|

市場調查報告書

商品編碼

1698607

自我監測血糖設備市場機會、成長動力、產業趨勢分析及 2025-2034 年預測Self-Monitoring Blood Glucose Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

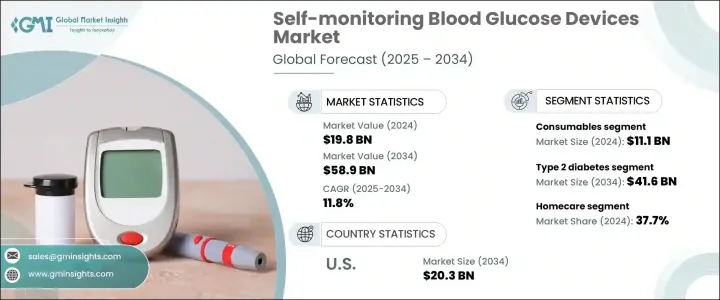

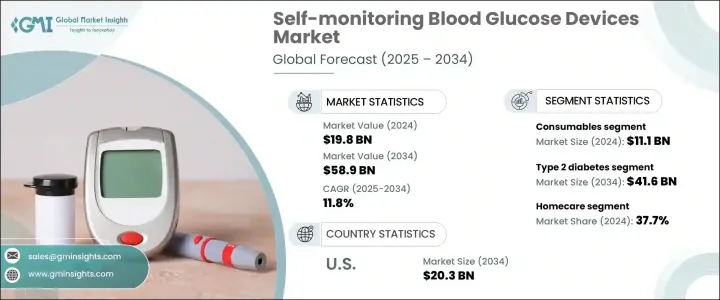

2024 年全球自我監測血糖設備市場價值為 198 億美元,預計 2025 年至 2034 年期間的複合年成長率為 11.8%。全球糖尿病盛行率的不斷上升是市場成長的主要驅動力,數百萬人需要持續血糖監測才能有效管理疾病。各國政府和醫療保健組織正在加強提高人們對糖尿病的認知,促進早期發現並鼓勵採用 SMBG 設備。在歐盟,針對高風險族群設計了有針對性的篩檢計劃,導致對糖尿病相關治療的需求不斷成長。對頻繁血糖監測的需求,特別是對於被診斷患有第 1 型和第 2 型糖尿病的個體而言,進一步加速了市場擴張。設備準確性和易用性的不斷提高正在增強患者和醫療保健提供者對其的採用。

市場根據產品、應用和最終用途進行細分。根據產品,SMBG 設備市場分為自我監測血糖儀和耗材。耗材領域引領市場,2024 年產值達 111 億美元。這些設備依賴試紙和採血針等消耗性組件,這些組件對於日常血糖監測至關重要。一次性使用的測試條由於體積小巧、使用方便,仍然是最受歡迎的組件。這些試紙的準確性對糖尿病管理有顯著影響,現代版本與相容的血糖儀一起使用時可以提供精確的讀數。製造商也正在改進採血針的設計,以減少採血時的痛苦,提高使用者的舒適度,並鼓勵經常監測血糖。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 198億美元 |

| 預測值 | 589億美元 |

| 複合年成長率 | 11.8% |

根據應用,SMBG 設備市場分為第 1 型糖尿病、2 型糖尿病和妊娠期糖尿病。 2 型糖尿病佔了最大的收入佔有率,佔 2024 年市場的 69.3%,預計到 2034 年將達到 416 億美元。 2 型糖尿病盛行率的不斷上升是其佔據市場主導地位的關鍵因素,因為患有這種疾病的人會出現胰島素分泌受損和細胞對胰島素反應降低的情況。肥胖和久坐習慣等與生活方式相關的風險因素的發生率不斷上升,進一步促進了該領域對 SMBG 設備的需求不斷增加。

根據最終用途,SMBG 設備市場分為醫院、門診手術中心、診斷中心、家庭護理和其他使用者。家庭護理成為最大的細分市場,到 2024 年佔據 37.7% 的市場。獨立監測血糖水平的能力減少了頻繁就診的需要,尤其有利於老年患者和行動不便的患者。這些設備在家庭中的廣泛使用可以讓人們即時調整飲食、運動和用藥習慣,從而改善糖尿病管理。

在美國,SMBG 設備市場在 2023 年的價值為 64 億美元,預計到 2034 年將達到 203 億美元。該國因糖尿病而面臨沉重的經濟負擔,與該疾病相關的醫療保健費用在 2022 年超過 4,129 億美元,較 2017 年的 3,270 億美元大幅增加。美國高昂的醫療保健支出促進了 SMBG 設備的廣泛採用,鼓勵了創新和先進的糖尿病管理解決方案。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 全球糖尿病盛行率不斷上升

- 政府為提高民眾意識所採取的舉措

- 已開發國家的技術進步

- 產業陷阱與挑戰

- 發展中國家先進設備和配件成本高昂

- 嚴格的監管要求

- 成長動力

- 成長潛力分析

- 監管格局

- 未來市場趨勢

- 技術格局

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按產品,2021 年至 2034 年

- 主要趨勢

- 自我監測血糖儀

- 耗材

- 測試條

- 刺血針

第6章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 1型糖尿病

- 2 型糖尿病

- 妊娠糖尿病

第7章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 醫院

- 門診手術中心(ASC)

- 診斷中心

- 居家護理

- 其他最終用途

第8章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第9章:公司簡介

- Abbott Laboratories

- AgaMatrix

- All Medicus

- Arkray

- Ascensia Diabetes Care Holdings

- B. Braun Melsungen

- Bionime Corporation

- DarioHealth

- F. Hoffmann-La Roche

- LifeScan

- Nova Biomedical

- Omnis Health

- Sanofi

- Sinocare

- Ypsomed Holding

The Global Self-Monitoring Blood Glucose Devices Market was valued at USD 19.8 billion in 2024 and is projected to expand at a CAGR of 11.8% from 2025 to 2034. The increasing prevalence of diabetes worldwide is the primary driver of market growth, with millions of individuals requiring continuous glucose monitoring for effective disease management. Governments and healthcare organizations are intensifying efforts to raise awareness about diabetes, promoting early detection and encouraging the adoption of SMBG devices. In the European Union, targeted screening programs are designed for high-risk populations, leading to a growing demand for diabetes-related treatments. The need for frequent blood sugar monitoring, particularly among individuals diagnosed with type 1 and type 2 diabetes, further accelerates market expansion. Continuous improvements in device accuracy and ease of use are enhancing their adoption among both patients and healthcare providers.

The market is segmented based on product, application, and end use. By product, the SMBG devices market is divided into self-monitoring blood glucose meters and consumables. The consumables segment led the market, generating USD 11.1 billion in 2024. These devices rely on consumable components such as test strips and lancets, which are critical for daily glucose monitoring. Test strips, designed for single use, remain the most in-demand component due to their compact size and convenience. The accuracy of these strips significantly impacts diabetes management, with modern versions delivering precise readings when used with compatible glucose meters. Manufacturers are also refining lancet designs to make blood sampling less painful, enhancing user comfort and encouraging frequent glucose monitoring.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $19.8 Billion |

| Forecast Value | $58.9 Billion |

| CAGR | 11.8% |

By application, the SMBG devices market is categorized into type 1 diabetes, type 2 diabetes, and gestational diabetes. Type 2 diabetes accounted for the largest revenue share, representing 69.3% of the market in 2024, and is projected to reach USD 41.6 billion by 2034. The growing prevalence of type 2 diabetes is a key factor behind its market dominance, as individuals with this condition experience impaired insulin production and reduced cellular response to insulin. The rising incidence of lifestyle-related risk factors, such as obesity and sedentary habits, further contributes to the increasing demand for SMBG devices in this segment.

By end use, the SMBG devices market is segmented into hospitals, ambulatory surgery centers, diagnostic centers, home care, and other users. Homecare emerged as the largest segment, holding 37.7% of the market share in 2024. The ability to monitor blood glucose levels independently reduces the need for frequent clinical visits, particularly benefiting elderly patients and those with mobility challenges. The widespread use of these devices at home allows individuals to make real-time adjustments to their diet, exercise, and medication routines, leading to improved diabetes management.

In the United States, the SMBG devices market was valued at USD 6.4 billion in 2023 and is expected to reach USD 20.3 billion by 2034. The country faces a significant economic burden due to diabetes, with healthcare costs associated with the disease exceeding USD 412.9 billion in 2022, a sharp increase from USD 327 billion in 2017. The high healthcare spending in the U.S. fosters the widespread adoption of SMBG devices, encouraging innovation and advanced diabetes management solutions.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of diabetes worldwide

- 3.2.1.2 Government initiatives for increasing awareness among people

- 3.2.1.3 Technological advancements in developed countries

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced devices and accessories in developing countries

- 3.2.2.2 Stringent regulatory requirements

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Future market trends

- 3.6 Technology landscape

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Self-monitoring blood glucose meters

- 5.3 Consumables

- 5.3.1 Testing strips

- 5.3.2 Lancets

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Type 1 diabetes

- 6.3 Type 2 diabetes

- 6.4 Gestational diabetes

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory Surgery Centers (ASCs)

- 7.4 Diagnostic centers

- 7.5 Home care

- 7.6 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Abbott Laboratories

- 9.2 AgaMatrix

- 9.3 All Medicus

- 9.4 Arkray

- 9.5 Ascensia Diabetes Care Holdings

- 9.6 B. Braun Melsungen

- 9.7 Bionime Corporation

- 9.8 DarioHealth

- 9.9 F. Hoffmann-La Roche

- 9.10 LifeScan

- 9.11 Nova Biomedical

- 9.12 Omnis Health

- 9.13 Sanofi

- 9.14 Sinocare

- 9.15 Ypsomed Holding