|

市場調查報告書

商品編碼

1699306

健康體檢市場機會、成長動力、產業趨勢分析及預測(2025-2034)Health Check-up Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

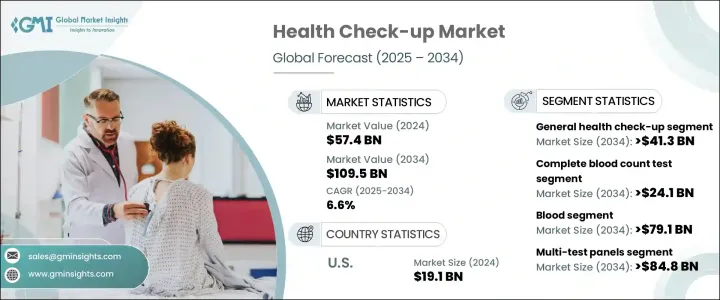

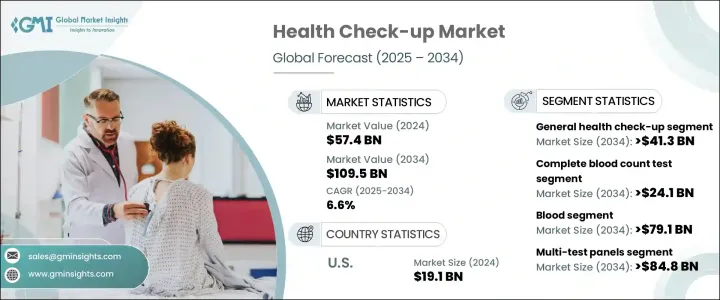

2024 年全球健康體檢市場價值為 574 億美元,預計 2025 年至 2034 年期間的複合年成長率為 6.6%,這主要得益於癌症、糖尿病和心血管疾病等慢性疾病盛行率的不斷上升。隨著越來越多的人重視預防性護理,對常規醫療篩檢的需求持續上升,以確保早期發現和改善治療效果。隨著診斷技術的進步,篩檢變得更加容易,醫療保健提供者和保險公司正在強調早期診斷的重要性,進一步推動市場擴張。

隨著主動健康管理意識的增強,定期檢查正成為全球醫療保健策略不可或缺的一部分。保險公司擴大將預防性篩檢納入保險計劃,鼓勵個人定期進行醫療評估。政府和私人醫療保健提供者也正在發起宣傳活動和健康計劃,以促進預防性篩檢。家庭診斷服務的便利性、遠距醫療的日益普及以及人工智慧診斷工具的發展正在改變健康檢查格局,使篩檢更加高效和廣泛可用。此外,雇主擴大支持員工健康和保健計劃,從而促進了定期健康評估的參與。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 574億美元 |

| 預測值 | 1095億美元 |

| 複合年成長率 | 6.6% |

市場按類型分為一般健康檢查、專門健康檢查、預防性健康檢查以及常規和健康檢查。其中,一般健康體檢領域仍是市場成長的主導力量。預計該領域的複合年成長率為 6.5%,到 2034 年將達到 413 億美元。常規醫療篩檢可以早期發現疾病,降低嚴重健康併發症的風險,並有助於及時進行醫療干預。現在許多健康保險計劃都包括定期檢查,確保個人接受必要的評估以維持整體健康。

根據測試類型,健康體檢市場包括全血細胞計數測試、血糖測試、腎功能測試、骨骼測試、電解質測試、肝功能測試、血脂測試、心臟生物標記、激素和維生素評估、腫瘤標記和其他診斷。全血球計數測試部分是市場擴張的關鍵推動因素,預計將以 6.2% 的複合年成長率成長,到 2034 年達到 241 億美元。這些測試提供有關血球組成的重要見解,包括紅血球和白血球計數以及血小板水平,使醫療保健提供者能夠診斷貧血、感染和血液疾病等病症。血紅素和血球容積比的測量也有助於評估營養狀況,有助於識別缺鐵和其他健康問題。

美國健康體檢市場規模在 2024 年將達到 191 億美元,預計在 2025 年至 2034 年期間的複合年成長率將達到 5.7%。糖尿病、高血壓和心血管疾病等慢性病的盛行率不斷上升,推動了頻繁篩檢的需求。此外,人口老化需要持續、全面的醫療評估,進一步刺激了預防性醫療保健服務的需求。隨著醫療保健提供者和保險公司積極推動早期干預,美國的常規醫療評估變得越來越普遍。隨著人們對主動健康管理的認知不斷提高,健康體檢市場將在未來十年持續擴張。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 人口篩檢投資激增

- 疾病盛行率不斷上升

- 老年人口增加

- 數位科技的採用日益增多

- 產業陷阱與挑戰

- 篩檢成本高

- 低度開發地區缺乏意識和適當的基礎設施

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 報銷場景

- 差距分析

- 波特的分析

- PESTEL分析

- 未來市場趨勢

- 價值鏈分析

- 健康檢查套餐概要

- 啟動場景

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按類型,2021 - 2034 年

- 主要趨勢

- 常規健康檢查

- 常規健康檢查

- 專業健康檢查

- 預防性健康檢查

第6章:市場估計與預測:按測試類型,2021 - 2034 年

- 主要趨勢

- 全血球計數檢查

- 血糖測試

- 電解質測試

- 血脂檢測

- 荷爾蒙和維生素

- 腫瘤標記

- 肝功能檢查

- 心臟生物標記

- 腎功能檢查

- 骨輪廓測試

- 其他測試類型

第7章:市場估計與預測:依樣本類型,2021 - 2034 年

- 主要趨勢

- 血

- 尿

- 唾液

- 其他樣本類型

第8章:市場估計與預測:按面板類型,2021 - 2034

- 主要趨勢

- 多重測試面板

- 單項測試面板

第9章:市場估計與預測:按服務供應商,2021 - 2034 年

- 主要趨勢

- 醫院實驗室

- 獨立實驗室

- 門診護理中心

- 中央實驗室

- 其他服務提供者

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 11 章:公司簡介

- ARUP Laboratories

- Cerba Healthcare

- eurofins

- Exact Sciences

- GRAIL

- INNOVA

- labcorp

- natera

- OPKO

- Q2 Solutions

- Quest Diagnostics

- Sonic Healthcare

- SYNLAB

- Trinity Biotech

- UNILABS

The Global Health Check-Up Market was valued at USD 57.4 billion in 2024 and is projected to expand at a CAGR of 6.6% from 2025 to 2034, driven by the increasing prevalence of chronic illnesses such as cancer, diabetes, and cardiovascular disorders. As more individuals prioritize preventive care, the demand for routine medical screenings continues to rise, ensuring early detection and improved treatment outcomes. With advancements in diagnostic technologies making screenings more accessible, healthcare providers and insurers are emphasizing the importance of early diagnosis, further propelling market expansion.

As the awareness of proactive health management gains traction, routine check-ups are becoming an integral part of healthcare strategies worldwide. Insurers are increasingly incorporating preventive screenings into coverage plans, encouraging individuals to undergo regular medical evaluations. Governments and private healthcare providers are also launching awareness campaigns and health programs to promote preventive screenings. The convenience of home-based diagnostic services, the growing penetration of telehealth, and the development of AI-driven diagnostic tools are transforming the health check-up landscape, making screenings more efficient and widely available. Additionally, increased employer initiatives supporting employee health and wellness programs are boosting participation in regular health assessments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $57.4 Billion |

| Forecast Value | $ 109.5 Billion |

| CAGR | 6.6% |

The market is segmented by type into general health check-ups, specialized health check-ups, preventive health check-ups, and routine and wellness health check-ups. Among these, the general health check-up segment remains a dominant force in market growth. This segment is expected to expand at a CAGR of 6.5%, reaching USD 41.3 billion by 2034. Routine medical screenings enable early disease detection, reducing the risk of severe health complications and facilitating timely medical interventions. Many health insurance plans now include regular check-ups, ensuring individuals receive essential evaluations to maintain their overall well-being.

Based on test type, the health check-up market comprises complete blood count tests, blood glucose tests, kidney function tests, bone profile tests, electrolyte tests, liver function tests, lipid profile tests, cardiac biomarkers, hormone and vitamin assessments, tumor markers, and other diagnostics. The complete blood count test segment is a key contributor to market expansion, projected to grow at a CAGR of 6.2% and reach USD 24.1 billion by 2034. These tests offer vital insights into blood cell composition, including red and white blood cell counts and platelet levels, enabling healthcare providers to diagnose conditions such as anemia, infections, and blood disorders. Hemoglobin and hematocrit measurements also help assess nutritional status, aiding in the identification of iron deficiency and other health concerns.

The US health check-up market, valued at USD 19.1 billion in 2024, is expected to grow at a CAGR of 5.7% between 2025 and 2034. The rising prevalence of chronic diseases such as diabetes, hypertension, and cardiovascular conditions is driving the need for frequent screenings. Additionally, the aging population requires consistent and comprehensive medical assessments, further fueling the demand for preventive healthcare services. With healthcare providers and insurers actively promoting early intervention, routine medical evaluations in the US are becoming increasingly common. As awareness surrounding proactive health management continues to grow, the health check-up market is poised for sustained expansion over the next decade.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Surging investments in population screening

- 3.2.1.2 Increasing prevalence of diseases

- 3.2.1.3 Rise in geriatric population

- 3.2.1.4 Increasing adoption of digital technology

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost associated with screening

- 3.2.2.2 Lack of awareness and proper infrastructure in under-developed regions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Reimbursement scenario

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Future market trends

- 3.11 Value chain analysis

- 3.12 Health check-up packages outline

- 3.13 Start-up scenario

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 General health check-up

- 5.3 Routine and wellness health check-up

- 5.4 Specialized health check-up

- 5.5 Preventive health check-up

Chapter 6 Market Estimates and Forecast, By Test Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Complete blood count test

- 6.3 Blood glucose test

- 6.4 Electrolyte test

- 6.5 Lipid profile test

- 6.6 Hormones & vitamins

- 6.7 Tumor markers

- 6.8 Liver function test

- 6.9 Cardiac biomarkers

- 6.10 Kidney function test

- 6.11 Bone profile test

- 6.12 Other test types

Chapter 7 Market Estimates and Forecast, By Sample Type, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Blood

- 7.3 Urine

- 7.4 Saliva

- 7.5 Other sample types

Chapter 8 Market Estimates and Forecast, By Panel Type, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Multi-test panels

- 8.3 Single-test panels

Chapter 9 Market Estimates and Forecast, By Service Provider, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospital-based laboratories

- 9.3 Standalone laboratories

- 9.4 Ambulatory care centers

- 9.5 Central laboratories

- 9.6 Other service providers

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 ARUP Laboratories

- 11.2 Cerba Healthcare

- 11.3 eurofins

- 11.4 Exact Sciences

- 11.5 GRAIL

- 11.6 INNOVA

- 11.7 labcorp

- 11.8 natera

- 11.9 OPKO

- 11.10 Q2 Solutions

- 11.11 Quest Diagnostics

- 11.12 Sonic Healthcare

- 11.13 SYNLAB

- 11.14 Trinity Biotech

- 11.15 UNILABS