|

市場調查報告書

商品編碼

1716498

素食蛋白粉市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Vegan Protein Powder Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

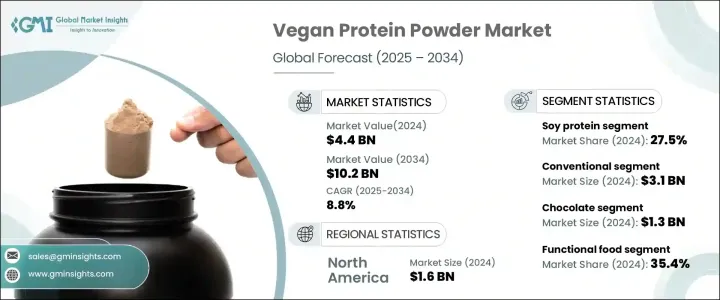

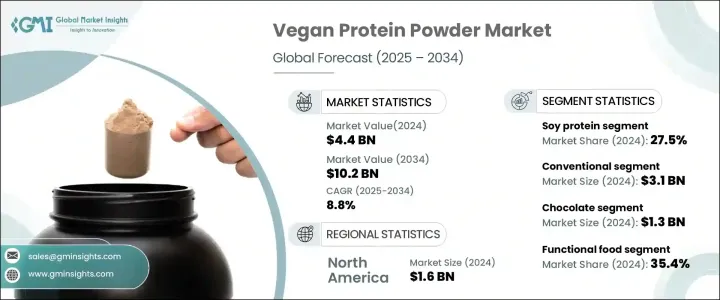

2024 年全球純素蛋白粉市場規模達 44 億美元,預計 2025 年至 2034 年期間的複合年成長率為 8.8%。這一強勁成長得益於人們對植物蛋白替代品的日益偏好,尤其是運動員、注重健康的個人以及堅持純素或素食飲食的人。隨著消費者養成更道德和永續的飲食習慣,對非動物蛋白質來源的需求激增。此外,人們對環境永續性和傳統畜牧業不利影響的日益擔憂促使消費者探索符合其價值觀的替代蛋白質來源。素食蛋白粉市場的公司正在利用這一趨勢,提供具有增強氨基酸成分、改善消化率和額外健康益處的創新產品,以滿足更廣泛的受眾的需求。

健身文化的興起以及人們對植物性蛋白質的健康優勢的認知不斷提高,進一步促進了市場的發展。植物蛋白粉通常添加必需的維生素和礦物質,吸引了追求更健康生活方式的消費者。隨著對功能性食品的需求不斷成長,製造商越來越注重生產不僅能滿足營養需求而且還能提供肌肉恢復、體重管理和增強免疫力等益處的蛋白粉。這項持續的創新持續吸引多樣化的消費者群體,從健身愛好者和職業運動員到只想改善整體健康的個人。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 44億美元 |

| 預測值 | 102億美元 |

| 複合年成長率 | 8.8% |

市場按蛋白質來源分類,包括豌豆、大豆、米、大麻和其他品種。佔據相當大市場佔有率的大豆濃縮蛋白預計到 2034 年將以 9.7% 的複合年成長率成長。它之所以廣受歡迎,是因為其卓越的氨基酸組成、優異的溶解性和價格實惠,使其成為運動營養和功能性食品的理想選擇。此外,大豆濃縮蛋白的多功能性和易得性增強了它的主導地位,使其成為素食蛋白粉產業成長的關鍵驅動力。

從性質上講,市場分為有機和傳統類別。傳統領域在 2024 年創造了 31 億美元的收入,預計到 2034 年將以 8.4% 的複合年成長率成長。傳統純素蛋白粉因其價格實惠且廣泛可用,仍然是首選。製造商青睞傳統蛋白質來源,因為它們的生產成本較低且功能含量高。這些產品在主流食品和飲料應用中佔有重要地位,並得到強大的零售網路的支持,推動市場持續擴張。

2024 年,北美佔了純素蛋白粉市場的 16 億美元,預計到 2034 年將以 3.6% 的複合年成長率成長。該地區對植物性營養的強勁需求,加上成熟的健康和保健產業,使其成為全球最大的市場。加拿大對有機和清潔標籤產品的日益青睞,加上政府支持植物性產業的舉措,大大促進了該地區在市場上的領導地位。素食主義、健身文化和功能性食品需求的興起進一步加強了北美在素食蛋白粉市場的主導地位。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商格局

- 利潤率分析

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 由於純素食人口不斷成長,對植物性食品和飲料的需求不斷增加,推動了市場成長

- 對高蛋白功能性食品和健康產品的需求不斷增加

- 運動營養市場不斷成長

- 產業陷阱與挑戰

- 生產成本高

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場規模及預測:依產品,2021 - 2034

- 主要趨勢

- 大麻蛋白

- 大豆分離蛋白

- 大豆濃縮蛋白

- 米分離蛋白

- 米濃縮蛋白

- 豌豆分離蛋白

- 豌豆蛋白濃縮物

- 螺旋藻蛋白

- 藜麥蛋白

- 蛋白質混合物

第6章:市場規模及預測:依性質,2021 - 2034

- 主要趨勢

- 有機的

- 傳統的

第7章:市場規模及預測:依口味,2021 - 2034

- 主要趨勢

- 無味

- 巧克力

- 香草

- 草莓

- 其他

第 8 章:市場規模與預測:按應用,2021 - 2034 年

- 主要趨勢

- 運動營養

- 飲料

- 功能性食品

- 其他

第9章:市場規模及預測:按配銷通路,2021 - 2034

- 主要趨勢

- 大型超市和超市

- 專賣店

- 網路零售

- 其他

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第 11 章:公司簡介

- Archer-Daniels-Midland Company

- AMCO Proteins

- Bunge Global SA

- Cargill, Incorporated

- Garden Of Life

- Glanbia plc

- Ingredion Incorporated

- Now Foods

- Orgain

- PlantFusion

- Vitaco Health Group

- Wilmar International Limited

The Global Vegan Protein Powder Market reached USD 4.4 billion in 2024 and is projected to grow at a CAGR of 8.8% between 2025 and 2034. This robust growth is fueled by the increasing preference for plant-based protein alternatives, especially among athletes, health-conscious individuals, and those adhering to vegan or vegetarian diets. As consumers embrace more ethical and sustainable eating habits, the demand for non-animal-based protein sources has skyrocketed. Additionally, growing concerns about environmental sustainability and the adverse effects of traditional livestock farming have pushed consumers to explore alternative protein sources that align with their values. Companies in the vegan protein powder market are capitalizing on this trend by offering innovative products with enhanced amino acid profiles, improved digestibility, and additional health benefits, catering to a broader audience.

The rise of fitness culture and the growing awareness of the health advantages associated with plant-based proteins have further bolstered the market. Plant-based protein powders, often fortified with essential vitamins and minerals, appeal to consumers seeking healthier lifestyles. As the demand for functional foods grows, manufacturers are increasingly focusing on creating protein powders that not only meet nutritional requirements but also provide benefits such as muscle recovery, weight management, and enhanced immunity. This ongoing innovation continues to attract a diverse consumer base, ranging from fitness enthusiasts and professional athletes to individuals simply looking to improve their overall well-being.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.4 Billion |

| Forecast Value | $10.2 Billion |

| CAGR | 8.8% |

The market is categorized by the source of protein, including pea, soy, rice, hemp, and other varieties. Soy protein concentrate, which holds a substantial share of the market, is expected to grow at a CAGR of 9.7% by 2034. Its widespread popularity is due to its superior amino acid profile, excellent solubility, and affordability, making it an ideal choice for sports nutrition and functional foods. Additionally, soy protein concentrate's versatility and accessibility enhance its dominance, positioning it as a pivotal driver of growth in the vegan protein powder industry.

In terms of nature, the market is segmented into organic and conventional categories. The conventional segment generated USD 3.1 billion in 2024 and is projected to grow at a CAGR of 8.4% through 2034. Conventional vegan protein powders remain the preferred choice due to their affordability and widespread availability. Manufacturers favor conventional protein sources because of their lower production costs and high functional content. These products enjoy a strong presence in mainstream food and beverage applications, supported by robust retail networks that drive continued market expansion.

North America accounted for USD 1.6 billion of the vegan protein powder market in 2024 and is expected to grow at a CAGR of 3.6% by 2034. The region's strong demand for plant-based nutrition, coupled with a well-established health and wellness sector, has made it the largest market globally. Canada's growing preference for organic and clean-label products, along with government initiatives supporting plant-based industries, contributes significantly to the region's leadership in the market. The rise in veganism, fitness culture, and the demand for functional foods further strengthens North America's dominant position in the vegan protein powder market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rising demand for plant-based food & beverages due to growing vegan population is driving market growth

- 3.6.1.2 Increasing demand for functional food and healthy products with high protein content

- 3.6.1.3 Growing market for sports nutrition

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High production costs

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Size and Forecast, By Product, 2021 - 2034 (USD Billion, Kilo Tons)

- 5.1 Key trends

- 5.2 Hemp protein

- 5.3 Soy protein isolate

- 5.4 Soy protein concentrate

- 5.5 Rice protein isolate

- 5.6 Rice protein concentrate

- 5.7 Pea protein isolate

- 5.8 Pea protein concentrate

- 5.9 Spirulina protein

- 5.10 Quinoa protein

- 5.11 Protein blends

Chapter 6 Market Size and Forecast, By Nature, 2021 - 2034 (USD Billion, Kilo Tons)

- 6.1 Key trends

- 6.2 Organic

- 6.3 Conventional

Chapter 7 Market Size and Forecast, By Flavor, 2021 - 2034 (USD Billion, Kilo Tons)

- 7.1 Key trends

- 7.2 Unflavoured

- 7.3 Chocolate

- 7.4 Vanilla

- 7.5 Strawberry

- 7.6 Other

Chapter 8 Market Size and Forecast, By Application, 2021 - 2034 (USD Billion, Kilo Tons)

- 8.1 Key trends

- 8.2 Sports nutrition

- 8.3 Beverages

- 8.4 Functional food

- 8.5 Others

Chapter 9 Market Size and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion, Kilo Tons)

- 9.1 Key trends

- 9.2 Hypermarkets & supermarkets

- 9.3 Specialty stores

- 9.4 Online retail

- 9.5 Others

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Kilo Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Archer-Daniels-Midland Company

- 11.2 AMCO Proteins

- 11.3 Bunge Global SA

- 11.4 Cargill, Incorporated

- 11.5 Garden Of Life

- 11.6 Glanbia plc

- 11.7 Ingredion Incorporated

- 11.8 Now Foods

- 11.9 Orgain

- 11.10 PlantFusion

- 11.11 Vitaco Health Group

- 11.12 Wilmar International Limited