|

市場調查報告書

商品編碼

1716509

電解質飲料市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Electrolyte Drink Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

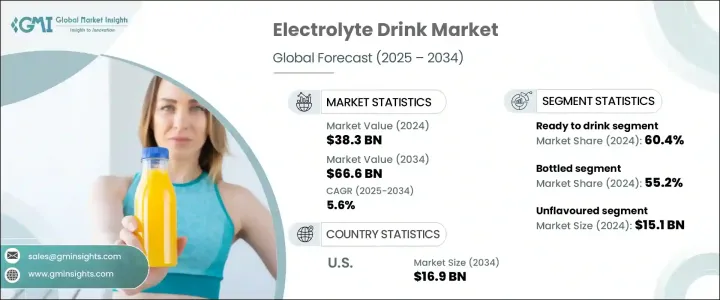

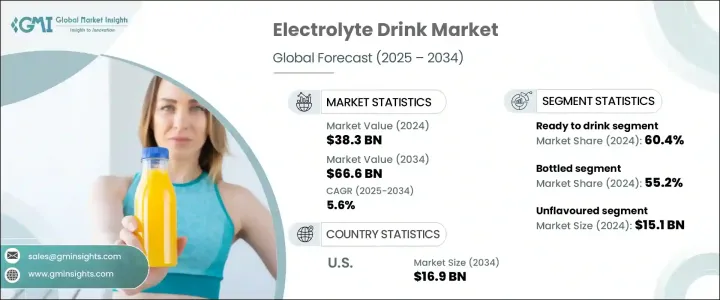

2024 年全球電解質飲料市場價值為 383 億美元,預計 2025 年至 2034 年的複合年成長率為 5.6%。這一穩定的市場擴張主要得益於消費者越來越意識到補水在整體健康和保健中的重要作用。隨著健身趨勢的興起,越來越多的人開始透過電解質飲料來補充流失的礦物質和液體,以確保在體育活動中達到最佳表現。無論是運動員、健身愛好者或過著積極生活方式的個人,對功能性飲料的需求都在不斷成長。人們對體育、戶外活動和整體健康日益成長的興趣正在推動市場向前發展。

除了健身圈之外,電解質飲料在日常消費者中也越來越受歡迎,因為他們希望在忙碌的生活中保持水分。人們向更健康的生活方式轉變加速了對這些飲料的需求,尤其是上班族、旅客以及那些尋求含糖蘇打水和人工能量飲料替代品的人。各大品牌正在利用這一趨勢,推出各種口味、創新配方和永續包裝,以滿足不斷變化的消費者偏好。市場競爭日益激烈,迫使企業透過先進的成分組合、清潔標籤配方和策略行銷活動來實現差異化。因此,電解質飲料不再只是運動員的小眾產品,而是正在成為補水的主流選擇。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 383億美元 |

| 預測值 | 666億美元 |

| 複合年成長率 | 5.6% |

市場依產品類型細分,包括即飲飲料、錠劑、粉末等。即飲電解質飲料因其便利性和廣泛性而佔據市場主導地位。同時,受攜帶式和易於使用的補水解決方案的需求推動,平板電腦預計在預測期內以 5.3% 的複合年成長率成長。粉狀電解質飲料通常受到健身愛好者和運動員的青睞,由於其可客製化的份量和經濟高效的批量購買選擇,越來越受到人們的青睞。

包裝創新也在市場成長中發揮關鍵作用。 2024 年,瓶裝電解質飲料佔了 55.2% 的市場佔有率,其受歡迎程度源自於易於使用和攜帶。許多製造商專注於永續和環保的包裝,包括不含 BPA 的塑膠、可回收材料和可生物分解的袋子,以吸引有環保意識的消費者。永續發展的推動預計將塑造未來的包裝趨勢,影響購買決策和品牌忠誠度。

受美國強勁的健身文化以及人們對健康和補水益處的認知不斷提高的推動,美國電解質飲料市場在 2024 年創造了 99 億美元的收入。消費者越來越傾向於符合現代健康趨勢的低糖、清潔標籤的電解質飲料。即飲型和粉狀電解質飲料越來越受到人們的歡迎,因為它們既方便又不影響品質。隨著越來越多的人關注健康,市場對滿足特定健康需求的電解質飲料的需求激增,包括添加維生素、天然成分和減少人工添加劑的飲料。傳統品牌和新興品牌都在不斷創新,以滿足不斷變化的消費者期望,推動整體市場擴張。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商格局

- 利潤率分析

- 重要新聞和舉措

- 監管格局

- 產業衝擊力

- 成長動力

- 提高消費者對補水在整體健康中的作用的認知

- 越來越多的人參與健身活動和體育運動,增加了對補水和恢復飲料的需求。

- 人們越來越喜歡天然、低糖和清潔標籤的產品

- 產業陷阱與挑戰

- 消費者的成本意識,尤其是在新興市場,可能會限制高階產品的成長潛力。

- 椰子水、調味水和其他天然替代品的競爭構成了威脅。

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依產品類型,2021 年至 2034 年

- 主要趨勢

- 即飲

- 平板電腦

- 粉末

- 其他

第6章:市場估計與預測:按包裝,2021 年至 2034 年

- 主要趨勢

- 瓶子

- 能

- 小袋

第7章:市場估計與預測:依口味,2021 年至 2034 年

- 主要趨勢

- 無味

- 調味

第8章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 離線

- 線上

第9章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第10章:公司簡介

- Abbott Laboratories

- CLEAN CAUSE

- Coca-Cola

- Hydralyte

- Kraft Heinz

- Liquid IV

- Nooma

- Nuun

- PepsiCo

- PURE Sports Nutrition

The Global Electrolyte Drink Market was valued at USD 38.3 billion in 2024 and is projected to grow at a CAGR of 5.6% from 2025 to 2034. This steady market expansion is primarily driven by the increasing consumer awareness of the essential role hydration plays in overall health and wellness. As fitness trends gain momentum, more people are turning to electrolyte drinks to replenish lost minerals and fluids, ensuring optimal performance during physical activities. Whether it's athletes, fitness enthusiasts, or individuals leading an active lifestyle, the demand for functional beverages is on the rise. The growing interest in sports, outdoor activities, and overall well-being is propelling the market forward.

Beyond fitness circles, electrolyte drinks are gaining popularity among everyday consumers looking to maintain hydration in their busy lives. The shift toward healthier lifestyle choices has accelerated demand for these beverages, especially among office-goers, travelers, and those seeking an alternative to sugary sodas and artificial energy drinks. Brands are capitalizing on this trend by introducing a variety of flavors, innovative formulations, and sustainable packaging to cater to evolving consumer preferences. The market is becoming increasingly competitive, pushing companies to differentiate themselves through advanced ingredient combinations, clean-label formulations, and strategic marketing campaigns. As a result, electrolyte drinks are no longer just a niche product for athletes but are becoming a mainstream choice for hydration.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $38.3 Billion |

| Forecast Value | $66.6 Billion |

| CAGR | 5.6% |

The market is segmented by product type, including ready-to-drink beverages, tablets, powders, and others. Ready-to-drink electrolyte beverages dominate the market due to their convenience and widespread availability. Meanwhile, tablets are anticipated to grow at a CAGR of 5.3% during the forecast period, driven by the demand for portable and easy-to-use hydration solutions. Powdered electrolyte drinks, often preferred by fitness enthusiasts and athletes, are gaining traction as they allow for customizable serving sizes and cost-effective bulk purchasing options.

Packaging innovations are also playing a critical role in market growth. Bottled electrolyte drinks accounted for 55.2% of the market share in 2024, with their popularity stemming from ease of use and portability. Many manufacturers are focusing on sustainable and eco-friendly packaging, including BPA-free plastic, recyclable materials, and biodegradable pouches, to appeal to environmentally conscious consumers. The push for sustainability is expected to shape future packaging trends, influencing purchasing decisions and brand loyalty.

The U.S. Electrolyte Drink Market generated USD 9.9 billion in 2024, fueled by the country's robust fitness culture and heightened awareness of health and hydration benefits. Consumers are increasingly gravitating toward low-sugar, clean-label electrolyte beverages that align with modern health trends. Ready-to-drink and powdered electrolyte drinks are gaining significant traction, as they offer convenience without compromising on quality. As more individuals focus on wellness, the market is witnessing a surge in demand for electrolyte drinks that cater to specific health needs, including those with added vitamins, natural ingredients, and reduced artificial additives. Both legacy brands and emerging players are innovating to meet evolving consumer expectations, driving overall market expansion.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Industry impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing consumer awareness of hydration’s role in overall wellness

- 3.6.1.2 Rising participation in fitness activities and sports boosts the need for hydration and recovery drinks.

- 3.6.1.3 Growing preference for natural, low-sugar, and clean-label products

- 3.6.2 Industry pitfalls and challenges

- 3.6.2.1 Consumers cost-consciousness, especially in emerging markets, can limit growth potential for premium products.

- 3.6.2.2 Competition from coconut water, flavored waters, and other natural alternatives poses a threat.

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Product type, 2021 – 2034 (USD Bn) (Ton)

- 5.1 Key trends

- 5.2 Ready to drink

- 5.3 Tablets

- 5.4 Powder

- 5.5 Others

Chapter 6 Market Estimates and Forecast, By Packaging, 2021 – 2034 (USD Bn) (Ton)

- 6.1 Key trends

- 6.2 Bottle

- 6.3 Can

- 6.4 Pouch

Chapter 7 Market Estimates and Forecast, By Flavour, 2021 – 2034 (USD Bn) (Ton)

- 7.1 Key trends

- 7.2 Unflavoured

- 7.3 Flavoured

Chapter 8 Market Estimates and Forecast, By Distribution channel, 2021 – 2034 (USD Bn) (Ton)

- 8.1 Key trends

- 8.2 Offline

- 8.3 Online

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Bn) (Ton)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Abbott Laboratories

- 10.2 CLEAN CAUSE

- 10.3 Coca-Cola

- 10.4 Hydralyte

- 10.5 Kraft Heinz

- 10.6 Liquid IV

- 10.7 Nooma

- 10.8 Nuun

- 10.9 PepsiCo

- 10.10 PURE Sports Nutrition