|

市場調查報告書

商品編碼

1699249

無人機攝影機市場機會、成長動力、產業趨勢分析及 2025-2034 年預測Drone camera Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

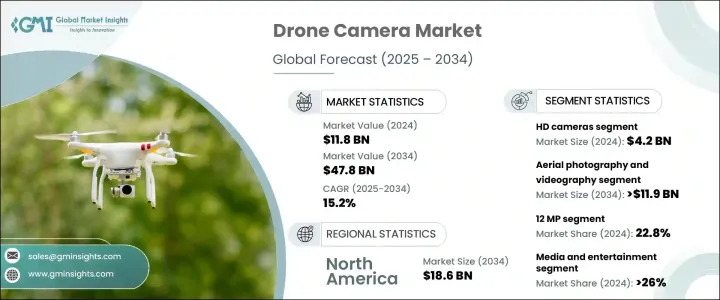

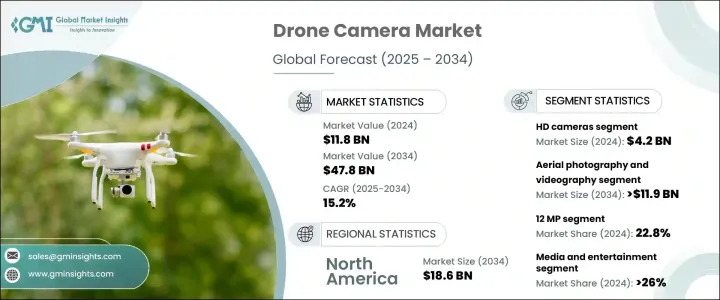

2024 年全球無人機攝影機市場價值為 118 億美元,預計 2025 年至 2034 年的複合年成長率為 15.2%。市場成長的激增得益於各行各業(尤其是媒體和娛樂業)對無人機的採用日益增加,以及無人機技術的快速進步。電影製作人和內容創作者正在利用無人機進行動態航拍,而這曾經是昂貴且難以實現的。隨著人工智慧和機器學習的融合,無人機正在成為從基礎設施檢查到農業監測等各種應用的必備工具。在農業領域,無人機攝影機被用於檢測蟲害、評估土壤健康狀況,並透過即時成像最佳化作物產量。高清和熱成像技術在安全、測量和工業檢查中的作用正在增強。對高品質航空影像和即時資料分析日益成長的需求預計將推動市場大幅擴張。

根據類型,市場分為高清、超高清、熱成像和多光譜攝影機。高清攝影機市場價值 2024 年將達到 42 億美元,由於價格低廉、性能卓越,廣泛應用於休閒無人機。隨著對卓越影像品質的需求不斷成長,預計到 2034 年超高清攝影機的市場規模將超過 142 億美元。熱像儀的價值在 2024 年將達到 25 億美元,它正在徹底改變搜救、消防和工業檢查。多光譜相機在 2024 年佔據 15.4% 的市場佔有率,在精準農業和環境監測中發揮至關重要的作用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 118億美元 |

| 預測值 | 478億美元 |

| 複合年成長率 | 15.2% |

市場也按應用分類,包括航空攝影、安全、地圖繪製、作物監測和檢查。隨著專業和業餘攝影師採用無人機技術,預計到 2034 年航空攝影市場將超過 119 億美元。預計到 2034 年,監控和安全應用的規模將達到 78 億美元,無人機將加強邊境管制和緊急應變。到 2024 年,測繪和測量行業的價值將達到 23 億美元,而無人機攝影機將為其提供精確的地形圖和 3D 模型。到 2034 年,作物監測市場規模預計將達到 85 億美元,多光譜成像技術將使農民能夠有效分析植物的健康狀況。 2024 年,檢查和監控將佔據 12.6% 的市場佔有率,各行各業都將利用無人機進行基礎設施評估。

根據解析度,12 MP 部分在 2024 年佔據 22.8% 的市場佔有率,主要用於娛樂和入門級專業用途。預計到 2034 年,1,200 萬至 2,000 萬像素市場的規模將超過 186 億美元,滿足專業攝影和測繪需求。 20-32 MP 細分市場將在 2024 年佔據 23% 的市場佔有率,廣泛用於城市規劃和電影攝影。預計到 2034 年,32 MP 市場的規模將達到 54 億美元,為科學研究和電影製作提供高階成像。

最終用途產業包括媒體、農業、國防、物流、建築和房地產。 2024 年,媒體和娛樂佔了 26% 的市場。預計到 2034 年,農業將達到 128 億美元。軍事和國防預計將以 14.4% 的複合年成長率成長。到 2034 年,物流市場規模預計將達到 56 億美元,而建築和房地產市場規模可能達到 83 億美元。受各行業無人機普及率的推動,北美預計將引領市場,到 2034 年市場規模將超過 186 億美元。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 商業應用的採用率不斷提高

- 媒體和娛樂需求不斷成長

- 無人機技術的進步

- 增強監控和安全能力

- 擴大在環境和野生動物監測的應用

- 產業陷阱與挑戰

- 技術限制和可靠性問題

- 高成本和負擔能力問題

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:依類型,2021-2034

- 主要趨勢

- 高畫質攝影機

- 超高畫質攝影機

- 熱像儀

- 多光譜相機

第6章:市場估計與預測:按應用,2021-2034

- 主要趨勢

- 航空攝影和攝影

- 監控和安全

- 測繪與測量

- 農業

- 檢查和監控

第7章:市場估計與預測:依決議,2021-2034

- 主要趨勢

- 12 百萬畫素

- 12-20 MP

- 20-32 MP

- 32 MP

第8章:市場估計與預測:按最終用途產業,2021-2034 年

- 主要趨勢

- 媒體和娛樂

- 農業

- 軍事和國防

- 商業的

- 建築和房地產

- 其他(例如採礦業、保險業)

第9章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 拉丁美洲其他地區

- MEA

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

- MEA 其餘地區

第10章:公司簡介

- AeroVironment, Inc.

- Autel Robotics

- Aerialtronics DV BV

- Bayspec Inc.

- Canon Inc.

- Controp Precision Technologies Ltd.

- DJI (SZ DJI Technology Co., Ltd.)

- GoPro, Inc.

- Panasonic Corporation

- Parrot SA

- Quantum-Systems GmbH

- Skydio Inc.

- Sony Group Corporation

- Teledyne FLIR LLC

- Yuneec International

- Zen Technologies

The Global Drone Camera Market was valued at USD 11.8 billion in 2024 and is projected to expand at a CAGR of 15.2% from 2025 to 2034. The surge in market growth is driven by increasing drone adoption across industries, particularly in media and entertainment, along with rapid advancements in drone technology. Filmmakers and content creators are leveraging drones for dynamic aerial shots that were once costly and challenging to achieve. With the integration of AI and machine learning, drones are becoming essential tools for various applications, from infrastructure inspections to agricultural monitoring. In agriculture, drone cameras are being used to detect pest infestations, assess soil health, and optimize crop yields through real-time imaging. High-definition and thermal imaging technologies are enhancing their role in security, surveying, and industrial inspections. The growing demand for high-quality aerial imagery and real-time data analysis is expected to drive significant market expansion.

By type, the market is divided into HD, ultra-HD, thermal, and multispectral cameras. The HD camera segment, valued at USD 4.2 billion in 2024, is widely used in recreational drones due to affordability and high performance. Ultra-HD cameras are expected to surpass USD 14.2 billion by 2034 as demand for superior image quality grows. Thermal cameras, valued at USD 2.5 billion in 2024, are revolutionizing search and rescue, firefighting, and industrial inspections. Multispectral cameras held a 15.4% market share in 2024, playing a crucial role in precision farming and environmental monitoring.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $11.8 Billion |

| Forecast Value | $47.8 Billion |

| CAGR | 15.2% |

The market is also categorized by application, including aerial photography, security, mapping, crop monitoring, and inspections. Aerial photography is expected to exceed USD 11.9 billion by 2034, as professional and amateur photographers adopt drone technology. Surveillance and security applications are projected to reach USD 7.8 billion by 2034, with drones enhancing border control and emergency response. Mapping and surveying, valued at USD 2.3 billion in 2024, are benefiting from drone cameras that generate accurate topographic maps and 3D models. Crop monitoring is set to reach USD 8.5 billion by 2034, with multispectral imaging enabling farmers to analyze plant health efficiently. Inspection and monitoring accounted for a 12.6% market share in 2024, with industries utilizing drones for infrastructure assessments.

Based on the resolution, the 12 MP segment held a 22.8% market share in 2024, primarily for recreational and entry-level professional use. The 12-20 MP segment is expected to exceed USD 18.6 billion by 2034, catering to professional photography and mapping needs. The 20-32 MP segment, with a 23% market share in 2024, is widely used for urban planning and cinematography. The 32 MP segment is projected to reach USD 5.4 billion by 2034, offering high-end imaging for scientific research and film production.

End-use industries include media, agriculture, defense, logistics, construction, and real estate. Media and entertainment held a 26% market share in 2024. Agriculture is expected to reach USD 12.8 billion by 2034. Military and defense is projected to grow at a 14.4% CAGR. Logistics is set to reach USD 5.6 billion, while construction and real estate may hit USD 8.3 billion by 2034. North America is poised to lead the market, exceeding USD 18.6 billion by 2034, fueled by high drone adoption across industries.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increased adoption in commercial applications

- 3.2.1.2 Growing demand in media and entertainment

- 3.2.1.3 Advancements in drone technology

- 3.2.1.4 Enhanced capabilities in surveillance and security

- 3.2.1.5 Expanding use in environmental and wildlife monitoring

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Technical limitations and reliability concerns

- 3.2.2.2 High costs and affordability issues

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Billion & Units)

- 5.1 Key trends

- 5.2 HD cameras

- 5.3 Ultra HD cameras

- 5.4 Thermal cameras

- 5.5 Multispectral cameras

Chapter 6 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion & Units)

- 6.1 Key trends

- 6.2 Aerial photography and videography

- 6.3 Surveillance and security

- 6.4 Mapping and surveying

- 6.5 Agriculture

- 6.6 Inspection and monitoring

Chapter 7 Market Estimates & Forecast, By Resolution, 2021-2034 (USD Billion & Units)

- 7.1 Key trends

- 7.2 12 MP

- 7.3 12-20 MP

- 7.4 20-32 MP

- 7.5 32 MP

Chapter 8 Market Estimates & Forecast, By End-use Industry, 2021-2034 (USD Billion & Units)

- 8.1 Key trends

- 8.2 Media and entertainment

- 8.3 Agriculture

- 8.4 Military and defense

- 8.5 Commercial

- 8.6 Construction and real estate

- 8.7 Others (e.g., Mining, Insurance)

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion & Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Rest of Latin America

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

- 9.6.4 Rest of MEA

Chapter 10 Company Profiles

- 10.1 AeroVironment, Inc.

- 10.2 Autel Robotics

- 10.3 Aerialtronics DV B.V.

- 10.4 Bayspec Inc.

- 10.5 Canon Inc.

- 10.6 Controp Precision Technologies Ltd.

- 10.7 DJI (SZ DJI Technology Co., Ltd.)

- 10.8 GoPro, Inc.

- 10.9 Panasonic Corporation

- 10.10 Parrot SA

- 10.11 Quantum-Systems GmbH

- 10.12 Skydio Inc.

- 10.13 Sony Group Corporation

- 10.14 Teledyne FLIR LLC

- 10.15 Yuneec International

- 10.16 Zen Technologies