|

市場調查報告書

商品編碼

1708244

汽車高級輪胎市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Automotive Premium Tires Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

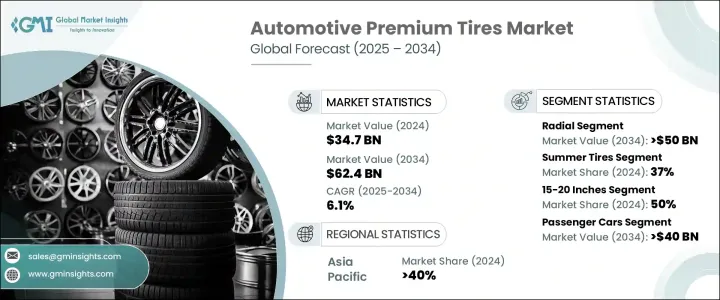

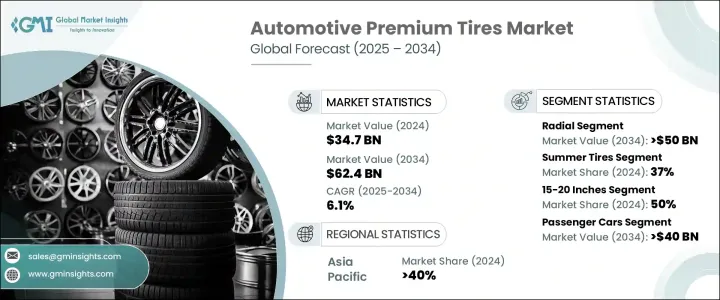

2024 年全球汽車高檔輪胎市場價值為 347 億美元,預計 2025 年至 2034 年期間的複合年成長率為 6.1%。這一成長主要受到對豪華車和高性能汽車日益成長的需求的推動,汽車製造商優先考慮卓越的輪胎質量,以提高車輛性能、舒適性和安全性。隨著消費者偏好轉向具有先進駕駛動力的車輛,高階輪胎製造商不斷創新,增強胎面膠料、先進的橡膠配方和改進的側壁結構。電動車(EV)的日益普及也促進了市場擴張,因為專為電動車設計的優質輪胎具有低滾動阻力、高效率和低噪音的特性。

對永續機動性的重視導致高階輪胎領域的研發活動增加。輪胎製造商正在採用環保原料、創新胎面設計和尖端技術來打造具有卓越抓地力、更長使用壽命和更高燃油效率的產品。消費者越來越意識到高性能輪胎的優勢,包括更好的煞車能力、更低的噪音水平和更好的抓地力,這進一步加速了市場的成長。此外,監管機構正在執行更嚴格的安全和燃油效率規範,迫使汽車製造商為車輛配備符合嚴格標準的高品質輪胎。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 347億美元 |

| 預測值 | 624億美元 |

| 複合年成長率 | 6.1% |

根據輪胎結構,市場分為子午線輪胎和斜交輪胎。 2024年,子午線輪胎佔據了80%的市場佔有率,預計到2034年將創造500億美元的市場價值。子午線輪胎因其增強的靈活性、卓越的牽引力和更長的胎面壽命而受到高階輪胎市場的青睞。鋼帶結構可最大限度地減少熱量積聚,提高燃油效率並延長輪胎壽命。隨著對高性能車輛的需求不斷增加,子午線輪胎因其高速穩定性和在惡劣駕駛條件下保持形狀的能力仍然是首選,從而進一步推動了市場擴張。

市場也按輪胎類型分類,包括夏季輪胎、冬季輪胎、全季輪胎、全地形輪胎等。 2024 年,夏季輪胎佔據了 37% 的市場佔有率,這得益於其在溫暖條件下提供出色的牽引力和煞車性能的能力。夏季輪胎採用特殊的胎面膠料和設計,可最大程度地減少滾動阻力,從而提高燃油經濟性並改善車輛操控性。豪華轎車和高性能汽車經常使用夏季輪胎來實現卓越的轉彎能力和高速穩定性。豪華車銷售的不斷成長,特別是在氣候較溫暖的地區,繼續推動對高性能夏季輪胎的需求。

2024 年,亞太地區佔據全球汽車高檔輪胎市場的 40%。該地區可支配收入的增加、快速的城市化以及對高階轎車、SUV 和運動車型的需求不斷成長是市場成長的主要推動因素。因此,對耐用、高性能輪胎的需求激增,促使製造商擴大其高階輪胎產品組合。領先的輪胎公司正在亞太地區投資生產設施和分銷網路,以滿足消費者對卓越輪胎品質、增強安全性和先進駕駛動力日益成長的需求。

目錄

第1章:方法論與範圍

- 研究設計

- 研究方法

- 資料收集方法

- 基礎估算與計算

- 基準年計算

- 市場估計的主要趨勢

- 預測模型

- 初步研究與驗證

- 主要來源

- 資料探勘來源

- 市場定義

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 原物料供應商

- 製造商

- 技術提供者

- 服務提供者

- 經銷商

- 最終用途

- 利潤率分析

- 技術與創新格局

- 專利分析

- 重要新聞和舉措

- 監管格局

- 價格趨勢

- 成本細分分析

- 衝擊力

- 成長動力

- 對豪華和高性能汽車的需求不斷成長

- 電動車的普及率不斷提高

- 消費者對先進安全功能和耐用高性能輪胎的偏好日益成長

- 擴大網路零售及獨家品牌經銷權

- 產業陷阱與挑戰

- 優質輪胎的初始成本高

- 原物料價格波動

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按輪胎,2021 - 2034 年

- 主要趨勢

- 夏季輪胎

- 冬季輪胎

- 全季節輪胎

- 全地形輪胎

- 其他

第6章:市場估計與預測:依輪胎結構,2021 - 2034 年

- 主要趨勢

- 徑向

- 偏見

第7章:市場估計與預測:依技術分類,2021 - 2034 年

- 主要趨勢

- 防爆技術

- 自密封輪胎

- 環保輪胎

- 降噪技術

- 其他

第8章:市場估計與預測:按輪轂尺寸,2021 - 2034

- 主要趨勢

- 低於 15 英寸

- 15-20英寸

- 20吋以上

第9章:市場估計與預測:依車型,2021 - 2034 年

- 主要趨勢

- 搭乘用車

- 越野車

- 轎車

- 掀背車

- 商用車

- 輕型商用車(LCV)

- 中型商用車(MCV)

- 重型商用車(HCV)

第 10 章:市場估計與預測:按銷售管道,2021 年至 2034 年

- 主要趨勢

- OEM

- 售後市場

第 11 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 義大利

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第12章:公司簡介

- Apollo Tyres

- Bridgestone

- CEAT

- Continental

- Cooper Tire & Rubber

- Dunlop Tires

- Falken Tire

- Goodyear Tire & Rubber

- Hankook

- Kumho Tire

- Maxxis Tires

- Michelin

- MRF

- Nitto Tire

- Nokian

- Pirelli

- Sumitomo Rubber Industries

- Toyo Tire

- Vredestein Bande

- Yokohama Rubber

The Global Automotive Premium Tires Market was valued at USD 34.7 billion in 2024 and is projected to grow at a CAGR of 6.1% between 2025 and 2034. This growth is largely driven by the increasing demand for luxury vehicles and high-performance cars, with automakers prioritizing superior tire quality to enhance vehicle performance, comfort, and safety. As consumer preferences shift toward vehicles offering advanced driving dynamics, premium tire manufacturers continue to innovate with enhanced tread compounds, advanced rubber formulations, and improved sidewall structures. The rising adoption of electric vehicles (EVs) also contributes to market expansion, as premium tires designed for EVs offer low rolling resistance, improved efficiency, and noise reduction.

The emphasis on sustainable mobility has led to an increase in research and development activities in the premium tires sector. Tire manufacturers are incorporating environmentally friendly raw materials, innovative tread designs, and cutting-edge technology to create products that offer superior grip, extended lifespan, and fuel efficiency. The growing consumer awareness of the benefits of high-performance tires, including improved braking capabilities, lower noise levels, and better road grip, further accelerates market growth. Additionally, regulatory bodies are enforcing stricter safety and fuel efficiency norms, compelling automakers to equip vehicles with high-quality tires that meet stringent standards.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $34.7 Billion |

| Forecast Value | $62.4 Billion |

| CAGR | 6.1% |

The market is segmented based on tire construction into radial and bias designs. In 2024, radial tires accounted for 80% of the market share and are expected to generate USD 50 billion by 2034. Radial tires are preferred in the premium tire market due to their enhanced flexibility, superior traction, and extended tread life. The steel-belted construction minimizes heat buildup, improving fuel efficiency and prolonging tire lifespan. As the demand for performance vehicles increases, radial tires remain the preferred choice for their high-speed stability and ability to maintain shape under challenging driving conditions, further fueling market expansion.

The market is also categorized by tire types, including summer tires, winter tires, all-season tires, all-terrain tires, and others. In 2024, summer tires held a 37% market share, driven by their ability to provide exceptional traction and braking performance in warm conditions. With specialized tread compounds and designs that minimize rolling resistance, summer tires enhance fuel economy and improve vehicle handling. Luxury sedans and high-performance cars frequently utilize summer tires to achieve superior cornering capabilities and high-speed stability. The increasing sales of luxury vehicles, particularly in regions with warmer climates, continue to boost demand for high-performance summer tires.

Asia Pacific accounted for 40% of the global automotive premium tires market share in 2024. The region's rising disposable income, rapid urbanization, and growing demand for high-end sedans, SUVs, and sports models are major contributors to market growth. As a result, the need for durable, high-performance tires has surged, prompting manufacturers to expand their premium tire portfolios. Leading tire companies are investing in production facilities and distribution networks across Asia Pacific to cater to the increasing consumer demand for superior tire quality, enhanced safety, and advanced driving dynamics.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material suppliers

- 3.2.2 Manufacturers

- 3.2.3 Technology providers

- 3.2.4 Service providers

- 3.2.5 Distributors

- 3.2.6 End use

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Price trends

- 3.9 Cost breakdown analysis

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Growing demand for luxury and high-performance vehicles

- 3.10.1.2 Increasing adoption of electric vehicles

- 3.10.1.3 Rising consumer preference for advanced safety features and durable high-performance tires

- 3.10.1.4 Expansion of online retail and exclusive brand dealerships

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 High initial cost of premium tires

- 3.10.2.2 Fluctuations in raw material prices

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Tire, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Summer tires

- 5.3 Winter tires

- 5.4 All-season tires

- 5.5 All terrain tires

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Tire Construction, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Radial

- 6.3 Bias

Chapter 7 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Run-flat technology

- 7.3 Self-sealing tires

- 7.4 Eco-friendly tires

- 7.5 Noise reduction technology

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By Rim Size, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Below 15 inches

- 8.3 15-20 inches

- 8.4 Above 20 inches

Chapter 9 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Passenger cars

- 9.2.1 SUV

- 9.2.2 Sedan

- 9.2.3 Hatchback

- 9.3 Commercial vehicles

- 9.3.1 Light Commercial Vehicles (LCV)

- 9.3.2 Medium Commercial Vehicles (MCV)

- 9.3.3 Heavy Commercial Vehicles (HCV)

Chapter 10 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 OEM

- 10.3 Aftermarket

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Russia

- 11.3.7 Nordics

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 ANZ

- 11.4.6 Southeast Asia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 UAE

- 11.6.2 South Africa

- 11.6.3 Saudi Arabia

Chapter 12 Company Profiles

- 12.1 Apollo Tyres

- 12.2 Bridgestone

- 12.3 CEAT

- 12.4 Continental

- 12.5 Cooper Tire & Rubber

- 12.6 Dunlop Tires

- 12.7 Falken Tire

- 12.8 Goodyear Tire & Rubber

- 12.9 Hankook

- 12.10 Kumho Tire

- 12.11 Maxxis Tires

- 12.12 Michelin

- 12.13 MRF

- 12.14 Nitto Tire

- 12.15 Nokian

- 12.16 Pirelli

- 12.17 Sumitomo Rubber Industries

- 12.18 Toyo Tire

- 12.19 Vredestein Bande

- 12.20 Yokohama Rubber