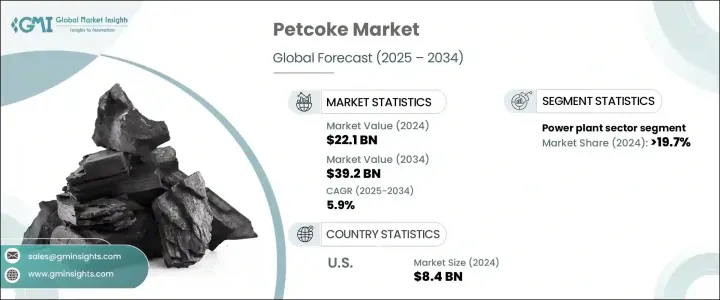

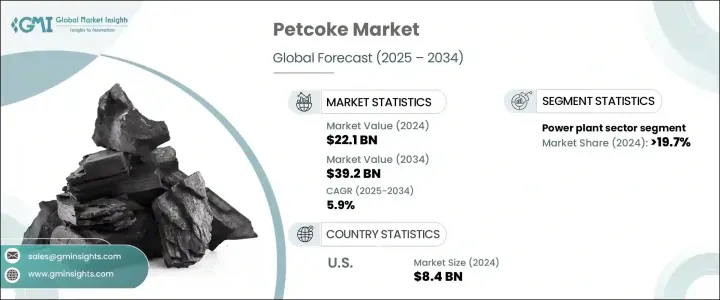

2024 年全球石油焦市場價值為 221 億美元,預計 2025 年至 2034 年期間的複合年成長率為 5.9%。石油焦是一種由石油精煉產生的富碳固體,仍是發電、水泥製造和鋼鐵生產等產業的主要燃料來源。它的高熱值和成本效益使其成為比傳統燃料更受歡迎的選擇。然而,日益成長的環境問題和監管壓力促使各行各業探索替代能源。由於煤炭對環境產生不利影響,尤其是高碳和高硫排放,世界各國政府正在實施嚴格的政策來限制煤炭的使用。這種轉變促使企業採用更乾淨的替代方案或實施先進的排放控制技術來繼續使用石油焦。

煉油能力的不斷擴大是石油焦供應不斷增加的關鍵因素。隨著越來越多的原油被提煉,作為重油加工的副產品,石油焦的產量也隨之增加。此外,水泥和鋼鐵業的穩定需求進一步推動了市場成長。這些產業依賴石油焦,因為其價格低廉且能量輸出高,確保了對該材料的持續需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 221億美元 |

| 預測值 | 392億美元 |

| 複合年成長率 | 5.9% |

石油焦市場分為燃料級石油焦和煅燒石油焦。燃料級石油焦因其在水泥廠、發電廠和鋼鐵生產設施中的廣泛使用而佔據主導地位。儘管人們對其高硫和高金屬含量感到擔憂,但它仍然是一種經濟有效的煤炭替代品。

按應用細分的市場包括發電廠、水泥、鋼鐵和鋁業等。 2024年,發電廠產業佔石油焦市場總量的19.7%以上,凸顯其在能源生產中的關鍵角色。火力發電廠繼續依賴石油焦,特別是在難以獲得清潔燃料的地區。

美國石油焦市場經歷了顯著成長,2022 年估值為 80 億美元,2023 年為 82 億美元,2024 年為 84 億美元。不斷擴張的鋼鐵和電力產業推動了這一需求,利用了石油焦的經濟優勢、高能量產量以及作為高爐碳源的角色。 2024年,美國的消費量將達到5,440萬公噸,主要用於工業應用。與天然氣和煤炭相比,石油焦的成本效益仍然是支撐其持續需求的關鍵因素。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 戰略儀表板

- 創新與技術格局

第5章:市場規模及預測:依等級,2021 - 2034

- 主要趨勢

- 燃料等級

- 煅燒石油焦

第6章:市場規模及預測:依實物形態,2021 - 2034

- 主要趨勢

- 海綿焦炭

- 清除焦炭

- 可樂

- 針狀焦

第7章:市場規模及預測:依應用,2021 - 2034

- 主要趨勢

- 發電廠

- 水泥業

- 鋼鐵業

- 鋁工業

- 其他

第8章:市場規模及預測:按地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 希臘

- 俄羅斯

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 中東和非洲

- 沙烏地阿拉伯

- 土耳其

- 科威特

- 拉丁美洲

- 巴西

- 阿根廷

- 智利

- 墨西哥

第9章:公司簡介

- BP

- Chevron Corporation

- Exxon Mobil

- HF Sinclair Corporation

- Husky Energy

- Marathon Petroleum Corporation

- Oxbow Corporation

- Phillips 66 Company

- Reliance Industries

- Saudi Aramco

- Shell plc

- Valero Energy Corp

- Indian Oil Corporation

- Rosneft

- TotalEnergies

The Global Petcoke Market was valued at USD 22.1 billion in 2024 and is projected to expand at a CAGR of 5.9% from 2025 to 2034. Petcoke, a carbon-rich solid derived from oil refining, remains a key fuel source for industries such as power generation, cement manufacturing, and steel production. Its high calorific value and cost-effectiveness make it a preferred choice over conventional fuels. However, rising environmental concerns and regulatory pressures are prompting industries to explore alternative energy sources. Governments worldwide are implementing stringent policies to curb coal usage due to its adverse environmental impact, particularly high carbon and sulfur emissions. This shift is pushing companies to either adopt cleaner alternatives or implement advanced emission control technologies to continue using petcoke.

The increasing expansion of refinery capacities is a crucial factor contributing to the growing availability of petcoke. As more crude oil is refined, higher volumes of petcoke are produced as a byproduct of processing heavy oil. Additionally, the steady demand from cement and steel industries further propels market growth. These industries rely on petcoke for its affordability and high energy output, ensuring a consistent demand for the material.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $22.1 Billion |

| Forecast Value | $39.2 Billion |

| CAGR | 5.9% |

The petcoke market is segmented into fuel-grade and calcined petcoke. Fuel-grade petcoke holds a dominant share due to its widespread use in cement plants, power stations, and steel production facilities. It remains a cost-effective alternative to coal despite concerns regarding its high sulfur and metal content.

Market segmentation by application includes power plants, cement, steel, and aluminum industries, among others. In 2024, the power plant sector accounted for over 19.7% of the total petcoke market share, highlighting its critical role in energy production. Thermal power plants continue to rely on petcoke, especially in regions where cleaner fuels are not readily accessible.

The U.S. petcoke market has experienced notable growth, with valuations of USD 8 billion in 2022, USD 8.2 billion in 2023, and USD 8.4 billion in 2024. The expanding steel and power industries drive this demand, capitalizing on petcoke's economic advantages, high energy yield, and role as a carbon source in blast furnaces. In 2024, U.S. consumption reached 54.4 million metric tonnes, primarily for these industrial applications. The cost-efficiency of petcoke compared to natural gas and coal remains a key factor supporting its sustained demand.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Grade, 2021 - 2034 (MT, USD Million)

- 5.1 Key trends

- 5.2 Fuel grade

- 5.3 Calcined petcoke

Chapter 6 Market Size and Forecast, By Physical Form, 2021 - 2034 (MT, USD Million)

- 6.1 Key trends

- 6.2 Sponge coke

- 6.3 Purge coke

- 6.4 Shot coke

- 6.5 Needle coke

Chapter 7 Market Size and Forecast, By Application, 2021 - 2034 (MT, USD Million)

- 7.1 Key trends

- 7.2 Power plants

- 7.3 Cement industry

- 7.4 Steel industry

- 7.5 Aluminum industry

- 7.6 Others

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (MT, USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Greece

- 8.3.5 Russia

- 8.3.6 Spain

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 Turkey

- 8.5.3 Kuwait

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

- 8.6.3 Chile

- 8.6.4 Mexico

Chapter 9 Company Profiles

- 9.1 BP

- 9.2 Chevron Corporation

- 9.3 Exxon Mobil

- 9.4 HF Sinclair Corporation

- 9.5 Husky Energy

- 9.6 Marathon Petroleum Corporation

- 9.7 Oxbow Corporation

- 9.8 Phillips 66 Company

- 9.9 Reliance Industries

- 9.10 Saudi Aramco

- 9.11 Shell plc

- 9.12 Valero Energy Corp

- 9.13 Indian Oil Corporation

- 9.14 Rosneft

- 9.15 TotalEnergies