|

市場調查報告書

商品編碼

1708166

塑膠桶市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Plastic Drums Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

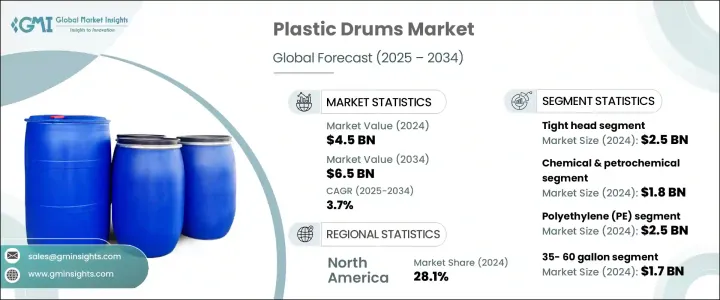

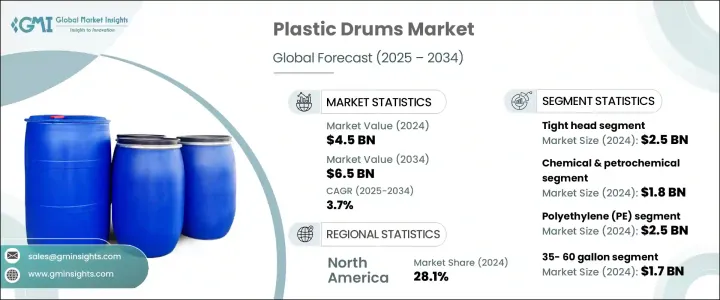

2024 年全球塑膠桶市場規模達 45 億美元,預計 2025 年至 2034 年期間的複合年成長率為 3.7%。這一成長軌跡主要受到化學品、食品和飲料、製藥、油漆和塗料等行業對塑膠桶需求激增的推動。隨著全球企業持續專注於高效、耐用且經濟的包裝解決方案,塑膠桶正逐漸成為儲存和運輸各種材料(包括危險和非危險物質)的首選。

隨著對工業產品安全合規包裝的日益重視,塑膠桶的採用率顯著成長。市場受益於工業化程度的提高、國際貿易的成長以及對符合監管和安全標準的可靠散裝包裝選擇的需求。此外,隨著供應鏈網路變得越來越複雜和全球化,對堅固、可重複使用和安全的容器的需求變得迫切,塑膠桶成為跨多個垂直領域的多功能解決方案。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 45億美元 |

| 預測值 | 65億美元 |

| 複合年成長率 | 3.7% |

化學工業繼續成為塑膠桶需求的主要驅動力,主要用於處理石化產品、化肥和特殊化學品。這些行業的工業需要重型、高耐用性的容器來安全地儲存和運輸液體和粉末。隨著監管機構對危險物質的儲存和運輸實施嚴格的指導方針,人們對提供防漏、耐腐蝕和安全包裝解決方案的塑膠桶的偏好正在上升。這些桶子不僅確保危險貨物的安全處理,而且符合環境和安全法規,使其成為整個化學品供應鏈中必不可少的。

塑膠桶主要分為開口型和緊閉型,分別滿足特定的工業需求。由於對包裝危險液體、油和溶劑的需求不斷成長,密封桶市場在 2024 年創造了 25 億美元的收入。密封桶具有密封的蓋子和狹窄的開口,非常適合在惡劣條件下進行長途運輸,防止洩漏或污染。由於美國交通部和美國食品藥物管理局等機構訂定了嚴格的安全規定,確保在處理易燃和危險材料時遵守規定,該領域繼續受到關注。隨著全球化學品和石油貿易的成長,密封桶越來越受到認可,因為它能夠提供耐用、防篡改的解決方案,確保整個運輸過程中產品的完整性。

根據最終用途行業,由於對用於儲存和運輸化學品、燃料和溶劑的安全、防漏容器的需求不斷成長,化學和石化行業在 2024 年創造了 18 億美元的收入。監管標準和環境問題導致整個工業生態系統越來越依賴塑膠桶進行高效、安全的包裝。

光是美國塑膠桶市場在 2024 年就創造了 11 億美元的收入,其中化學製造和散裝儲存解決方案的擴張是主要驅動力。各行各業對安全高效運輸的需求日益成長,保持了需求的穩定,鞏固了塑膠桶在支持現代工業供應鏈中的作用。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 電子商務和全球貿易的成長

- 化工產業需求不斷成長

- 成本效益和耐用性

- 食品飲料產業快速擴張

- 農業部門依賴

- 產業陷阱與挑戰

- 原物料價格波動

- 來自替代材料的競爭

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按材料,2021 年至 2034 年

- 主要趨勢

- 聚乙烯(PE)

- 高密度聚乙烯(HDPE)

- 低密度聚乙烯(LDPE)

- 聚丙烯(PP)

- 聚對苯二甲酸乙二酯(PET)

- 其他

第6章:市場估計與預測:按產能,2021 年至 2034 年

- 主要趨勢

- 低於35加侖

- 35-60加侖

- 60-80加侖

- 80加侖以上

第7章:市場估計與預測:按頭部類型,2021 年至 2034 年

- 主要趨勢

- 打開頭

- 緊頭

第8章:市場估計與預測:按最終用途產業,2021 年至 2034 年

- 主要趨勢

- 化工和石化

- 食品和飲料

- 製藥

- 油漆和塗料

- 其他

第9章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第10章:公司簡介

- CL Smith

- Cospak

- CurTec

- Eagle Manufacturing

- FDL Packaging Group

- Fries KT

- Greif

- Jiangsu Xinhuasheng Packaging New Materials

- Jiangsu Xuan Sheng Plastic Technology

- Kodama Plastics

- Mauser Packaging Solutions

- Muller Group

- Nova Chemicals

- P. Wilkinson Containers

- Pyramid Technoplast

- Schutz

- Snyder Industries

- The Cary Company

- Time Technoplast

- US Coexcell

The Global Plastic Drums Market generated USD 4.5 billion in 2024 and is projected to expand at a CAGR of 3.7% between 2025 and 2034. This growth trajectory is largely fueled by the surging demand for plastic drums across industries such as chemicals, food and beverage, pharmaceuticals, and paints and coatings, among others. As businesses worldwide continue to focus on efficient, durable, and cost-effective packaging solutions, plastic drums are gaining momentum as a preferred choice for storing and transporting a wide range of materials, including hazardous and non-hazardous substances.

With increasing emphasis on safe and compliant packaging for industrial products, the adoption of plastic drums has witnessed significant growth. The market benefits from rising industrialization, growing international trade, and the need for reliable bulk packaging options that meet regulatory and safety standards. Moreover, as supply chain networks grow more complex and globalized, the need for robust, reusable, and secure containers becomes imperative, positioning plastic drums as a versatile solution across multiple verticals.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.5 Billion |

| Forecast Value | $6.5 Billion |

| CAGR | 3.7% |

The chemical industry continues to be a major driver of plastic drums demand, primarily for handling petrochemicals, fertilizers, and specialty chemicals. Industries in these sectors require heavy-duty, highly durable containers to store and transport liquids and powders safely. As regulatory bodies enforce stringent guidelines for the storage and transportation of hazardous substances, the preference for plastic drums that offer leak-proof, corrosion-resistant, and safe packaging solutions is rising. These drums not only ensure the safe handling of dangerous goods but also comply with environmental and safety regulations, making them essential across chemical supply chains.

Plastic drums are mainly categorized into open head and tight head types, each serving specific industrial needs. The tight head drum segment generated USD 2.5 billion in 2024, driven by rising demand for packaging hazardous liquids, oils, and solvents. Tight head drums feature sealed lids and narrow openings, which make them ideal for long-distance transportation under harsh conditions, preventing leaks or contamination. The segment continues to gain traction due to stringent safety mandates by authorities like the DOT and FDA, ensuring compliance when handling flammable and hazardous materials. As global trade in chemicals and oils grows, tight head drums are increasingly recognized for offering durable, tamper-resistant solutions that ensure product integrity throughout transport.

Based on end-use industries, the chemical and petrochemical segment generated USD 1.8 billion in 2024, owing to the rising need for secure, leak-proof containers to store and transport chemicals, fuels, and solvents. Regulatory standards and environmental concerns have led to growing reliance on plastic drums for efficient and safe packaging across industrial ecosystems.

The U.S. Plastic Drums Market alone generated USD 1.1 billion in 2024, with expansion in chemical manufacturing and bulk storage solutions being key drivers. The growing need for safe and efficient transportation across industries keeps demand steady, cementing the role of plastic drums in supporting modern industrial supply chains.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growth in E-commerce and global trade

- 3.2.1.2 Rising demand from chemical industry

- 3.2.1.3 Cost effectiveness and durability

- 3.2.1.4 Rapid expansion of food and beverage industry

- 3.2.1.5 Agriculture sector reliance

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Raw materials price volatility

- 3.2.2.2 Competition from alternative materials

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Material, 2021 – 2034 (USD Billion & Kilo Tons)

- 5.1 Key trends

- 5.2 Polyethylene (PE)

- 5.2.1 High-Density Polyethylene (HDPE)

- 5.2.2 Low-Density Polyethylene (LDPE)

- 5.3 Polypropylene (PP)

- 5.4 Polyethylene Terephthalate (PET)

- 5.5 Others

Chapter 6 Market Estimates and Forecast, By Capacity, 2021 – 2034 (USD Billion & Kilo Tons)

- 6.1 Key trends

- 6.2 Below 35 gallons

- 6.3 35-60 gallons

- 6.4 60-80 gallons

- 6.5 Above 80 gallons

Chapter 7 Market Estimates and Forecast, By Head Type, 2021 – 2034 (USD Billion & Kilo Tons)

- 7.1 Key trends

- 7.2 Open head

- 7.3 Tight head

Chapter 8 Market Estimates and Forecast, By End Use Industry, 2021 – 2034 (USD Billion & Kilo Tons)

- 8.1 Key trends

- 8.2 Chemical and petrochemical

- 8.3 Food and beverage

- 8.4 Pharmaceuticals

- 8.5 Paints and coatings

- 8.6 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Billion & Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 C.L. Smith

- 10.2 Cospak

- 10.3 CurTec

- 10.4 Eagle Manufacturing

- 10.5 FDL Packaging Group

- 10.6 Fries KT

- 10.7 Greif

- 10.8 Jiangsu Xinhuasheng Packaging New Materials

- 10.9 Jiangsu Xuan Sheng Plastic Technology

- 10.10 Kodama Plastics

- 10.11 Mauser Packaging Solutions

- 10.12 Muller Group

- 10.13 Nova Chemicals

- 10.14 P. Wilkinson Containers

- 10.15 Pyramid Technoplast

- 10.16 Schutz

- 10.17 Snyder Industries

- 10.18 The Cary Company

- 10.19 Time Technoplast

- 10.20 US Coexcell