|

市場調查報告書

商品編碼

1716480

工業機器人市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Industrial Robotics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

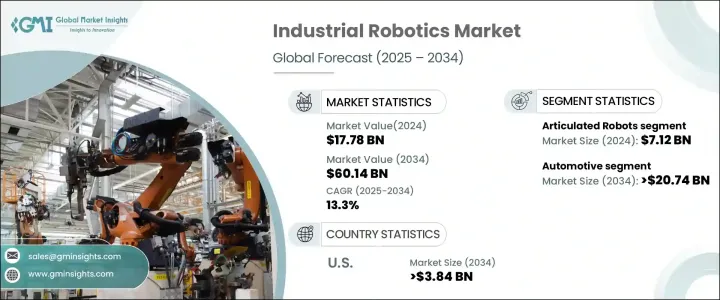

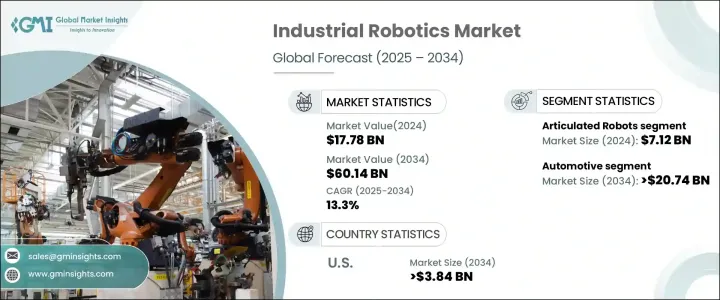

2024 年全球工業機器人市場規模達 177.8 億美元,預計 2025 年至 2034 年的複合年成長率為 13.3%。隨著企業尋求提高生產力並應對勞動力短缺和勞動力成本上升等挑戰,各行業對自動化的需求不斷成長,推動了這項快速擴張。自動化在製造業等行業尤其受到關注,這些行業使用機器人系統來簡化操作、降低成本並提高產品品質。物流中自動化應用的增加,尤其是電子商務的興起,也導致了機器人需求的激增。公司現在更加依賴自動化系統來分類和管理倉庫庫存,以提高效率。隨著企業專注於提高營運效率,機器人技術的採用將比以往更快成長。

影響向機器人自動化轉變的主要因素之一是缺乏可用的熟練勞動力,加上營運費用不斷上升。美國、日本、德國等人口老化的已開發國家尤其面臨這項挑戰。此外,中國和印度等發展中國家的工資成長速度更快,這使得企業有必要尋求機器人等具有成本效益的替代方案。這些因素迫使各行各業以更快的速度採用機器人解決方案,以保持競爭力和獲利能力。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 177.8億美元 |

| 預測值 | 601.4億美元 |

| 複合年成長率 | 13.3% |

市場根據機器人類型進行細分,包括關節機器人、笛卡爾機器人、SCARA 機器人、圓柱形機器人、協作機器人 (cobots)、並聯機器人和極地機器人。關節機器人佔據最大的市場佔有率,到 2024 年價值將達到 71.2 億美元,這得益於其出色的靈活性和執行焊接和材料處理等複雜任務的能力。這些機器人因其降低成本和提高效率的能力而受到汽車、金屬加工和重工業等行業的青睞。

從應用方面來看,工業機器人市場分為汽車、電子、食品飲料、製藥和其他產業。尤其是汽車產業,預計到 2034 年其規模將達到 207.4 億美元,因為機器人技術廣泛應用於焊接、噴漆和組裝等製造過程。機器人技術在電動車生產中也發揮著重要作用,因為精度和效率至關重要。

美國工業機器人市場預計將大幅成長,預計到 2034 年將超過 38.4 億美元。預計機器人技術的應用將繼續在汽車、電子和物流等領域擴大。此外,人工智慧和機器人軟體的整合正在獲得發展動力,小型企業對協作機器人和自主系統的興趣日益濃厚。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 自動化需求不斷成長

- 人工智慧和機器學習的進步

- 勞動短缺和成本上升

- 智慧工廠和工業4.0的成長

- 機器人技術在新興產業的擴展

- 產業陷阱與挑戰

- 初始投資和維護成本高

- 勞動流失和技能差距

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按類型,2021 年至 2034 年

- 關節型機器人

- 笛卡兒機器人/龍門機器人

- SCARA機器人

- 圓柱形機器人

- 協作機器人/ COBOTS

- 並聯機器人/Delta機器人

- 極地機器人/球形機器人

第6章:市場估計與預測:依最終用途,2021 年至 2034 年

- 汽車

- 金屬和機械

- 橡膠和塑膠

- 食品和飲料

- 電氣和電子產品

- 消費品

- 衛生保健

- 其他

第7章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第8章:公司簡介

- ABB Group

- Comau SpA

- Denso Corporation

- Epson America, Inc.

- Fanuc Corporation

- HD HYUNDAI ROBOTICS

- Kawasaki Heavy Industries, Ltd.

- KUKA AG

- Mitsubishi Electric Corporation

- Nachi Fujikoshi Corp

- Daihen, Inc.

- Omron Corporation

- Panasonic Corporation

- Rethink Robotics Inc.

- Staubli Group

- Universal Robots A/S

- Yamaha Motor Co., Ltd.

The Global Industrial Robotics Market reached USD 17.78 billion in 2024 and is expected to grow at a CAGR of 13.3% from 2025 to 2034. This rapid expansion is being driven by the growing demand for automation across various sectors as businesses seek to improve productivity and address challenges such as labor shortages and rising labor costs. Automation is particularly gaining traction in industries like manufacturing, where robotic systems are used to streamline operations, reduce expenses, and enhance product quality. The increased use of automation in logistics, especially with the rise of e-commerce, has also contributed to the surge in demand for robotics. Companies are now relying more on automated systems for sorting and managing inventory in warehouses, enhancing efficiency. With businesses focusing on boosting their operations, the adoption of robotic technologies is set to increase faster than ever.

One of the main factors influencing the shift toward robotic automation is the lack of available skilled labor, coupled with rising operational expenses. Developed countries with aging populations, such as the U.S., Japan, and Germany, are particularly facing this challenge. In addition, developing nations like China and India are experiencing higher wage growth, making it necessary for businesses to seek cost-effective alternatives such as robotics. These factors are compelling industries to adopt robotic solutions at a much faster rate to remain competitive and maintain profitability.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $17.78 Billion |

| Forecast Value | $60.14 Billion |

| CAGR | 13.3% |

The market is segmented based on the types of robots, which include articulated robots, cartesian robots, SCARA robots, cylindrical robots, collaborative robots (cobots), parallel robots, and polar robots. Articulated robots hold the largest market share, valued at USD 7.12 billion in 2024, due to their exceptional agility and ability to perform complex tasks like welding and material handling. These robots are highly favored in industries such as automotive, metalworking, and heavy industries due to their ability to reduce costs and improve efficiency.

In terms of application, the industrial robotics market is categorized into automotive, electronics, food and beverage, pharmaceuticals, and other industries. The automotive industry, in particular, is expected to reach USD 20.74 billion by 2034, as robotics are widely used in manufacturing processes like welding, painting, and assembly. Robotics also play a significant role in electric vehicle production, where precision and efficiency are crucial.

The U.S. industrial robotics market is set to grow substantially, with projections indicating it will surpass USD 3.84 billion by 2034. Adoption of robotics is expected to continue expanding across sectors such as automotive, electronics, and logistics. Additionally, the integration of AI and robotics software is gaining momentum, with smaller businesses showing increasing interest in cobots and autonomous systems.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing Demand for Automation

- 3.2.1.2 Advancements in AI and Machine Learning

- 3.2.1.3 Rising Labor Shortages and Costs

- 3.2.1.4 Growth of Smart Factories & Industry 4.0

- 3.2.1.5 Expansion of Robotics in New Industries

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High Initial Investment & Maintenance Costs

- 3.2.2.2 Workforce Displacement & Skill Gaps

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates & Forecast, By Type, 2021 – 2034 (USD Million and Units)

- 5.1 Articulated robots

- 5.2 Cartesian robots/ Gantry robots

- 5.3 SCARA robots

- 5.4 Cylindrical robots

- 5.5 Collaborative robots/ COBOTS

- 5.6 Parallel robots/ Delta robots

- 5.7 Polar robots/ spherical robots

Chapter 6 Market estimates & forecast, By End Use, 2021 – 2034 (USD Million and Units)

- 6.1 Automotive

- 6.2 Metal & Machinery

- 6.3 Rubber & Plastic

- 6.4 Food & beverage

- 6.5 Electrical & electronics

- 6.6 Consumer goods

- 6.7 Healthcare

- 6.8 Others

Chapter 7 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Million and Units)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 Saudi Arabia

- 7.6.2 South Africa

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 ABB Group

- 8.2 Comau SpA

- 8.3 Denso Corporation

- 8.4 Epson America, Inc.

- 8.5 Fanuc Corporation

- 8.6 HD HYUNDAI ROBOTICS

- 8.7 Kawasaki Heavy Industries, Ltd.

- 8.8 KUKA AG

- 8.9 Mitsubishi Electric Corporation

- 8.10 Nachi Fujikoshi Corp

- 8.11 Daihen, Inc.

- 8.12 Omron Corporation

- 8.13 Panasonic Corporation

- 8.14 Rethink Robotics Inc.

- 8.15 Staubli Group

- 8.16 Universal Robots A/S

- 8.17 Yamaha Motor Co., Ltd.