|

市場調查報告書

商品編碼

1797873

醫療穿戴式注射器市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Medical Wearable Injector Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

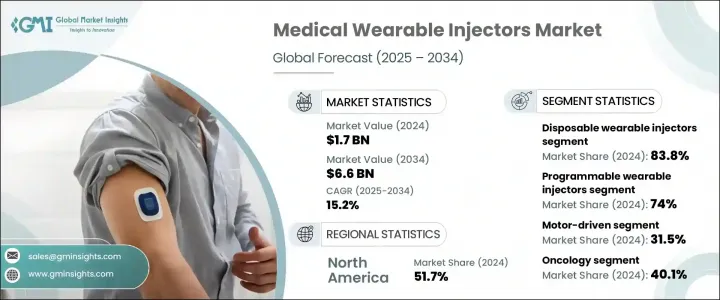

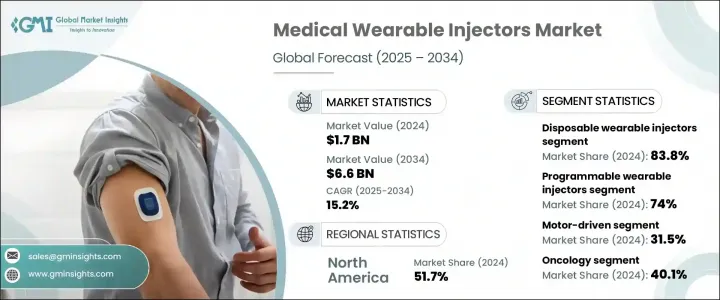

2024 年全球醫用穿戴注射器市場價值為 17 億美元,預計到 2034 年將以 15.2% 的複合年成長率成長,達到 66 億美元。這種快速成長源於多種因素,包括癌症、糖尿病和心血管疾病等慢性病發病率的上升,對家庭醫療保健解決方案的偏好日益增加,以及自我給藥系統的加速採用。

穿戴式科技和生物製劑的持續發展進一步推動了市場擴張。這些設備經過專門設計,穿戴式在身上,長時間皮下注射高劑量藥物,為患者提供便利,並提高治療順從性。它們特別適用於生物製劑和不適合傳統注射器或標準自動注射器的高劑量注射劑。市場格局受到日益成長的需求的影響,這些解決方案兼具易用性、精準度和患者舒適度,這使得穿戴式注射器成為現代藥物輸送方式不可或缺的一部分。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 17億美元 |

| 預測值 | 66億美元 |

| 複合年成長率 | 15.2% |

根據設備類型,市場分為可編程穿戴式注射器和非可編程大容量注射器。可程式設備在2024年佔據了約74%的市場佔有率,這得益於其能夠提供精準劑量、適應患者特定需求以及支援複雜生物製劑。預計到2034年,該細分市場的規模將超過51億美元,在分析期間的複合年成長率為15.6%。其先進的功能使其在慢性病管理中尤其具有吸引力,因為持續精準的藥物輸送至關重要。相較之下,非可編程大容量注射器細分市場預計將以13.8%的複合年成長率成長,這得益於其價格實惠、操作簡單以及在大容量給藥中擴大以預充式和一次性形式使用而受到青睞。

從技術角度來看,市場包括馬達驅動、彈簧驅動、膨脹電池驅動、旋轉幫浦和其他系統。馬達驅動注射器在2024年佔據了最大的市場佔有率,達到31.5%,這得益於其卓越的精度、處理高黏度生物製劑的能力以及與可編程模型的頻繁整合。其性能優勢在於,無論藥物的黏度或體積如何,都能以一致、可控的速率輸送藥物,這使得它們在慢性病和罕見疾病治療中使用的複雜藥物的給藥方面非常有效。

從應用角度來看,腫瘤學在2024年佔據40.1%的市場佔有率,佔據領先地位。這個領域佔據主導地位的因素包括:全球癌症負擔的增加、生物製劑在癌症治療中的接受度不斷提高,以及人們越來越傾向於在家給藥以減少對醫院的依賴。心血管和自體免疫疾病應用也與腫瘤學一起佔據了相當大的市場佔有率,約佔總市場價值的85%。在這些治療領域,穿戴式針筒兼具便利性和提高患者依從性的雙重優勢,尤其適用於長期和高劑量的藥物治療方案。

從地區來看,北美佔最高佔有率,2024 年為 51.7%。美國市場在 2021 年達到 12 億美元,2022 年達到 10 億美元,隨後在 2023 年下降至 9.672 億美元,2024 年下降至 8.767 億美元。近期下降主要與主要產品失去獨佔權有關;然而,排除這一因素,大多數市場參與者仍保持了積極的成長趨勢。北美的領先地位得益於其慢性病的高發病率、先進的醫療基礎設施以及創新藥物輸送技術的廣泛採用。美國和加拿大擁有大量需要長期治療的患者,這使得穿戴式注射器對患者和醫療保健提供者來說都是一個有吸引力的解決方案。

為市場成長做出貢獻的知名公司包括大型製藥和醫療器材製造商,以及專業的藥物傳輸技術公司。這些公司正在積極投資研發,以開發具有增強功能(例如無線連接、更高的藥物相容性和方便用戶使用介面)的下一代穿戴式注射器,從而確保市場在未來十年持續擴張。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 慢性病發生率不斷上升

- 轉向居家醫療保健

- 生物製劑需求不斷成長

- 患者對微創設備的偏好

- 全球人口老化

- 產業陷阱與挑戰

- 穿戴式注射器成本高

- 技術和設計挑戰

- 市場機會

- 生物製劑和大分子藥物的成長

- 居家照護和遠端監控的偏好日益成長

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 比較分析:患者對手持式自動注射器與穿戴式大容量注射器的偏好

- 技術進步

- 當前的技術趨勢

- 新興技術

- 技術採用率

- 供應鏈分析

- 報銷場景

- 穿戴式注射器的成功實施

- 醫療保健成本降低分析

- 消費者行為趨勢

- 產品線分析

- 2024 年全球範圍內按設備類型分類的定價分析

- 品牌分析

- 頂尖公司的銷售模式

- 安進

- 屋宇署

- 頂尖公司的商業模式

- 安進

- 屋宇署

- 其他公司

- 市場進入策略分析

- 波特的分析

- PESTEL分析

- 未來市場趨勢

- 差距分析

- 正在開發的生物藥物(按治療類別分類)

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 全球的

- 北美洲

- 歐洲

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按設備類型,2021 - 2034 年

- 主要趨勢

- 可編程穿戴式注射器

- 不可編程穿戴式注射器

第6章:市場估計與預測:按使用類型,2021 - 2034 年

- 主要趨勢

- 免洗穿戴式注射器

- 可重複使用的穿戴式注射器

第7章:市場估計與預測:按技術,2021 - 2034 年

- 主要趨勢

- 馬達驅動

- 基於 Spring

- 擴充電池

- 旋轉泵

- 其他技術

第8章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 腫瘤學

- 心血管疾病

- 自體免疫疾病

- 傳染病

- 其他應用

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 世界其他地區

第10章:公司簡介

- Amgen

- Becton Dickinson (BD)

- CCBio

- Enable Injections

- Gerresheimer

- LTS Lohmann Therapie-Systeme AG

- Nemera

- Sencoboz

- Stevanato Group

- West Pharmaceutical Services, Inc.

- Ypsomed

The Global Medical Wearable Injector Market was valued at USD 1.7 billion in 2024 and is estimated to grow at a CAGR of 15.2% to reach USD 6.6 billion by 2034. This rapid growth stems from multiple factors, including the increasing incidence of chronic illnesses such as cancer, diabetes, and cardiovascular diseases, a rising preference for home-based healthcare solutions, and the accelerating adoption of self-administered drug delivery systems.

The ongoing advancements in wearable technologies and biologics are further strengthening market expansion. These devices are specifically engineered to administer high-volume medications subcutaneously over extended periods while being worn on the body, offering patients convenience and enabling better treatment adherence. They are particularly suited for biologics and large-volume injectables that are unsuitable for conventional syringes or standard auto-injectors. The market landscape is shaped by the growing demand for solutions that combine ease of use, precision, and patient comfort, making wearable injectors an integral part of modern drug delivery approaches.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.7 Billion |

| Forecast Value | $6.6 Billion |

| CAGR | 15.2% |

By device type, the market is categorized into programmable wearable injectors and non-programmable large volume injectors. Programmable devices represented about 74% of the market share in 2024, driven by their ability to deliver accurate doses, adapt to patient-specific needs, and support complex biologics. This segment is forecasted to exceed USD 5.1 billion by 2034, growing at a CAGR of 15.6% over the analysis period. Their advanced features make them particularly appealing for chronic disease management, where consistent and precise drug delivery is essential. In comparison, the non-programmable large volume injector segment is anticipated to grow at a CAGR of 13.8%, favored for its affordability, simple operation, and increasing use in prefilled, disposable formats for high-volume drug administration.

When assessed by technology, the market includes motor-driven, spring-based, expanding battery, rotary pump, and other systems. Motor-driven injectors accounted for the largest market share at 31.5% in 2024, supported by their superior precision, ability to handle high-viscosity biologics, and frequent integration into programmable models. Their performance advantage lies in delivering drugs at consistent, controlled rates regardless of viscosity or volume, making them highly effective for administering complex medications used in chronic and rare disease therapies.

From an application perspective, oncology led with a 40.1% share in 2024. The segment's dominance is fueled by the rising global cancer burden, increased acceptance of biologics in cancer treatment, and a growing preference for home-based administration options that reduce hospital dependency. Cardiovascular and autoimmune disease applications also hold substantial market shares, together with oncology, representing around 85% of the total market value. Across these therapeutic areas, wearable injectors provide the dual benefits of convenience and improved patient compliance, particularly for long-term and high-volume drug regimens.

Regionally, North America commanded the highest share at 51.7% in 2024. The U.S. market recorded USD 1.2 billion in 2021 and USD 1 billion in 2022 before declining to USD 967.2 million in 2023 and USD 876.7 million in 2024. The recent dip is primarily linked to the loss of exclusivity for a major product; however, excluding this factor, most market players maintained positive growth trends. North America's leading position is reinforced by its high prevalence of chronic diseases, advanced healthcare infrastructure, and strong adoption of innovative drug delivery technologies. The U.S. and Canada together account for a significant patient base requiring long-term treatments, making wearable injectors an attractive solution for both patients and healthcare providers.

Prominent companies contributing to market growth include major pharmaceutical and medical device manufacturers, as well as specialized drug delivery technology firms. These players are actively investing in R&D to develop next-generation wearable injectors with enhanced features such as wireless connectivity, improved drug compatibility, and user-friendly interfaces, ensuring the market's continued expansion over the coming decade.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Device type trends

- 2.2.3 Usage type trends

- 2.2.4 Technology trends

- 2.2.5 Application trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing incidence of chronic conditions

- 3.2.1.2 Shift towards home-based healthcare

- 3.2.1.3 Increasing demand for biologics

- 3.2.1.4 Patient preference for minimally invasive devices

- 3.2.1.5 Global aging population

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of wearable injectors

- 3.2.2.2 Technical and design challenges

- 3.2.3 Market opportunities

- 3.2.3.1 Growth in biologics and large-molecule drugs

- 3.2.3.2 Rising preference for at-home care & remote monitoring

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.5 Comparative analysis: Patient preferences for handheld autoinjectors Vs wearable large-volume injectors

- 3.6 Technological advancements

- 3.6.1 Current technological trends

- 3.6.2 Emerging technologies

- 3.6.3 Technology adoption rate

- 3.7 Supply chain analysis

- 3.8 Reimbursement scenario

- 3.8.1 Successful implementation of wearable injectors

- 3.8.2 Healthcare cost reduction analysis

- 3.9 Consumer behaviour trend

- 3.10 Product pipeline analysis

- 3.11 Pricing analysis, by device type, at global level, 2024

- 3.12 Brand analysis

- 3.13 Sales model of top companies

- 3.13.1 Amgen

- 3.13.2 BD

- 3.14 Business model of top companies

- 3.14.1 Amgen

- 3.14.2 BD

- 3.14.3 Other companies

- 3.15 Go-to-market strategy analysis

- 3.16 Porter's analysis

- 3.17 PESTEL analysis

- 3.18 Future market trends

- 3.19 Gap analysis

- 3.20 Biologic medicines in development, by therapeutic categories

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Device Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Programmable wearable injectors

- 5.3 Non-programmable wearable injectors

Chapter 6 Market Estimates and Forecast, By Usage Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Disposable wearable injectors

- 6.3 Reusable wearable injectors

Chapter 7 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Motor-driven

- 7.3 Spring-based

- 7.4 Expanding battery

- 7.5 Rotary pump

- 7.6 Other technologies

Chapter 8 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Oncology

- 8.3 Cardiovascular disease

- 8.4 Autoimmune disease

- 8.5 Infectious disease

- 8.6 Other applications

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Rest of World

Chapter 10 Company Profiles

- 10.1 Amgen

- 10.2 Becton Dickinson (BD)

- 10.3 CCBio

- 10.4 Enable Injections

- 10.5 Gerresheimer

- 10.6 LTS Lohmann Therapie-Systeme AG

- 10.7 Nemera

- 10.8 Sencoboz

- 10.9 Stevanato Group

- 10.10 West Pharmaceutical Services, Inc.

- 10.11 Ypsomed