|

市場調查報告書

商品編碼

1708140

再製造汽車零件市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Remanufactured Automotive Parts Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

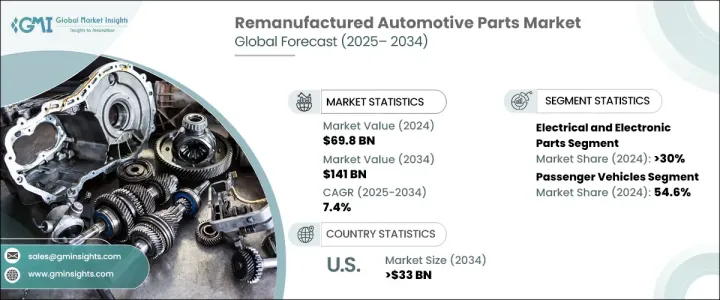

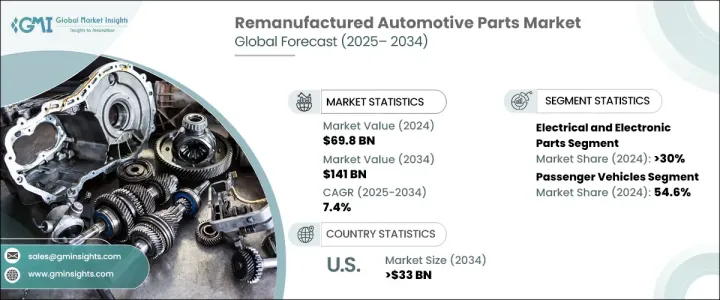

2024 年全球再製汽車零件市場規模達到 698 億美元,預計 2025 年至 2034 年期間的複合年成長率為 7.4%。由於技術進步、環境效益和成本效益等因素的共同作用,對再製造汽車零件的需求正在激增。隨著永續性問題和循環經濟原則的日益受到重視,再製造零件正成為新零件的首選替代品。這些組件經過嚴格的翻新過程,確保它們達到或超過原始設備製造商 (OEM) 標準,同時減少材料浪費和能源消耗。因此,汽車製造商和消費者都認知到再製造汽車零件的優勢,從而推動了市場大幅擴張。

自動化、數位化和材料科學創新的快速融合徹底改變了再製造過程,並提高了產品品質和可靠性。借助現代技術,再製造商可以有效地將舊零件恢復到接近新的狀態,確保最佳性能和使用壽命。電動車 (EV) 和混合動力車的日益普及進一步增強了這一趨勢,因為它們依賴更多的複雜零件。此外,政府對排放和永續發展措施的嚴格監管正在推動汽車製造商投資再製造解決方案,從而促進市場成長。隨著越來越多的車主尋求經濟高效且環保的新零件替代品,高品質再生零件以具有競爭力的價格不斷增加,這影響著消費者的購買決策。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 698億美元 |

| 預測值 | 1410億美元 |

| 複合年成長率 | 7.4% |

再製造汽車零件市場分為幾個主要零件類別,包括電氣和電子零件、引擎、變速箱、車輪和煞車。 2024年,電氣和電子零件領域佔最大的市場佔有率,佔30%。對感測器、電動傳動系統和資訊娛樂系統等先進車輛技術的日益依賴,增加了對再製造電氣和電子元件的需求。這些零件提供了一種永續的方法來延長車輛系統的使用壽命,同時降低維修和更換成本。再製造電子產品的整合不僅提高了車輛效率,而且還顯著減少了電子垃圾,進一步推動了市場的發展。

按車輛類型分類,再製造汽車零件市場包括乘用車和商用車。 2024 年,乘用車市場佔據主導地位,佔有 54.6% 的佔有率。這種成長很大程度上得益於延長汽車零件使用壽命和減少汽車生產碳足跡的努力。再生起動機、交流發電機和高壓電池的日益普及與產業向循環經濟的轉型相一致,在循環經濟中,重複使用和翻新零件可最大限度地減少對環境的影響並節約寶貴的資源。隨著汽車製造商優先考慮永續生產和維修解決方案,乘用車領域對再製造零件的需求預計將加速成長。

2024 年,北美佔據再製汽車零件市場的 35% 佔有率,其中美國將成為主要貢獻者。預測顯示,隨著人們越來越關注永續性、成本效益以及OEM支持的再製造計劃,美國市場規模到 2034 年將達到 330 億美元。主要汽車製造商正在擴大其再製造計劃,提供各種各樣的再製造零件以滿足不斷成長的需求。憑藉嚴格的環境政策、強大的售後市場行業以及不斷增強的消費者意識,北美仍然是推動全球再製造汽車零件市場擴張的關鍵地區。

目錄

第1章:方法論與範圍

- 研究設計

- 研究方法

- 資料收集方法

- 基礎估算與計算

- 基準年計算

- 市場評估的主要趨勢

- 預測模型

- 初步研究和驗證

- 主要來源

- 資料探勘來源

- 市場範圍和定義

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 汽車製造商

- 第三方再製造商

- 逆向物流供應商

- 最終用途

- 供應商格局

- 利潤率分析

- 技術與創新格局

- 專利分析

- 重要新聞和舉措

- 成本明細

- 價格趨勢

- 監管格局

- 衝擊力

- 成長動力

- 改善再製流程

- 更嚴格的環境政策

- 越來越重視減少浪費

- 透過使用再製造零件來節省更多成本

- 產業陷阱與挑戰

- 消費者的負面看法

- 供應鏈複雜性

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依組件,2021 年至 2034 年

- 主要趨勢

- 電氣和電子零件

- 引擎

- 傳染

- 車輪和煞車

- 其他

第6章:市場估計與預測:依車型,2021 - 2034 年

- 主要趨勢

- 搭乘用車

- 掀背車

- 轎車

- 越野車

- 商用車

- 輕型商用車(LCV)

- 中型商用車(MCV)

- 重型商用車(HCV)

第7章:市場估計與預測:依供應量,2021 - 2034 年

- 主要趨勢

- OEM

- 售後市場

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第9章:公司簡介

- Andre Niermann

- BBB Industries

- BorgWarner

- Bosch

- Cardone

- Carwood

- Caterpillar

- Denso

- Detroit Diesel

- Eaton

- Jasper Engines & Transmissions

- Lucas Electrical

- Marelli

- Maval

- Motorcar Parts of America

- NAPA

- Stellantis

- Teamec

- Valeo

- ZF

The Global Remanufactured Automotive Parts Market reached USD 69.8 billion in 2024 and is projected to grow at a CAGR of 7.4% between 2025 and 2034. The demand for remanufactured automotive parts is surging due to a combination of technological advancements, environmental benefits, and cost-efficiency. As sustainability concerns and circular economy principles gain momentum, remanufactured components are emerging as a preferred alternative to new parts. These components undergo rigorous refurbishment processes, ensuring they meet or exceed original equipment manufacturer (OEM) standards while reducing material waste and energy consumption. As a result, automakers and consumers alike are recognizing the advantages of remanufactured automotive parts, driving substantial market expansion.

The rapid integration of automation, digitalization, and material science innovations has revolutionized the remanufacturing process, enhancing product quality and reliability. With modern technology, remanufacturers can efficiently restore used parts to near-new condition, ensuring optimal performance and longevity. This trend is further bolstered by the rising adoption of electric vehicles (EVs) and hybrid models, which rely on a greater number of sophisticated components. Additionally, stringent government regulations on emissions and sustainability initiatives are pushing automakers to invest in remanufacturing solutions, reinforcing market growth. The increasing availability of high-quality remanufactured parts at competitive prices is influencing consumer purchasing decisions as more vehicle owners seek cost-effective and environmentally friendly alternatives to new components.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $69.8 Billion |

| Forecast Value | $141 Billion |

| CAGR | 7.4% |

The remanufactured automotive parts market is segmented into key component categories, including electrical and electronic parts, engines, transmissions, wheels, and brakes. In 2024, the electrical and electronic parts segment held the largest market share, accounting for 30%. The growing reliance on advanced vehicle technologies, such as sensors, electric drivetrains, and infotainment systems, has amplified the demand for remanufactured electrical and electronic components. These components offer a sustainable way to extend the lifespan of vehicle systems while lowering repair and replacement costs. The integration of remanufactured electronics not only enhances vehicle efficiency but also significantly reduces electronic waste, further driving the market forward.

By vehicle type, the remanufactured automotive parts market includes passenger and commercial vehicles. The passenger vehicle segment dominated the market in 2024, securing a 54.6% share. This growth is largely driven by efforts to extend the longevity of automotive components and reduce the carbon footprint of vehicle production. The increasing adoption of remanufactured starters, alternators, and high-voltage batteries aligns with the industry's transition toward a circular economy, where reusing and refurbishing parts minimizes environmental impact and conserves valuable resources. With automakers prioritizing sustainable production and repair solutions, the demand for remanufactured parts in the passenger vehicle sector is expected to accelerate.

North America held a significant 35% share of the remanufactured automotive parts market in 2024, with the U.S. emerging as the dominant contributor. Projections indicate that the U.S. market will reach USD 33 billion by 2034, fueled by an increasing focus on sustainability, cost-effectiveness, and OEM-backed remanufacturing programs. Major automotive manufacturers are expanding their remanufacturing initiatives, offering a diverse range of remanufactured components to cater to rising demand. With stringent environmental policies, a strong aftermarket industry, and growing consumer awareness, North America remains a key region driving the global expansion of the remanufactured automotive parts market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Automakers

- 3.1.2 Third-party remanufacturers

- 3.1.3 Reverse logistics providers

- 3.1.4 End use

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Cost breakdown

- 3.8 Price trend

- 3.9 Regulatory landscape

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Improving remanufacturing processes

- 3.10.1.2 Stricter environmental policies

- 3.10.1.3 Growing emphasis on reducing waste

- 3.10.1.4 Increasing cost savings by using remanufactured parts

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 Negative consumer perception

- 3.10.2.2 Supply chain complexity

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 – 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Electrical and electronic parts

- 5.3 Engine

- 5.4 Transmission

- 5.5 Wheels and brakes

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Passenger vehicles

- 6.2.1 Hatchback

- 6.2.2 Sedan

- 6.2.3 SUV

- 6.3 Commercial vehicles

- 6.3.1 Light Commercial Vehicles (LCV)

- 6.3.2 Medium Commercial Vehicles (MCV)

- 6.3.3 Heavy Commercial Vehicles (HCV)

Chapter 7 Market Estimates & Forecast, By Supply, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 OEM

- 7.3 Aftermarket

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.3.7 Nordics

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Southeast Asia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 UAE

- 8.6.2 South Africa

- 8.6.3 Saudi Arabia

Chapter 9 Company Profiles

- 9.1 Andre Niermann

- 9.2 BBB Industries

- 9.3 BorgWarner

- 9.4 Bosch

- 9.5 Cardone

- 9.6 Carwood

- 9.7 Caterpillar

- 9.8 Denso

- 9.9 Detroit Diesel

- 9.10 Eaton

- 9.11 Jasper Engines & Transmissions

- 9.12 Lucas Electrical

- 9.13 Marelli

- 9.14 Maval

- 9.15 Motorcar Parts of America

- 9.16 NAPA

- 9.17 Stellantis

- 9.18 Teamec

- 9.19 Valeo

- 9.20 ZF