|

市場調查報告書

商品編碼

1716472

工業電壓感測器市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Industrial Voltage Transducer Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

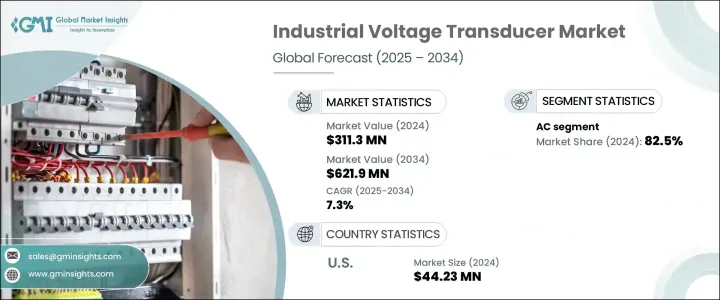

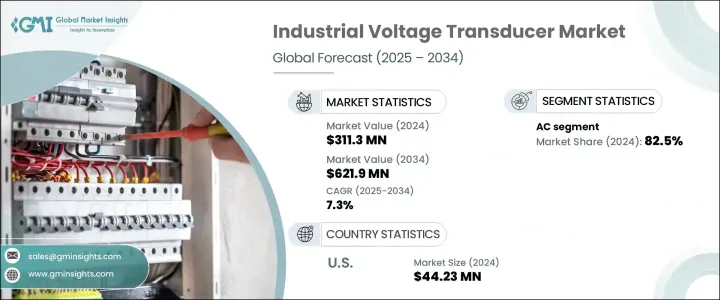

2024 年全球工業電壓感測器市場價值為 3.113 億美元,預計 2025 年至 2034 年期間的複合年成長率為 7.3%。工業流程向自動化的轉變日益成為該市場擴張的主要驅動力。隨著全球各行各業都致力於提高生產力和降低營運成本,電壓感測器在最佳化能源管理和確保系統穩定性方面的作用變得比以往任何時候都更加重要。這些設備對於監控和控制電壓水平至關重要,有助於維持無縫的工業運作並防止設備故障。

工業 4.0、智慧製造和預測性維護解決方案的日益普及進一步推動了對電壓感測器的需求。隨著公司越來越依賴即時資料分析來提高決策能力和效率,電壓感測器為能源消耗模式、電能品質和系統性能提供了關鍵見解。此外,隨著工業部門優先考慮永續能源解決方案,向智慧電網和再生能源的持續轉變正在擴大市場成長。世界各國政府正在實施支持能源效率措施的政策,加強了工業應用中對電壓感測器的需求。物聯網電力監控系統的進步以及人工智慧在能源管理解決方案中的整合也促進了該市場的擴張。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 3.113億美元 |

| 預測值 | 6.219億美元 |

| 複合年成長率 | 7.3% |

工業電壓感測器市場分為兩大主要產品類別:交流電壓感測器和直流電壓感測器。 2024 年,交流電壓感測器佔據市場主導地位,佔有 82.5% 的佔有率。電網的日益現代化和公用事業規模應用中能源流的廣泛自動化是該領域的主要成長動力。這些感測器對於穩定電壓波動和最佳化大規模電網應用至關重要。隨著電力基礎設施的不斷發展,對交流電壓感測器的需求仍然強勁,尤其是在再生能源領域。這些設備在確保風能和太陽能無縫連接電網、提高能源效率和永續性方面發揮關鍵作用。

隨著企業尋求經濟高效的解決方案來監控和調節能源消耗,電力成本上升是推動工業電壓感測器需求的另一個因素。這些感測器提供即時電壓監控,幫助公司在保持能源效率的同時降低高峰時段的電力費用。電動車 (EV) 的普及和對清潔能源運輸的日益重視也導致了對直流電壓感測器的需求增加。這些設備對於電池監控尤其重要,可確保電動車和再生能源應用中的最佳能量儲存和分配。

在政府提高能源效率和投資智慧電網技術的推動下,美國工業電壓感測器市場規模到 2024 年將達到 4,423 萬美元。北美再生能源和電動車基礎設施的日益普及,繼續增強了公用事業環境中對這些感測器的需求。同時,隨著亞太經濟體採用清潔能源技術並加強其工業自動化框架,電壓感測器的需求預計將激增,特別是在公用事業和製造業。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 戰略儀表板

- 創新與永續發展格局

第5章:市場規模及預測:依產品,2021 年至 2034 年

- 主要趨勢

- 交流電

- 直流

第6章:市場規模及預測:依地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 英國

- 法國

- 德國

- 義大利

- 俄羅斯

- 西班牙

- 亞太地區

- 中國

- 澳洲

- 印度

- 日本

- 韓國

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第7章:公司簡介

- ABB

- Analog Devices

- Carlo Gavazzi

- CR Magnetics

- LEM International

- NK Technologies

- Phoenix Contact

- Schneider Electric

- Siemens

- Socomec

The Global Industrial Voltage Transducer Market was valued at USD 311.3 million in 2024 and is projected to grow at a CAGR of 7.3% between 2025 and 2034. The increasing shift toward automation in industrial processes continues to be a key driver behind this market's expansion. As industries worldwide focus on enhancing productivity and minimizing operational costs, the role of voltage transducers in optimizing energy management and ensuring system stability has become more crucial than ever. These devices are integral to monitoring and controlling voltage levels, helping to maintain seamless industrial operations and prevent equipment failures.

The rising adoption of Industry 4.0, smart manufacturing, and predictive maintenance solutions is further fueling the demand for voltage transducers. With companies increasingly relying on real-time data analytics to enhance decision-making and efficiency, voltage transducers provide critical insights into energy consumption patterns, power quality, and system performance. Moreover, the ongoing transition to smart grids and renewable energy sources is amplifying market growth as industrial sectors prioritize sustainable energy solutions. Governments worldwide are implementing policies that support energy efficiency initiatives, reinforcing the demand for voltage transducers in industrial applications. Advancements in IoT-enabled power monitoring systems and the integration of AI in energy management solutions are also contributing to the expansion of this market.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $311.3 Million |

| Forecast Value | $621.9 Million |

| CAGR | 7.3% |

The industrial voltage transducer market is segmented into two primary product categories: AC and DC voltage transducers. In 2024, AC voltage transducers dominated the market with an 82.5% share. The increased modernization of power grids and the widespread automation of energy flow in utility-scale applications are key growth drivers for this segment. These transducers are essential for stabilizing voltage fluctuations and optimizing large-scale grid applications. As power infrastructures continue to evolve, the demand for AC voltage transducers remains strong, particularly in the renewable energy sector. These devices play a pivotal role in ensuring seamless integration of wind and solar power into the grid, enhancing energy efficiency and sustainability.

Rising electricity costs are another factor driving demand for industrial voltage transducers as businesses seek cost-effective solutions to monitor and regulate energy consumption. These transducers provide real-time voltage monitoring, helping companies reduce peak-hour electricity expenses while maintaining energy efficiency. The expanding adoption of electric vehicles (EVs) and the growing emphasis on clean energy transportation have also contributed to the increasing demand for DC voltage transducers. These devices are particularly critical for battery monitoring, ensuring optimal energy storage and distribution in EVs and renewable energy applications.

The U.S. Industrial Voltage Transducer Market reached USD 44.23 million in 2024, driven by government initiatives promoting energy efficiency and investments in smart grid technologies. The growing penetration of renewable energy sources and EV infrastructure across North America continues to bolster demand for these transducers in utility settings. Meanwhile, as Asia-Pacific economies embrace cleaner energy technologies and strengthen their industrial automation frameworks, the demand for voltage transducers is expected to surge, particularly in the utility and manufacturing sectors.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Product, 2021 – 2034 (USD Million)

- 5.1 Key trends

- 5.2 AC

- 5.3 DC

Chapter 6 Market Size and Forecast, By Region, 2021 – 2034 (USD Million)

- 6.1 Key trends

- 6.2 North America

- 6.2.1 U.S.

- 6.2.2 Canada

- 6.2.3 Mexico

- 6.3 Europe

- 6.3.1 UK

- 6.3.2 France

- 6.3.3 Germany

- 6.3.4 Italy

- 6.3.5 Russia

- 6.3.6 Spain

- 6.4 Asia Pacific

- 6.4.1 China

- 6.4.2 Australia

- 6.4.3 India

- 6.4.4 Japan

- 6.4.5 South Korea

- 6.5 Middle East & Africa

- 6.5.1 Saudi Arabia

- 6.5.2 UAE

- 6.5.3 South Africa

- 6.6 Latin America

- 6.6.1 Brazil

- 6.6.2 Argentina

Chapter 7 Company Profiles

- 7.1 ABB

- 7.2 Analog Devices

- 7.3 Carlo Gavazzi

- 7.4 CR Magnetics

- 7.5 LEM International

- 7.6 NK Technologies

- 7.7 Phoenix Contact

- 7.8 Schneider Electric

- 7.9 Siemens

- 7.10 Socomec