|

市場調查報告書

商品編碼

1708186

金屬化阻隔膜包裝市場機會、成長動力、產業趨勢分析及2025-2034年預測Metalized Barrier Film Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

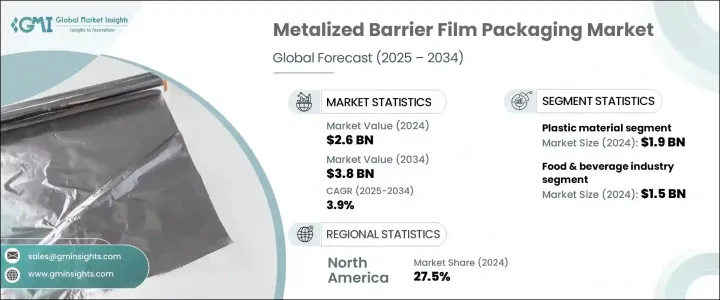

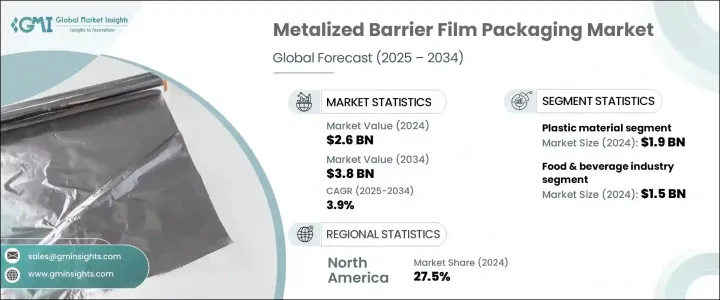

2024 年全球金屬化阻隔膜包裝市場價值為 26 億美元,預估 2025 年至 2034 年的複合年成長率為 3.9%。這一成長主要受製藥業需求成長和各行業對延長保存期限的需求不斷成長的推動。金屬化阻隔膜可有效抵抗環境因素,維持包裝食品的新鮮度、風味和營養品質。隨著全球化和消費者對包裝和加工食品的偏好不斷增加,製造商開始使用這些薄膜來確保產品在延長的運輸時間內的完整性。製藥業尤其受益於泡殼包裝和醫用袋中的這些薄膜,確保敏感藥物的保護。專注於高門檻解決方案和遵守監管標準的製造商將會看到該領域的採用率不斷提高。

對更長保存期限的需求是推動市場擴張的另一個重要因素。這些薄膜可以有效地保護包裝食品、藥品和化妝品,防止變質並長期維持品質。隨著消費者生活節奏越來越快,他們越來越傾向於即食食品和加工食品,推動了對先進包裝解決方案的需求。此外,電子商務和全球貿易的興起也增加了對堅固的阻隔膜的需求,以便在運輸和儲存過程中保護產品。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 26億美元 |

| 預測值 | 38億美元 |

| 複合年成長率 | 3.9% |

市場按材料細分,其中塑膠佔據主導地位,到 2024 年市場規模將達到 19 億美元。塑膠基金屬化薄膜因其重量輕、成本效益高和靈活性而受到青睞。隨著消費者擴大選擇便攜、便捷的包裝,軟性塑膠薄膜越來越受到青睞。它們能夠減少對防腐劑的需求,同時保持產品新鮮度,使其成為大量應用的理想選擇。即食食品和飲料的日益普及進一步支持了這一趨勢,這些食品和飲料需要優質的包裝來保持其品質。

按終端用途產業分類,食品和飲料產業是最大的貢獻者,2024 年的估值為 15 億美元。該行業的成長歸因於快速的城市化和消費者習慣的改變,消費者更青睞包裝和即食產品。金屬化阻隔膜廣泛應用於零食、咖啡、乳製品和其他包裝食品,無需依賴化學防腐劑即可保持新鮮、防止變質。監管部門對永續包裝的日益重視以及消費者對環保解決方案的需求進一步推動了這一領域的採用。

受高阻隔包裝需求不斷成長和電子商務行業快速成長的推動,北美將在 2024 年佔據全球 27.5% 的市場佔有率。政府對採用永續包裝材料的支持,加上消費者偏好的變化,正在推動金屬化阻隔膜包裝的採用。美國引領區域市場,2024 年市場規模達 5.239 億美元,這得益於對包裝食品日益成長的需求,這些食品需要高性能包裝來維持產品在運輸過程中的完整性。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 延長保存期限的需求不斷成長

- 永續阻隔塗層的進展

- 蓬勃發展的電子商務和食品配送服務

- 快速的城市化和忙碌的生活方式

- 藥品包裝需求不斷成長

- 產業陷阱與挑戰

- 有限的回收和永續性問題

- 來自可生物分解替代品的競爭

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按材料,2021 年至 2034 年

- 主要趨勢

- 塑膠

- 聚丙烯(PP)

- 聚對苯二甲酸乙二酯(PET)

- 聚醯胺(PA)

- 聚乙烯(PE)

- 尼龍

- 其他

- 金屬

第6章:市場估計與預測:依最終用途產業,2021 年至 2034 年

- 主要趨勢

- 食品和飲料

- 製藥

- 電子產品

- 個人護理和化妝品

- 其他

第7章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第8章:公司簡介

- Aerolam Group

- Amcor

- Cosmo Films

- Dunmore

- Ester Industries

- Finfoil

- Flex Films

- Jindal Films

- Kolon Industries

- Nahar PolyFilms

- PC Laminations

- SRF

- Sumilon Group

- Taghleef Industries

- Toray

- Zhejiang Changyu New Materials

The Global Metalized Barrier Film Packaging Market, valued at USD 2.6 billion in 2024, is expected to grow at a CAGR of 3.9% from 2025 to 2034. This growth is primarily driven by rising demand from the pharmaceutical industry and the increasing need for extended shelf life across various sectors. Metalized barrier films provide high protection against environmental factors, preserving the freshness, flavor, and nutritional quality of packaged goods. As globalization and consumer preferences for packaged and processed foods increase, manufacturers are turning to these films to ensure product integrity during extended transit times. The pharmaceutical sector, in particular, benefits from these films in blister packs and medical pouches, ensuring the protection of sensitive drugs. Manufacturers focusing on high-barrier solutions and adherence to regulatory standards will see increased adoption in this sector.

The need for longer shelf life is another significant factor fueling market expansion. These films effectively safeguard packaged foods, pharmaceuticals, and cosmetics, preventing spoilage and maintaining quality over time. As consumer lifestyles become more fast-paced, there is a greater inclination toward ready-to-eat and processed food products, driving demand for advanced packaging solutions. In addition, the rise in e-commerce and global trade has heightened the need for robust barrier films to protect products during transportation and storage.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.6 Billion |

| Forecast Value | $3.8 Billion |

| CAGR | 3.9% |

The market is segmented by material, with plastic dominating this space, accounting for USD 1.9 billion in 2024. Plastic-based metalized films are preferred due to their lightweight nature, cost-efficiency, and flexibility. As consumers increasingly opt for portable and convenient packaging, flexible plastic films gain traction. Their ability to reduce the need for preservatives while maintaining product freshness makes them ideal for high-volume applications. This trend is further supported by the growing popularity of ready-to-eat foods and beverages, which require superior packaging to retain their quality.

By end-use industry, the food and beverage segment is the largest contributor, with a valuation of USD 1.5 billion in 2024. The segment's growth is attributed to rapid urbanization and changing consumer habits, which favor packaged and ready-to-eat products. Metalized barrier films are widely used in snacks, coffee, dairy, and other packaged foods, preserving freshness and preventing spoilage without relying on chemical preservatives. Increasing regulatory emphasis on sustainable packaging and consumer demand for eco-friendly solutions further boost adoption in this segment.

North America held 27.5% of the global market share in 2024, driven by the rising need for high-barrier packaging and the rapid growth of the e-commerce sector. Government support for adopting sustainable packaging materials, combined with changing consumer preferences, is promoting the adoption of metalized barrier film packaging. The United States led the regional market, accounting for USD 523.9 million in 2024, fueled by the growing demand for packaged foods that require high-performance packaging to maintain product integrity during transportation.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for extended shelf life

- 3.2.1.2 Advancements in sustainable barrier coatings

- 3.2.1.3 Booming e-commerce & food delivery services

- 3.2.1.4 Rapid urbanization and busy lifestyles

- 3.2.1.5 Growing demand in pharmaceutical packaging

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Limited recycling & sustainability issues

- 3.2.2.2 Competition from biodegradable alternatives

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Material, 2021 – 2034 (USD Million & Kilo Tons)

- 5.1 Key trends

- 5.2 Plastics

- 5.2.1 Polypropylene (PP)

- 5.2.2 Polyethylene Terephthalate (PET)

- 5.2.3 Polyamide (PA)

- 5.2.4 Polyethylene (PE)

- 5.2.5 Nylon

- 5.2.6 Others

- 5.3 Metals

Chapter 6 Market Estimates and Forecast, By End Use Industry, 2021 – 2034 (USD Million & Kilo Tons)

- 6.1 Key trends

- 6.2 Food & beverage

- 6.3 Pharmaceuticals

- 6.4 Electronics

- 6.5 Personal care and cosmetics

- 6.6 Others

Chapter 7 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Million & Kilo Tons)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 Saudi Arabia

- 7.6.2 South Africa

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Aerolam Group

- 8.2 Amcor

- 8.3 Cosmo Films

- 8.4 Dunmore

- 8.5 Ester Industries

- 8.6 Finfoil

- 8.7 Flex Films

- 8.8 Jindal Films

- 8.9 Kolon Industries

- 8.10 Nahar PolyFilms

- 8.11 PC Laminations

- 8.12 SRF

- 8.13 Sumilon Group

- 8.14 Taghleef Industries

- 8.15 Toray

- 8.16 Zhejiang Changyu New Materials