|

市場調查報告書

商品編碼

1699356

自主船舶市場機會、成長動力、產業趨勢分析及 2025-2034 年預測Autonomous Ships Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

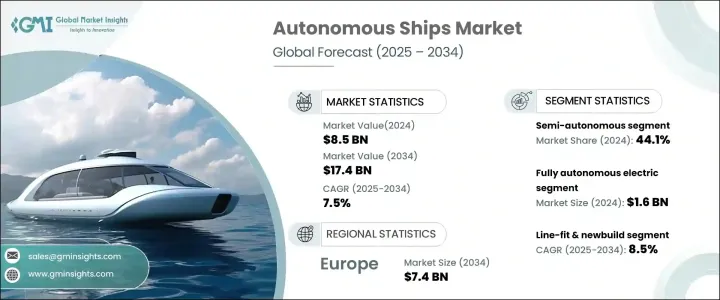

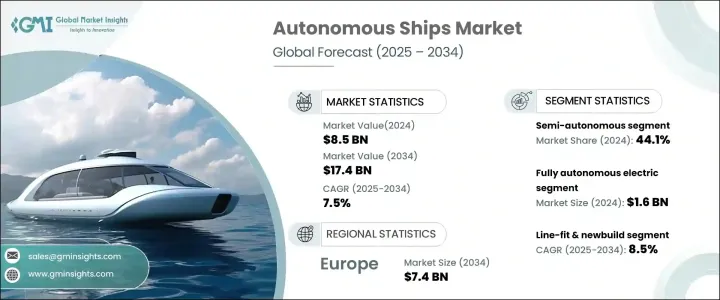

2024 年全球自主船舶市場規模達到 85 億美元,預計 2025 年至 2034 年的複合年成長率為 7.5%。人工智慧 (AI) 和機器學習 (ML) 技術的日益普及正在推動市場擴張,徹底改變自主船舶的運作方式。製造商正在大力投資開發全自動船舶,整合 GPS、感測器和物聯網 (IoT) 等尖端組件。這些進步顯著提高了自主船舶的營運效率,最大限度地減少了人為干預,並確保了更好的安全標準。

在對更具成本效益和環保的解決方案的需求的推動下,自主航運業正在迅速發展。隨著全球貿易的成長,航運公司擴大尋求最佳化營運成本、改善安全措施和減少排放的方法。自主船舶透過簡化海上作業和最大限度地減少人為錯誤,提供了一種有前景的替代方案。人工智慧導航系統使船舶能夠即時回應環境和導航變化,從而降低與人為誤判相關的風險。此外,監管機構正在支持向自動化轉變,例如增加對智慧港口基礎設施和數位海事解決方案的投資。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 85億美元 |

| 預測值 | 174億美元 |

| 複合年成長率 | 7.5% |

根據船舶類型,市場分為半自動船舶、全自動船舶和遙控船舶。半自主船舶在 2024 年佔據 44.1% 的市場佔有率,需求持續穩定。這些船隻可以在特定條件下自主運行,提供靈活性,同時減少對人類操作員的依賴。製造商正在透過簡化設計、消除甲板室和供暖等昂貴的子系統以及減少資本投資來提高半自主船舶的成本效益。該行業對半自動化解決方案的關注凸顯了對逐步自動化日益成長的偏好,這使得航運公司無需對現有船隊進行徹底改造即可採用該技術。

市場的另一個關鍵部分是推進技術,包括全電動、混合動力和傳統系統。到 2024 年,全電動自主船舶的價值將達到 16 億美元,這代表著朝著實現零排放邁出了重要一步。隨著永續性成為航運業的焦點,電力推進可望推動進一步的創新。全電動船舶為傳統燃料驅動船舶提供了更清潔、更節能的替代方案,符合全球減碳目標。混合動力系統也越來越受到關注,因為它們在燃油效率和運行範圍之間實現了平衡,使其成為長途航線的首選。

德國自主船舶市場預計將大幅成長,預計到 2034 年將以 10.1% 的複合年成長率擴張。該國處於自主航運技術的前沿,多家公司率先推出增強船舶自主性的技術進步。隨著產業的成熟,自動駕駛船舶有望降低營運成本、減少排放並提高海上安全。人們越來越關注永續性和效率,這使得自主船舶成為全球航運業的變革者,確保企業和環境的長期利益。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 人工智慧和機器學習的進步

- 降低勞動力和營運成本

- 綠色航運解決方案需求不斷成長

- 支持性政府和海事政策

- 產業陷阱與挑戰

- 原料供應鏈中斷

- 消費者對自動駕駛船舶的信任問題

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按類型,2021 年至 2034 年

- 主要趨勢

- 半自主

- 完全自主

- 遠端操作

第6章:市場估計與預測:按推進技術,2021 年至 2034 年

- 主要趨勢

- 全電動

- 混合

- 傳統的

第7章:市場估計與預測:依適用性,2021 年至 2034 年

- 主要趨勢

- 線路安裝和新建

- 改造

第8章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- >8.2 商業

- 客船

- 貨櫃船

- 油輪

- 其他

- 軍事與國防

- 潛水艇

- 航空母艦

- 驅逐艦

- 護衛艦

第9章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第10章:公司簡介

- ABB Ltd.

- Aselsan AS

- BAE Systems

- DNV GL

- Fugro

- General Electric

- Hyundai Heavy Industries Inc.

- Kongsberg Maritime

- L3Harris Technologies, Inc.

- Mitsui E&S Shipbuilding Co., Ltd.

- Northrop Grumman Corporation

- Praxis Automation Technology BV

- RH Marine

- Rolls-Royce Holdings plc

- Samsung Heavy Industries Co., Ltd.

- Sea Machines Robotics, Inc

- Siemens AG

- Ulstein Group ASA

- Valmet

- Vigor Industrial LLC

- Wartsila

The Global Autonomous Ships Market reached USD 8.5 billion in 2024 and is anticipated to grow at a CAGR of 7.5% from 2025 to 2034. The increasing adoption of artificial intelligence (AI) and machine learning (ML) technologies is driving market expansion, revolutionizing the way autonomous vessels operate. Manufacturers are heavily investing in the development of fully autonomous ships by integrating cutting-edge components such as GPS, sensors, and the Internet of Things (IoT). These advancements are significantly enhancing the operational efficiency of autonomous ships, minimizing human intervention, and ensuring better safety standards.

The autonomous shipping industry is evolving rapidly, driven by the need for more cost-efficient and environmentally friendly solutions. With global trade rising, shipping companies are increasingly looking for ways to optimize operational costs, improve safety measures, and reduce emissions. Autonomous vessels offer a promising alternative by streamlining maritime operations and minimizing human error. AI-powered navigation systems enable ships to respond to environmental and navigational changes in real time, reducing the risks associated with human miscalculations. Additionally, regulatory bodies are supporting the shift towards automation, as seen in increasing investments in smart port infrastructures and digital maritime solutions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.5 Billion |

| Forecast Value | $17.4 Billion |

| CAGR | 7.5% |

The market is segmented based on vessel type into semi-autonomous, fully autonomous, and remotely operated ships. Semi-autonomous ships accounted for 44.1% market share in 2024 and continue to see steady demand. These vessels can function autonomously under specific conditions, providing flexibility while reducing reliance on human operators. Manufacturers are making semi-autonomous ships more cost-effective by simplifying design, eliminating costly subsystems like deck houses and heating, and reducing capital investment. The industry's focus on semi-autonomous solutions highlights the growing preference for gradual automation, allowing shipping companies to adopt technology without a complete overhaul of their existing fleets.

Another key segment of the market is propulsion technology, which includes fully electric, hybrid, and conventional systems. Fully electric autonomous ships, valued at USD 1.6 billion in 2024, represent a major step toward achieving zero emissions. With sustainability taking center stage in the maritime industry, electric propulsion is expected to drive further innovation. Fully electric vessels offer a cleaner and more energy-efficient alternative to conventional fuel-powered ships, aligning with global carbon reduction goals. Hybrid systems are also gaining traction as they offer a balance between fuel efficiency and operational range, making them a preferred choice for long-haul shipping routes.

Germany Autonomous Ship Market is poised for substantial growth, projected to expand at a CAGR of 10.1% through 2034. The country is at the forefront of autonomous shipping technology, with multiple companies pioneering advancements that enhance vessel autonomy. As the industry matures, autonomous ships are expected to reduce operational costs, lower emissions, and improve maritime safety. The increasing focus on sustainability and efficiency is positioning autonomous vessels as a game-changer for the global shipping industry, ensuring long-term benefits for both businesses and the environment.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Advancement in AI & Machine learning

- 3.2.1.2 Cost reduction in labour and operations

- 3.2.1.3 Growing demand for green shipping solutions

- 3.2.1.4 Supportive government & maritime policies

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Supply chain disruption of raw materials

- 3.2.2.2 Consumers trust issues in autonomous ship

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Semi-Autonomous

- 5.3 Fully autonomous

- 5.4 Remotely operated

Chapter 6 Market Estimates and Forecast, By Propulsion Technology, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Fully electric

- 6.3 Hybrid

- 6.4 Conventional

Chapter 7 Market Estimates and Forecast, By Fit, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Line-fit & newbuild

- 7.3 Retrofit

Chapter 8 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- >8.2 Commercial

- 8.2.1 Passenger ship

- 8.2.2 Container ship

- 8.1.3 Tankers

- 8.2.4 Others

- 8.3 Military & defense

- 8.3.1 Submarines

- 8.3.2 Aircraft carriers

- 8.3.3 Destroyers

- 8.3.4 Frigates

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 ABB Ltd.

- 10.2 Aselsan A.S.

- 10.3 BAE Systems

- 10.4 DNV GL

- 10.5 Fugro

- 10.6 General Electric

- 10.7 Hyundai Heavy Industries Inc.

- 10.8 Kongsberg Maritime

- 10.9 L3Harris Technologies, Inc.

- 10.10 Mitsui E&S Shipbuilding Co., Ltd.

- 10.11 Northrop Grumman Corporation

- 10.12 Praxis Automation Technology B.V.

- 10.13 RH Marine

- 10.14 Rolls-Royce Holdings plc

- 10.15 Samsung Heavy Industries Co., Ltd.

- 10.16 Sea Machines Robotics, Inc

- 10.17 Siemens AG

- 10.18 Ulstein Group ASA

- 10.19 Valmet

- 10.20 Vigor Industrial LLC

- 10.21 Wartsila