|

市場調查報告書

商品編碼

1716452

折彎機市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Bending Machine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

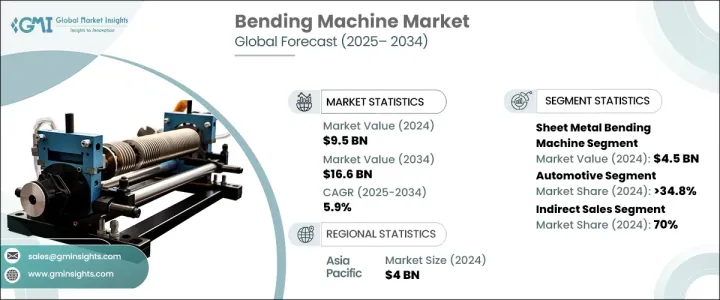

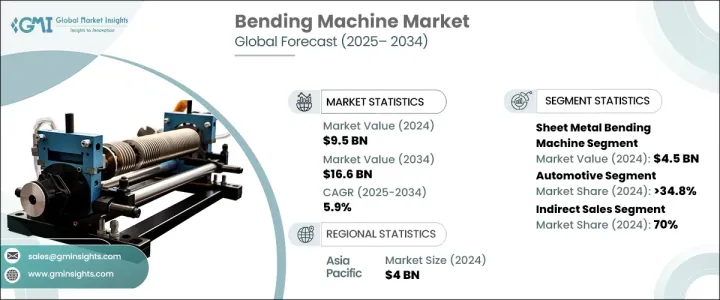

2024 年全球折彎機市場價值為 95 億美元,預計 2025 年至 2034 年的複合年成長率為 5.9%。折彎機在製造業、建築業、汽車業和航太等多個行業中發揮著不可或缺的作用。這些機器用於成型金屬板、管道、管子和型材,使其成為生產複雜零件和結構不可或缺的工具。隨著全球工業化進程的加快,對折彎機的需求不斷增加,特別是在基礎設施和建築項目迅速擴張的新興經濟體。各行業擴大採用自動化和精密工程,進一步促進了市場成長,推動了對能夠高精度處理複雜設計的先進折彎機的需求。

技術進步正在改變折彎機的格局,CNC 和機器人模型提供了卓越的效率和精確度。然而,這些先進機器的高昂購買和維護成本可能是一個巨大的挑戰,特別是對於新興經濟體中的小型製造商而言。此外,這些機器需要熟練的操作員,他們精通程式設計和管理複雜的系統,這對技術專長有限的公司來說是一個障礙。儘管面臨這些挑戰,但對自動化流程和客製化組件生產的日益重視正在推動各行各業採用先進的折彎機。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 95億美元 |

| 預測值 | 166億美元 |

| 複合年成長率 | 5.9% |

2024 年,鈑金折彎機市場創收 45 億美元,預計到 2034 年複合年成長率將達到 6.6%。鈑金廣泛應用於建築、汽車、航太、電子和製造等行業,因此這些機器具有很高的價值。它們擅長彎曲複雜的形狀和角度,使製造商能夠高精度地滿足特定的設計要求。與管道或管材折彎機相比,鈑金折彎機在加工較大板材時具有成本優勢,使其在經濟上可行,適合大規模零件生產。輕質材料的日益普及和對客製化零件的需求進一步增強了對鈑金折彎機的需求。

市場按最終用途細分為航太和國防、汽車、通用機械和設備、電氣和電子以及其他,包括醫療保健和海洋應用。汽車領域在 2024 年佔據了 34.8% 的市場佔有率,預計到 2034 年將以 5.6% 的複合年成長率成長。折彎機在汽車製造業中至關重要,它們可以製造精確和客製化的零件,例如排氣系統、防滾架和底盤元件。隨著汽車製造商擴大採用鋁和先進合金等輕質材料來提高燃油效率和性能,對折彎機的需求持續上升。

2024 年,亞太地區折彎機市場的營收為 40 億美元。該地區擁有主要的製造業中心,尤其是汽車、航太、建築和電子行業。中國、印度和韓國等國家的快速工業擴張和基礎設施發展正在推動對折彎機的需求,以生產各種零件,包括汽車零件、結構件和消費性電子產品。該地區對技術創新和精密製造的重視預計將推動市場成長,使亞太地區成為全球折彎機產業的主導者。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商概況

- 定價分析

- 技術與創新格局

- 重要新聞和舉措

- 監管格局

- 製造商

- 經銷商

- 對部隊的影響

- 成長動力

- 工業化和基礎建設不斷加強

- 製造業快速成長

- 製造技術的進步

- 產業陷阱與挑戰

- 初期投資高

- 熟練勞動力短缺

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按類型,2021 - 2034 年(十億美元)

- 主要趨勢

- 鈑金折彎機

- 彎管機

- 其他(折彎機、輥軋成型機、鋼筋彎曲機)

第6章:市場估計與預測:按驅動機制,2021 - 2034 年(十億美元)

- 主要趨勢

- 電的

- 油壓

- 氣動

- 機械的

第7章:市場估計與預測:按營運技術,2021 - 2034 年(十億美元)

- 主要趨勢

- 傳統的

- 電腦數控(CNC)

第8章:市場估計與預測:按最終用途,2021 - 2034 年(十億美元)

- 主要趨勢

- 航太與國防

- 汽車

- 通用機械及設備

- 建築與施工

- 其他(採礦、海洋等)

第9章:市場估計與預測:按配銷通路,2021 - 2034 年(十億美元)

- 主要趨勢

- 直銷

- 間接銷售

第10章:市場估計與預測:按地區,2021 - 2034 年(十億美元)

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第 11 章:公司簡介

- Amada

- Amob

- Baileigh Industrial

- BLM Group

- Bystronic Group

- Euromac

- Horn Machine Tools

- Murata Machinery

- Pedax

- Prima Industrie

- Sahinler Metal Makina Industry

- Shuz Tung Machinery Industrial

- Transfluid

- Trumpf

- Wafios

The Global Bending Machine Market was valued at USD 9.5 billion in 2024 and is expected to grow at a CAGR of 5.9% from 2025 to 2034. Bending machines play an integral role across multiple industries, including manufacturing, construction, automotive, and aerospace. These machines are used to shape sheet metal, pipes, tubes, and profiles, making them indispensable in producing complex components and structures. As global industrialization accelerates, the demand for bending machines is increasing, especially in emerging economies where infrastructure and construction projects are expanding rapidly. The rising adoption of automation and precision engineering in various sectors further boosts market growth, driving demand for advanced bending machines that can handle intricate designs with high accuracy.

Technological advancements are transforming the bending machine landscape, with CNC and robotic models offering superior efficiency and precision. However, the high acquisition and maintenance costs of these advanced machines can be a significant challenge, particularly for smaller manufacturers in emerging economies. Additionally, these machines require skilled operators proficient in programming and managing complex systems, posing a barrier for companies with limited technical expertise. Despite these challenges, the growing emphasis on automated processes and customized component production is fueling the adoption of advanced bending machines across industries.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.5 Billion |

| Forecast Value | $16.6 Billion |

| CAGR | 5.9% |

The sheet metal bending machine segment generated USD 4.5 billion in 2024 and is projected to grow at a CAGR of 6.6% through 2034. Sheet metal is extensively used across industries such as construction, automotive, aerospace, electronics, and manufacturing, making these machines highly valuable. They excel in bending intricate shapes and angles, enabling manufacturers to meet specific design requirements with high precision. Compared to pipe or tube bending machines, sheet metal bending machines offer cost advantages when processing larger sheets, making them economically viable for large-scale component production. The growing adoption of lightweight materials and the need for customized parts further enhance the demand for sheet metal bending machines.

The market is segmented by end-use into aerospace & defense, automotive, general machinery & equipment, electrical & electronics, and others, including healthcare and marine applications. The automotive segment accounted for 34.8% of the market share in 2024 and is expected to grow at a CAGR of 5.6% through 2034. Bending machines are essential in automotive manufacturing, where they create precise and customized components such as exhaust systems, roll cages, and chassis elements. As automakers increasingly incorporate lightweight materials like aluminum and advanced alloys to improve fuel efficiency and performance, the demand for bending machines continues to rise.

Asia Pacific generated USD 4 billion in revenue from the bending machine market in 2024. The region hosts major manufacturing hubs, particularly in the automotive, aerospace, construction, and electronics sectors. Rapid industrial expansion and infrastructure development in countries like China, India, and South Korea are driving the demand for bending machines to produce a wide range of components, including automotive parts, structural elements, and consumer electronics. The region's emphasis on technological innovation and precision manufacturing is expected to propel market growth, making the Asia Pacific a dominant player in the global bending machine industry.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier Landscape

- 3.3 Pricing analysis

- 3.4 Technology & innovation landscape

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Manufacturers

- 3.8 Distributors

- 3.9 Impact on forces

- 3.9.1 Growth drivers

- 3.9.1.1 Increasing industrialization and infrastructure development

- 3.9.1.2 Rapid growth in the manufacturing sector

- 3.9.1.3 Advancements in manufacturing technologies

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 High initial investment

- 3.9.2.2 Shortage of skilled labor

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 ($Bn) (Thousand Units)

- 5.1 Key trends

- 5.2 Sheet metal bending machine

- 5.3 Pipe/tube bending machine

- 5.4 Others (press brake, roll forming, bar bending)

Chapter 6 Market Estimates & Forecast, By Driving Mechanism, 2021 - 2034 ($Bn) (Thousand Units)

- 6.1 Key trends

- 6.2 Electric

- 6.3 Hydraulic

- 6.4 Pneumatic

- 6.5 Mechanical

Chapter 7 Market Estimates & Forecast, By Operating Technology, 2021 - 2034 ($Bn) (Thousand Units)

- 7.1 Key trends

- 7.2 Conventional

- 7.3 Computer numerically controlled (CNC)

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn) (Thousand Units)

- 8.1 Key trends

- 8.2 Aerospace & defense

- 8.3 Automotive

- 8.4 General machinery & equipment

- 8.5 Building & construction

- 8.6 Others (mining, marine, etc.)

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Bn) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct sales

- 9.3 Indirect sales

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Amada

- 11.2 Amob

- 11.3 Baileigh Industrial

- 11.4 BLM Group

- 11.5 Bystronic Group

- 11.6 Euromac

- 11.7 Horn Machine Tools

- 11.8 Murata Machinery

- 11.9 Pedax

- 11.10 Prima Industrie

- 11.11 Sahinler Metal Makina Industry

- 11.12 Shuz Tung Machinery Industrial

- 11.13 Transfluid

- 11.14 Trumpf

- 11.15 Wafios