|

市場調查報告書

商品編碼

1716475

高爾夫推桿市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Golf Putter Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

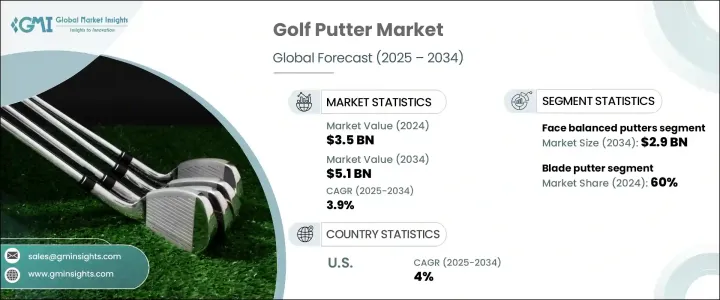

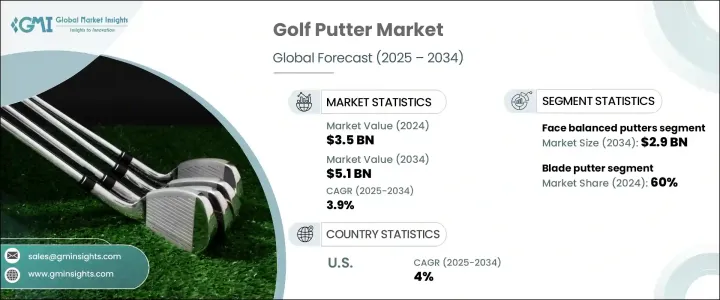

2024 年全球高爾夫推桿市場價值為 35 億美元,預計 2025 年至 2034 年期間的複合年成長率為 3.9%。全球高爾夫球手數量的增加以及高爾夫相關體育活動的日益普及正在推動對高爾夫推桿的需求。隨著越來越多的人出於休閒、健身或職業願望而從事這項運動,對高品質和提高性能的設備的需求也不斷成長。高爾夫設備製造商正在透過引入創新設計、先進材料和增強客製化選項來滿足業餘和職業高爾夫球手的喜好,以滿足這一需求。

高爾夫旅遊業的興起、國際錦標賽參與度的提高以及高爾夫運動被納入全球體育賽事,進一步推動了市場的成長。電子商務平台在讓更多人能夠買到高品質推桿方面發揮了重要作用,促進了市場的擴張。此外,精密銑削、增強的桿面設計和改進的重量分佈等技術進步使得推桿對於追求準確性和一致性的高爾夫球手更具吸引力。客製化功能允許高爾夫球手根據擊球機制、握桿偏好和對準技術來個性化他們的推桿,這也刺激了需求,確保製造商在這個競爭激烈的市場中保持領先地位。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 35億美元 |

| 預測值 | 51億美元 |

| 複合年成長率 | 3.9% |

高爾夫推桿市場按產品類型細分,其中面平衡推桿和趾部平衡推桿佔據主導地位。 2024 年,臉部平衡推桿市場創造了 20 億美元的市場規模,這得益於喜歡穩定、直線推桿和直線推桿的高爾夫球手的需求不斷成長。臉部平衡推桿提供了增強的穩定性和更高的準確性,使其成為擊球弧度較低的球員的熱門選擇。隨著高爾夫球手繼續優先考慮能夠增強推桿體驗並最大程度減少不一致的工具,臉部平衡部分有望在整個預測期內保持穩定成長。

刀刃推桿市場在 2024 年佔據了 60% 的市場佔有率,預計其成長將持續到 2034 年。刀刃推桿以其輕巧的設計和卓越的反饋而聞名,為高爾夫球手提供簡約的感覺並增強對距離和衝擊力的控制。許多高爾夫球手欣賞刀刃推桿的精準度,使其成為重視性能和一致性的球員的首選。他們能夠輕鬆地與目標保持一致,從而增強用戶體驗,進一步促進該領域的成長。

受美國消費者強勁需求的推動,美國高爾夫推桿市場每年以 4% 的速度成長。美國製造商繼續引領全球市場,專注於創新、精密銑削和使用先進材料來滿足高爾夫球手不斷變化的需求。這些公司強調可自訂的功能,以滿足不同的打球風格,確保業餘和職業高爾夫球手都能使用高品質、提高性能的裝備。對品質和創新的承諾鞏固了美國市場的地位,並促進了全球高爾夫推桿行業的整體成長。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 零售商

- 衝擊力

- 成長動力

- 熱門品牌

- 技術和設計創新

- 客製化和個人化

- 產業陷阱與挑戰

- 經濟因素

- 競爭格局

- 成長動力

- 消費者購買行為分析

- 人口趨勢

- 影響購買決策的因素

- 消費者產品採用

- 首選配銷通路

- 首選價格範圍

- 成長潛力分析

- 監管格局

- 定價分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依產品類型,2021 年至 2034 年

- 主要趨勢

- 麵平衡推桿

- 趾部平衡推桿

第6章:市場估計與預測:2021 年至 2034 年設計

- 主要趨勢

- 刀片推桿

- 槌頭推桿

第7章:市場估計與預測:依長度 2021 – 2034

- 主要趨勢

- 傳統長度(32-36吋)

- 腹式推桿(41-46吋)

- 長推桿(48-52吋)

第8章:市場估計與預測:依價格區間 2021 年至 2034 年

- 主要趨勢

- 高級或高

- 經濟型或中檔型

第9章:市場估計與預測:依最終用途 2021 – 2034

- 主要趨勢

- 專業人士

- 業餘

第 10 章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 直銷

- 間接銷售

第 11 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第12章:公司簡介

- Adams Golf Inc.

- Bettinardi Golf

- Bobby Grace Putters

- Bridgestone Sports Ltd

- Callaway Golf Company

- Cleveland Golf Company, Inc.

- Cobra Golf

- Fourteen Golf

- Henry Griffitts

- Honma Golf Ltd.

- Mizuno USA, Inc

- Rock Bottom Golf

- TaylorMade Golf Company, Inc.

- The Acushnet Holdings Company

- Vega Golf

The Global Golf Putter Market was valued at USD 3.5 billion in 2024 and is expected to grow at a CAGR of 3.9% between 2025 and 2034. The rising number of golfers worldwide and the growing popularity of golf-related sports activities are driving the demand for golf putters. As more individuals take up the sport for leisure, fitness, or professional aspirations, the need for high-quality and performance-enhancing equipment continues to grow. Golf equipment manufacturers are responding to this demand by introducing innovative designs, advanced materials, and enhanced customization options to cater to the preferences of both amateur and professional golfers.

The rise of golf tourism, increased participation in international tournaments, and the inclusion of golf in global sporting events have further fueled market growth. E-commerce platforms have played a significant role in making high-quality putters more accessible to a wider audience, contributing to the expansion of the market. Moreover, technological advancements, such as precision milling, enhanced clubface designs, and improved weight distribution, are making putters more appealing to golfers seeking accuracy and consistency in their performance. Customization features that allow golfers to personalize their putters based on stroke mechanics, grip preferences, and alignment techniques are also boosting demand, ensuring that manufacturers stay ahead in this competitive market.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.5 Billion |

| Forecast Value | $5.1 Billion |

| CAGR | 3.9% |

The golf putter market is segmented by product type, with face-balanced and toe-balanced putters dominating the landscape. In 2024, the face-balanced putter segment generated USD 2 billion, driven by increasing demand from golfers who prefer a stable and straight-back, straight-through putting stroke. Face-balanced putters offer enhanced stability and improved accuracy, making them a popular choice among players with a low arc in their strokes. As golfers continue to prioritize tools that enhance their putting experience and minimize inconsistencies, the face-balanced segment is poised to maintain steady growth throughout the forecast period.

The blade putter segment accounted for 60% of the market share in 2024, with its growth expected to persist through 2034. Blade putters, known for their lightweight design and superior feedback, provide golfers with a minimalist feel and enhanced control over distance and impact. Many golfers appreciate the precision offered by blade putters, making them a preferred option for players who value performance and consistency. Their ability to align easily with the target enhances user experience, further contributing to the segment's growth.

The U.S. golf putter market is growing at a rate of 4% annually, driven by strong demand from American consumers. U.S.-based manufacturers continue to lead the global market by focusing on innovation, precision milling, and the use of advanced materials to meet the evolving needs of golfers. These companies emphasize customizable features that cater to different playing styles, ensuring that both amateur and professional golfers have access to high-quality, performance-enhancing equipment. This commitment to quality and innovation strengthens the U.S. market's position and contributes to the overall growth of the global golf putter industry.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast parameters

- 1.4 Data sources

- 1.4.1 Primary

- 1.5 Secondary

- 1.5.1.1 Paid sources

- 1.5.1.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.1.7 Retailers

- 3.2 Impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Popular brands

- 3.2.1.2 Technology and design innovations

- 3.2.1.3 Customization and personalization

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Economic factors

- 3.2.2.2 Competitive landscape

- 3.2.1 Growth drivers

- 3.3 Consumer buying behavior analysis

- 3.3.1 Demographic trends

- 3.3.2 Factors affecting buying decision

- 3.3.3 Consumer product adoption

- 3.3.4 Preferred distribution channel

- 3.3.5 Preferred price range

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Pricing analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 – 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Face balanced putters

- 5.3 Toe balanced putters

Chapter 6 Market Estimates & Forecast, By Design 2021 – 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Blade putter

- 6.3 Mallet putter

Chapter 7 Market Estimates & Forecast, By Length 2021 – 2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Traditional length (32-36 inches)

- 7.3 Belly putter (41-46 inches)

- 7.4 Long putter (48-52 inches)

Chapter 8 Market Estimates & Forecast, By Price Range 2021 – 2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Premium or high

- 8.3 Economy or Mid-Range

Chapter 9 Market Estimates & Forecast, By End Use 2021 – 2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Professionals

- 9.3 Amateur

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021 – 2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Direct sales

- 10.3 Indirect sales

Chapter 11 Market Estimates & Forecast, By Region, 2021 – 2034 (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Japan

- 11.4.3 India

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 12.1 Adams Golf Inc.

- 12.2 Bettinardi Golf

- 12.3 Bobby Grace Putters

- 12.4 Bridgestone Sports Ltd

- 12.5 Callaway Golf Company

- 12.6 Cleveland Golf Company, Inc.

- 12.7 Cobra Golf

- 12.8 Fourteen Golf

- 12.9 Henry Griffitts

- 12.10 Honma Golf Ltd.

- 12.11 Mizuno USA, Inc

- 12.12 Rock Bottom Golf

- 12.13 TaylorMade Golf Company, Inc.

- 12.14 The Acushnet Holdings Company

- 12.15 Vega Golf