|

市場調查報告書

商品編碼

1699411

廚房電器市場機會、成長動力、產業趨勢分析及2025-2034年預測Kitchen Appliances Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

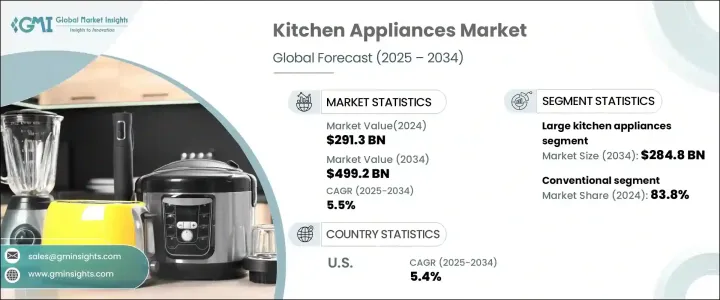

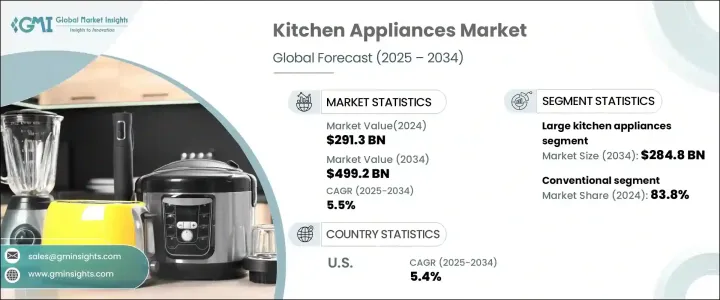

2024 年全球廚房電器市場規模達到 2,913 億美元,預計 2025 年至 2034 年期間的複合年成長率為 5.5%。對更有效率、技術更先進、方便用戶使用的電器的需求激增推動了這一成長。消費者越來越追求廚房的便利性、速度和卓越的性能,這推動了向更智慧、更互聯的解決方案的轉變。大型和小型家電的創新正在改變家庭的運作方式,提供符合日益成長的永續發展趨勢的節能和直覺的選擇。隨著人們對環境問題的認知不斷提高,消費者開始有意識地選擇投資節能產品,以減少電力消耗和降低碳足跡。此外,中產階級人口的不斷擴大、可支配收入的不斷提高以及發展中經濟體的快速城市化也促進了現代廚房用具的普及。這些因素,加上持續的技術進步,使得廚房電器市場成為全球經濟的重要參與者。

市場分為大型和小型廚房電器,其中大型電器部分在 2024 年創造 1557 億美元的產值,預計到 2034 年將達到 2848 億美元。大型廚房電器,包括冰箱、烤箱和洗碗機,被認為是必不可少的長期投資,具有耐用性和先進的功能。消費者優先考慮這些高價商品,因為它們能夠提高便利性、提高烹飪效率並降低能源消耗。現代大型家電融合了智慧感測器、觸控控制和節能技術等功能,吸引了追求性能和永續性的技術買家。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 2913億美元 |

| 預測值 | 4992億美元 |

| 複合年成長率 | 5.5% |

廚房電器也分為傳統型和智慧型。 2024 年,傳統家電佔據了 83.8% 的市場佔有率,預計到 2034 年將以 5.2% 的穩定速度成長。儘管人們對智慧廚房技術的興趣日益濃厚,但爐灶、烤箱和傳統冰箱等傳統家電以其可靠性、成熟的性能和易用性仍然廣受歡迎。這些設備繼續保持強大的吸引力,尤其是對於喜歡熟悉的、經過時間考驗的解決方案的消費者而言。製造商正在將智慧功能融入傳統設計中,提供將先進功能與傳統模型的可靠性相結合的混合選項。

美國廚房電器市場正以每年 5.4% 的速度擴張,這得益於不斷提升整體用戶體驗的智慧技術的普及。隨著消費者追求便利性和省時的功能,製造商正在透過創新來簡化烹飪、清潔和食物儲存。語音控制、遠端監控和基於人工智慧的功能的整合正在重塑廚房電器的未來,使其更加直覺、更能響應用戶偏好。隨著消費者偏好的變化以及對智慧、永續解決方案的日益重視,廚房電器市場將在未來十年實現顯著成長。

目錄

第1章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測參數

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 零售商

- 衝擊力

- 成長動力

- 可支配所得增加

- 家電技術進步

- 改變消費者的生活方式

- 產業陷阱與挑戰

- 經濟衰退

- 競爭激烈的市場

- 成長動力

- 消費者購買行為分析

- 人口趨勢

- 影響購買決策的因素

- 消費者產品採用

- 首選配銷通路

- 首選價格範圍

- 成長潛力分析

- 監管格局

- 定價分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依產品類型,2021 年至 2034 年

- 主要趨勢

- 大型廚房電器

- 烹飪用具

- 冰箱

- 洗碗機

- 烤箱

- 其他(抽油煙機等)

- 廚房小家電

- 咖啡機

- 攪拌機

- 食品加工機

- 烤麵包機

- 榨汁機

- 電熱水壺

- 電炸鍋

- 其他

第6章:市場估計與預測:按類型,2021 年至 2034 年

- 主要趨勢

- 聰明的

- 傳統的

第7章:市場估計與預測:以價格,2021 年至 2034 年

- 主要趨勢

- 低的

- 中等的

- 高的

第 8 章:市場估計與預測:按安裝量 2021 年至 2034 年

- 主要趨勢

- 室內的

- 戶外的

第9章:市場估計與預測:依最終用途 2021 – 2034

- 主要趨勢

- 住宅

- 商業的

- 餐廳

- 飯店

- 自助餐廳

- 餐飲服務

- 零售

- 其他(機構廚房等)

第 10 章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 線上

- 電子商務網站

- 公司網站

- 離線

- 專賣店

- 個別商店

- 其他

第 11 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第12章:公司簡介

- BSH Home Appliances Group

- Electrolux AB

- Groupe SEB

- Haier Group Corporation

- HISENSE Group

- Hitachi Appliances Inc.

- LG Electronics

- Midea Group Co., Ltd.

- Panasonic Corporation

- Robert Bosch Gmbh

- Samsung electronics

- Sharp Corporation

- Toshiba Corporation

- Voltas

- Whirlpool corporation

The Global Kitchen Appliances Market reached USD 291.3 billion in 2024 and is projected to grow at a CAGR of 5.5% between 2025 and 2034. The surge in demand for more efficient, technologically advanced, and user-friendly appliances is driving this growth. Consumers are increasingly seeking convenience, speed, and superior performance in the kitchen, which has fueled the shift toward smarter, more connected solutions. Innovations in both large and small appliances are transforming the way households function, providing energy-efficient and intuitive options that align with growing sustainability trends. As awareness around environmental concerns increases, consumers are making conscious choices to invest in energy-efficient products that reduce electricity consumption and lower carbon footprints. Furthermore, the expanding middle-class population, rising disposable incomes, and rapid urbanization across developing economies are contributing to the increased adoption of modern kitchen appliances. These factors, combined with ongoing technological advancements, are making the kitchen appliances market a key player in the global economy.

The market is segmented into large and small kitchen appliances, with the large appliances segment generating USD 155.7 billion in 2024 and expected to reach USD 284.8 billion by 2034. Large kitchen appliances, including refrigerators, ovens, and dishwashers, are considered essential, long-term investments that offer durability and advanced functionality. Consumers prioritize these high-ticket items due to their ability to enhance convenience, improve cooking efficiency, and reduce energy consumption. Modern large appliances incorporate features such as smart sensors, touch controls, and energy-saving technologies that appeal to tech-savvy buyers seeking performance and sustainability.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $291.3 Billion |

| Forecast Value | $499.2 Billion |

| CAGR | 5.5% |

Kitchen appliances are also categorized into conventional and smart segments. In 2024, conventional appliances dominated the market with an 83.8% share and are expected to grow at a steady rate of 5.2% through 2034. Despite the rising interest in smart kitchen technology, conventional appliances such as stoves, ovens, and traditional refrigerators remain widely popular due to their reliability, proven performance, and ease of use. These appliances continue to hold strong appeal, especially among consumers who prefer familiar, time-tested solutions. Manufacturers are integrating smart capabilities into conventional designs, offering hybrid options that combine advanced functionality with the reliability of traditional models.

The US kitchen appliances market is expanding at an annual rate of 5.4%, driven by the growing adoption of smart technologies that enhance the overall user experience. As consumers seek convenience and time-saving features, manufacturers are responding with innovations that streamline cooking, cleaning, and food storage. The integration of voice control, remote monitoring, and AI-based functionalities is reshaping the future of kitchen appliances, making them more intuitive and responsive to user preferences. With changing consumer preferences and an increasing emphasis on smart, sustainable solutions, the kitchen appliances market is poised for significant growth over the next decade.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast parameters

- 1.4 Data sources

- 1.4.1 Primary

- 1.5 Secondary

- 1.5.1.1 Paid sources

- 1.5.1.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.1.7 Retailers

- 3.2 Impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising disposable income

- 3.2.1.2 Technological advancement in appliances

- 3.2.1.3 Changing consumers lifestyles

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Economic downturn

- 3.2.2.2 Highly competitive market

- 3.2.1 Growth drivers

- 3.3 Consumer buying behavior analysis

- 3.3.1 Demographic trends

- 3.3.2 Factors Affecting Buying Decision

- 3.3.3 Consumer Product Adoption

- 3.3.4 Preferred Distribution Channel

- 3.3.5 Preferred Price Range

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Pricing analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 – 2034 (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Large kitchen appliances

- 5.2.1 Cooking appliances

- 5.2.2 Refrigerator

- 5.2.3 Dishwasher

- 5.2.4 Ovens

- 5.2.5 Others (Range hood, etc.)

- 5.3 Small kitchen appliances

- 5.3.1 Coffee makers

- 5.3.2 Blenders

- 5.3.3 Food processors

- 5.3.4 Toasters

- 5.3.5 Juicers

- 5.3.6 Electric kettles

- 5.3.7 Electric deep fryers

- 5.3.8 Others

Chapter 6 Market Estimates & Forecast, By Type, 2021 – 2034, (USD Billion) (Million units)

- 6.1 Key trends

- 6.2 Smart

- 6.3 Conventional

Chapter 7 Market Estimates & Forecast, By Price, 2021 – 2034, (USD Billion) (Million units)

- 7.1 Key trends

- 7.2 Low

- 7.3 Medium

- 7.4 High

Chapter 8 Market Estimates & Forecast, By Installation 2021 – 2034, (USD Billion) (Million units)

- 8.1 Key trends

- 8.2 Indoor

- 8.3 Outdoor

Chapter 9 Market Estimates & Forecast, By End Use 2021 – 2034, (USD Billion) (Million units)

- 9.1 Key trends

- 9.2 Residential

- 9.3 Commercial

- 9.3.1 Restaurants

- 9.3.2 Hotels

- 9.3.3 Cafeterias

- 9.3.4 Catering services

- 9.3.5 Retail

- 9.3.6 Others (Institutional kitchens, etc.)

Chapter 10 Market Estimates & Forecast, By Distribution channel, 2021 – 2034, (USD Billion) (Million units)

- 10.1 Key trends

- 10.2 Online

- 10.2.1 E-Commerce Site

- 10.2.2 Company website

- 10.3 Offline

- 10.3.1 Specialty stores

- 10.3.2 Individual stores

- 10.3.3 Others

Chapter 11 Market Estimates & Forecast, By Region, 2021 – 2034, (USD Billion) (Million Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Japan

- 11.4.3 India

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 12.1 BSH Home Appliances Group

- 12.2 Electrolux AB

- 12.3 Groupe SEB

- 12.4 Haier Group Corporation

- 12.5 HISENSE Group

- 12.6 Hitachi Appliances Inc.

- 12.7 LG Electronics

- 12.8 Midea Group Co., Ltd.

- 12.9 Panasonic Corporation

- 12.10 Robert Bosch Gmbh

- 12.11 Samsung electronics

- 12.12 Sharp Corporation

- 12.13 Toshiba Corporation

- 12.14 Voltas

- 12.15 Whirlpool corporation