|

市場調查報告書

商品編碼

1716507

太陽能儲能市場機會、成長動力、產業趨勢分析及2025-2034年預測Solar Energy Storage Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

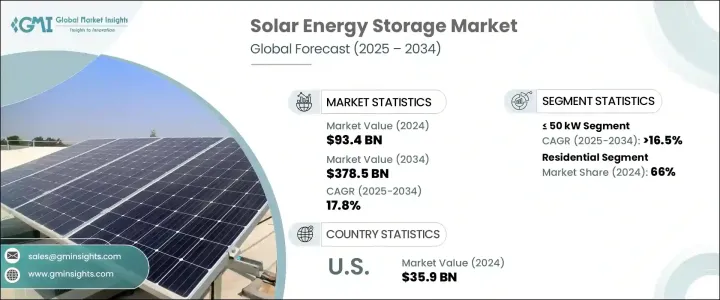

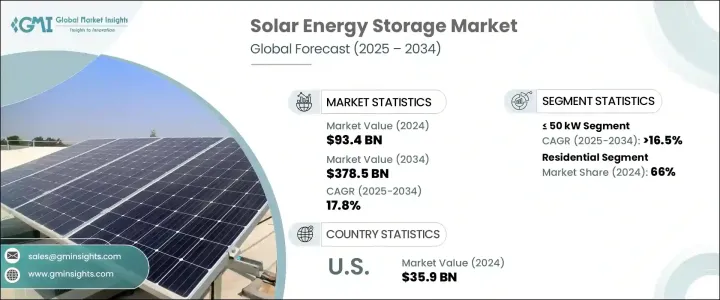

2024 年全球太陽能儲存市場價值為 934 億美元,預計將大幅成長,預計 2025 年至 2034 年期間的複合年成長率為 17.8%。這一顯著的成長軌跡是由日益成長的環境問題、有利的政府激勵措施以及能源儲存技術的進步共同推動的。隨著世界各國加大對減少碳排放和推廣再生能源的關注,太陽能加儲能解決方案正成為能源轉型的重要組成部分。多個地區的政府正在推出稅收抵免和補貼等豐厚的激勵措施,以鼓勵採用太陽能儲存系統。此外,淨計量政策為自行發電和儲存能源的用戶提供了經濟利益,使得太陽能儲存系統對家庭和企業更具吸引力。

技術創新是影響市場趨勢的另一個關鍵因素。電池技術(尤其是鋰離子電池)的不斷進步正在提高成本效率並改善太陽能儲存解決方案的整體性能。這些創新使得儲能系統更易於獲取,並且更可靠,適用於更廣泛的應用。此外,人工智慧能源管理系統的整合正在提高電池效率,確保最佳能源使用,並最大限度地減少浪費。隨著這些技術變得越來越主流,其採用率預計將激增,從而進一步推動市場擴張。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 934億美元 |

| 預測值 | 3785億美元 |

| 複合年成長率 | 17.8% |

預計到 2034 年,51 至 250 千瓦的太陽能儲存市場規模將達到 350 億美元,主要得益於商業建築、小型企業和社區太陽能專案需求的不斷成長。商業設施正在認知到太陽能加儲能系統的成本節約潛力,使其成為降低長期營運成本的有吸引力的投資。此外,基於人工智慧的能源管理平台正在最佳化電池效能並提供即時洞察,從而加速這些儲存解決方案的採用。

市場分為住宅、商業和工業以及公用事業規模的應用。 2024 年,住宅太陽能儲存領域佔據 66% 的市場佔有率,反映出屋主對能源獨立的追求日益成長。不斷上漲的電力成本和對電網可靠性的擔憂促使屋主投資太陽能儲存解決方案。此外,太陽能加儲能系統正在提高房地產價值,使其成為具有長期財務回報的有吸引力的投資。

受環保意識增強和能源成本上升的推動,美國太陽能儲存市場將在 2024 年創造 359 億美元的收入。美國非常重視採用節能技術和減少對化石燃料的依賴,而太陽能儲存系統正在住宅、商業和工業領域中廣泛應用。隨著越來越多的個人和企業重視永續性,預計未來幾年對太陽能儲存解決方案的需求將保持強勁勢頭。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 戰略展望

- 創新與永續發展格局

第5章:市場規模及預測:依構成,2021 年至 2034 年

- 主要趨勢

- 鉛酸

- 鋰離子

第6章:市場規模及預測:依產能,2021 年至 2034 年

- 主要趨勢

- ≤ 50 千瓦

- 51至250千瓦

- 251至500千瓦

- 501至1,000千瓦

- 1,001至2,500千瓦

- 2,501至5,000千瓦

- 5,001至10,000千瓦

- > 10,000 千瓦

第7章:市場規模及預測:依安裝量,2021 年至 2034 年

- 主要趨勢

- 並網

- 離網

第 8 章:市場規模與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 住宅

- 商業和工業

- 公用事業

第9章:市場規模及預測:依地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 法國

- 義大利

- 西班牙

- 英國

- 瑞士

- 奧地利

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第10章:公司簡介

- ABB

- BAE Batteries

- BYD Company

- Eaton

- ENERSYS

- Honeywell International

- Huawei

- Innova Renewables

- Leclanche SA

- LG Electronics

- Maxwell Technologies

- NextEra Energy

- Primus Power

- Saft

- SAMSUNG

- Schneider Electric

- Siemens Energy

- Sol Systems

- Tesla

- Toshiba Corporation

The Global Solar Energy Storage Market, valued at USD 93.4 billion in 2024, is poised for significant growth, with a CAGR of 17.8% projected during 2025-2034. This remarkable growth trajectory is driven by a combination of rising environmental concerns, favorable government incentives, and advancements in energy storage technology. As nations worldwide intensify their focus on reducing carbon emissions and promoting renewable energy, solar-plus-storage solutions are becoming an essential part of the energy transition. Governments across multiple regions are introducing lucrative incentives, such as tax credits and subsidies, to encourage the adoption of solar energy storage systems. Additionally, net metering policies are providing financial benefits to users who generate and store their own energy, making solar energy storage systems more appealing to homeowners and businesses alike.

Technological innovation is another key factor shaping the market's trajectory. Continuous advancements in battery technology, especially lithium-ion batteries, are driving cost efficiencies and improving the overall performance of solar energy storage solutions. These innovations are making energy storage systems more accessible and reliable for a broader range of applications. Furthermore, the integration of AI-powered energy management systems is enhancing battery efficiency, ensuring optimal energy usage, and minimizing wastage. As these technologies become more mainstream, their adoption is expected to surge, further driving market expansion.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $93.4 Billion |

| Forecast Value | $378.5 Billion |

| CAGR | 17.8% |

The 51 to 250 kW solar energy storage segment is projected to reach USD 35 billion by 2034, largely driven by increasing demand from commercial buildings, small businesses, and community-based solar projects. Commercial facilities are recognizing the cost-saving potential of solar-plus-storage systems, making them an attractive investment for reducing long-term operational costs. Moreover, AI-based energy management platforms are optimizing battery performance and providing real-time insights, which is accelerating the adoption of these storage solutions.

The market is segmented into residential, commercial & industrial, and utility-scale applications. In 2024, the residential solar energy storage segment held a commanding 66% market share, reflecting a growing trend toward energy independence among homeowners. Rising electricity costs and concerns over grid reliability are pushing homeowners to invest in solar energy storage solutions. Moreover, solar-plus-storage systems are enhancing property values, making them an attractive investment for long-term financial returns.

The U.S. Solar Energy Storage Market generated USD 35.9 billion in 2024, driven by growing environmental consciousness and rising energy costs. With a strong emphasis on adopting energy-efficient technologies and reducing dependence on fossil fuels, the United States is witnessing widespread adoption of solar energy storage systems across residential, commercial, and industrial sectors. As more individuals and businesses prioritize sustainability, the demand for solar energy storage solutions is expected to maintain strong momentum in the coming years.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Composition, 2021 – 2034 (MW & USD Million)

- 5.1 Key trends

- 5.2 Lead acid

- 5.3 Lithium ion

Chapter 6 Market Size and Forecast, By Capacity, 2021 – 2034 (MW & USD Million)

- 6.1 Key trends

- 6.2 ≤ 50 kW

- 6.3 51 to 250 kW

- 6.4 251 to 500 kW

- 6.5 501 to 1,000 kW

- 6.6 1,001 to 2,500 kW

- 6.7 2,501 to 5,000 kW

- 6.8 5,001 to 10,000 kW

- 6.9 > 10,000 kW

Chapter 7 Market Size and Forecast, By Installation, 2021 – 2034 (MW & USD Million)

- 7.1 Key trends

- 7.2 On-grid

- 7.3 Off-grid

Chapter 8 Market Size and Forecast, By Application, 2021 – 2034 (MW & USD Million)

- 8.1 Key trends

- 8.2 Residential

- 8.3 Commercial & industrial

- 8.4 Utility

Chapter 9 Market Size and Forecast, By Region, 2021 – 2034 (MW & USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 France

- 9.3.3 Italy

- 9.3.4 Spain

- 9.3.5 UK

- 9.3.6 Switzerland

- 9.3.7 Austria

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Middle East & Africa

- 9.5.1 Saudi Arabia

- 9.5.2 UAE

- 9.5.3 South Africa

- 9.6 Latin America

- 9.6.1 Brazil

- 9.6.2 Argentina

Chapter 10 Company Profiles

- 10.1 ABB

- 10.2 BAE Batteries

- 10.3 BYD Company

- 10.4 Eaton

- 10.5 ENERSYS

- 10.6 Honeywell International

- 10.7 Huawei

- 10.8 Innova Renewables

- 10.9 Leclanche SA

- 10.10 LG Electronics

- 10.11 Maxwell Technologies

- 10.12 NextEra Energy

- 10.13 Primus Power

- 10.14 Saft

- 10.15 SAMSUNG

- 10.16 Schneider Electric

- 10.17 Siemens Energy

- 10.18 Sol Systems

- 10.19 Tesla

- 10.20 Toshiba Corporation