|

市場調查報告書

商品編碼

1708188

智慧骨科植入物市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Smart Orthopedic Implants Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

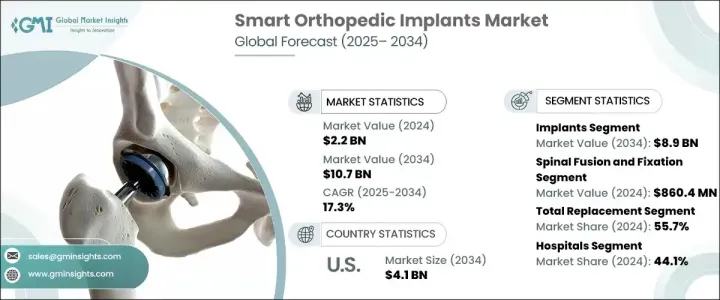

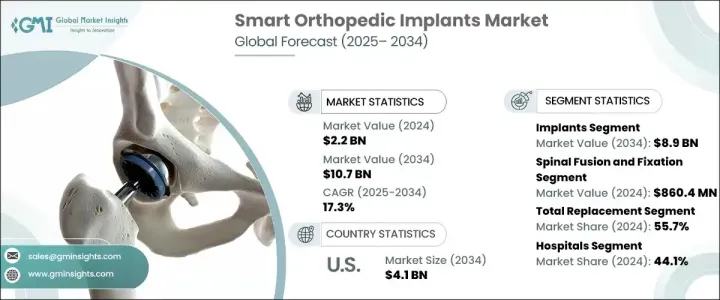

2024 年全球智慧骨科植入物市場價值為 22 億美元,預計 2025 年至 2034 年的複合年成長率為 17.3%。智慧骨科植入物是配備感測器和連接功能的創新醫療設備,可監測、診斷和改善肌肉骨骼疾病的治療效果。這些植入物提供有關負荷、排列和癒合進度等指標的即時資料,從而實現個人化患者護理並提高治療效率。個人化醫療需求的不斷成長,加上技術的進步,推動了這些植入物的採用,從而促進了市場的顯著成長。肌肉骨骼疾病病例的增加和老年人口的增加進一步刺激了需求。由於老化、久坐的生活方式和肥胖,骨關節炎、骨質疏鬆症和骨折等疾病變得越來越常見,對有效治療方案的需求也隨之增加。

市場根據組件進行細分,主要類別為植入物和電子組件。 2024 年,植入物佔市場收入的 83.4%,預計到 2034 年將達到 89 億美元。這些植入物,尤其是用於膝關節和髖關節置換的植入物,被廣泛用於治療退化性骨病,這推動了它們在市場上的主導地位。感測器和人工智慧 (AI) 等先進技術的整合提高了植入物的性能,從而帶來了更好的患者治療效果和更高的採用率。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 22億美元 |

| 預測值 | 107億美元 |

| 複合年成長率 | 17.3% |

根據應用,智慧骨科植入物市場包括脊椎融合和固定、VCF 治療、運動保存/非融合和脊椎減壓。脊椎融合和固定佔據市場主導地位,2024 年價值達 8.604 億美元。這些手術通常用於治療椎間盤突出、脊椎側彎和椎管狹窄,尤其是在老年族群。即時監控感測器的整合和固定技術的改進提高了這些手術的有效性,確保了它們持續的市場領先地位。

按手術類型細分,市場包括全置換、部分置換和其他手術。全關節置換成為主導領域,佔 2024 年收入佔有率的 55.7%,預計到 2034 年將達到 59 億美元。退化性關節疾病發生率的上升和人口老化推動了對全關節置換手術的需求,尤其是膝關節置換手術。這些程序為嚴重的關節疾病提供了全面的解決方案,提供了更好的功能和長期緩解,從而鞏固了其市場主導地位。

根據最終用途,市場分為醫院、門診手術中心、專科診所和其他設施。醫院憑藉其管理複雜手術和提供全面術後護理的能力,在 2024 年佔據了 44.1% 的最大收入佔有率。他們擁有先進的手術能力、專業的設備和多學科護理,成為涉及智慧植入物的骨科手術的首選。

在美國,智慧骨科植入物市場在 2023 年的規模為 7.485 億美元,預計將大幅成長,到 2034 年將達到 41 億美元。該國重視醫療保健創新、強大的基礎設施、廣泛的保險覆蓋以及對尖端骨科解決方案日益成長的認知,推動了不同患者群體採用智慧骨科植入物。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 肌肉骨骼疾病盛行率不斷上升

- 已開發經濟體和發展中經濟體老年人口不斷增加

- 轉向個人化醫療

- 智慧植入物領域的技術進步

- 產業陷阱與挑戰

- 嚴格的監管框架

- 植入物成本高昂

- 成長動力

- 成長潛力分析

- 監管格局

- 未來市場趨勢

- 差距分析

- 技術格局

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按組成部分,2021 年至 2034 年

- 主要趨勢

- 植入物

- 膝關節置換術

- 髖關節置換術

- 脊椎融合

- 骨折固定

- 其他植入物

- 電子元件

第6章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 脊椎融合與固定

- VCF治療

- 運動保留/非融合

- 脊椎減壓

第7章:市場估計與預測:按程序類型,2021 年至 2034 年

- 主要趨勢

- 完全替換

- 部分替換

- 其他手術類型

第8章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 醫院

- 門診手術中心

- 專科診所

- 其他最終用途

第9章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第10章:公司簡介

- Canary Medical

- Exactech

- Medtronic

- SpineGuard

- Stryker

- Zimmer Biomet

The Global Smart Orthopedic Implants Market was valued at USD 2.2 billion in 2024 and is expected to grow at a CAGR of 17.3% from 2025 to 2034. Smart orthopedic implants are innovative medical devices equipped with sensors and connectivity features that monitor, diagnose, and enhance treatment outcomes for musculoskeletal conditions. These implants offer real-time data on metrics such as load, alignment, and healing progress, enabling personalized patient care and improving treatment efficiency. Increasing demand for personalized healthcare, coupled with advancements in technology, is driving the adoption of these implants, contributing to significant market growth. Rising cases of musculoskeletal disorders and a growing geriatric population further fuel the demand. Conditions such as osteoarthritis, osteoporosis, and fractures are becoming increasingly common due to aging, sedentary lifestyles, and obesity, boosting the need for effective treatment solutions.

The market is segmented based on components, with implants and electronic components as the primary categories. Implants accounted for 83.4% of the market revenue in 2024 and are projected to reach USD 8.9 billion by 2034. These implants, particularly for knee and hip replacements, are widely used to treat degenerative bone conditions, which drives their market dominance. The integration of advanced technologies like sensors and artificial intelligence (AI) enhances implant performance, leading to better patient outcomes and greater adoption rates.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.2 Billion |

| Forecast Value | $10.7 Billion |

| CAGR | 17.3% |

By application, the smart orthopedic implants market includes spinal fusion and fixation, VCF treatment, motion preservation/non-fusion, and spinal decompression. Spinal fusion and fixation dominated the market with a value of USD 860.4 million in 2024. These procedures are commonly used to treat herniated discs, scoliosis, and spinal stenosis, particularly among the aging population. The integration of sensors for real-time monitoring and improved fixation techniques enhances the effectiveness of these procedures, ensuring their continued market leadership.

When segmented by procedure type, the market includes total replacement, partial replacement, and other procedures. Total replacement emerged as the dominant segment, accounting for 55.7% of the revenue share in 2024, and is estimated to reach USD 5.9 billion by 2034. The rising incidence of degenerative joint diseases and an aging population drive the demand for total replacement procedures, particularly for knee joints. These procedures provide comprehensive solutions for severe joint conditions, offering better functionality and long-term relief, which reinforces their market dominance.

Based on end use, the market is segmented into hospitals, ambulatory surgical centers, specialty clinics, and other facilities. Hospitals held the largest revenue share of 44.1% in 2024 due to their capability to manage complex surgeries and provide comprehensive post-operative care. Their advanced surgical capabilities, specialized equipment, and multidisciplinary care make them the preferred choice for orthopedic procedures involving smart implants.

In the United States, the smart orthopedic implants market accounted for USD 748.5 million in 2023 and is expected to grow significantly, reaching USD 4.1 billion by 2034. The country's emphasis on healthcare innovation, robust infrastructure, widespread insurance coverage, and increasing awareness of cutting-edge orthopedic solutions drive the adoption of smart orthopedic implants across diverse patient demographics.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing prevalence of musculoskeletal disorders

- 3.2.1.2 Rising geriatric population in developed as well as developing economies

- 3.2.1.3 Shift towards personalized medicine

- 3.2.1.4 Technological advancements in the field of smart implants

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Stringent regulatory framework

- 3.2.2.2 High cost of implants

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Future market trends

- 3.6 Gap analysis

- 3.7 Technological landscape

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Component, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Implants

- 5.2.1 Knee arthroplasty

- 5.2.2 Hip arthroplasty

- 5.2.3 Spine fusion

- 5.2.4 Fracture fixation

- 5.2.5 Other implants

- 5.3 Electronic components

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Spinal fusion and fixation

- 6.3 VCF treatment

- 6.4 Motion preservation/ non - fusion

- 6.5 Spinal decompression

Chapter 7 Market Estimates and Forecast, By Procedure Type, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Total replacement

- 7.3 Partial replacement

- 7.4 Other procedure types

Chapter 8 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Ambulatory surgical centers

- 8.4 Specialty clinics

- 8.5 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Canary Medical

- 10.2 Exactech

- 10.3 Medtronic

- 10.4 SpineGuard

- 10.5 Stryker

- 10.6 Zimmer Biomet