|

市場調查報告書

商品編碼

1698540

醬料及調味品市場機會、成長動力、產業趨勢分析及 2025-2034 年預測Sauces and Condiments Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

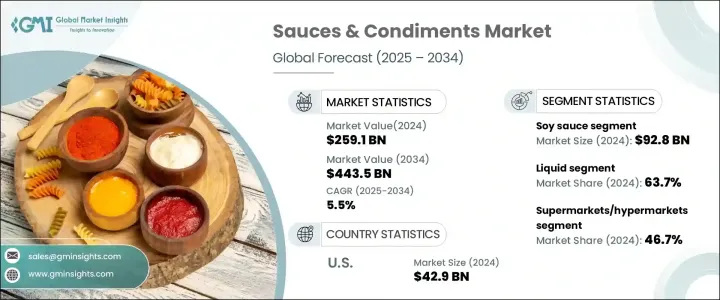

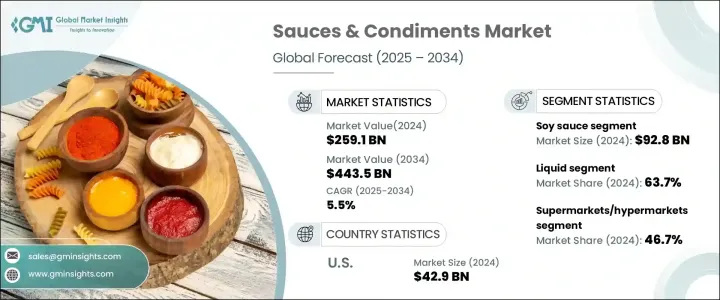

2024 年全球醬料和調味品市場價值為 2,591 億美元,預估 2025 年至 2034 年的複合年成長率為 5.5%。消費者對便利性和增強烹飪體驗的偏好日益成長,推動了需求的成長。隨著生活方式越來越忙碌以及全球化程度不斷提高,越來越多的人選擇使用現成的醬料和調味品來輕鬆準備餐點。此外,家庭烹飪和備餐的趨勢也促進了對這些產品的需求不斷成長。製造商正在透過重新制定配方來獲得更好的口味和健康益處、引入新成分以及改進包裝以適應不斷變化的消費者偏好,從而確保市場持續擴張。

儘管存在成長機會,但由於競爭加劇,行業收入面臨挑戰。新興品牌和成熟品牌都在進入市場,帶來價格壓力、產品創新和積極的行銷策略。由於品牌努力保持市場佔有率,利潤率正在收緊。自有品牌的興起透過提供吸引注重預算的消費者的經濟實惠的替代品,進一步顛覆了該行業。市場動態也受到不斷成長的即食食品行業的影響,預計到 2025 年該行業規模將達到 0.64 兆美元,年成長率為 6.07%。這種轉變增加了對醬料和調味品的需求,強化了它們在快速方便的餐點中不可或缺的作用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 2591億美元 |

| 預測值 | 4435億美元 |

| 複合年成長率 | 5.5% |

根據食品類型,醬料和調味品市場包括醬油、蘑菇醬、辣醬、雞尾酒醬和其他品種。 2024 年醬油市場規模達 928 億美元,預估 2025 年至 2034 年期間的複合年成長率為 6.4%。醬油廣泛用於烹飪、醃製和作為調味品,是全球美食的主要食材。注重健康的消費者擴大選擇無麩質、低鈉和非基因改造食品。此外,加入柑橘和大蒜等成分的調味品種也越來越受歡迎,以滿足人們不斷變化的口味。

隨著消費者追求濃郁辛辣的口味,辣醬市場正快速擴張。年輕族群尤其喜歡熱調味品,從而帶動了對創新香料組合的強勁需求。對辣味食物的偏好促進了市場的成長軌跡,製造商不斷開發新的品種來滿足消費者的渴望。

液體醬汁在醬汁和調味品市場佔據主導地位,到 2024 年將佔 63.7% 的佔有率。這些用途廣泛的產品可用於烹飪、蘸醬和調味,是世界各地家庭的必備品。天然、無糖和益生菌的選擇正在吸引注重健康的買家。此外,擠壓瓶和定量包裝袋等便利的包裝解決方案正變得越來越普遍,以滿足現代消費者的需求。

在分銷方面,超市和大賣場在2024年的銷售額佔比為46.7%。這些零售通路由於其產品選擇範圍廣、可及性強而仍佔據主導地位。大型連鎖店在主流品牌和高階品牌的供應方面發揮著至關重要的作用,而自有品牌產品則繼續吸引對價格敏感的消費者。

受人們對國際風味興趣日益濃厚的推動,美國醬料和調味品市場規模到 2024 年將超過 429 億美元。受多元文化和全球食品趨勢的影響,消費者偏好的變化推動了對多樣化調味品的需求。此外,道德採購和成分透明度正在成為購買決策的關鍵因素,越來越多的消費者尋求負責任的採購和高品質的成分。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商格局

- 利潤率分析

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 消費者食品偏好的改變

- 便利性需求

- 多樣化的烹飪體驗

- 產業陷阱與挑戰

- 競爭日益激烈

- 原料成本上漲

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依產品類型,2021 年至 2034 年

- 主要趨勢

- 醬油

- 辣醬

- 蘑菇醬

- 雞尾酒醬

- 其他

第6章:市場估計與預測:依形式,2021 年至 2034 年

- 主要趨勢

- 液體

- 貼上

- 乾燥

第7章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 超市/大賣場

- 便利商店

- 網路零售

- 專賣店

- 其他

第8章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第9章:公司簡介

- Bay Valley

- Berner Foods

- Casa Fiesta

- Conagra Brands

- Fuchs Gewürze GmbH

- General Mills

- Hormel Foods Corporation

- Huy Fong Foods

- Kikkoman Corporation

- Lee Kum Kee

- Mars, Incorporated

- McCormick & Company

- Nestlé

- The Kraft Heinz Company

- Unilever

The Global Sauces And Condiments Market was valued at USD 259.1 billion in 2024 and is projected to grow at a CAGR of 5.5% from 2025 to 2034. Rising consumer preference for convenience and enhanced culinary experiences is driving demand. With busier lifestyles and increased globalization, more people are turning to ready-made sauces and condiments for effortless meal preparation. Additionally, the trend of home cooking and meal prepping has contributed to the rising need for these products. Manufacturers are responding by reformulating recipes for better taste and health benefits, introducing new ingredients, and improving packaging to align with shifting consumer preferences, ensuring continued market expansion.

Despite growth opportunities, industry revenue faces challenges due to intensifying competition. Both emerging and established brands are entering the market, leading to price pressures, product innovation, and aggressive marketing strategies. Profit margins are tightening as brands strive to maintain market share. The rise of private-label brands is further disrupting the industry by offering cost-effective alternatives appealing to budget-conscious consumers. Market dynamics are also influenced by the growing ready-to-eat meals sector, which is expected to reach USD 0.64 trillion by 2025, expanding at an annual growth rate of 6.07%. This shift has increased demand for sauces and condiments, reinforcing their integral role in quick and convenient meals.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $259.1 Billion |

| Forecast Value | $443.5 Billion |

| CAGR | 5.5% |

Based on food type, the sauces and condiments market includes soy sauce, mushroom sauce, hot sauce, cocktail sauce, and other varieties. The soy sauce segment accounted for USD 92.8 billion in 2024 and is expected to grow at a 6.4% CAGR from 2025 to 2034. Soy sauce is widely used in cooking, marination, and as a condiment, making it a staple in global cuisine. Health-conscious consumers are increasingly choosing gluten-free, low-sodium, and non-GMO options. Additionally, flavored varieties incorporating ingredients like citrus and garlic are gaining popularity, catering to evolving tastes.

The hot sauce market is expanding rapidly as consumers seek bold, spicy flavors. Younger demographics are particularly drawn to heat-infused condiments, driving strong demand for innovative spice combinations. The preference for spicier food has contributed to the market's growth trajectory, with manufacturers continuously developing new variations to satisfy consumer cravings.

Liquid sauces dominate the sauces and condiments market, holding a 63.7% share in 2024. These versatile products are used for cooking, dipping, and dressing, making them essential in households worldwide. Natural, sugar-free, and probiotic-infused options are attracting health-conscious buyers. Additionally, convenient packaging solutions, such as squeeze bottles and portion-controlled sachets, are becoming more prevalent to meet modern consumer demands.

In terms of distribution, supermarkets and hypermarkets accounted for 46.7% of sales in 2024. These retail channels remain dominant due to their wide product selection and accessibility. Major chains play a crucial role in the availability of mainstream and premium brands, while private-label offerings continue to attract price-sensitive consumers.

U.S. sauces and condiments market exceeded USD 42.9 billion in 2024, fueled by a growing interest in international flavors. Changing consumer preferences, influenced by multicultural exposure and global food trends, have driven demand for diverse condiments. Additionally, ethical sourcing and ingredient transparency are becoming key factors in purchasing decisions, with more consumers seeking responsibly sourced and high-quality ingredients.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Base estimates and calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news and initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Changing consumer food preferences

- 3.6.1.2 Demand for convenience

- 3.6.1.3 Diverse culinary experiences

- 3.6.2 Industry pitfalls and challenges

- 3.6.2.1 Increasing competition

- 3.6.2.2 Rising raw material costs

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 – 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Soy sauce

- 5.3 Hot sauce

- 5.4 Mushroom sauce

- 5.5 Cocktail sauce

- 5.6 Others

Chapter 6 Market Estimates and Forecast, By Form, 2021 – 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Liquid

- 6.3 Paste

- 6.4 Dry

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Supermarkets/hypermarkets

- 7.3 Convenience stores

- 7.4 Online retail

- 7.5 Specialty stores

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Bay Valley

- 9.2 Berner Foods

- 9.3 Casa Fiesta

- 9.4 Conagra Brands

- 9.5 Fuchs Gewürze GmbH

- 9.6 General Mills

- 9.7 Hormel Foods Corporation

- 9.8 Huy Fong Foods

- 9.9 Kikkoman Corporation

- 9.10 Lee Kum Kee

- 9.11 Mars, Incorporated

- 9.12 McCormick & Company

- 9.13 Nestlé

- 9.14 The Kraft Heinz Company

- 9.15 Unilever