|

市場調查報告書

商品編碼

1708153

商用車 ADAS 市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Commercial Vehicle ADAS Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

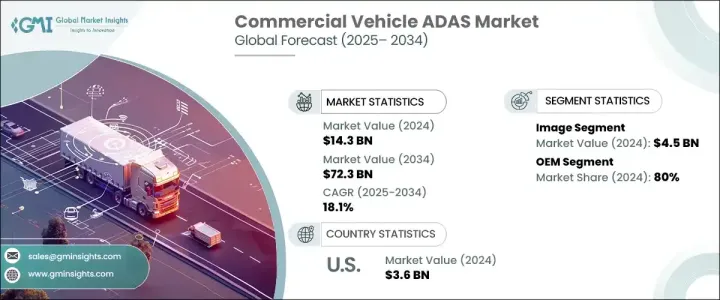

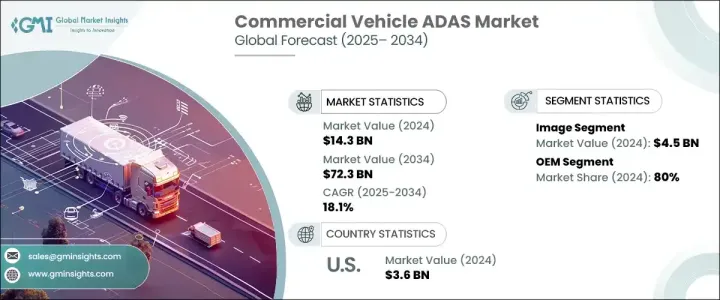

2024 年全球商用車 ADAS 市值為 143 億美元,預計 2025 年至 2034 年期間的複合年成長率為 18.1%。隨著全球安全法規的收緊,促使商業車隊營運商採用先進駕駛輔助系統(ADAS),市場正在顯著擴張。隨著人們對道路安全、事故預防和法規遵循的關注日益增加,北美、歐洲和亞洲部分地區對 ADAS 解決方案的需求激增。各國政府正在實施嚴格的政策,強制採用監控駕駛員疲勞、分心和車道維持的整合系統,進一步加速 ADAS 的採用。這些技術對於減少人為錯誤造成的事故至關重要,特別是在長途貨運和城市商業運輸。此外,人工智慧驅動的 ADAS 功能的不斷整合提高了安全性和營運效率,使其成為現代商用車的重要組成部分。

市場根據感測器類型進行分類,包括雷達、LiDAR、超音波、影像和其他感測器。其中,影像感測器領域佔據30%的佔有率,2024年創造了45億美元的市場規模。影像感測器對於基於視覺的ADAS功能(例如車道偏離警告、交通標誌識別和碰撞偵測)至關重要。這些感測器透過即時視訊捕捉和處理發揮作用,幫助商業駕駛員安全應對複雜的交通狀況。隨著自動化和機器學習能力的進步,商用車 ADAS 對高解析度影像感測器的依賴日益增加,從而提高了車輛的反應能力和事故預防能力。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 143億美元 |

| 預測值 | 723億美元 |

| 複合年成長率 | 18.1% |

根據分銷管道,商用車 ADAS 市場細分為OEM (原始設備製造商)和售後市場解決方案。 2024 年, OEM領域佔據主導地位,佔有 80% 的市場。原始設備製造商 (OEM) 在製造過程中將 ADAS 技術直接整合到車輛中,確保基本安全功能是標準配置或作為選用配備。由於車隊所有者優先考慮可靠性、效率和對監管要求的遵守,對工廠安裝的安全系統的日益偏好正在推動OEM佔據主導地位。這種內建整合為商用車配備尖端 ADAS 技術提供了一種無縫且高效的方法。

北美以 35% 的佔有率領先商用車 ADAS 市場,光是美國在 2024 年的市場價值就達到 36 億美元。美國擁有龐大的商用車隊,包括長途卡車、送貨貨車和公共交通車輛,這導致對 ADAS 解決方案的需求很高。安全性改進、營運效率的提高和燃料消耗的降低是推動美國採用 ADAS 技術的主要因素,車隊營運商正在大力投資這些系統,以提高道路安全性、降低保險成本並提高整體駕駛表現。隨著技術的不斷發展,在監管支援、技術進步和不斷增強的安全意識的推動下,商用車 ADAS 市場有望持續成長。

目錄

第1章:方法論與範圍

- 研究設計

- 研究方法

- 資料收集方法

- 基礎估算與計算

- 基準年計算

- 市場評估的主要趨勢

- 預測模型

- 初步研究和驗證

- 主要來源

- 資料探勘來源

- 市場範圍和定義

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 零件供應商

- 技術提供者

- 製造商

- 經銷商

- 最終用途

- 利潤率分析

- 技術與創新格局

- 專利分析

- 重要新聞和舉措

- 監管格局

- 成本分析

- 衝擊力

- 成長動力

- 加強道路安全法規

- 自動駕駛技術進步

- 改進車隊管理

- 車輛安全的需求不斷成長

- 產業陷阱與挑戰

- 舊車改裝複雜度高

- ADAS技術的初始成本高

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按系統,2021 - 2034 年

- 主要趨勢

- 自適應巡航控制

- 盲點偵測

- 車道偏離預警系統

- 自動緊急煞車(AEM)

- 前方碰撞警告

- 夜視系統

- 駕駛員監控

- 輪胎壓力監測系統

- 抬頭顯示器

- 停車輔助系統

- 其他

第6章:市場估計與預測:按感測器,2021 - 2034 年

- 主要趨勢

- 雷達

- LiDAR

- 超音波

- 影像

- 其他

第7章:市場估計與預測:依車型,2021 - 2034 年

- 主要趨勢

- 輕型商用車

- 丙型肝炎病毒

第8章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- OEM

- 售後市場

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第10章:公司簡介

- Applied Intuition

- Autoliv

- Bosch

- Continental

- Daimler

- Ford

- Gauzy

- Harman

- HL Mando

- Imagination Technologies

- Kenworth Trucks

- KUS Americas

- MAN

- Masstrans

- Scania

- Starkenn

- Valeo

- Vignal Group

- Volvo

- ZF Friedrichshafen

The Global Commercial Vehicle ADAS Market was valued at USD 14.3 billion in 2024 and is projected to grow at a CAGR of 18.1% between 2025 and 2034. The market is witnessing significant expansion as safety regulations tighten worldwide, prompting commercial fleet operators to adopt advanced driver assistance systems (ADAS). With increasing concerns over road safety, accident prevention, and regulatory compliance, the demand for ADAS solutions is surging across North America, Europe, and parts of Asia. Governments are implementing stringent policies to mandate integrated systems that monitor driver fatigue, distraction, and lane-keeping, further accelerating ADAS adoption. These technologies are proving essential in reducing accidents caused by human error, particularly in long-haul trucking and urban commercial transport. Additionally, the rising integration of AI-driven ADAS features enhances safety and operational efficiency, making them a vital component in modern commercial vehicles.

The market is categorized based on sensor types, including radar, LiDAR, ultrasonic, image, and other sensors. Among these, the image sensor segment accounted for a 30% share and generated USD 4.5 billion in 2024. Image sensors are critical in vision-based ADAS features such as lane departure warnings, traffic sign recognition, and collision detection. These sensors function through real-time video capturing and processing, helping commercial drivers navigate complex traffic conditions safely. As automation and machine learning capabilities advance, the reliance on high-resolution image sensors in commercial vehicle ADAS is increasing, improving vehicle responsiveness and accident prevention.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $14.3 Billion |

| Forecast Value | $72.3 Billion |

| CAGR | 18.1% |

Based on distribution channels, the commercial vehicle ADAS market is segmented into OEM (original equipment manufacturer) and aftermarket solutions. In 2024, the OEM segment dominated with an 80% market share. OEMs integrate ADAS technologies directly into vehicles during manufacturing, ensuring that essential safety features are either standard or available as optional equipment. The increasing preference for factory-fitted safety systems is driving OEM dominance as fleet owners prioritize reliability, efficiency, and compliance with regulatory mandates. This built-in integration offers a seamless and efficient approach to equipping commercial vehicles with cutting-edge ADAS technologies.

North America led the commercial vehicle ADAS market with a 35% share, and the U.S. alone was valued at USD 3.6 billion in 2024. The United States has a vast commercial vehicle fleet, including long-haul trucks, delivery vans, and public transport vehicles, contributing to the high demand for ADAS solutions. Safety improvements, enhanced operational efficiency, and fuel consumption reduction are primary factors driving the adoption of ADAS technologies in the U.S. Fleet operators are investing heavily in these systems to enhance road safety, lower insurance costs, and improve overall driver performance. As technology continues to evolve, the commercial vehicle ADAS market is poised for continued growth, driven by regulatory support, technological advancements, and increasing safety awareness.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Component suppliers

- 3.2.2 Technology providers

- 3.2.3 Manufacturers

- 3.2.4 Distributors

- 3.2.5 End use

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Cost analysis

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Increasing road safety regulations

- 3.9.1.2 Technological advancements in autonomous driving

- 3.9.1.3 Improved vehicle fleet management

- 3.9.1.4 Rising demand for vehicle safety

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 High complexity in retrofitting older vehicles

- 3.9.2.2 High initial cost of ADAS technologies

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By System, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Adaptive cruise control

- 5.3 Blind spot detection

- 5.4 Lane departure warning system

- 5.5 Automatic emergency braking (AEM)

- 5.6 Forward collision warning

- 5.7 Night vision system

- 5.8 Driver monitoring

- 5.9 Tire pressure monitoring system

- 5.10 Head-up display

- 5.11 Park assist system

- 5.12 Others

Chapter 6 Market Estimates & Forecast, By Sensor, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Radar

- 6.3 Lidar

- 6.4 Ultrasonic

- 6.5 Image

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 LCV

- 7.3 HCV

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Applied Intuition

- 10.2 Autoliv

- 10.3 Bosch

- 10.4 Continental

- 10.5 Daimler

- 10.6 Ford

- 10.7 Gauzy

- 10.8 Harman

- 10.9 HL Mando

- 10.10 Imagination Technologies

- 10.11 Kenworth Trucks

- 10.12 KUS Americas

- 10.13 MAN

- 10.14 Masstrans

- 10.15 Scania

- 10.16 Starkenn

- 10.17 Valeo

- 10.18 Vignal Group

- 10.19 Volvo

- 10.20 ZF Friedrichshafen