|

市場調查報告書

商品編碼

1698594

X 光探測器市場機會、成長動力、產業趨勢分析及 2025-2034 年預測X-ray Detectors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

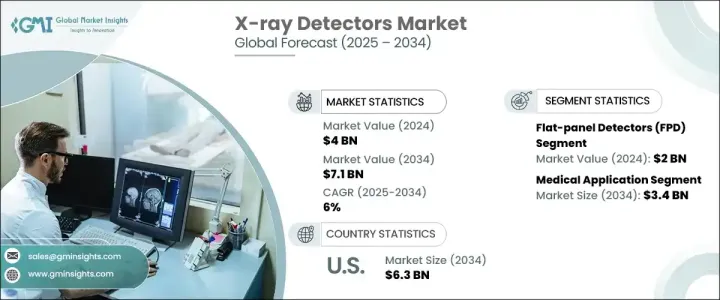

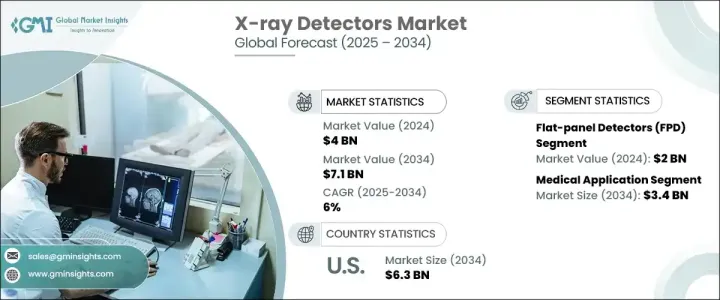

2024 年全球 X光探測器市場價值為 40 億美元,預計 2025 年至 2034 年期間的複合年成長率為 6%。這些偵測器將 X 光輻射轉換為電子或視覺訊號,在各種成像應用中發揮關鍵作用,尤其是在醫療和牙科領域。由於慢性病的日益流行,對早期疾病檢測的需求不斷成長,從而推動了市場擴張。癌症仍然是世界範圍內的主要死亡原因之一,對先進篩檢和診斷解決方案的需求日益增加。隨著醫療保健系統強調早期診斷和提高成像準確性,X 光探測器的採用率預計會增加。

技術進步大大提高了X光檢測的效率,從而提高了影像品質並加快了診斷速度。從膠片式 X 光探測器到數位 X 光探測器的轉變已經加速,從而能夠在醫療環境中更快地捕捉影像並簡化工作流程。直接數位放射成像 (DR) 系統以其速度和準確性而聞名,正在獲得越來越大的關注。隨著輕型和無線探測器的整合,市場不斷發展,提供更好的空間解析度和減少輻射暴露。預計探測器技術的創新將在未來幾年推動產業成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 40億美元 |

| 預測值 | 71億美元 |

| 複合年成長率 | 6% |

根據偵測器類型,市場包括平板偵測器 (FPD)、電腦放射成像 (CR) 偵測器和電荷耦合元件偵測器等。 2023 年市場收入為 38 億美元,其中 FPD 領域占主導地位,2024 年貢獻 20 億美元。 FPD 因其高影像品質、快速處理速度以及消除基於膠片的成像的能力而受到青睞,從而提高了醫療機構的效率。它們在數位射線照相和透視應用中的日益普及正在加速市場的成長。直接轉換和無線連接的不斷增強進一步鞏固了其在行業中的地位,使其成為醫學成像專業人士的首選。

該市場分為醫療、牙科和其他應用,其中醫療領域在 2024 年佔收入佔有率的 46.9%。受肌肉骨骼疾病和慢性呼吸系統疾病日益流行的推動,預計到 2034 年,該領域將產生 34 億美元的收入。影響骨骼和關節的疾病的增加導致人們更加依賴X光影像來進行準確的診斷和治療計劃。此外,呼吸系統疾病需要頻繁成像,這加強了對先進 X光偵測器解決方案的需求。

醫院仍然是主要的終端用戶,到 2024 年將佔 34.5% 的收入佔有率。醫院的大量患者和先進的影像基礎設施鞏固了其市場主導地位。數位放射系統的整合提高了工作流程效率,支援X光偵測器的廣泛採用。隨著醫院不斷擴大放射科以滿足日益成長的診斷成像需求,政府對先進成像技術的投資增加進一步推動了市場成長。

在美國,2023 年的市場收入為 15.3 億美元,預計到 2034 年將達到 63 億美元。慢性病發生率的上升和高昂的醫療支出支持醫療機構廣泛採用 X 光探測器。早期診斷意識的提高繼續推動需求,使美國成為全球市場擴張的主要貢獻者。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 早期疾病診斷的需求日益增加

- 技術進步

- 提高對 X 光技術優勢的認知

- 有利的報銷方案

- 產業陷阱與挑戰

- X光偵測器成本高昂

- 嚴格的監管情景

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按探測器類型,2021 年至 2034 年

- 主要趨勢

- 平板探測器(FPD)

- 電腦放射成像 (CR) 偵測器

- 電荷耦合元件探測器

- 其他探測器類型

第6章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 醫療應用

- 牙科應用

- 其他應用

第7章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 醫院

- 診斷實驗室

- 其他最終用途

第8章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第9章:公司簡介

- Agfa-Gevaert Group

- Canon Medical Systems

- Carestream Health

- Fujifilm

- General Electric Company

- Konica Minolta

- Koninklijke Philips

- PerkinElmer

- Siemens Healthineers

- Teledyne Technologies

- Thales Group

- Toshiba

- Varex Imaging

The Global X-Ray Detectors Market was valued at USD 4 billion in 2024 and is projected to expand at a CAGR of 6% from 2025 to 2034. These detectors, which convert X-ray radiation into electronic or visual signals, play a critical role in various imaging applications, particularly in the medical and dental fields. The rising demand for early disease detection, driven by the growing prevalence of chronic illnesses, is fueling market expansion. Cancer remains one of the leading causes of death worldwide, increasing the need for advanced screening and diagnostic solutions. The adoption of X-ray detectors is expected to rise as healthcare systems emphasize early diagnosis and improved imaging accuracy.

Technological advancements have significantly enhanced the efficiency of X-ray detection, leading to improved image quality and faster diagnosis. The transition from film-based to digital X-ray detectors has accelerated, enabling quicker image capture and streamlined workflow in medical settings. Direct digital radiography (DR) systems, known for their speed and accuracy, are gaining traction. The market continues to evolve with the integration of lightweight and wireless detectors, offering better spatial resolution and reduced radiation exposure. Innovations in detector technology are expected to drive industry growth in the coming years.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4 Billion |

| Forecast Value | $7.1 Billion |

| CAGR | 6% |

By detector type, the market includes flat-panel detectors (FPD), computed radiography (CR) detectors, and charge-coupled device detectors, among others. In 2023, market revenue stood at USD 3.8 billion, with the FPD segment dominating, contributing USD 2 billion in 2024. FPDs are favored for their high image quality, rapid processing speed, and ability to eliminate film-based imaging, improving efficiency in healthcare facilities. Their increasing adoption in digital radiography and fluoroscopy applications is accelerating market growth. Continuous enhancements in direct conversion and wireless connectivity further strengthen their position in the industry, making them the preferred choice for medical imaging professionals.

The market is categorized into medical, dental, and other applications, with the medical segment accounting for 46.9% of revenue share in 2024. This segment is expected to generate USD 3.4 billion by 2034, driven by the increasing prevalence of musculoskeletal disorders and chronic respiratory diseases. A rise in conditions affecting bones and joints has led to greater reliance on X-ray imaging for accurate diagnosis and treatment planning. Additionally, respiratory illnesses necessitate frequent imaging, reinforcing the demand for advanced X-ray detector solutions.

Hospitals remain the leading end users, capturing a 34.5% revenue share in 2024. The high patient volume and sophisticated imaging infrastructure in hospitals contribute to their dominant market position. The integration of digital radiography systems enhances workflow efficiency, supporting the widespread adoption of X-ray detectors. Increased government investment in advanced imaging technologies further propels market growth, as hospitals continue to expand radiology departments to meet the growing demand for diagnostic imaging.

In the U.S., market revenue was USD 1.53 billion in 2023 and is projected to reach USD 6.3 billion by 2034. The rising incidence of chronic diseases and high healthcare expenditure support the extensive adoption of X-ray detectors across medical facilities. Increased awareness of early diagnosis continues to drive demand, positioning the U.S. as a key contributor to global market expansion.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.3 Methodology and Scope

- 1.3.1 Research approach

- 1.3.2 Data collection methods

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Forecast model

- 1.6 Primary research and validation

- 1.6.1 Primary sources

- 1.6.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand for early disease diagnosis

- 3.2.1.2 Technological advancement

- 3.2.1.3 Increased awareness about the benefits of X-ray technology

- 3.2.1.4 Favorable reimbursement scenario

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost associated with X-ray detectors

- 3.2.2.2 Stringent regulatory scenario

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Detector Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Flat-panel detectors (FPD)

- 5.3 Computed radiography (CR) detectors

- 5.4 Charge coupled device detectors

- 5.5 Other detector types

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Medical application

- 6.3 Dental application

- 6.4 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Diagnostic laboratories

- 7.4 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Agfa-Gevaert Group

- 9.2 Canon Medical Systems

- 9.3 Carestream Health

- 9.4 Fujifilm

- 9.5 General Electric Company

- 9.6 Konica Minolta

- 9.7 Koninklijke Philips

- 9.8 PerkinElmer

- 9.9 Siemens Healthineers

- 9.10 Teledyne Technologies

- 9.11 Thales Group

- 9.12 Toshiba

- 9.13 Varex Imaging