|

市場調查報告書

商品編碼

1699243

電腦微晶片市場機會、成長動力、產業趨勢分析及 2025-2034 年預測Computer Microchips Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

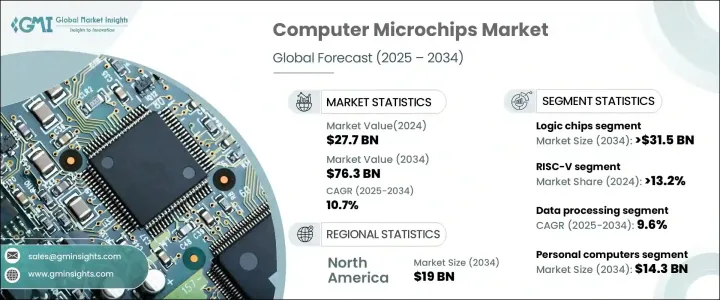

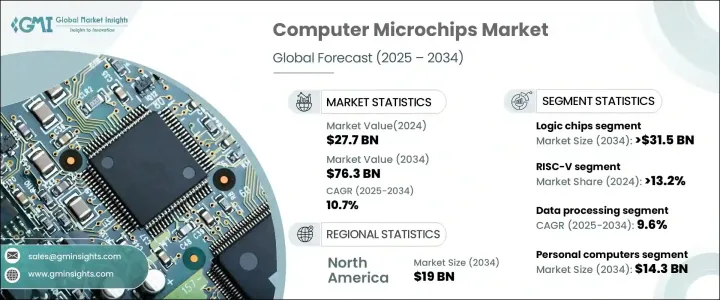

2024 年全球電腦微晶片市場價值為 277 億美元,預計 2025 年至 2034 年期間的複合年成長率為 10.7%。人工智慧、機器學習和雲端運算的日益普及正在推動對高效能、低功耗微晶片的需求。隨著企業和消費者越來越依賴數位轉型,對先進處理器、記憶體晶片和網路組件的需求持續上升。該公司正專注於可擴展且節能的晶片,以支援人工智慧驅動的應用程式、資料密集型工作負載和基於雲端的操作。隨著企業投資先進的微晶片以最佳化電源效率並降低營運成本,不斷擴大的資料中心基礎設施也在加速市場的成長。半導體製造的創新和人工智慧最佳化晶片的興起正在塑造產業的發展。

製造商優先考慮針對人工智慧和雲端運算應用的高效能、低功耗晶片。人工智慧工作負載需要專門為深度學習、神經網路和巨量資料分析設計的處理器。人們越來越重視更快、更有效率的運算,這推動了微晶片架構的創新。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 277億美元 |

| 預測值 | 763億美元 |

| 複合年成長率 | 10.7% |

根據晶片類型,市場分為記憶體晶片、邏輯晶片、SoC 和 ASIC。在半導體技術進步以及 5G 和物聯網日益普及的推動下,邏輯晶片領域預計將大幅擴張。預計到 2034 年邏輯晶片市場規模將超過 315 億美元,智慧型手機、平板電腦、筆記型電腦和遊戲設備的需求不斷成長將推動其成長。將多種處理功能整合到單一單元的系統單晶片 (SoC) 架構正在提高行動和穿戴式裝置的效能。

按架構分類的市場包括 x86、ARM、RISC-V 等。 RISC-V 領域因其開源框架、靈活性和成本效益而正在經歷快速成長。 2024年,RISC-V佔超過13.2%的市佔率。其開源特性使得公司無需支付許可費用即可開發客製化晶片設計,從而節省大量成本並避免對供應商的依賴。

根據應用,市場分為資料處理、圖形渲染、人工智慧和機器學習、網路、感測器整合、加密和安全。預計到 2034 年,資料處理領域的複合年成長率將達到 9.6%。對基於人工智慧的分析、巨量資料、雲端運算和高效能運算的需求不斷成長,推動了對能夠處理大規模運算工作負載的複雜晶片的需求。

最終用途細分包括個人電腦、伺服器和資料中心、智慧型手機和平板電腦、遊戲機等。受遠距工作、線上教育和數位內容創作需求不斷成長的推動,個人電腦市場預計到 2034 年將達到 143 億美元。人工智慧筆記型電腦和基於 ARM 的處理器的日益普及正在重塑 PC 行業。

從地區來看,預計到 2034 年北美的市場規模將達到 190 億美元,這得益於強勁的研發投資、先進的半導體供應鏈以及對人工智慧和基於雲端的技術不斷成長的需求。在政府擴大國內半導體生產和減少對外部供應鏈依賴的措施的支持下,僅美國市場規模就預計將達到 167 億美元。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 人工智慧和機器學習的進步

- 消費性電子產品的成長

- 雲端運算和資料中心的擴展

- 半導體需求不斷成長

- 電動車(EV)和自動駕駛汽車的興起

- 產業陷阱與挑戰

- 全球半導體供應鏈中斷

- 複雜性和製造成本不斷上升

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按晶片類型,2021 年至 2034 年

- 主要趨勢

- 邏輯晶片

- 記憶體晶片

- ASIC

- 系統級晶片

第6章:市場估計與預測:按建築,2021 年至 2034 年

- 主要趨勢

- x86

- 手臂

- RISC-V

- 其他

第7章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 資料處理

- 圖形渲染

- 人工智慧和機器學習

- 網路和連接

- 感測器整合

- 加密和安全

- 其他

第8章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 個人電腦

- 伺服器和資料中心

- 智慧型手機和平板電腦

- 遊戲機

- 其他

第9章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第10章:公司簡介

- Advanced Micro Devices

- Analog Devices

- Arm Holdings

- Broadcom

- Espressif Systems

- Infineon Technologies

- Intel

- Kioxia Holdings

- Marvell Technology Group

- Microchip Technology

- Micron Technology

- NVIDIA

- NXP Semiconductors

- Qualcomm

- Renesas Electronics

- Samsung Electronics

- STMicroelectronics

- Taiwan Semiconductor Manufacturing Company

- Texas Instruments

The Global Computer Microchips Market was valued at USD 27.7 billion in 2024 and is projected to expand at a CAGR of 10.7% from 2025 to 2034. Increasing adoption of artificial intelligence, machine learning, and cloud computing is fueling demand for high-performance, low-power microchips. With businesses and consumers increasingly relying on digital transformation, the need for advanced processors, memory chips, and networking components continues to rise. Companies are focusing on scalable and energy-efficient chips to support AI-driven applications, data-intensive workloads, and cloud-based operations. Expanding data center infrastructure is also accelerating the market's growth as firms invest in advanced microchips to optimize power efficiency and reduce operational costs. Innovations in semiconductor manufacturing and the rise of AI-optimized chips are shaping the industry's evolution.

Manufacturers are prioritizing high-performance, low-power chips tailored for AI and cloud computing applications. AI workloads require specialized processors designed for deep learning, neural networks, and big data analytics. The growing emphasis on faster, more efficient computing is driving innovation in microchip architecture.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $27.7 Billion |

| Forecast Value | $76.3 Billion |

| CAGR | 10.7% |

By chip type, the market is segmented into memory chips, logic chips, SoCs, and ASICs. The logic chips segment is expected to witness substantial expansion, driven by advancements in semiconductor technology and the increasing use of 5G and IoT. The market for logic chips is projected to exceed USD 31.5 billion by 2034, with rising demand for smartphones, tablets, laptops, and gaming devices contributing to its growth. System-on-chip (SoC) architectures that integrate multiple processing functions into a single unit are enhancing the performance of mobile and wearable devices.

Market segmentation by architecture includes x86, ARM, RISC-V, and others. The RISC-V segment is experiencing rapid growth due to its open-source framework, flexibility, and cost benefits. In 2024, RISC-V accounted for over 13.2% of the market. Its open-source nature allows companies to develop custom chip designs without licensing fees, offering significant cost savings and avoiding vendor dependency.

By application, the market is categorized into data processing, graphics rendering, AI and machine learning, networking, sensor integration, encryption, and security. The data processing segment is forecasted to grow at a CAGR of 9.6% by 2034. Expanding demand for AI-based analytics, big data, cloud computing, and high-performance computing is boosting the requirement for sophisticated chips that can handle large-scale computational workloads.

The end-use segmentation includes personal computers, servers and data centers, smartphones and tablets, gaming consoles, and others. The personal computers segment is expected to reach USD 14.3 billion by 2034, driven by increasing demand for remote work, online education, and digital content creation. The growing adoption of AI-powered laptops and ARM-based processors is reshaping the PC industry.

Regionally, North America is forecasted to reach USD 19 billion by 2034, benefiting from strong R&D investments, an advanced semiconductor supply chain, and rising demand for AI and cloud-based technologies. The U.S. market alone is expected to hit USD 16.7 billion, supported by government initiatives to expand domestic semiconductor production and reduce reliance on external supply chains.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Advancements in AI and machine learning

- 3.2.1.2 Growth in consumer electronics

- 3.2.1.3 Expansion of cloud computing and data centres

- 3.2.1.4 Increasing demand for semiconductors

- 3.2.1.5 Rise in electric vehicles (EVs) and autonomous cars

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Global semiconductor supply chain disruptions

- 3.2.2.2 Rising complexity and manufacturing costs

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Chip Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Logic chips

- 5.3 Memory chips

- 5.4 ASICs

- 5.5 SoCs

Chapter 6 Market Estimates and Forecast, By Architecture, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 x86

- 6.3 ARM

- 6.4 RISC-V

- 6.5 Others

Chapter 7 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Data processing

- 7.3 Graphics rendering

- 7.4 Artificial intelligence and machine learning

- 7.5 Networking and connectivity

- 7.6 Sensor integration

- 7.7 Encryption and security

- 7.8 Others

Chapter 8 Market Estimates and Forecast, By End-use, 2021– 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Personal computers

- 8.3 Servers and data centers

- 8.4 Smartphones and tablets

- 8.5 Gaming consoles

- 8.6 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Advanced Micro Devices

- 10.2 Analog Devices

- 10.3 Arm Holdings

- 10.4 Broadcom

- 10.5 Espressif Systems

- 10.6 Infineon Technologies

- 10.7 Intel

- 10.8 Kioxia Holdings

- 10.9 Marvell Technology Group

- 10.10 Microchip Technology

- 10.11 Micron Technology

- 10.12 NVIDIA

- 10.13 NXP Semiconductors

- 10.14 Qualcomm

- 10.15 Renesas Electronics

- 10.16 Samsung Electronics

- 10.17 STMicroelectronics

- 10.18 Taiwan Semiconductor Manufacturing Company

- 10.19 Texas Instruments