|

市場調查報告書

商品編碼

1699320

檢視機器人市場機會、成長動力、產業趨勢分析及 2025-2034 年預測Inspection Robots Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

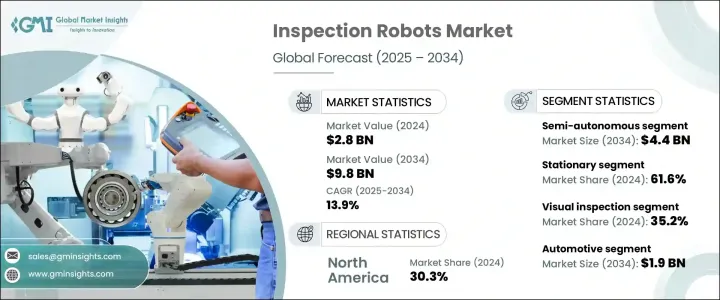

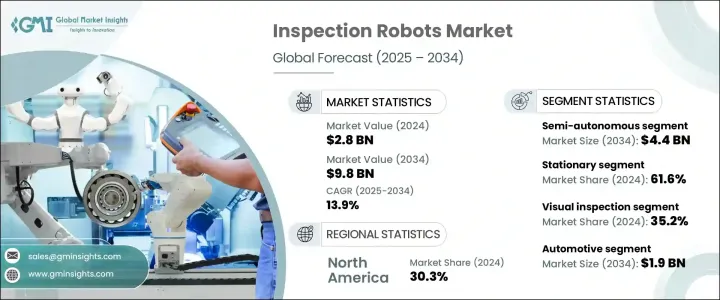

全球檢查機器人市場規模在 2024 年將達到 28 億美元,預計在 2025 年至 2034 年期間的複合年成長率將達到 13.9%。推動這一成長的動力來自各行各業對機器人的應用日益增多,這些行業旨在提高效率、降低營運風險並遵守不斷發展的安全法規。製造業、能源業和基礎設施行業的企業正在將檢查機器人整合到其營運中,以簡化工作流程、最大限度地減少停機時間並確保遵守嚴格的行業標準。

隨著各行各業對自動化和精確度的重視,檢查機器人在維護和品質控制中發揮關鍵作用。這些先進的系統提供了更高的準確性和可靠性,消除了與人工檢查相關的限制。各組織正在利用機器人技術來滿足對無損檢測、即時分析和預測性維護日益成長的需求。對人工智慧 (AI) 和機器學習 (ML) 技術的投資不斷增加,進一步推動了機器人檢測系統的創新,實現了自主決策和自適應學習。隨著公司致力於提高工作場所的安全性並最佳化營運績效,對危險和難以到達的環境中持續監控的需求正在加速成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 28億美元 |

| 預測值 | 98億美元 |

| 複合年成長率 | 13.9% |

按類型分類的市場包括非自主機器人、半自主機器人和全自動機器人。預計到 2034 年,半自動駕駛領域的市場規模將達到 44 億美元,由於其能夠在自動化和人工監督之間取得平衡,因此將廣泛應用。這些系統在高風險行業中尤其有價值,在這些行業中,人工智慧輔助決策允許人類操作員僅在必要時進行干預。它們能夠在複雜的環境中運作而無需持續監督,這使得它們成為尋求提高效率同時保持對關鍵操作控制的企業的有吸引力的選擇。

根據技術,市場分為固定式和移動式檢查機器人。 2024 年,固定式系統佔據了 61.6% 的市場佔有率,由於其高精度和與自動化製造環境的無縫整合而獲得了發展動力。這些機器人在需要精細品質控制的行業中發揮重要作用,提供高精度缺陷檢測和即時性能監控。對無損檢測和高速評估技術的日益重視進一步推動了其應用。製造商優先考慮減少錯誤和提高操作效率,使得固定式檢測機器人成為現代生產線中不可或缺的一部分。

美國檢測機器人市場預計將大幅成長,預計到 2034 年將達到 28 億美元。製造業對自動化的依賴程度不斷提高,加上對缺陷檢測和品質保證的高度重視,正在加速機器人檢測系統的部署。該公司正在投資先進的機器人技術,以提高生產力、最大限度地減少停機時間並最佳化營運效率。隨著自動化不斷改變工業工作流程,機器人檢測系統正在成為確保始終如一的品質和卓越營運的重要組成部分。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 服務機器人的銷售量和採用率增加

- 擴大使用無人機和移動機器人進行遠端檢查

- 智慧製造和工業 4.0 計劃的成長

- 石油天然氣和能源產業的擴張

- 各行業嚴格的安全和品質法規

- 產業陷阱與挑戰

- 中小企業部署成本高

- 複雜性和整合困難

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按類型,2021 年至 2034 年

- 主要趨勢

- 非自治

- 半自主

- 完全自主

第6章:市場估計與預測:按技術,2021 年至 2034 年

- 主要趨勢

- 固定式

- 移動的

第7章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 目視檢查

- 超音波檢查

- 雷射掃描檢測

- 熱檢查

- 品質檢驗

第8章:市場估計與預測:按最終用途產業,2021 年至 2034 年

- 主要趨勢

- 汽車

- 建造

- 食品和飲料

- 製造業

- 石油和天然氣

- 力量

- 其他

第9章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第10章:公司簡介

- ABB

- Cognex

- Denso Wave

- DSI Robotics

- Energy Robotics

- Fanuc

- Honeybee Robotics

- Innok Robotics

- JH Robotics

- Kuka

- Mitsubishi Heavy Industries

- Nexxis

- Robotnik Automation

- Staubli

- Superdroid Robotics

- Universal Robots

The Global Inspection Robots Market, valued at USD 2.8 billion in 2024, is set to expand at a CAGR of 13.9% from 2025 to 2034. The growth is driven by increasing adoption across industries seeking to enhance efficiency, reduce operational risks, and comply with evolving safety regulations. Businesses across manufacturing, energy, and infrastructure sectors are integrating inspection robots into their operations to streamline workflows, minimize downtime, and ensure compliance with stringent industry standards.

With industries prioritizing automation and precision, inspection robots are playing a critical role in maintenance and quality control. These advanced systems offer enhanced accuracy and reliability, eliminating the limitations associated with manual inspections. Organizations are leveraging robotics to meet growing demands for non-destructive testing, real-time analytics, and predictive maintenance. Increasing investments in artificial intelligence (AI) and machine learning (ML) technologies are further driving innovation in robotic inspection systems, enabling autonomous decision-making and adaptive learning. The need for continuous monitoring in hazardous and hard-to-reach environments is accelerating demand as companies aim to improve workplace safety while optimizing operational performance.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.8 Billion |

| Forecast Value | $9.8 Billion |

| CAGR | 13.9% |

Market segmentation by type includes non-autonomous, semi-autonomous, and fully autonomous robots. The semi-autonomous segment is expected to reach USD 4.4 billion by 2034, witnessing significant adoption due to its ability to strike a balance between automation and human oversight. These systems are particularly valuable in high-risk industries, where AI-assisted decision-making allows human operators to intervene only when necessary. Their ability to function in complex environments without constant supervision makes them an attractive choice for businesses seeking to enhance efficiency while maintaining control over critical operations.

Based on technology, the market is segmented into stationary and mobile inspection robots. In 2024, stationary systems accounted for 61.6% of the market share, gaining traction due to their high precision and seamless integration into automated manufacturing environments. These robots play an essential role in industries that demand meticulous quality control, offering high-accuracy defect detection and real-time performance monitoring. The growing emphasis on non-destructive testing and high-speed evaluation techniques is further fueling adoption. Manufacturers are prioritizing error reduction and operational efficiency, making stationary inspection robots indispensable across modern production lines.

The US inspection robots market is poised for substantial growth, projected to reach USD 2.8 billion by 2034. Increasing reliance on automation in manufacturing, coupled with a strong focus on defect detection and quality assurance, is accelerating the deployment of robotic inspection systems. Companies are investing in advanced robotic technologies to enhance productivity, minimize downtime, and optimize operational efficiency. As automation continues to transform industrial workflows, robotic inspection systems are emerging as an essential component in ensuring consistent quality and operational excellence.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increased sales and adoption of service robots

- 3.2.1.2 Increasing use of drones and mobile robots for remote inspections

- 3.2.1.3 Growth in smart manufacturing and industry 4.0 initiatives

- 3.2.1.4 Expansion of the oil & gas and energy sectors

- 3.2.1.5 Stringent safety and quality regulations across industries

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High deployment cost for SME

- 3.2.2.2 Complexity & integration difficulties

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 (USD Bn)

- 5.1 Key trends

- 5.2 Non-autonomous

- 5.3 Semi-autonomous

- 5.4 Fully autonomous

Chapter 6 Market Estimates and Forecast, By Technology , 2021 – 2034 (USD Bn)

- 6.1 Key trends

- 6.2 Stationary

- 6.3 Mobile

Chapter 7 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Bn)

- 7.1 Key trends

- 7.2 Visual inspection

- 7.3 Ultrasonic inspection

- 7.4 Laser scanning inspection

- 7.5 Thermal inspection

- 7.6 Quality inspection

Chapter 8 Market Estimates and Forecast, By End Use Industry, 2021 – 2034 (USD Bn)

- 8.1 Key trends

- 8.2 Automotive

- 8.3 Construction

- 8.4 Food & beverages

- 8.5 Manufacturing

- 8.6 Oil & gas

- 8.7 Power

- 8.8 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 ABB

- 10.2 Cognex

- 10.3 Denso Wave

- 10.4 DSI Robotics

- 10.5 Energy Robotics

- 10.6 Fanuc

- 10.7 Honeybee Robotics

- 10.8 Innok Robotics

- 10.9 JH Robotics

- 10.10 Kuka

- 10.11 Mitsubishi Heavy Industries

- 10.12 Nexxis

- 10.13 Robotnik Automation

- 10.14 Staubli

- 10.15 Superdroid Robotics

- 10.16 Universal Robots