|

市場調查報告書

商品編碼

1708144

汽車觸控螢幕控制系統市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Automotive Touch Screen Control System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

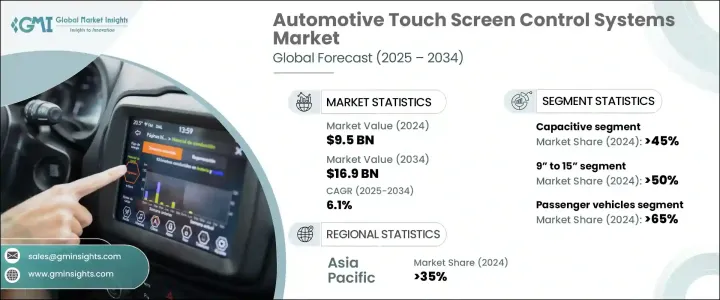

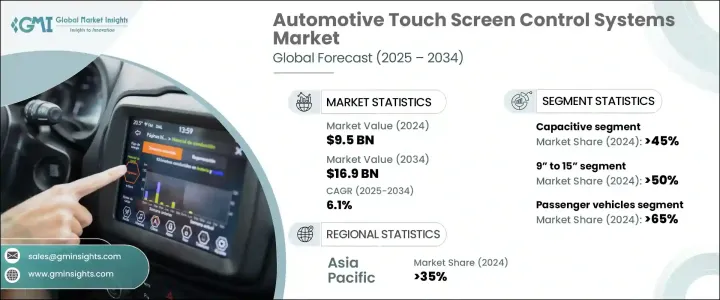

2024 年全球汽車觸控螢幕控制系統市場價值為 95 億美元,預計 2025 年至 2034 年期間的複合年成長率為 6.1%。市場擴張的動力來自於現代車輛對先進觸控介面日益成長的需求,尤其是電動車 (EV) 和連網汽車技術的迅速普及。汽車製造商優先考慮使用者友好、高性能的觸控螢幕系統,以增強駕駛體驗並簡化車輛功能。

隨著汽車產業經歷數位轉型,觸控螢幕控制系統已成為下一代汽車的核心部件。電動車的興起極大地影響了專用觸控介面的發展,這些介面可以實現電池監控、再生煞車和節能氣候設定。汽車製造商還整合了人工智慧 (AI) 和基於雲端的技術來增強觸控螢幕功能,實現無縫連接、個人化設定和預測控制。向數位駕駛艙的轉變進一步推動了市場成長,製造商專注於透過高解析度觸控螢幕提供複雜的資訊娛樂系統、互動式車輛控制和增強的安全功能。消費者對直覺、多功能介面的偏好日益增加,導致對電容式觸控螢幕的需求激增,因為電容式觸控螢幕具有卓越的反應能力、多點觸控功能和清晰的顯示品質。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 95億美元 |

| 預測值 | 169億美元 |

| 複合年成長率 | 6.1% |

汽車觸控螢幕市場根據觸控螢幕技術進行細分,其中電容式觸控螢幕在 2024 年佔據 45% 的主導市場佔有率。與需要物理壓力來記錄輸入的電阻式觸控螢幕不同,電容式觸控螢幕可提供流暢無縫的交互,使其成為資訊娛樂系統、導航控制和氣候設定的首選。這些先進的觸控螢幕不僅提高了使用者的便利性,而且還透過實現光滑、無按鈕的儀表板增強了車輛的美觀性。

螢幕尺寸是另一個關鍵的市場細分,9 吋至 15 吋的螢幕尺寸將在 2024 年佔據 50% 的市場佔有率。這一尺寸範圍已成為現代車輛的標準,在可用性和可視性之間實現了完美平衡。中型觸控螢幕廣泛用於車載導航、媒體控制和系統設置,提供沉浸式但非侵入式的介面。汽車製造商正在利用人工智慧驅動的功能、可自訂的顯示器和語音輔助控制來增強觸控螢幕功能,確保高度互動和個人化的用戶體驗。

2024 年,亞太地區將佔據汽車觸控螢幕控制系統市場的 35% 佔有率,中國將成為主要的成長動力。受電動汽車產業蓬勃發展和智慧汽車技術投資不斷增加的推動,預計到 2034 年,該國的電動車產業將創收 30 億美元。隨著汽車製造商將先進的數位介面整合到電動車和連網汽車中,對人工智慧大尺寸觸控螢幕的推動正在加速採用率。隨著競爭加劇,市場參與者專注於創新,結合手勢識別、觸覺回饋和擴增實境 (AR) 顯示等尖端功能,以在不斷發展的汽車領域保持領先地位。

目錄

第1章:方法論與範圍

- 研究設計

- 研究方法

- 資料收集方法

- 基礎估算與計算

- 基準年計算

- 市場評估的主要趨勢

- 預測模型

- 初步研究和驗證

- 主要來源

- 資料探勘來源

- 市場範圍和定義

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商

- 製造商

- 系統整合商

- 技術提供者

- 最終用途

- 供應商格局

- 利潤率分析

- 技術與創新格局

- 專利分析

- 重要新聞和舉措

- 成本分析

- 監管格局

- 衝擊力

- 成長動力

- 車載資訊娛樂需求不斷成長

- 電動車和連網汽車的普及率不斷上升

- 觸控螢幕技術日益進步

- 直覺式觸控控制和語音輔助介面的採用率不斷上升

- 產業陷阱與挑戰

- 耐用性和可靠性問題

- 先進觸控螢幕系統成本高昂

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按觸控螢幕,2021 年至 2034 年

- 主要趨勢

- 電阻式

- 紅外線的

- 電容式

- 光學成像

第6章:市場估計與預測:依螢幕尺寸,2021 年至 2034 年

- 主要趨勢

- 低於 9 英寸

- 9英寸至15英寸

- 15吋以上

第7章:市場估計與預測:依車型,2021 - 2034 年

- 主要趨勢

- 搭乘用車

- 掀背車

- 轎車

- 越野車

- 商用車

- 輕型商用車(LCV)

- 中型商用車(MCV)

- 重型商用車(HCV)

第 8 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 資訊娛樂系統

- 導航系統

- 氣候控制

- 駕駛員輔助功能

- 車輛診斷

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第10章:公司簡介

- Analog

- AU Optronics

- Bosch

- Continental

- Denso

- Dingtouch

- Eaton

- Harman

- Infineon

- Kyocera

- LG Display

- Magneti Marelli

- Microchip

- Nippon Seiki

- Pioneer

- Sharp

- Synaptics

- TPK Holding

- Valeo

- Visteon

The Global Automotive Touch Screen Control Systems Market was valued at USD 9.5 billion in 2024 and is projected to grow at a CAGR of 6.1% between 2025 and 2034. The market expansion is driven by the increasing demand for advanced touch interfaces in modern vehicles, particularly with the rapid adoption of electric vehicles (EVs) and connected car technologies. Automakers are prioritizing user-friendly, high-performance touchscreen systems to enhance the driving experience and streamline vehicle functionalities.

As the automotive industry undergoes a digital transformation, touchscreen control systems have become a central component of next-generation vehicles. The rise of EVs has significantly influenced the development of specialized touch interfaces that facilitate battery monitoring, regenerative braking, and energy-efficient climate settings. Automakers are also integrating artificial intelligence (AI) and cloud-based technologies to enhance touchscreen capabilities, allowing for seamless connectivity, personalized settings, and predictive controls. The shift towards digital cockpits is further fueling market growth, with manufacturers focusing on delivering sophisticated infotainment systems, interactive vehicle controls, and enhanced safety features through high-resolution touchscreens. Increasing consumer preference for intuitive, multi-functional interfaces has led to a surge in demand for capacitive touch panels, which offer superior responsiveness, multi-touch capabilities, and crystal-clear display quality.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.5 Billion |

| Forecast Value | $16.9 Billion |

| CAGR | 6.1% |

The automotive touch screen market is segmented based on touch panel technology, with capacitive touch panels holding a dominant 45% market share in 2024. Unlike resistive touch panels, which require physical pressure to register inputs, capacitive touch screens provide a smooth and seamless interaction, making them the preferred choice for infotainment systems, navigation controls, and climate settings. These advanced touchscreens not only improve user convenience but also enhance vehicle aesthetics by enabling sleek, button-free dashboards.

Screen size is another key market segmentation, with the 9" to 15" category accounting for a 50% market share in 2024. This size range has become the standard for modern vehicles, offering the perfect balance between usability and visibility. Mid-sized touchscreens are widely used for in-car navigation, media control, and system settings, providing an immersive yet non-intrusive interface. Automakers are leveraging AI-driven features, customizable displays, and voice-assisted controls to enhance touchscreen functionality, ensuring a highly interactive and personalized user experience.

Asia Pacific accounted for a significant 35% share of the Automotive Touch Screen Control Systems Market in 2024, with China emerging as a major growth driver. The country is expected to generate USD 3 billion by 2034, fueled by its booming electric vehicle sector and increasing investment in smart vehicle technologies. The push for AI-powered, large-format touchscreens is accelerating adoption rates as automakers integrate advanced digital interfaces into EVs and connected vehicles. As competition intensifies, market players are focusing on innovation, incorporating cutting-edge features such as gesture recognition, haptic feedback, and augmented reality (AR) displays to stay ahead in the evolving automotive landscape.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Suppliers

- 3.1.2 Manufacturers

- 3.1.3 System Integrators

- 3.1.4 Technology Providers

- 3.1.5 End Use

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Cost analysis

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Growing demand for in-vehicle infotainment

- 3.9.1.2 Rising adoption of electric and connected vehicles

- 3.9.1.3 Increasing advancements in touchscreen technology

- 3.9.1.4 Rising adoption of intuitive touch controls and voice-assisted interfaces

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Durability and reliability concerns

- 3.9.2.2 High cost of advanced touchscreen systems

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Touch Panel, 2021 – 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Resistive

- 5.3 Infrared

- 5.4 Capacitive

- 5.5 Optical imaging

Chapter 6 Market Estimates & Forecast, By Screen Size, 2021 – 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Below 9”

- 6.3 9” to 15”

- 6.4 Above 15”

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Passenger vehicles

- 7.2.1 Hatchback

- 7.2.2 Sedan

- 7.2.3 SUV

- 7.3 Commercial vehicles

- 7.3.1 Light Commercial Vehicles (LCV)

- 7.3.2 Medium Commercial Vehicles (MCV)

- 7.3.3 Heavy Commercial Vehicles (HCV)

Chapter 8 Market Estimates & Forecast, By Application, 2021 – 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Infotainment systems

- 8.3 Navigation systems

- 8.4 Climate control

- 8.5 Driver assistance features

- 8.6 Vehicle diagnostics

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Analog

- 10.2 AU Optronics

- 10.3 Bosch

- 10.4 Continental

- 10.5 Denso

- 10.6 Dingtouch

- 10.7 Eaton

- 10.8 Harman

- 10.9 Infineon

- 10.10 Kyocera

- 10.11 LG Display

- 10.12 Magneti Marelli

- 10.13 Microchip

- 10.14 Nippon Seiki

- 10.15 Pioneer

- 10.16 Sharp

- 10.17 Synaptics

- 10.18 TPK Holding

- 10.19 Valeo

- 10.20 Visteon