|

市場調查報告書

商品編碼

1716494

資料中心改造市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Data Center Renovation Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

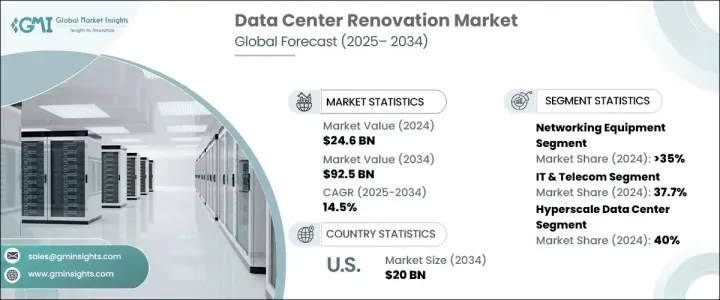

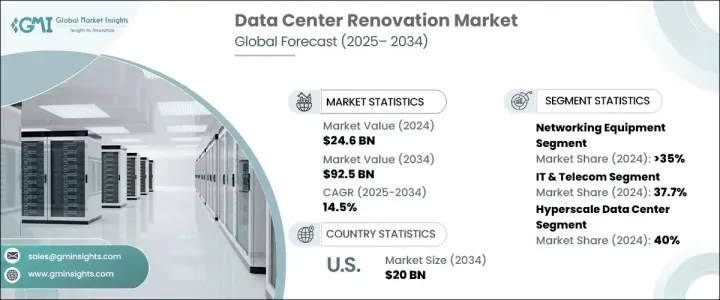

2024 年全球資料中心改造市場價值為 246 億美元,預計 2025 年至 2034 年期間的複合年成長率為 14.5%。雲端運算、串流媒體平台、社群媒體和電子商務的快速發展引發了全球資料流量的大幅成長,促使各組織對其資料中心進行現代化改造,以滿足日益成長的需求。隨著企業不斷採用遠距工作、線上協作和數位交易,對高效能、低延遲資料處理的需求變得至關重要。

人工智慧 (AI)、巨量資料分析和 5G 應用的日益普及進一步推動了基礎設施升級的需求,以確保無縫的資料流、增強的安全性和營運效率。資料中心營運商正在投資先進的解決方案來改善電源管理、冷卻效率和網路效能。此外,對環境永續性的日益重視正在推動再生能源、液體冷卻系統和人工智慧能源管理解決方案的採用,以最大限度地降低營運成本並減少碳足跡。隨著企業專注於擴展超大規模和邊緣資料中心以支援高速連接和低延遲通訊,升級基礎設施的需求持續激增。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 246億美元 |

| 預測值 | 925億美元 |

| 複合年成長率 | 14.5% |

市場根據產品細分為冷卻、電源、IT 機架和機櫃、網路設備、低壓/中壓配電和資料中心基礎設施管理 (DCIM)。受高速連接和無縫資料流需求的推動,到 2024 年,網路設備將佔據資料中心改造市場的 35% 佔有率。隨著各行各業數位轉型的加速,資料中心正在升級其路由器、交換器、光纖基礎設施和負載平衡器,以支援雲端運算、人工智慧和 5G 技術日益成長的工作負載。軟體定義網路 (SDN) 和網路功能虛擬化 (NFV) 的採用正在增強營運靈活性並減少延遲,使其成為市場的關鍵部分。

根據最終用途,市場分為 BFSI、醫療保健、IT 和電信、政府和其他。由於對先進數位基礎設施的需求不斷成長,以適應雲端服務、人工智慧應用和 5G 網路不斷擴大的覆蓋範圍,IT 和電信業在 2024 年將以 37.7% 的佔有率引領市場。隨著資料量的飆升,電信業者和雲端服務供應商正在投資超大規模和邊緣資料中心,以確保更快的資料處理、提高網路效率和減少延遲。這一趨勢極大地促進了全球對資料中心現代化和改造計劃的需求。

2024 年,北美資料中心改造市場將佔據 35% 的佔有率,其中美國佔據主導地位。雲端運算的快速成長、人工智慧的普及以及不斷變化的監管要求促使超大規模和企業資料中心大力投資現代化建設。這些投資主要集中在提高冷卻效率、最佳化電力使用和加強網路安全協議。永續發展計畫在製定這些革新策略中發揮關鍵作用,公司整合再生能源解決方案、液體冷卻技術和人工智慧驅動的能源管理系統,以提高效率並減少碳足跡。隨著美國資料中心營運商繼續優先考慮創新和合規性,市場將在未來幾年實現持續成長。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 製造商

- 系統整合商

- 安裝和維護提供者

- 最終用途

- 供應商格局

- 利潤率分析

- 技術與創新格局

- 專利分析

- 重要新聞和舉措

- 案例研究

- 監管格局

- 衝擊力

- 成長動力

- 全球範圍內在線服務的使用日益增多

- 資料中心現代化的需求不斷成長

- 政府採取措施降低資料中心的能源消耗

- 資訊科技和電信業的擴張

- 產業陷阱與挑戰

- 設施日常營運活動中斷

- 原料和熟練勞動成本上漲

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依產品,2021 年至 2034 年

- 主要趨勢

- 冷卻

- 力量

- IT 機架與機櫃

- 網路裝置

- LV/MV分佈

- 資料中心基礎設施管理

第6章:市場估計與預測:按資料中心,2021 年至 2034 年

- 主要趨勢

- 超大規模

- 主機託管

- 企業

- 邊緣

第7章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 金融服務業

- 政府

- 衛生保健

- IT與電信

- 其他

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第9章:公司簡介

- ABB

- Acer

- Ascenty

- Cisco

- Dell

- Equinix

- Fujitsu

- Gensler

- Hewlett Packard Enterprise (HPE)

- Hitachi

- HostDime

- Huawei

- IBM

- Inspur

- IPXON Networks

- KIO Networks

- Lenovo

- Oracle

- Schneider Electric

- Vertiv

The Global Data Center Renovation Market was valued at USD 24.6 billion in 2024 and is projected to register a CAGR of 14.5% between 2025 and 2034. The exponential rise of cloud computing, streaming platforms, social media, and e-commerce has triggered a massive increase in global data traffic, prompting organizations to modernize their data centers to meet growing demands. As businesses continue to embrace remote work, online collaboration, and digital transactions, the need for high-performance, low-latency data processing has become essential.

The increasing adoption of artificial intelligence (AI), big data analytics, and 5G-enabled applications is further fueling the need for infrastructure upgrades to ensure seamless data flow, enhanced security, and operational efficiency. Data center operators are investing in advanced solutions to improve power management, cooling efficiency, and network performance. Additionally, the growing emphasis on environmental sustainability is driving the adoption of renewable energy sources, liquid cooling systems, and AI-powered energy management solutions to minimize operational costs and reduce carbon footprints. As organizations focus on scaling hyperscale and edge data centers to support high-speed connectivity and low-latency communication, the demand for upgraded infrastructure continues to surge.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $24.6 Billion |

| Forecast Value | $92.5 Billion |

| CAGR | 14.5% |

The market is segmented based on product into cooling, power, IT racks and enclosures, networking equipment, LV/MV distribution, and data center infrastructure management (DCIM). Networking equipment dominated the data center renovation market with a 35% share in 2024, driven by the need for high-speed connectivity and seamless data flow. As digital transformation accelerates across industries, data centers are upgrading their routers, switches, fiber-optic infrastructure, and load balancers to support increasing workloads from cloud computing, AI, and 5G technologies. The adoption of software-defined networking (SDN) and network function virtualization (NFV) is enhancing operational flexibility and reducing latency, making it a critical segment of the market.

On the basis of end use, the market is divided into BFSI, healthcare, IT and telecom, government, and others. The IT and telecom sector led the market with a 37.7% share in 2024 due to the growing need for advanced digital infrastructure to accommodate the expanding footprint of cloud services, AI applications, and 5G networks. As data volumes soar, telecom operators and cloud service providers are investing in hyperscale and edge data centers to ensure faster data processing, improved network efficiency, and reduced latency. This trend has resulted in a significant boost to the demand for data center modernization and renovation initiatives globally.

North America data center renovation market accounted for a 35% share in 2024, with the United States dominating the region. The rapid growth of cloud computing, increased adoption of AI, and evolving regulatory requirements have prompted hyperscale and enterprise data centers to invest heavily in modernization efforts. These investments are focused on enhancing cooling efficiency, optimizing power usage, and strengthening cybersecurity protocols. Sustainability initiatives play a critical role in shaping these renovation strategies, with companies integrating renewable energy solutions, liquid cooling technologies, and AI-driven energy management systems to improve efficiency and reduce their carbon footprints. As data center operators in the U.S. continue to prioritize innovation and compliance, the market is poised for sustained growth over the coming years.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Manufacturers

- 3.1.2 System integrators

- 3.1.3 Installation and maintenance providers

- 3.1.4 End Use

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Case studies

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Increasing use of online services across the globe

- 3.9.1.2 Growing demand for data center modernization

- 3.9.1.3 Government initiatives to reduce the energy consumption of data centers

- 3.9.1.4 Expansion of the IT & telecom sector

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Disruptions in the daily operational activities of facilities

- 3.9.2.2 Rising cost of raw materials and skilled labor

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product, 2021 – 2034 (USD Million)

- 5.1 Key trends

- 5.2 Cooling

- 5.3 Power

- 5.4 IT Racks & enclosures

- 5.5 Networking equipment

- 5.6 LV/MV distribution

- 5.7 DCIM

Chapter 6 Market Estimates & Forecast, By Data Center, 2021 – 2034 (USD Million)

- 6.1 Key trends

- 6.2 Hyperscale

- 6.3 Colocation

- 6.4 Enterprise

- 6.5 Edge

Chapter 7 Market Estimates & Forecast, By Application, 2021 – 2034 (USD Million)

- 7.1 Key trends

- 7.2 BFSI

- 7.3 Government

- 7.4 Healthcare

- 7.5 IT & telecom

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.3.7 Nordics

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Southeast Asia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 UAE

- 8.6.2 South Africa

- 8.6.3 Saudi Arabia

Chapter 9 Company Profiles

- 9.1 ABB

- 9.2 Acer

- 9.3 Ascenty

- 9.4 Cisco

- 9.5 Dell

- 9.6 Equinix

- 9.7 Fujitsu

- 9.8 Gensler

- 9.9 Hewlett Packard Enterprise (HPE)

- 9.10 Hitachi

- 9.11 HostDime

- 9.12 Huawei

- 9.13 IBM

- 9.14 Inspur

- 9.15 IPXON Networks

- 9.16 KIO Networks

- 9.17 Lenovo

- 9.18 Oracle

- 9.19 Schneider Electric

- 9.20 Vertiv