|

市場調查報告書

商品編碼

1708170

紙托盤市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Paper Pallets Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

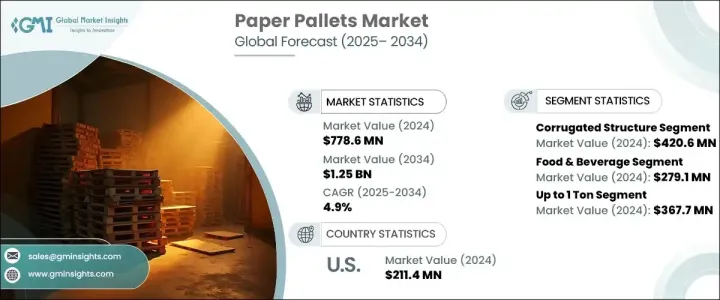

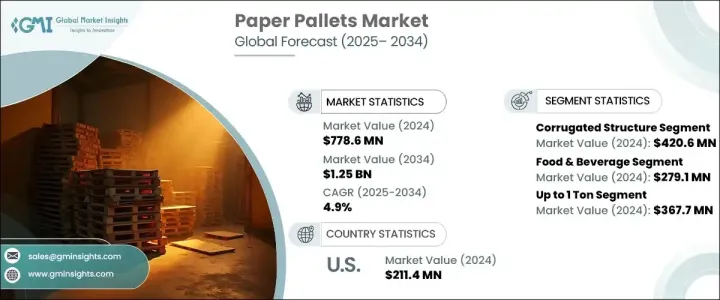

2024 年全球紙托盤市場價值為 7.786 億美元,預計 2025 年至 2034 年期間的複合年成長率為 4.9%。這一成長主要得益於電子商務行業的快速擴張以及對透過永續且具有成本效益的解決方案簡化供應鏈的日益重視。隨著全球工業採用對環境負責的商業實踐,紙托盤已成為傳統木質和塑膠托盤的實用且環保的替代品。這些托盤因其輕質結構、可回收性和成本效益而獲得了顯著的吸引力。各行各業的公司擴大選擇紙質托盤來降低運輸成本、遵守嚴格的環境法規並滿足消費者對永續包裝日益成長的需求。

此外,人們越來越重視最佳化物流、減少碳足跡和遵守減少塑膠的規定,這推動了全球對紙質托盤的需求。向紙質托盤的轉變也受到公司提高倉庫效率、削減營運費用以及響應政府支持環保包裝解決方案舉措的戰略努力的推動。跨境貿易和全球物流網路的興起,以及對衛生、一次性和符合出口要求的包裝的需求不斷增加,增加了紙托盤的市場吸引力。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 7.786億美元 |

| 預測值 | 12.5億美元 |

| 複合年成長率 | 4.9% |

隨著各行各業尋求不僅具有成本效益而且符合環境標準和循環經濟目標的包裝解決方案,對紙托盤的需求持續激增。企業正在轉向使用紙質托盤來提高營運效率,同時最大限度地減少對環境的影響,這種趨勢在電子商務、食品和飲料、製藥和消費品等領域迅速發展。對於那些努力滿足監管要求和消費者對更環保產品和包裝材料不斷變化的偏好的公司來說,紙托盤是一個有吸引力的選擇。隨著全球供應鏈變得越來越複雜,對多功能、輕巧和可回收的托盤解決方案的需求正在推動強勁的市場前景。

紙托盤市場可按結構和最終用途行業進行細分。瓦楞紙托盤引領市場,2024 年市場規模達 4.206 億美元。這些托盤重量輕、耐用,且由可再生和可回收材料製成,非常適合專注於永續物流的企業。減少塑膠垃圾的監管力道進一步推動了塑膠袋的採用,尤其是在電子商務等行業,高效的最後一英里配送是這些行業的關鍵要求。

在應用方面,受永續和衛生包裝解決方案需求不斷成長的推動,食品和飲料領域的市場規模在 2024 年將達到 2.791 億美元。包裝食品消費量的不斷成長以及線上食品配送服務的興起是這一趨勢的關鍵因素。紙托盤是一種安全、經濟高效且環保的包裝選擇,符合業界對更高永續性的追求。

北美在全球紙托盤市場佔據主導地位,2024 年佔據紙托盤市場 32.4% 的佔有率。該地區的成長得益於對可回收和輕量級物流解決方案的強勁需求,以及政府鼓勵使用環保材料和禁止使用一次性塑膠的政策。這些因素,加上電子商務和食品配送等行業消費者對永續包裝的偏好日益成長,正在加速北美地區紙質托盤的採用。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 塑膠使用的嚴格規定

- 輕量化和成本效益

- 更加重視供應鏈最佳化

- 電子商務產業快速擴張

- 食品飲料業的成長

- 產業陷阱與挑戰

- 初期投資成本高

- 濕氣敏感性和耐久性問題

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:依結構,2021 年至 2034 年

- 主要趨勢

- 瓦楞紙托盤

- 蜂巢托盤

- 混合

第6章:市場估計與預測:按負載能力,2021 年至 2034 年

- 主要趨勢

- 高達1噸

- 1-2噸

- 2噸以上

第7章:市場估計與預測:按類型,2021 年至 2034 年

- 主要趨勢

- 雙向

- 四通

第 8 章:市場估計與預測:按最終用途產業,2021 年至 2034 年

- 主要趨勢

- 食品和飲料

- 製藥

- 零售與電子商務

- 化學

- 其他

第9章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第10章:公司簡介

- DS Smith

- Elsons International

- EXA PACK

- FICUS PAX

- GL Packaging

- International Paper

- INTERPAK INDUSTRIES PTE LTD

- Karton Palet

- Kraftpal

- Litco International, Inc.

- Mondi

- Napco Nationa

- Pallite Group

- ProtoPack, LLC.

- Shenzhen Topwon Group Co.,Ltd

- Signode Industrial Group LLC

- Smurfit Kappa

- Tri-Wall

- WestRock Company

- Custom Packaging Products

The Global Paper Pallets Market was valued at USD 778.6 million in 2024 and is expected to grow at a CAGR of 4.9% between 2025 and 2034. This growth is primarily fueled by the rapid expansion of the e-commerce sector and the growing focus on streamlining supply chains with sustainable and cost-effective solutions. As global industries embrace environmentally responsible business practices, paper pallets have emerged as a practical and eco-friendly alternative to traditional wooden and plastic pallets. These pallets are gaining remarkable traction due to their lightweight structure, recyclability, and cost-efficiency. Companies across industries are increasingly opting for paper pallets to reduce shipping costs, comply with stringent environmental regulations, and meet growing consumer demand for sustainable packaging.

Furthermore, the rising emphasis on optimizing logistics, minimizing carbon footprints, and adhering to plastic reduction mandates is propelling the demand for paper pallets worldwide. The shift toward paper pallets is also driven by companies' strategic efforts to improve warehouse efficiency, cut operational expenses, and align with government initiatives that support eco-friendly packaging solutions. The rise of cross-border trade and global logistics networks, along with the increasing need for hygienic, disposable, and export-compliant packaging, adds to the growing market appeal of paper pallets.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $778.6 Million |

| Forecast Value | $1.25 Billion |

| CAGR | 4.9% |

The demand for paper pallets continues to surge as industries seek packaging solutions that are not only cost-effective but also comply with environmental standards and circular economy goals. Businesses are turning to paper pallets to enhance operational efficiencies while minimizing their environmental impact, and this trend is rapidly gaining momentum across sectors like e-commerce, food and beverage, pharmaceuticals, and consumer goods. Paper pallets are an attractive choice for companies striving to meet both regulatory demands and evolving consumer preferences for greener products and packaging materials. As global supply chains become more complex, the need for versatile, lightweight, and recyclable pallet solutions is driving a robust market outlook.

The paper pallets market can be segmented by structure and end-use industries. Corrugated paper pallets led the market, generating USD 420.6 million in 2024. These pallets are lightweight, durable, and made from renewable and recyclable materials, making them an ideal fit for businesses focused on sustainable logistics. Their adoption is further boosted by regulatory efforts to reduce plastic waste, especially in industries like e-commerce, where efficient last-mile delivery is a critical requirement.

In terms of application, the food and beverage segment accounted for USD 279.1 million in 2024, driven by increasing demand for sustainable and hygienic packaging solutions. The growing consumption of packaged food and the rise in online food delivery services are key contributors to this trend. Paper pallets offer a safe, cost-effective, and eco-friendly packaging option that aligns with the industry's push toward greater sustainability.

North America dominated the global landscape, capturing a 32.4% share of the paper pallets market in 2024. The region's growth is powered by strong demand for recyclable and lightweight logistics solutions, coupled with government policies encouraging the use of eco-friendly materials and bans on single-use plastics. These factors, along with rising consumer preference for sustainable packaging in industries such as e-commerce and food delivery, are accelerating paper pallet adoption across North America.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Stringent Regulations on Plastic Usage

- 3.2.1.2 Lightweight and Cost Efficiency

- 3.2.1.3 Increased Focus on Supply Chain Optimization

- 3.2.1.4 Rapid Expansion of the E-Commerce Industry

- 3.2.1.5 Growth in the Food & Beverage Industry

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High Initial Investment Cost

- 3.2.2.2 Moisture Sensitivity and Durability Issues

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Structure, 2021 – 2034 (USD Million & Kilo Tons)

- 5.1 Key trends

- 5.2 Corrugated pallets

- 5.3 Honeycomb pallets

- 5.4 Hybrid

Chapter 6 Market Estimates and Forecast, By Load Capacity, 2021 – 2034 (USD Million & Kilo Tons)

- 6.1 Key trends

- 6.2 Up to 1 Ton

- 6.3 1-2 Tons

- 6.4 Above 2 Tons

Chapter 7 Market Estimates and Forecast, By Type, 2021 – 2034 (USD Million & Kilo Tons)

- 7.1 Key trends

- 7.2 2-way

- 7.3 4-way

Chapter 8 Market Estimates and Forecast, By End Use Industry, 2021 – 2034 (USD Million & Kilo Tons)

- 8.1 Key trends

- 8.2 Food & beverage

- 8.3 Pharmaceuticals

- 8.4 Retail & E-Commerce

- 8.5 Chemical

- 8.6 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Million & Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 DS Smith

- 10.2 Elsons International

- 10.3 EXA PACK

- 10.4 FICUS PAX

- 10.5 GL Packaging

- 10.6 International Paper

- 10.7 INTERPAK INDUSTRIES PTE LTD

- 10.8 Karton Palet

- 10.9 Kraftpal

- 10.10 Litco International, Inc.

- 10.11 Mondi

- 10.12 Napco Nationa

- 10.13 Pallite Group

- 10.14 ProtoPack, LLC.

- 10.15 Shenzhen Topwon Group Co.,Ltd

- 10.16 Signode Industrial Group LLC

- 10.17 Smurfit Kappa

- 10.18 Tri-Wall

- 10.19 WestRock Company

- 10.20 Custom Packaging Products