|

市場調查報告書

商品編碼

1699242

一次性溫度計市場機會、成長動力、產業趨勢分析及2025-2034年預測Disposable Thermometer Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

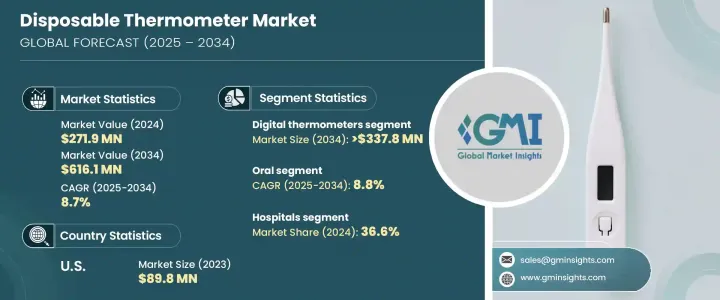

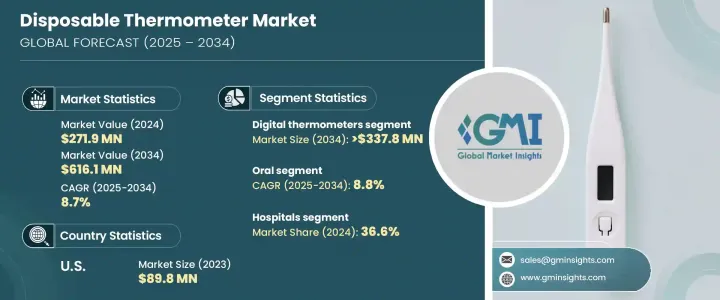

2024 年全球一次性溫度計市場價值為 2.719 億美元,預計 2025 年至 2034 年的複合年成長率為 8.7%。不斷成長的醫療保健需求、醫療技術的進步以及對感染控制的日益關注是市場擴張的主要驅動力。醫院和診所擴大採用一次性溫度計來預防醫院內感染。在新冠疫情期間,一次性溫度計的需求激增,凸顯了其在預防感染方面的重要性。隨著人口老化和慢性病病例的增加,越來越多的人依賴一次性溫度計進行常規健康監測。

由於技術進步,這些設備現在更加準確和方便用戶使用,使其成為臨床和家庭醫療保健環境的首選。隨著家庭醫療保健的普及,尤其是在已開發國家,一次性溫度計正成為不可或缺的工具。消費者青睞這些溫度計,因為它們方便、安全且價格實惠,而越來越多的人將它們放入旅行和急救醫療包中。可支配收入的增加也促進了醫療保健支出,促進了市場成長。預計可支配收入和醫療支出之間的相關性將在未來幾年加強對這些溫度計的需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 2.719億美元 |

| 預測值 | 6.161億美元 |

| 複合年成長率 | 8.7% |

市場按類型分為數位溫度計和條形溫度計,其中數位部分預計將以 8.5% 的複合年成長率擴張,到 2034 年將達到 3.378 億美元以上。由於數位溫度計的準確性、速度和易用性有所提高,消費者正在從傳統溫度計轉向數位溫度計。醫療保健提供者青睞使用數位溫度計來最大限度地降低交叉污染風險,特別是在醫院、診所和療養院。這場疫情進一步加速了它們在工作場所、學校和公共場所的採用。感測器技術的進步提高了準確性和反應時間,增加了醫療專業人員和家庭用戶的可靠性。患有慢性疾病且需要經常監測體溫的人更喜歡使用數位溫度計,因為它們便於攜帶且高效。

根據目標區域,市場分為口腔、腋窩、直腸和其他部分,口腔溫度計預計到 2034 年將達到 1.926 億美元以上,複合年成長率為 8.8%。口腔溫度計由於其易於使用和讀數可靠,仍然是家庭和醫療機構的熱門選擇。它們舒適、經濟高效,是醫院感染控制的廣泛選擇。疫情期間對衛生的高度重視刺激了重症監護區對一次性口腔溫度計的需求。

根據最終用途,市場分為醫院、診斷中心、家庭護理和其他環境。受嚴格的衛生規程和有效感染控制需求的推動,醫院在 2024 年佔據了 36.6% 的最大市場佔有率。疫情進一步凸顯了急診室、加護病房和新生兒病房對一次性溫度計的必要性。這些溫度計無需每次使用之間進行消毒,從而節省了時間和資源,提供了一種經濟高效的解決方案。

在美國,2021 年一次性溫度計市場價值為 8,080 萬美元。該國在 2023 年以 8,980 萬美元的規模領先北美市場,高於 2022 年的 8,500 萬美元。感染控制措施仍然是醫療機構的首要任務,越來越依賴一次性溫度計來防止交叉污染。傳染病、季節性疾病和慢性病的增加進一步推動了需求。人口老化以及醫療保健需求的增加導致醫院和家庭醫療保健機構擴大採用一次性溫度計。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 日益重視感染預防和控制

- 院內感染(HAI)增多

- 嚴格的醫療保健和衛生法規

- 居家照護服務需求不斷成長

- 技術進步

- 產業陷阱與挑戰

- 替代品的可用性

- 技術限制

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 差距分析

- 波特的分析

- PESTEL分析

- 未來市場趨勢

- 價值鏈分析

- 一次性口腔體溫計臨床應用概況

- 不同體溫測量技術的準確性與功能展望

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按類型,2021 - 2034 年

- 主要趨勢

- 數位溫度計

- 條形溫度計

第6章:市場估計與預測:按目標區域,2021 - 2034 年

- 主要趨勢

- 口服

- 腋窩

- 直腸

- 其他目標區域

第7章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 醫院

- 診斷中心

- 居家護理

- 其他最終用途

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- 3M

- Acme United Corporation

- Advanced Meditech Internationals (AMI)

- American Diagnostics Corporation

- FIRST AID ONLY

- graham field

- HB Instrument

- Hopkins Medical Products

- LCR Hallcrest

- MEDICAL INDICATORS

- MEDLINE

- microlife corporation

- Protontek

- tempagenix

- Zeal

The Global Disposable Thermometer Market was valued at USD 271.9 million in 2024 and is projected to grow at a CAGR of 8.7% from 2025 to 2034. Increasing healthcare demands, advancements in medical technology, and the growing focus on infection control are key drivers of market expansion. Hospitals and clinics are increasingly adopting single-use thermometers to prevent hospital-acquired infections. The demand for disposable thermometers surged during the COVID-19 pandemic, reinforcing their importance in infection prevention. With aging populations and rising chronic disease cases, more people are relying on disposable thermometers for routine health monitoring.

These devices are now more accurate and user-friendly due to technological advancements, making them a preferred choice for both clinical and home healthcare settings. As home-based medical care gains traction, particularly in developed nations, disposable thermometers are becoming essential tools. Consumers favor these thermometers for their convenience, safety, and affordability, while more individuals include them in travel and emergency medical kits. Rising disposable income is also boosting healthcare spending, contributing to market growth. The correlation between disposable income and medical expenditures is expected to strengthen demand for these thermometers in the coming years.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $271.9 Million |

| Forecast Value | $ 616.1 Million |

| CAGR | 8.7% |

The market is segmented by type into digital and strip thermometers, with the digital segment projected to expand at a CAGR of 8.5%, reaching over USD 337.8 million by 2034. Consumers are shifting from traditional to digital thermometers due to their improved accuracy, speed, and ease of use. Healthcare providers favor digital thermometers to minimize cross-contamination risks, particularly in hospitals, clinics, and nursing homes. The pandemic further accelerated their adoption in workplaces, schools, and public spaces. Advancements in sensor technology have enhanced accuracy and response times, increasing reliability for both medical professionals and home users. Individuals with chronic conditions requiring frequent temperature monitoring prefer digital thermometers for their portability and efficiency.

Based on target area, the market is categorized into oral, axilla, rectal, and other segments, with oral thermometers expected to reach over USD 192.6 million by 2034 at a CAGR of 8.8%. Oral thermometers remain a popular choice for homes and healthcare facilities due to their ease of use and reliable readings. They are comfortable, cost-effective, and widely preferred in hospitals for infection control. The heightened focus on hygiene during the pandemic fueled demand for disposable oral thermometers in critical care areas.

By end use, the market is divided into hospitals, diagnostic centers, homecare, and other settings. Hospitals held the largest market share of 36.6% in 2024, driven by stringent hygiene protocols and the need for efficient infection control. The pandemic reinforced the necessity of disposable thermometers in emergency rooms, intensive care units, and neonatal wards. These thermometers offer a cost-effective solution by eliminating the need for sterilization between uses, saving time and resources.

In the U.S., the disposable thermometer market was valued at USD 80.8 million in 2021. The country led the North America market in 2023 with USD 89.8 million, up from USD 85 million in 2022. Infection control measures remain a priority for healthcare facilities, increasing reliance on single-use thermometers to prevent cross-contamination. The rise in infectious diseases, seasonal illnesses, and chronic conditions has further propelled demand. An aging population with higher healthcare needs has led to greater adoption of disposable thermometers in hospitals and home healthcare settings.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing emphasis on infection prevention and control

- 3.2.1.2 Rising hospital acquired infections (HAIs)

- 3.2.1.3 Strict healthcare and sanitation regulations

- 3.2.1.4 Rising demand for home-based care services

- 3.2.1.5 Technological advancements

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Availability of substitutes

- 3.2.2.2 Technical limitation

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Gap analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Future market trends

- 3.10 Value chain analysis

- 3.11 Overview on disposable oral thermometer in clinical use

- 3.12 Outlook on the accuracy and function of different thermometry techniques for measuring body temperature

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Digital thermometers

- 5.3 Strip thermometers

Chapter 6 Market Estimates and Forecast, By Target Area, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Oral

- 6.3 Axilla

- 6.4 Rectal

- 6.5 Other target areas

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Diagnostic centers

- 7.4 Homecare

- 7.5 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 3M

- 9.2 Acme United Corporation

- 9.3 Advanced Meditech Internationals (AMI)

- 9.4 American Diagnostics Corporation

- 9.5 FIRST AID ONLY

- 9.6 graham field

- 9.7 H-B Instrument

- 9.8 Hopkins Medical Products

- 9.9 LCR Hallcrest

- 9.10 MEDICAL INDICATORS

- 9.11 MEDLINE

- 9.12 microlife corporation

- 9.13 Protontek

- 9.14 tempagenix

- 9.15 Zeal