|

市場調查報告書

商品編碼

1699382

濕紙巾市場機會、成長動力、產業趨勢分析及 2025-2034 年預測Wet Wipes Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

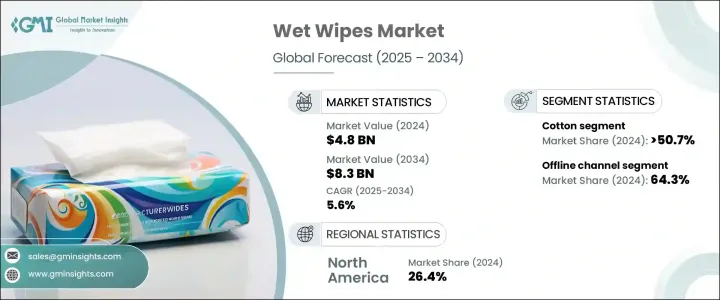

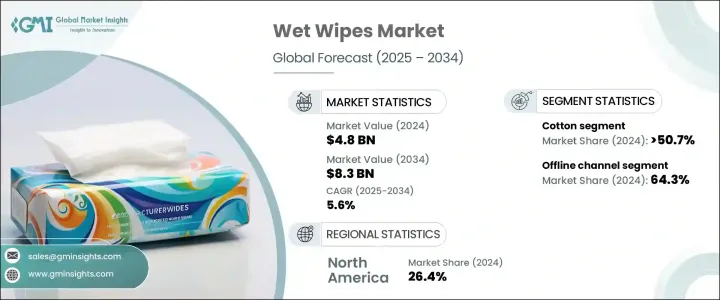

2024 年全球濕紙巾市場價值為 48 億美元,預計 2025 年至 2034 年的複合年成長率為 5.6%。這一強勁成長是由消費者對個人護理和家庭應用中便利、衛生解決方案的需求不斷成長所推動的。隨著城市人口的成長和日常生活節奏的加快,濕紙巾已成為無需用水即可保持清潔的首選解決方案。疫情過後,人們對個人衛生的重視持續推動市場擴張,消費者優先考慮能夠快速、有效率衛生的產品。此外,人們對護膚、永續性和無化學配方的認知不斷提高,正在影響購買決策,導致對環保和可生物分解濕紙巾的需求激增。

隨著製造商不斷創新以滿足消費者對更溫和、更永續的選擇的偏好,市場正在經歷快速轉型。各大品牌紛紛推出注入天然萃取物、經皮膚科測試的成分和抗菌特性的濕紙巾,以滿足注重健康的消費者的需求。一次性濕紙巾的便利性推動了銷售,尤其是適合忙碌生活方式的旅行友善包裝。此外,推廣環保產品的監管措施正在塑造市場趨勢,許多公司專注於可生物分解和無塑膠替代品。製造商和零售商之間的策略合作也推動了競爭性定價和增強的產品可用性,進一步加速了市場滲透。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 48億美元 |

| 預測值 | 83億美元 |

| 複合年成長率 | 5.6% |

就產品類型而言,市場分為個人護理濕巾和家用濕紙巾。個人護理領域引領市場,2024 年創造 34 億美元的收入,預計在預測期內以 5.7% 的複合年成長率成長。日常衛生、護膚和便利性對這些產品的依賴性日益增強,推動了這一成長。嬰兒濕紙巾、臉部濕紙巾、女性衛生濕紙巾和身體清潔濕紙巾由於其實用性和無水使用性而需求量不斷增加。城市生活方式和繁忙的日程進一步鞏固了個人護理濕紙巾作為必需衛生產品的地位。隨著消費者尋求有效、可攜帶的解決方案來保持清潔,這些產品的採用率持續上升。

材料選擇在市場動態中起著至關重要的作用,濕巾通常由棉、不織布和機織布製成。 2024 年,棉花部分在預測期內佔據 5.8% 的市場。棉花的天然和可生物分解的特性使其成為具有環保意識的消費者的一個有吸引力的選擇。它的柔軟性和吸收性使其特別適合用於嬰兒濕紙巾和臉部濕紙巾,滿足了人們對溫和、親膚替代品日益成長的需求。隨著對合成材料和有害化學物質的擔憂日益加劇,消費者正在積極轉向符合他們對永續、無化學物質選擇的偏好的棉質濕紙巾。

2024 年,北美佔據濕紙巾市場的 26.4%,價值 12.7 億美元。由於消費者重視個人和家庭護理的衛生,該地區對濕紙巾的需求持續上升。大型零售商透過提供價格具競爭力的自有品牌濕紙巾來促進市場擴張,使廣大消費者更容易購買這些產品。此外,監管機構正在鼓勵採用更安全、更環保的成分,影響產品配方和行銷策略。旅行裝多用途濕紙巾的需求在美國和加拿大尤為強勁,在這些國家,隨時隨地的衛生解決方案已成為生活方式活躍的消費者的必需品。這些因素共同支持了北美濕紙巾市場的持續成長和發展。

目錄

第1章:方法論與範圍

- 研究設計

- 研究方法

- 資料收集方法

- 基礎估算與計算

- 基準年計算

- 市場估計的主要趨勢

- 預測模型

- 初步研究與驗證

- 主要來源

- 資料探勘來源

- 市場定義

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 定價分析

- 技術與創新格局

- 重要新聞和舉措

- 監管格局

- 製造商

- 經銷商

- 零售商

- 衝擊力

- 成長動力

- 越來越重視衛生

- 便利性和便攜性趨勢

- 衛生法規和標準

- 酒店業蓬勃發展

- 產業陷阱與挑戰

- 監管壓力

- 市場飽和與競爭

- 成長動力

- 成長潛力分析

- 消費者購買行為

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按產品類型,2021 - 2034 年(十億美元)

- 主要趨勢

- 個人護理濕紙巾

- 面巾

- 身體濕紙巾

- 私密濕紙巾

- 嬰兒濕紙巾

- 其他

- 家用濕紙巾

第6章:市場估計與預測:按材料,2021 - 2034 年(十億美元)

- 主要趨勢

- 棉布

- 非織物

- 機織布料

第7章:市場估計與預測:按價格,2021-2034 年(十億美元)

- 主要趨勢

- 低的

- 中等的

- 高的

第8章:市場估計與預測:按包裝尺寸,2021 - 2034 年(十億美元)

- 主要趨勢

- 最多 50 張濕紙巾

- 50-100張濕紙巾

- 超過 100 張濕紙巾

第9章:市場估計與預測:依最終用途,2021 - 2034 年(十億美元)

- 主要趨勢

- 個人

- 商業的

第 10 章:市場估計與預測:按配銷通路,2021 年至 2034 年(十億美元)

- 主要趨勢

- 線上

- 電子商務

- 公司網站

- 離線

- 超市

- 個別商店

- 一元商店

- 其他(專賣店等)

第 11 章:市場估計與預測:按地區,2021 年至 2034 年(十億美元)

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第12章:公司簡介

- Beiersdorf

- Cascades

- Clorox

- Essity

- Estee Lauder

- Johnson & Johnson

- Kimberly-Clark

- Kirkland Signature

- Nice-Pak Products

- PDI

- Procter & Gamble

- Reckitt Benckiser

- Sani Professional

- Seventh Generation

- Unilever

The Global Wet Wipes Market was valued at USD 4.8 billion in 2024 and is projected to expand at a CAGR of 5.6% from 2025 to 2034. This robust growth is fueled by rising consumer demand for convenient, hygienic solutions across personal care and household applications. As urban populations grow and daily routines become increasingly fast-paced, wet wipes have become a go-to solution for maintaining cleanliness without water. The post-pandemic emphasis on personal hygiene continues to drive market expansion, with consumers prioritizing products that offer quick and efficient sanitation. Additionally, heightened awareness of skincare, sustainability, and chemical-free formulations is influencing buying decisions, leading to a surge in demand for eco-friendly and biodegradable wet wipes.

The market is experiencing rapid transformation as manufacturers innovate to meet consumer preferences for gentler, more sustainable options. Brands are introducing wet wipes infused with natural extracts, dermatologically tested ingredients, and antibacterial properties, catering to a health-conscious audience. The convenience of single-use wipes is propelling sales, especially in travel-friendly packaging that appeals to busy lifestyles. Furthermore, regulatory initiatives promoting eco-conscious products are shaping market trends, with many companies focusing on biodegradable and plastic-free alternatives. Strategic collaborations between manufacturers and retailers are also driving competitive pricing and enhanced product availability, further accelerating market penetration.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.8 billion |

| Forecast Value | $8.3 billion |

| CAGR | 5.6% |

In terms of product type, the market is categorized into personal care and household wet wipes. The personal care segment led the market, generating USD 3.4 billion in 2024, and is anticipated to grow at a CAGR of 5.7% over the forecast period. The increasing reliance on these products for daily hygiene, skincare, and convenience fuels this growth. Baby wipes, facial wipes, feminine hygiene wipes, and body cleansing wipes are witnessing heightened demand due to their practicality and waterless application. Urban lifestyles and hectic schedules have further cemented the role of personal care wipes as essential hygiene products. As consumers seek effective, portable solutions to maintain cleanliness, the adoption of these products continues to rise.

Material selection plays a crucial role in market dynamics, with wet wipes commonly made from cotton, non-woven fabrics, and woven fabrics. In 2024, the cotton segment accounted for a 5.8% market share during the forecast period. Cotton's natural and biodegradable properties make it an attractive choice for environmentally conscious consumers. Its softness and absorbency make it particularly suitable for baby wipes and facial wipes, addressing the growing demand for gentle, skin-friendly alternatives. As concerns over synthetic materials and harmful chemicals increase, consumers are actively shifting towards cotton-based wipes that align with their preference for sustainable, chemical-free options.

North America held a 26.4% share of the wet wipes market in 2024, amounting to USD 1.27 billion. The demand for wet wipes continues to rise in this region as consumers emphasize hygiene in both personal and household care. Major retailers are contributing to market expansion by offering competitively priced private-label wet wipes, making them more accessible to a broad consumer base. Additionally, regulatory bodies are encouraging the adoption of safer and eco-friendly ingredients, influencing product formulations and marketing strategies. The demand for travel-sized, multi-use wet wipes is particularly strong in the United States and Canada, where on-the-go hygiene solutions have become a necessity for consumers with dynamic lifestyles. These factors collectively support the continued growth and evolution of the North American wet wipes market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research Approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.3 Pricing analysis

- 3.4 Technology & innovation landscape

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Manufacturers

- 3.8 Distributors

- 3.9 Retailers

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 The growing emphasis on hygiene

- 3.10.1.2 Convenience and portability trends

- 3.10.1.3 Health regulations and standards

- 3.10.1.4 Growing hospitality sector

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 Regulatory pressures

- 3.10.2.2 Market saturation and competition

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Consumer buying behavior

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034 ($Bn) (Thousand Units)

- 5.1 Key trends

- 5.2 Personal care wet wipes

- 5.2.1 Face wipes

- 5.2.2 Body wipes

- 5.2.3 Intimate wipes

- 5.2.4 Baby wipes

- 5.2.5 Others

- 5.3 Household wet wipes

Chapter 6 Market Estimates & Forecast, By Material, 2021 - 2034 ($Bn) (Thousand Units)

- 6.1 Key trends

- 6.2 Cotton

- 6.3 Non-woven fabrics

- 6.4 Woven fabrics

Chapter 7 Market Estimates & Forecast, By Price, 2021 - 2034 ($Bn) (Thousand Units)

- 7.1 Key trends

- 7.2 Low

- 7.3 Medium

- 7.4 High

Chapter 8 Market Estimates & Forecast, By Packaging Size, 2021 - 2034 ($Bn) (Thousand Units)

- 8.1 Key trends

- 8.2 Upto 50 wipes

- 8.3 50-100 wipes

- 8.4 More than 100 wipes

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn) (Thousand Units)

- 9.1 Key trends

- 9.2 Individual

- 9.3 Commercial

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Bn) (Thousand Units)

- 10.1 Key trends

- 10.2 Online

- 10.2.1 E-commerce

- 10.2.2 Company websites

- 10.3 Offline

- 10.3.1 Supermarkets

- 10.3.2 Individual stores

- 10.3.3 Dollar stores

- 10.3.4 Others (specialty stores, etc.)

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn) (Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 The U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 UAE

- 11.6.2 South Africa

- 11.6.3 Saudi Arabia

Chapter 12 Company Profiles

- 12.1 Beiersdorf

- 12.2 Cascades

- 12.3 Clorox

- 12.4 Essity

- 12.5 Estee Lauder

- 12.6 Johnson & Johnson

- 12.7 Kimberly-Clark

- 12.8 Kirkland Signature

- 12.9 Nice-Pak Products

- 12.10 PDI

- 12.11 Procter & Gamble

- 12.12 Reckitt Benckiser

- 12.13 Sani Professional

- 12.14 Seventh Generation

- 12.15 Unilever