|

市場調查報告書

商品編碼

1716462

基於交通運輸的氫能儲存市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Transportation Based Hydrogen Energy Storage Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

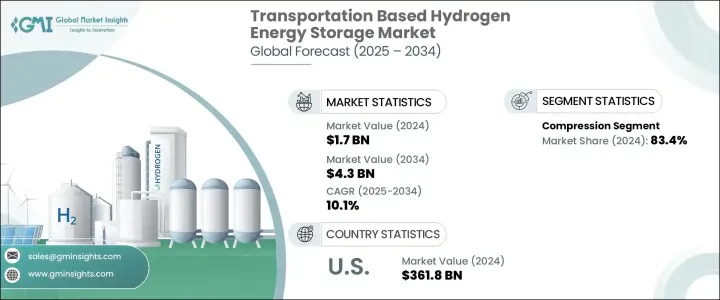

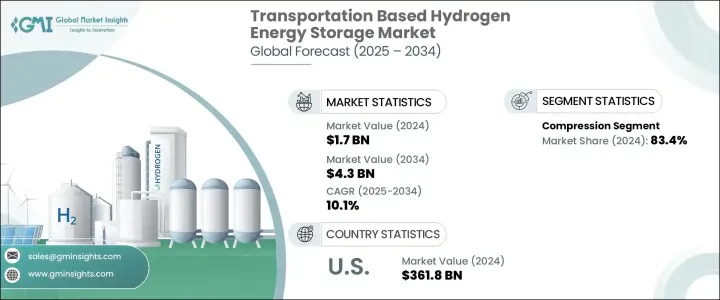

2024 年全球交通運輸氫能儲存市場規模估計為 17 億美元,預計在氫儲存技術進步的推動下,2025 年至 2034 年期間的複合年成長率將達到 10.1%。金屬氫化物、高壓罐和液態氫儲存解決方案的日益普及提高了系統的效率、安全性和性能。氫基能源儲存作為卡車、火車和飛機等長距離電動車的永續替代方案,正日益受到關注。電動車銷售的成長,尤其是在新興經濟體,促進了對氫儲存解決方案的需求不斷成長,而政府的激勵措施和支持綠色能源採用的政策也進一步支持了這一需求。

氫燃料電池因其高能量密度、輕重量和長使用壽命而成為電動車的首選。燃料電池技術的不斷創新正在突破能源效率的界限,使儲氫成為未來永續交通的關鍵組成部分。世界各國政府都在積極推動氫能儲存,特別是在交通運輸領域,以減少碳排放。旅遊業的成長和出行頻率的上升也推動了對飛機和重型卡車等長途車輛高效儲能解決方案的需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 17億美元 |

| 預測值 | 43億美元 |

| 複合年成長率 | 10.1% |

基於交通運輸的氫能儲存市場依方法分為壓縮、液化和基於材料的儲存。 2024 年,壓縮領域佔據主導地位,佔總市佔率的 83.4%。由於氫能能夠長時間儲存能量,人們也在探索將其與再生能源和電網儲能結合。世界各國都在實施優惠政策和大型能源計畫來支持這些措施。抽水蓄能廣泛應用於再生能源整合,在擴大氫能儲存應用方面發揮關鍵作用。

全球電動車銷量的成長正在加速對氫燃料電池的需求,清潔能源汽車的採用率也穩定成長。隨著各國優先考慮脫碳工作,歐洲、北美和亞太地區的市場正在強勁擴張。太陽能產業也正在經歷顯著成長,預計到 2025 年底裝置容量將超過 2 TW。預計向太陽能的轉變將為交通運輸領域帶來對氫燃料電池的強勁需求。

城市化、工業擴張和老化電網的現代化進一步推動了交通運輸對氫能儲存的需求。各國政府正在投資氫能中心、再生能源儲存項目和大規模基礎設施改進,以促進永續能源解決方案。

在美國,交通運輸類氫能儲存市場規模在2022年達到3.051億美元,2023年達到3.319億美元,2024年達到3.618億美元。對儲能技術的策略性投資預計將推動未來的市場成長。中國和印度等新興經濟體也正在加速採用具成本效益的能源儲存系統,從而推動整個亞太地區的需求。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 戰略儀表板

- 創新與永續發展格局

第5章:市場規模及預測:依產品,2021 年至 2034 年

- 主要趨勢

- 壓縮

- 液化

- 基於材料

第6章:市場規模及預測:依地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 荷蘭

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 世界其他地區

第7章:公司簡介

- Air Liquide

- Air Products and Chemicals

- Cockerill Jingli Compressed hydrogen

- ENGIE

- FuelCell Energy

- GKN Compressed Hydrogen

- Gravitricity

- ITM Power

- Linde plc

- McPhy Energy

- Nel

- SSE

The Global Transportation Based Hydrogen Energy Storage Market was estimated at USD 1.7 billion in 2024 and is projected to grow at a CAGR of 10.1% from 2025 to 2034, driven by advancements in hydrogen storage technology. The increasing adoption of metal hydrides, high-pressure tanks, and liquid hydrogen storage solutions enhances system efficiency, safety, and performance. Hydrogen-based energy storage is gaining traction as a sustainable alternative for long-range electric vehicles, including trucks, trains, and airplanes. The rise in electric vehicle sales, particularly in emerging economies, contributes to the growing demand for hydrogen storage solutions, further supported by government incentives and policies favoring green energy adoption.

Hydrogen fuel cells are becoming a preferred choice in battery electric vehicles due to their high energy density, lightweight properties, and extended lifespan. Continuous innovations in fuel cell technology are pushing the boundaries of energy efficiency, positioning hydrogen storage as a key component in the future of sustainable transportation. Governments worldwide are actively promoting hydrogen energy storage, particularly in the transportation sector, to reduce carbon emissions. Increasing tourism and rising travel frequency are also fueling the demand for efficient energy storage solutions for long-haul vehicles, including planes and heavy-duty trucks.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.7 Billion |

| Forecast Value | $4.3 Billion |

| CAGR | 10.1% |

The transportation-based hydrogen energy storage market is segmented by method into compression, liquefaction, and material-based storage. The compression segment dominated in 2024, accounting for 83.4% of the total market share. Due to its ability to store energy for extended periods, hydrogen storage is also being explored for integration with renewable energy sources and grid energy storage. Countries worldwide are implementing favorable policies and large-scale energy projects to support these initiatives. Pumped hydro, widely used in renewable energy integration, is playing a critical role in expanding hydrogen-based energy storage applications.

Rising global electric vehicle sales are accelerating demand for hydrogen fuel cells, with a steady increase in the adoption of clean energy vehicles. The market is witnessing robust expansion in Europe, North America, and Asia-Pacific as nations prioritize decarbonization efforts. The solar energy sector is also experiencing significant growth, with installed capacity expected to surpass 2 TW by the end of 2025. This transition toward solar power is projected to create a strong demand for hydrogen fuel cells in the transportation sector.

Urbanization, industrial expansion, and the modernization of aging power grids are further fueling the demand for transportation-based hydrogen energy storage. Governments are investing in hydrogen hubs, renewable energy storage projects, and large-scale infrastructure improvements to promote sustainable energy solutions.

In the United States, the transportation-based hydrogen energy storage market reached USD 305.1 million in 2022, USD 331.9 million in 2023, and USD 361.8 million in 2024. Strategic investments in energy storage technologies are expected to drive future market growth. Emerging economies such as China and India are also accelerating the adoption of cost-effective energy storage systems, boosting demand across the Asia-Pacific region.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market Definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Product, 2021 – 2034 (USD Million)

- 5.1 Key trends

- 5.2 Compression

- 5.3 Liquefaction

- 5.4 Material-based

Chapter 6 Market Size and Forecast, By Region, 2021 – 2034 (USD Million)

- 6.1 Key trends

- 6.2 North America

- 6.2.1 U.S.

- 6.2.2 Canada

- 6.2.3 Mexico

- 6.3 Europe

- 6.3.1 Germany

- 6.3.2 UK

- 6.3.3 France

- 6.3.4 Italy

- 6.3.5 Netherlands

- 6.3.6 Russia

- 6.4 Asia Pacific

- 6.4.1 China

- 6.4.2 India

- 6.4.3 Japan

- 6.5 Rest of World

Chapter 7 Company Profiles

- 7.1 Air Liquide

- 7.2 Air Products and Chemicals

- 7.3 Cockerill Jingli Compressed hydrogen

- 7.4 ENGIE

- 7.5 FuelCell Energy

- 7.6 GKN Compressed Hydrogen

- 7.7 Gravitricity

- 7.8 ITM Power

- 7.9 Linde plc

- 7.10 McPhy Energy

- 7.11 Nel

- 7.12 SSE